6/4/24-SNOW❄️,All-In Pod🎧 ,Milli→Micro→Nanosecond⚡

I want to attempt a magic trick in your mind🪄

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Snowflake Earnings Call and A Couple Comments

I chuckle at humans and how excited they are about the new new thing and then 6 to 18 months later they have moved on to the NEXT new thing. We like bright and flashy objects. Snowflake use to be the new thing😃, but I suspect by now the initial excitement has dissipated😑.

Most of the time, a new thing is over hyped and does not continue to offer the benefits that were initially advertised. But sometimes a company does indeed continue to provide evidence of good long term prospects. I suspect Snowflake is one such company. I am not going to write a large bull case piece on it, but I am going to offer a couple bread crumbs as a trail for you to consider following.

Snowflake announced earnings last week and CEO Sridhar responded to a question that caught my attention.

Iceberg 🧊

Brent A. Bracelin- Analyst, Piper Sandler -

Sridhar, in your opening remarks, you flagged Iceberg as a potential unlock that could accelerate growth. Maybe that's a longer-term view. But can you just walk through how or why spending could actually go up for Snowflake in an environment where a customer moves to Iceberg? Thanks.

........................................................................................

Sridhar Ramaswamy- CEO-

So first of all, Iceberg is a capability. And it is a capability to be able to read and to write files in a structured interoperable format. And yes, there will be some customers that will move a portion of their data from Snowflake into an Iceberg format because they have an application that they want to run on top of the data. But the fact of the matter is that Data Lakes or cloud storage in general for most customers has data that is often 100 times or 200 times the amount of data that is sitting inside Snowflake.

And now with Iceberg as a format and our support for it, all of a sudden, you can run workloads with Snowflake directly on top of this data. And we don't have to wait for some future time in order to be able to pitch and win these use cases, whether it's data engineering or whether it is AI, Iceberg becomes a seamless pipe into all of this information that existing customers already have, and that's the unlock that I'm talking about…

Data Sharing🫱🏼🫲🏽

Below is a graph showing the number of large customers and dark blue represents expansion of data sharing between them. 32% data sharing now, up from 23% two years ago.

Average Daily # of Queries

Below is a quick table summarizing the average number of daily queries performed in MILLIONS, trending by year. Consider doing the math and giving the year over year growth a think.

Long Term Debt

Debt is not prima facie bad, but many of these companies listed below committed to convertible debt to fortify their cash position and balance sheet. I might whisper🤫 “Window Dressing.” Many in this list placed the cash at the time of receipt in interest bearing accounts where it has remained for years. Yes, perhaps it might be handy for an acquisition, but…. Debt comes with a cost and convertible debt comes with the chance of dilution. I suspect that much of this debt has a negative carry. Snowflake has no debt and engaged in no such convertible debt behavior.

Exceptional Cap Table

Warren Buffett’s Berkshire Hathaway invested in the IPO and currently owns ~ 2% (Todd and Ted🤔). Brad Gerstner and his Altimeter Capital owns ~4%.

This is not investment advice and do your own due diligence. As mentioned above, Snowflake has some positive trends that are building in its favor. My process is not to put my finger in the air to guess which way the stock price winds of today are blowing. My goal as an investor simply is to purchase, at a rational price, a part interest in an easily-understandable business whose earnings are virtually certain to be materially higher five, ten and twenty years from now.

If you would like more of my thoughts on Snowflake, in my 3/12/24 post here, Mike Scarpelli, CFO discussed the new CEO Sridhar and upcoming products.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- SNOW 0.00%↑ , NVDA 0.00%↑ , MDB 0.00%↑ , S 0.00%↑ , ZS 0.00%↑ , DELL 0.00%↑

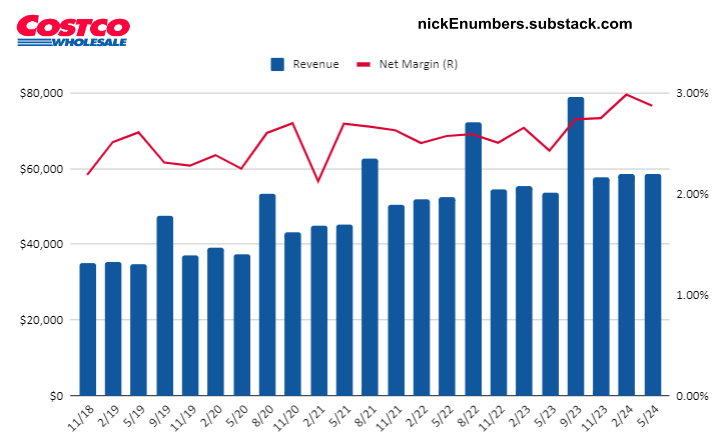

Others- COST 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.)

Podcasts

I want to make a general recommendation for the weekly show The All-In Podcast. Industry veterans, degenerate gamblers and besties Chamath Palihapitiya (Facebook Mastermind), Jason Calacanis (Angel Investor), David Sacks (PayPal Mafia) and David Friedberg (Google Prodigy) cover all things economic, tech, political, social and poker. I find their analysis to be Irreverent and therefor mostly honest. Plus, rarely do all 4 agree on the same topic, so you get that rare opportunity to hear thoughtful difference of opinion (😡Respectful Conflict). Strong recommend.

Videos

6 Minute video, How Microchips are Made.. and Where are Microchips Made?

Amazing. Think- TSMC, NVDA, ASML, AMAT, LRCX, INTC

Books and Articles since my last edition

(Books are like loading software on your brain. If I get bored of a book I quit and move on.)

Oryx and Crake by Margaret Atwood Science Fiction, Dystopian. It has 268K ratings on Goodreads, very popular. I liked it, but it is weird and hard to describe. If you like the genre, click the link and read the review to see if you are interested.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Seconds → Milli → Micro → Nanosecond…⚡ does it matter?

The 3 min video from X-Men best illustrates life at a different scale of time, and the result is an excellent analogy of computers operating at significantly faster speeds than humans. Watch the video and then I want to unpack sub-second time below.

The video production is imaginative and the special effects are fantastically artistic🎨🖼️. Our hero Quicksilver’s expressions and pranks crack me up, but they also tease out how he seems to have unlimited time enabled by his speed. (Quicksilver and Jensen Huang both wear black leather jackets, just saying.😀)

Seconds ⌚

Human life exists at the rate of seconds. 10 seconds, 5 seconds, maybe 1 second. We think, make decisions and move in a universe of seconds. A normal year has ~32 million seconds in it.

MILLIseconds (One thousandth of one second)

If one could operate in the milli world, every 22 days would seem like a year.

MICROseconds (One millionth of one second)

If one could operate in the micro world, every 32 seconds would seem like a year.

NANOseconds (One billionth of one second)

If one could operate in the nano world, EVERY SINGLE SECOND would seem LIKE 3 YEARS. This is the scale on which our computers, phones and datacenters operate.

When experts say that AI is going to be able to think and operate more quickly than we can, this is what they are referring to. Quicksilver in our video is your computer, he is AI. I want to attempt a magic trick in your mind🪄. Imagine you had a friend you were helping or working with. Every three years, they leave you a message in your mailbox containing directions or updates. You receive their message, you knock the work out in about 2 hours, and then you sit there and wait for another 3 years. If you were a laptop or smartphone this is how you would experience working with humans.😮🤯

3 years to wait.. waiting, waiting..🥺😔 What to do with all this processing power and speed🤔left unused? What to do, what to do? SHARE IT!!! If your imaginary mailbox starts to receive more requests from more humans then we can keep you more active, more utilized, more productive. Your nanosecond fast superpower can now assist, delight and improve the lives of MANY humans. Joy abounds 😃💐🎆.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

I really enjoyed the section where you explained the speed at which computers operate. Using Quicksilver as a comparison really helps to give some sort of perspective!

The All In pod sounds great! I just subscribed. Also I finally bought Nvidia a couple weeks ago. I don’t think I will be sorry!