10/09/23-Recycled Info♻️,Dangerous⚠️CFOs, Zuck, & Finger Snap Test🫰🏽

Secondary recycled ♻️information is three day old halibut🐟 in seafood stew🍲.

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Primary Information vs Secondary (or Recycled) Information-

Almost all of us are looking for a hack to save time and glean the most news and actionable investing intelligence. Watching the news vs. spending 2 hours reading the whole WSJ. Following creators or influencers that share their summary and opinion of a story, company or trend. And the story that we tell ourselves is “I just saved myself a bunch of time because this hack provided everything that I needed to know in a fraction of the time.” Essentially we are looking for a compression channel with high signal and low time investment.

Before I continue, I want to point out that I don’t know what is best for Beginner investors, but I suspect they should expose themselves to a variety of high quality information sources. What follows below is geared toward people with more experience (Intermediate/Advanced Investors).

I am going to just give it to you straight 🥃- most news I prefer to get directly from the source. I don’t want the information filtered through someone else’s head, and I don’t want it pre-analyzed for me. I want the primary information.

Read the news release from the FOMC and listen to the live press conference with J Powell. [Don’t wait for some other recap.]

Read the important public company earnings release, listen to the whole earnings call, and review the SEC filing. [Don’t skip it and just review everyone else’s summary.]

Read all/most of the foundational investing books. [Don’t just read the 10 most important things from each book.]

Listen to interviews with and watch speeches from the leaders in business and industry. Yes, some might be 1, 2, or 3 hours.

Read the weekly economic data releases from the issuing organization.

Why Nick? What does it matter if we cut some time corners when it comes to our news and information diet? Because, successful investing is not about time Efficiency. Time spent is irrelevant. Rather, successful investing is only about effectiveness. For most of us, achieving a superlative rate of return over many years requires a significant time investment.

If you are achieving a high annual return with a minimal time investment, I would regard you to be the exception. If you are not achieving a high annual return year after year, where is your information diet coming from and is much of it from primary sources or secondary recycled opinion?

Charlie Munger told Howard Marks about investing during lunch one day- “Its not suppose to be easy. Anyone who finds it easy is stupid!”

Most of the primary information sources are chocked full of insight, wisdom, and actionable intelligence. They are disguised🥸 in a boring conference, in a speaker’s monotone voice or in a question and answer session stretching on for 30 minutes too long, but by the time the analysis has made its way to the secondary information channels much of the Alpha has already been captured.

Secondary recycled information reminds me of the analogy used by world famous chef 👨🏽🍳Anthony Bourdain in the film ‘The Big Short’ to describe CDOs.

ANTHONY BOURDAIN- “Okay, I’m a chef on a Sunday afternoon setting the night’s menu at a big restaurant. I ordered my fish on Friday which is the mortgage bond that Michael Burry shorted. But some of the fresh fish doesn’t sell. I don’t know why, maybe it just came out halibut has the intelligence of a dolphin. So what am I going to do, throw all this unsold old fish, which is the BBB level of the bond, in the garbage and take the loss?”😢👎🏽

Bourdain chops up the old fish and pushes it into the big pot of “SEAFOOD STEW.”

ANTHONY BOURDAIN (CONTINUED)- “No way. Being the crafty and morally onerous chef that I am, whatever crappy levels of the bond I don’t sell I throw into a “sea food stew.” See, it’s not old fish. It’s a whole new thing! And no one knows they’re eating three day old halibut. That is a CDO.”

And that generally describes secondary recycled ♻️information, three day old halibut🐟 in seafood stew🍲.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- MU

Others- COST, KMX

📘7 Powers⚡️by Hamilton Helmer applied to Costco-

YES- Scale, Network, Switch, Brand, Process MAYBE- Counter NO- Cornered

📘7 Powers⚡️by Hamilton Helmer applied to Micron-

YES- Scale MAYBE- Network, Switch, Process NO- Counter, Brand, Cornered

📘7 Powers⚡️by Hamilton Helmer applied to Carmax-

YES- Scale, Network, Brand MAYBE- Counter, Cornered NO- Switch, Process

Hold on to your low interest rate mortgage as long as you can. It might be a long time before you can come close to that rate again. 😬

Enjoyed this Organizational Chart Visual😂 (Manu Cornet bonkersworld.net)

Articles & Posts

Some of the funniest and captivating short stories about investing and markets come fromDoug Lucas. He had a successful career in finance that I can’t even start to describe.🤩 He publishes some of the stories on his website, https://www.stories.finance

There is a 3 minute story that I want all of you to read. It is eye opening😬. Link below.

Dangerous CFOs, Imperial CEOs, Chagrined Bankers, and Warren Buffett/Charlie Munger

Below is a excerpt to wet your appetite🍤:

I met “very important CEOs” who came in to our New York office with multiple handlers: bankers, press people, and assistants. My first thought when I saw such a crowd was there must be something going on with the company I didn’t know about;😬😟😰 something that required a lot of people to explain and made this meeting especially critical.

Videos

10 Minute video of Forbes interviewing Zuckerberg. I find Mark to be thoughtful, approachable, and brilliant💡. He is one of the few remaining active founders of a gigantic tech firm. I suspect Mark and META 0.00%↑ are meaningfully underrated.

Books and Articles since my last edition

(Books are like loading software on your brain. If I get bored of a book I quit and move on.)

Golda Meir: The Life and Legacy of the Only Woman to Serve as Israel’s Prime Minister

by Charles River Editors Biography of Golda Meir

Code: The Hidden Language of Computer Hardware and Software by Charles Petzold Nonfiction about Software & Hardware Engineering. 🤓💥 Using everyday objects and familiar language systems such as Braille and Morse code, author Charles Petzold weaves an illuminating narrative for anyone who’s ever wondered about the secret inner life of computers. Petzold’s sense of humor is a bonus. I found it fascinating, but others might use it as a sleep aid. 🤭

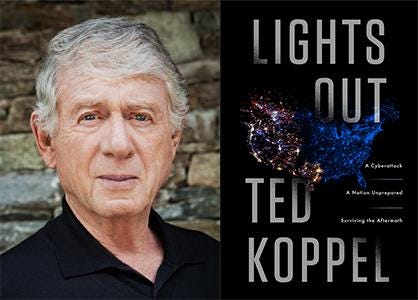

Lights Out: A Cyberattack, A Nation Unprepared, Surviving the Aftermath

Ted Koppel Nonfiction. Ted Koppel reveals that a major cyberattack on America’s power grid⚡ is not only possible but likely, that it would be devastating, and that the United States is shockingly unprepared.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Premium Investing Tool- The Finger Snap Test🫰🏽

I am giving this premium tool to you as a reward for the growing newsletter engagement.✊🤩 Thank you!!

The Finger Snap Test is an imagination exercise. Imagine we snapped our fingers and a company that you are invested in disappears. 😮😲🫢 How does this affect its customers and how do they behave? Does this affect other stakeholders, does it ripple through a larger ecosystem? Can this company’s disappearance be remedied in a week or a month? A year after they are gone has everyone forgotten them, or is the ecosystem still struggling to recover and fill the void?

The results of the test helps you understand the moat and the strength of the company you own or are interested in. If the prospect company can not survive the Finger Snap Test, why are you considering it as an investment?

A couple examples to illustrate this might be helpful. But, before I start painting, please don’t react to my investment examples, I am just writing in hypothetical terms.

Think of a car manufacturer (Ford, Tesla, Kia), if it disappeared. Would it matter to the customers? Or, would they buy one of the other 8 alternative vehicles.

What about a public company restaurant brand. These rise and fall all the time. As a customer, if some of my favorite restaurants disappeared, I just go to another restaurant.

What about a company that makes steel in the USA, or some other commodity product. Do their customers care who they buy from, or what geography supplies them? Or, do they just look at the cost of the delivered steel.

Cruise Lines 🛳️ They are so much fun and the ships are amazing. But, if one of the large public lines disappeared, would we stop taking cruises? 6 months later would we all be booking at one of the other 3 alternatives.

If Amazon disappeared, and we stopped getting little brown boxes to our house. We would be pissed off. Forced to drive all over town for products we need and want, some of them would not be in stock, some would be difficult or impossible to source. It would be horrible.

How would customers survive if Bed Bath and Beyond disappeared? Oh, that is right. 🏃🏽♀️💨 It is already gone. Most of their customers moved on effortlessly.

Use the Finger Snap Test🫰🏽 to help understand your current or prospect positions and the existence and degree of their competitive strength.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

Yes, I really liked the finger snap test too! I think a lot of time, finding and understanding the moat of a company is difficult and not quantifiable, so using the finger snap test is a great way to get started with a simple exercise.

Love the finger snap test, Nick! And the Microsoft graphic is hilarious!