3/28/23- Chess Hustlers, Munger FOOLS🤡, Housing, Nas, Kirk Kerkorian, & 🎰Las Vegas

It’s waiting that helps you as an investor, & people just can’t stand to wait. -Munger

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

NYC Chess Hustlers Give Me 3 Investing Thoughts

The section below was inspired by an article (Life Advice from NYC Chess Hustlers) written by a friend of mine and bestselling💫 Substack author Anne Kadet who writes

. She was previously the NYC business and trends columnist for the Wall Street Journal📰 before she became world famous on Substack. Anne’s weekly NYC focused newsletter, , is absolutely delightful! Please check it out <link here>.In her edition, Anne interviews 3 experienced independent chess hustlers who are regulars in the NYC Washington Square Park.

My name is Nathaniel, and I'm known as Nate. I’m a native New Yorker. My mother taught me how to play chess when I was eleven. When I came home from the Air Force, in 1978, I was 23. So I’d been playing twelve years and I thought I was a good player. The first day I played here was November 8 of 1978. I've been playing in this park for 43 years.

Marcel, another player, goes on to explain:

[..] people bet serious money, like $200, $300. They think they can beat me. And they were good players. But my thing, I like to play three-minute games. So we played on the clock. Three minutes. They’re really good. But when they get on the clock, they get nervous. Some people crumble under pressure. I was born under pressure!

What type of player do you think you are? Do you know who you are playing against? How do you know you are correct? Being able to do something without a time limit and performing in under 3 minutes 😮, different. Even I am pretty good at answering Jeopardy! questions…. once I hit the pause⏯️ button⏰⏱️⏰.

Several chess hustlers discuss the tradition that has been going on in the park for over 80 years-

I’ll give you a lesson, a half hour for $20. I have some children that come just to see me once a week and I give them a lesson—$20 for a half hour. And there’s a lot of NYU students that come by, we give them a discount for being students. One hour for 40 bucks.

Whether you’re giving a lesson, providing entertainment, giving them a puzzle like myself or allowing a visitor to challenge you in a championship game for money. But as long as you keep the 80 years of tradition, there being a transaction of money, then I don’t have a problem with you.

I would be curious if the chess players are still learning. If there is a regular visitor who the chess hustlers regard to be unbeatable. Do the hustlers have any daily anxiety in having to show up every day and perform in front of strangers? Can you imagine.? I also would like to recognize the bravery🦁 that is required to sit with people and compete in public. The courage to do mental battle with stranger after stranger. ⚔️🙏🏽

Information Edge- Chess♟️ is a game where all players have what is called Perfect Information. All of the pieces and moves are in the open, nothing can be hidden. A game like Texas Hold’em poker🃏 has some community cards (perfect information) and some private player cards (Imperfect information). Investing is more like poker where some information is imperfect/private. Another way to think about Chess vs. Poker is Skill and Luck. At it’s purest, Chess is all SKILL and no Luck. As Poker cards are shuffled and dealt out randomly, there is always going to be some small element of Luck. In investing we need both Skill and Luck and in addition you can work for an advantage with your own unique information edge.

Opposing an Expert or a Fool- When you enter Washington Square Park to challenge a resident chess player to a game, who is the better player? C’mon, they are called “Chess Hustlers.” Be honest with yourself, because you are the easiest person to lie to. These guys play chess, every day, all day. They think and breathe it.

In the Paypal Mafia PYPL 0.00%↑ photo above, Sacks, Levchin AFRM 0.00%↑ , and Botha are all bang-shang-a-lang brilliant. And Peter Thiel (in crown) is playing all of them Simultaneously 🤯. From Jimmy Soni's book The Founders-

Thiel would take his Queen off the board, and still beat me. He'd take his Queen and Rook off the board, and still beat me.. He would take his Queen, and 2 Rooks off the board, and FINALLY I could beat him.

When we are investing do we want to play against experts? No. We do not get “extra points” for earning $10K by slaying a difficult investing dragon🐉 vs. calmly picking it up off the middle of the market floor. Before you invest, ask yourself if you are playing someone else’s game (a guest in their investing house🏠)? Avoid the Dragons and the Experts.

Charlie Munger has often said that we should wait to invest until we are playing against FOOLS🤡. Why? Because they are easier to defeat.

“You’re looking for a mispriced gamble. That’s what investing is. And you have to know enough to know whether the gamble is mispriced. That’s value investing.”

Patience- The Chess Hustlers above talk about a 3 minute game or often they are using a timer. Many poker tournaments I have played in often make use of a timer to speed up the action. Investing should not have a time/urgency element. If urgency is forcing you to make a decision, you should probably get up and walk away.

In Trading, you have to really wait for the opportunities. I just wait until it is money lying in the corner of the floor and I just have to walk up and take it. -Investor

Patience is waiting for a Big FAT Pitch to come down the center. The stock market is a device which transfers money from the impatient to the patient. -Warren Buffett

You don’t make money when you buy stocks, and you don’t make money when you sell. You make money when you wait. It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait. -Charlie Munger

The chess hustlers in NYC Washington Square Park are a unique resource. Go visit them and invest some time and $20. Expect to lose the chess match, but the lesson you learn from them will be worth it.

All of

's weekly editions are excellent, but if you would like me to recommend another unique interview, let me suggest "A Secret Apartment in the Mall" 🤫🤫🤨.Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information session since my last edition that I reviewed-

Technology- S 0.00%↑ , PATH 0.00%↑ , ADBE 0.00%↑ , NVDA 0.00%↑ GTC 2023 conference link

Others- FIVE 0.00%↑ , FDX 0.00%↑

Housing & Banking - KBH 0.00%↑ , LEN 0.00%↑

Lennar’s CEO Stuart Miller gave a vivid description of the Existing and New housing market in the US. Participants in the housing system react to information/feedback and they pull levers and adjust dampers in pursuit of their own self interest. (The quote below is Stuart’s, but the graphs are mine taken from various places with credit provided 😉)

While margins fell 360 basis points over the prior quarter and 570 basis points year over year, they reflected the use of price reductions and incentives, that is,

closing cost payments and

interest rate buydown,

..to offset volatile interest rate and market shifts. We used these tools both to sell homes, as well as to protect our backlog, by adjusting pricing and incentives to ensure closings. Our first quarter cancellation rate improved to 21.5%. While this is higher than the 10.2% last year, it is decidedly lower than the 26% last quarter and has been falling in each consecutive month.

While our new orders were down some 10% year over year, that result has compared favorably to reported market conditions and enabled us to maintain a strong start pace [..]

On a positive note,

very limited new home inventory exists.

Limited existing home supply exists as existing homeowners hold on to extremely low mortgage rates and

very limited multifamily production, combined with the chronic housing production shortfall over the past decade and leads the industry in the middle of what we believe will be a fairly short duration correction without an inventory overhang to resolve. These factors will also extend the runway for longer-term housing growth as the correction develops.

Things that I want to call special attention to:

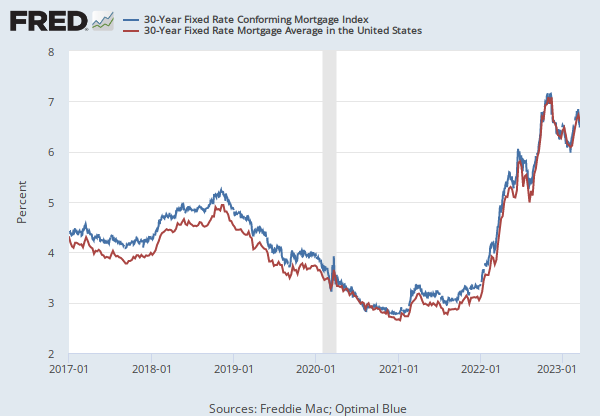

The table below are two examples that I modeled to demonstrate how much a mortgage payment would go up based upon the interest rate changes from 2019 to present/2023. The monthly payment differences are enormous.

Just as an imagination 🤔exercise… suppose you wanted to move from your current $400K home, 5 miles down the street to a different $400K house. Same house price range, but you must abandon your old 4% interest rate, and your new 6.5% rate has a payment that is $620 more per month. ~$7500 more per year. No, almost everyone would refuse to move. I think people decide to stay in their current home/interest rate. At a macro level, these dynamics influence existing Homeowner Psychology.

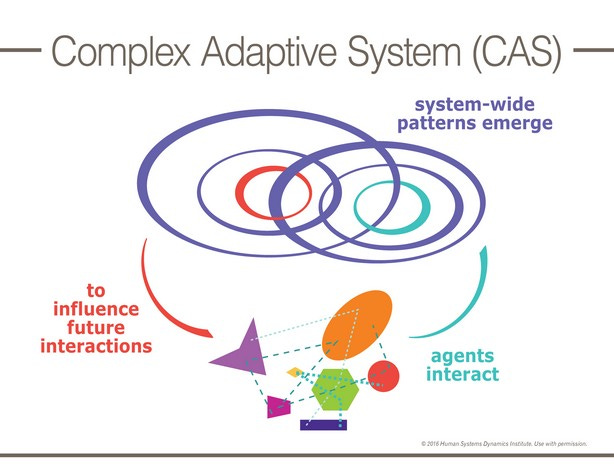

Aggregate Behavior of the real estate market participants (existing homeowners, new home builders, amount of inventory, The FED, first-time homebuyers, RE Investors, etc) emerges as a complex adaptive system (CAS, chart below). This is similar to a CAS in the ecology of a coral reef. 🪸🐟🐡🦈🦐🪸 The future is hard to predict because dynamic feedback alters the trajectory.

Podcasts

Rick Rubin is one of my favorite people, and he is an exceptional listener 👂.

This 58 minute conversation with legendary music artist Nas is surprisingly open and relaxed as they discuss life, philosophy and creativity🎨🎶. I hope you like it as much as I do.

Videos

12 Minute video below. Visualization of How City Water Purification Works and the presentation in the 3D computer graphics is marvelous.👍

Cities purify millions of gallons of drinking and wastewater daily. This incredible process happens behind the scenes, day and night.

📕BOOKS📙 (Software for the Mind 💽+🧠) and Articles

(I am usually reading 2 at a time, and if I get bored of a book I quit and move on.)

Lonesome Dove by Larry Mcmurtry I keep a short list of books that are so good that I want to read again. Lonesome Dove is one of them, ⭐⭐⭐⭐⭐. It is a Western novel that follows the adventures of several retired Texas Rangers as they drive a cattle herd from Texas to Montana. The novel explores themes of friendship, loyalty, courage, and mortality in a harsh and unforgiving landscape. The book won the Pulitzer Prize for Fiction in 1986 and was adapted into a popular television miniseries in 1989.

My review: Lonesome Dove is a captivating and epic story that immerses the reader in the lives and struggles of its memorable characters. The author creates a vivid and realistic portrait of the American West, with its beauty🌄 and brutality, its humor and tragedy. The novel is full of action, drama, romance, and humor, but also touches on deeper issues such as racism, violence, greed, and loss. The book is long but never boring, as it keeps the reader engaged with its fast-paced plot and rich dialogue. It has a clear and elegant style that conveys both emotion and detail. I would highly recommend Lonesome Dove to anyone who enjoys historical fiction, Westerns, or simply a great story. Give it a chance. 😉

Station Breaker by Andrew Mayne Technothriller fiction that is a page turner.

The Gambler: How Penniless Dropout Kirk Kerkorian Became the Greatest Deal Maker in Capitalist History by William C. Rempel Biography. The author does a very good job of telling Kirk’s story. Kirk leveled up from airplane pilot over time to casino owner💵💰, but he accomplished it through hard work, planning and cultivating friends. Sometimes we learn what not to do, and Kirk’s 4 marriages along with many romances up until his death is cautionary. One of Kirk’s philosophies was to negotiate so that the other person ALSO got a good deal!🤔

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Video, 17 minutes- The Battle for Las Vegas- CAESARS 🥊vs.🥊 MGM RESORTS

The video below describes how Las Vegas has become a 2 player roll up/consolidation race between CZR 0.00%↑ vs. MGM 0.00%↑ MGM Resorts in Las Vegas owes much of its success to… Kirk Kerkorian (see books above).

My family and I spent some enjoyable time a few months back at MGM’s Mandalay Bay in Las Vegas🎲 (photo above, and mentioned in the video below).

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

Thanks for the shoutout and kind words, Nick, but I loved this WHOLE post. Especially the thoughts about patience. And I share your love of Rick Rubin and Lonesome Dove so I’ll have to check out your other picks as well!