8/1/23- 📘Jim Simons, 🏦Brian Moynihan, 🎧Seth Klarman, 🤖Mira Murati OpenAI

"Bad ideas is good, good ideas is terrific, no ideas is terrible."

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

📘The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution

If you could travel back in time and work with either legendary investors Jim Simons or Ed Thorp at the beginning of their hedge fund careers, who would you choose and why? (At the bottom of this section, I give you my selection.)

I just finished Gregory Zuckerman’s book The Man Who Solved the Market, and it is excellent. I love well written finance stories/biographies and this is certainly one.

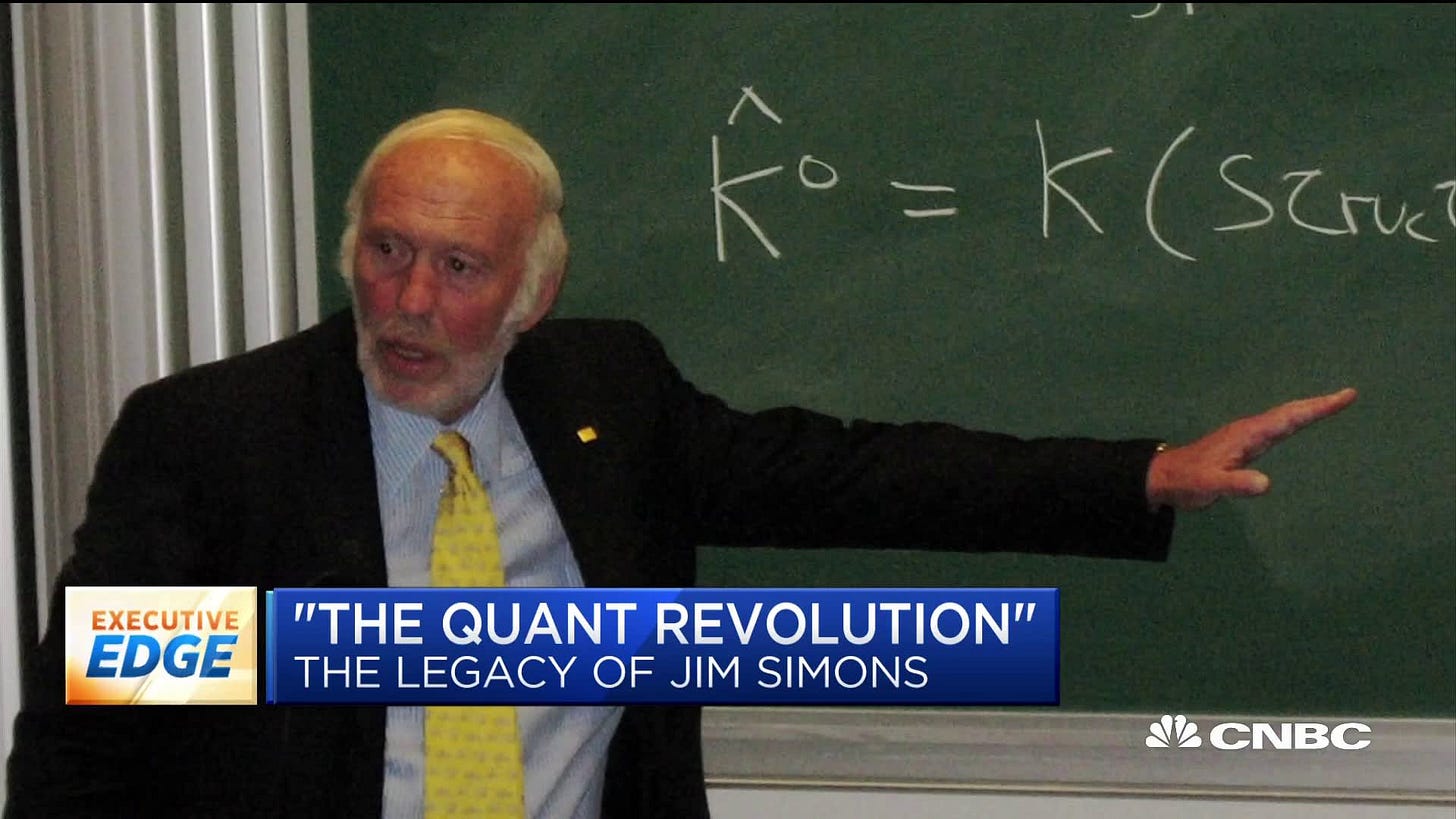

There are a number of good video interviews that Jim Simons has given over the years. Here, here, and here. Simons is private, secretive, tight lipped with a stated goal of protecting his investment strategies and edge. Simons has been known to sue former employees that have left his firm and attempted to use strategies Simons alleges were stolen from him.

So, how was Zuckerman able to successfully write this book? It seems that he was pretty unyielding in his efforts and pursuit of the story. Simons and others discouraged Zuckerman from writing the book.😡 And, when Simons came to the conclusion that Zuckerman would not relent, Simons finally agreed to a series of 10 hour interviews about his life and career. Simons would not discuss trading strategies or the inner workings of Renaissance Technologies (Medallion Fund.)

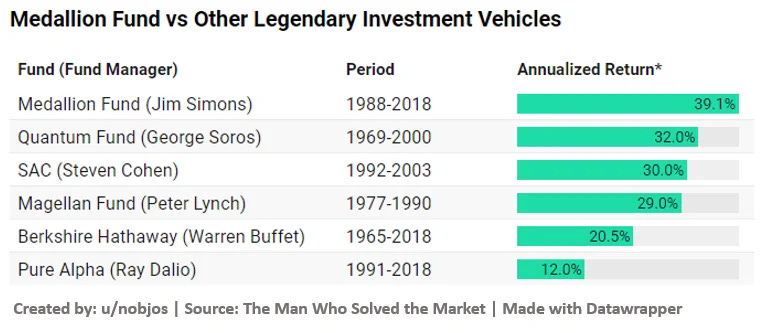

Just to set the table, below is a chart of Jim Simons, Medallion Fund, compared to a series of other famous investors. I know the math fans are going to read this chart, look at Simons ~40% average annual return and marvel 🤯. These returns partly explain his secrecy 🤫.

In 1962 at age 24 Simons produced some groundbreaking original math for his studies on pattern recognition. He developed the Chern–Simons form (with famous mathematician Shiing-Shen Chern), and contributed to the development of string theory by providing a theoretical framework to combine geometry and topology with quantum field theory.

What could a young smart person focus on next? Simons set his mind on solving trading markets. Quick success did NOT come as easily or at all. (Anyone that thinks investing is time spent pleasantly with clean hands is in store for disappointment.😫)

Creating even a tiny edge on markets almost bankrupted Simons multiple times. He burnt through not just one set of work partners, but 2 sets of partners. Years and years would pass without meaningful success. Simons shuffled hat in hand multiple times to raise money for his new improved strategy, only to get rejection. A few sources of capital had already invested with a different quant shop, D.E. Shaw. [Recall Jeff Bezos worked at D.E. Shaw before founding Amazon.]

But, over time, Simons slowly started to gain an edge. We are not precisely sure how Simons and team achieved this, but Zuckerman interviewed many former employees and provides us with a basic explanation.

Simons hired a series of some of the best mathematicians, AND he got out of their way. He was there to support and collaborate, but he left them to research and discover. The Team would say- “Bad ideas is good, good ideas is terrific, no ideas is terrible.”

They hired several talented computer scientists to create computerized trading models.

Over time Simons would hire astronomers. What? Yep, they discovered that space data sets are gigantic posing a significant challenge for astronomers, who must carefully search them for any signs of a signal. Markets create gigantic data sets also. 🤔

Is there anyone that Simons didn’t hire? Yes. They didn’t hire people that had previously worked on Wall Street. They wanted a fresh clean perspective, and people with no Wall Street network.

It would be fair to think of the Simons Team as Algorithmic traders. They were NOT fundamental traders interviewing prospect company management and their respective financial statements.

Some aspects of Momentum Investing were integrated into their trading software.

An example from the book of a statistical tool that they might use- having sifted through a large data set (slicing and dicing data), if a stock or security was closing below a trend line on a certain day of the week, Simons Team might purchase it at market close and sell it at market open assuming a return to the trend.

The fund had short holding time periods for their positions, averaging 1.5 days.

Finally, Markov chains were frequently mentioned.

🚨Deeper Look🚨- A Markov chain is a mathematical model that uses probability to predict the likelihood of a sequence of events based on the most recent event. The probability of each event depends only on the state of the previous event. For example, Google uses a Markov chain to predict the next word in a sentence based on the previous entry in Gmail or a Google Search. Simons Team might look at only todays trading prices, or only prices today from 2-3pm.

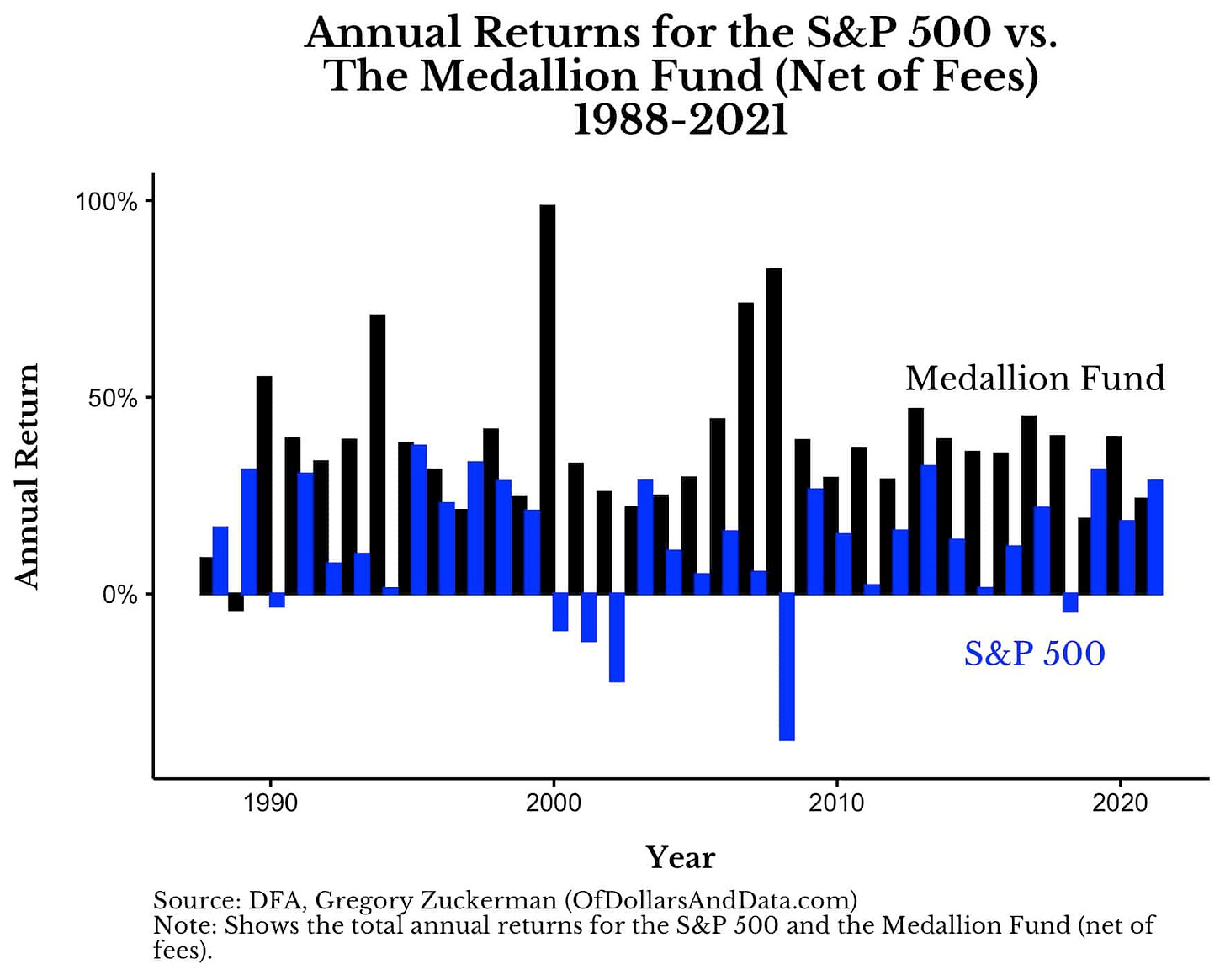

Below is an outstanding year by year visual on Jim Simons, Medallion Fund, compared to the S&P.

You can probably tell by my enthusiasm that it was a well researched and written book. I am also a fan of the larger subject area. Like a bunch of 12 year old kids going to a Tayler Swift concert🧑🏽🎤🤘🏽.

As promised- If you could travel back in time and work with either legendary investors Jim Simons or Ed Thorp at the beginning of their hedge fund careers, who would you choose and why?

It is like attempting to pick from a beautiful sunrise🌄, or a beautiful sunset🌇.

Simons created a hyper competitive math social environment at his company. It was effective but dysfunctional. Simons Team earned ~40% CAGR for 30 years, and Simons personal net worth is estimated to be $25 billion, making him the 66th-richest person in the world. An endless pursuit of MORE followed him for a long time.

Thorp also had a math approach in his fund, but his operation was significantly smaller and lower stress. Thorp was hands on, and achieved ~20% CAGR for ~30 years. Net worth ~ $1 billion. Thorp is calm, peaceful and joyful😄 . (Here is a great interview that Tim Ferris hosted with Ed Thorp last year.]

Ed Thorp is a better fit for me. But, they are both amazing humans!

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- TSLA, META, SNAP, GOOG, MSFT

Semis- ASML, TSM, TXN, INTC, UMC, LRCX, ON

Housing & Banking - BAC, WFC, AXP, SOFI, DHI, PHM, BZH,

Others- NFLX, CSX, UNP, ROP, MLM

Wells Fargo hosted their earnings call this past week and something caught my attention:

Below are some of the metrics that I use to compare and better understand the large banks. And, just because JP Morgan is green, doesn’t make it the winner. We also have to look at its trading price → JPM 0.00%↑

DR Horton, America’s largest home builder, metrics.

Videos

Kevin Scott, CTO at Microsoft (fellow Virginia native), hosts an excellent 66 min conversation with Mira Murati, CTO at OpenAI. Mira also worked deep in engineering at Tesla for 3 years.🤘🏽

Podcasts

43 Minute podcast below, of the master finance journalist Jim Grant interviewing friend Seth A. Klarman, CEO of the Baupost Group. Both Seth and Jim have so much experience the conversation is outstanding.

🎧Special Guest Seth A. Klarman, CEO of the Baupost Group

If you like Seth Klarman and you want another recent interview, here is a 1 hr 30 min conversation that he did with Ted Seides that is also very good and ~75% of the content is different.

Books and Articles since my last edition

(Books are like loading software on your brain. I am usually reading 2 at a time, and if I get bored of a book I quit and move on.)

On Writing Well by William Zinsser Nonfiction about writing. Easy to read and thoughtful. I guess it better be easy to read, it is a book on writing after all. 🤭

Neuromancer by William Gibson Science Fiction, Cyberpunk. Published in 1984, it is very imaginative and almost predictive. Art influences Life influences Art...♻️

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Bank of America’s Brian Moynihan

I need to make a confession up front, I find Jamie Dimon, CEO of JP Morgan, to be interesting and entertaining. He is so opinionated we need to buckle up. Interviews with Jamie are like throwing meat in front of a hungry lion.🥩+🦁 .

Brian Moynihan is not Jamie, in a good way. Moynihan, 63 yrs old, was born and grew up in Ohio. His parents had 8 kids and he was number 6. (In the photo below, I am guessing Brian is excited to be wearing his sister’s fashionable red jacket and hat as it is pretty close to Bank of America’s colors. ¯\_(ツ)_/¯)

Brian graduated from Notre Dame Law School, moved to Providence Rhode Island and began working at a law firm. Some of Brian’s clients at the firm were engaged in M&A, involving several banks. One of Brian’s mentors said-

“Brian is too smart to be a lawyer, we need to bring him over to the banking business side.”

Brian joined Fleet Boston bank in 1993 as a deputy general council. Bank of America merged with Fleet in 2004. Around the Great Financial Crisis, the former CEO of BAC 0.00%↑ Ken Lewis stepped down in 2010, and Moynihan became CEO of Bank of America. 😁

About a year later in 2011 Warren Buffett was in his bathtub.🛀🏽 (I know right.👀 This just took a turn.) Buffett already owned a stake in Bank of America. He had the idea that he could inject $5B into Bank of America as a vote of confidence in the bank and to put some money to work for Berkshire. Buffett didn’t know Brian, so Buffett called📞 a Bank of America call center and asked to speak to Brian. (I am not making this up. How adorable and old school.) After the call center stopped laughing 🤣😂, they explained that they don’t transfer calls to the Bank of America CEO no matter how cute the caller is. Buffett then called an investment banker who knew the Bank of America CFO… the CFO… got Brian on the phone with Buffett. Brian said:

“I talked to him (Buffett) the first time in my life on a Monday at 11am, and we had the agreement signed on Tuesday at 8am. We had the money by Thursday.⚡

Today, Buffett has accumulated a 13% stake in Bank of America, and is the largest shareholder by far. Buffett currently owns exactly zero JP Morgan and zero Wells Fargo.

Brian Moynihan is in his 13th year as CEO of Bank of America and I think he is doing an outstanding job. BAC 0.00%↑ Brian is a popular resource for university students seeking guidance, and he shared his thoughts...

“When I talk to young folks the #1 thing I tell them is Be Curious, Keep Learning.”

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

It is really impressive to see how big Jim Simmons returns are with his Medallion Fund compared to the other top funds. Over the past few decades his fund has had a CAGR of nearly double Warren Buffet's, and no fund even comes close.