Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

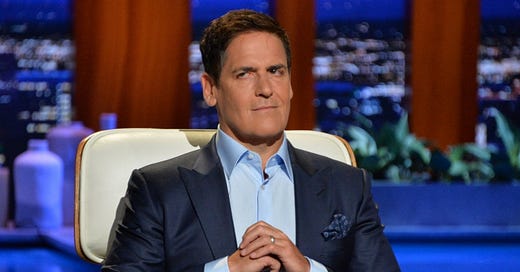

That is a product, not a company. - Shark Tank 🦈

While watching Shark Tank with my family over the years, from time to time we hear one of the sharks say to an overly enthusiastic guest pitching an idea “That is a product, not a company.”🤔

I wanted to stop the bus, and park🛑on this idea for a moment. We all know what the VC is saying on the surface, but it merits some careful consideration.

The Insta-Pot Company → is a Product. GoPro → is a Product. Peloton → might be just a Product.

To come at it from a different direction lets invert and look at companies that are more than just 1 product or service. Look at companies that have worked to diversify their revenue stream- Apple, Amazon, Microsoft and Alphabet. Consider the purpose behind this creation.

Other companies like Roper, Constellation Software, Heico and even Berkshire Hathaway have even more revenue diversity to go along with their growth strategy.

Finally, software and SAAS companies talk about a “Land and Expand” strategy. Check out companies like Datadog, Crowdstrike, Cloudflare, Salesforce, ServiceNow, etc.

The slide below is taken from the most recent Cloudflare NET 0.00%↑ earnings release to show the stated “land and expand” strategy. But all the companies mentioned above have the same strategy and a similar slide.

It is a wonderful thing to invest in a small company in hopes of a meteoric rise, like catching lightning⚡ by the tail. A small company can grow your capital exponentially quicker than a large company. But the risk with a small one product company is that it is not meaningfully innovating and this can lead to significant problems ☠️.

With your long term investments, ask is it a strong company or just another product without a long term moat.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- AMD, QCOM,

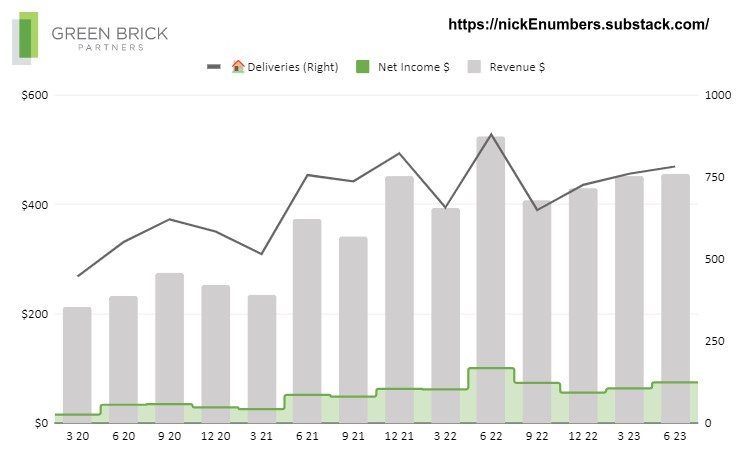

Housing & Banking - GRBK, VMC, UPST

Others- BRK.B, UBER, LYFT, DIS, TTD

Some of these companies I own, some are peers. Some of these provide decent economic indicators. In going through all of these companies there is a fair amount of Noise, but there is enough Signal to have value.📶

Podcasts

58 Minute podcast. Frank Slootman CEO of Snowflake ❄️🌨️has a strong leadership style and it comes across clearly in this excellent interview below.

🎧Frank Slootman: Doing Less, Doing Better [The Knowledge Project Ep. #173]

I don’t think a business is a family… you can’t fire your family even though sometimes you want to. [..] In business it is more like a sports franchise. You are assembling the best players, and we may be friends but we don’t have to be, because we are NOT coming together based on friendship, we ARE coming together based on a mission, on our shared purpose.

When asked how Snowflake allocates bonus compensation to the employees-

Use this money to send messages to all your people. Don’t peanut butter it out. We want to know who was deserving of 2X, 3X vs who was deserving of zero. [..] This is not so much that I don’t want to give money to people that are not doing well, this is more “are we giving enough to the ones that are doing great☝️.” I don’t want the great ones to feel like they are treated the same way as the ones who are not in good standing.🤩

Those quotes are to wet your appetite. The whole interview is outstanding.

Bonus Podcast-

The conversation about private and public markets, about marks of private market positions, incentives, and motivation pushing private companies toward IPO (sometimes with a gun to their back🔫😬😖.) It is enlightening and special guest Bill Gurley is fantastic.

Videos

30 Minute video. 90% of progress in business comes from exploiting the mess. Yet 90% of the effort is devoted to pretending it away. Rory Sutherland, Vice Chairman of Ogilvy UK, teaches us that it's time to embrace the mess.

If you don’t know who Rory is, you are in for a real treat.😊 It is too difficult to try to introduce Rory other than to say he is an original thinker, working in marketing, and he is consistently brilliant 💡. Enjoy!

Books and Articles since my last edition

(Books are like loading software on your brain. If I get bored of a book I quit and move on.)

The 80/20 Principle and 92 Other Power Laws of Nature: The Science of Success by Richard Koch Business strategy book.

Cinder by Marissa Meyer Science Fiction. Great writing.

The Outsiders by William Thorndike Business book. This is one of those books that I reread every few years.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Texas Instruments is 93 years old. The company is run in a conservative manner and the executive team are consummate adults. They don’t crack jokes and they don’t suffer fools. The image below is a Texas Instruments executive having a good time:

With that as background, in February of 2023 the TXN team hosted a discussion and the slide below was part of the presentation. The conclusion of the slide is that over a 30 year time period semiconductor cycles average 40 months from peak to peak.

I know you are as curious as I am so I will save you the time→ TXN marks the peak of the most recent cycle at March 2022, therefore the next peak should be in the second half of 2025. The midpoint (low point) would be around the end of 2023.

I thought it was worth calling to your attention that a group of conservative engineers who manage an excellent company (Texas Instruments) think it is valuable to share a forward looking tool in the slide above.

Famous investor David Einhorn of Greenlight Capital has a theory that a super majority of investors don’t review financial statements, don’t listen to earnings call or slide decks and don’t perform independent valuations. If David's insights are accurate, then we can use this knowledge to gain a competitive advantage and improve our odds of achieving alpha.🫰🏽💰💵🤑.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

I really like the Texas Instruments graph at the end of the post because it must be significant if a conservative company like TXN thinks semiconductor cycles are worth presenting. If any random high growth company that makes a bunch of false promises posted the graph, I do not think it would be as notable.