10/7/24-Stock Price Hope🤞🏽, 5 Min⏲️ w B Gates, OpenAI Soap🧼Opera

Cue cartoon villain laugh. " mWahahaha, mUahahaha. "😅😂🦹🏻😈

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Should I expect the price of a stock I own to go up?

Anyone that has owned a stock for a short or a long amount of time has found themselves hoping the stock price continues to go up☝🏽. First, hope is the thing Disney Movies are made of, but hope is not a strategy in investing😑. Second I wanted to revisit the main inputs that cause a stock price to increase from a fundamental perspective.

Those are- Revenue growth, earnings growth, share count reduction.

But Wait🚨- I need to make an initial simplifying assumption up front. We need to assume that we are purchasing or have purchased the company stock at its fair value. Not above and not below. And, over the course of this example, I am going to further assume that multiples, PE (Price to Earnings) for example, remain unchanged over the time interval. This would also imply that market interest rates are stable.

Revenue Growth- Annual revenue growth of 5%, should lead to at least 5% of earnings growth, and this should result in about a 5% increase in the stock price. With zero revenue and earnings growth year over year, we can expect zero stock price growth. And that makes sense as there has been no change from one year to the next.

How can a company grow its revenue? It could sell more units, raise per unit prices, grow organically into a new product/market/geography. It could also acquire another company. These are just a few and there are others, to be sure.

Earnings Growth- Earnings or Net Income growth can come about from several efforts. Surprisingly I am going to start with control of expenses. This one should be obvious to you, so I am not going to unpack it too much. But, to the extent a company has slop in its expenses, it needs to reduce and eliminate the slop/excess/bloat. This is like playing a good defense. Defense is essential.

Revenue growth is the offense of earnings growth. If a company can not grow its revenue, the future is limited and maybe questionable. Think about physical newspapers a few years ago as an example. They couldn’t grow revenue via selling more physical papers, and might have been tempted to grow earnings by cutting expenses. I’m not interested in a company who’s plan is to shrink every year until they vanish. No thanks.

The best case is a company that can grow revenue AND increase earnings margins in the process. Net margins were 20%, and now 22%, and next year 24%. Operating Leverage, this is the holy grail. Of each new dollar the company brings in, they keep an ever increasing portion of it for their shareholders.

Share Repurchase- The final main driver of share price increase that I am going to describe is the reduction of the outstanding number of shares. A company can choose to do a number of things with its excess cash. It can expand organically, acquire another company, pay a dividend, or REPURCHASE its own shares from existing shareholders. Ideally the company repurchases shares at or below the fair value. After the repurchase there are fewer shares outstanding, the remaining shareholders each own a larger portion of the company and thus the per share value should go up.

Closing- If your company’s Revenue+Earnings are up and the Share Count is down, expect the share price to go up. But if Revenue+Earnings is unchanged or down, and Share Count is up, expect no share price growth or worse. You can tell from the topics above that I am thinking in time intervals of years, often many years. My tactics and strategy are not tooled to get rich quick. Rather, I am content to grow my wealth over time.🐢

[If you would like to read more about what influences a company’s financial performance, in my 3/12/2024 post I wrote about Revenue Drivers in detail. Link here.]

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

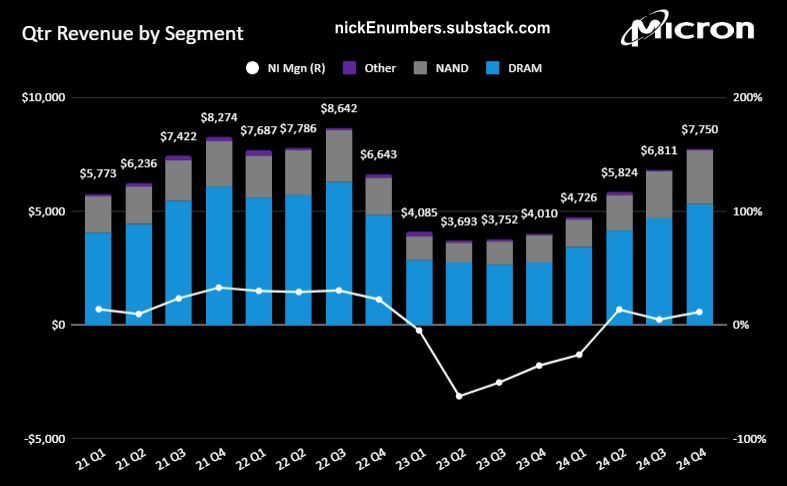

Technology- MU 0.00%↑ ,

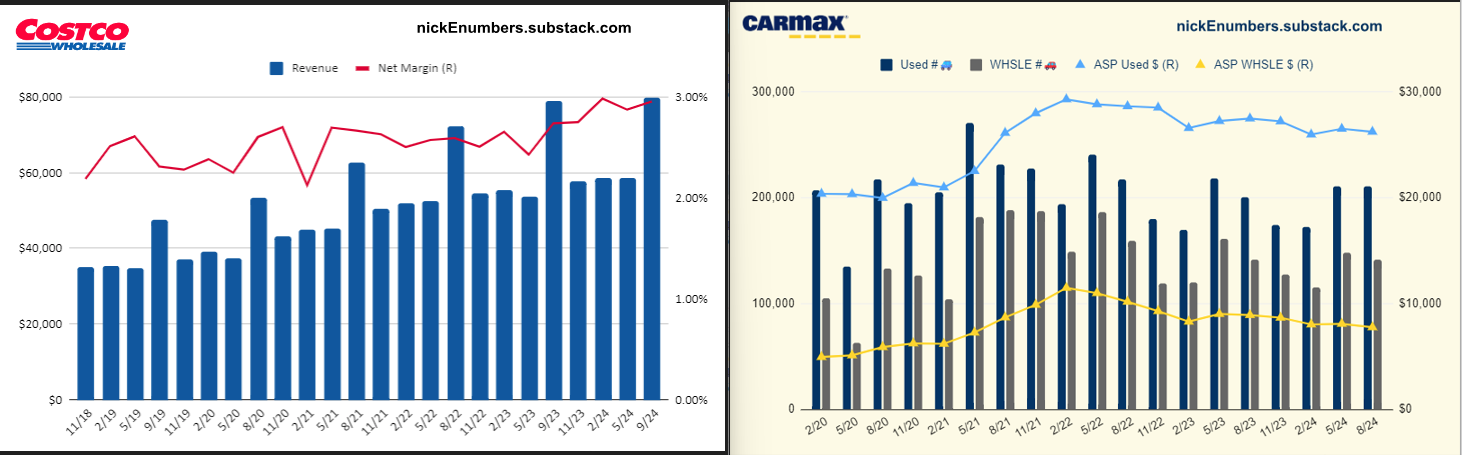

Others- COST 0.00%↑ , KMX 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.)

5 Minutes with Bill Gates

The Late Show with Stephen Colbert hosts Bill Gates. They cover a lot of territory in 5 minutes, including → AI Is "The First Technology That Has No Limit".

Videos

30 Minutes- Nikesh Arora, CEO Palo Alto Networks | All-In Summit 2024

Nikesh is whip smart and opinionated. Listen to his views on the State of Cyber Threats, How AI agents will change consumer apps, AI impacting cybersecurity. PANW 0.00%↑

Books and Articles since my last edition

(Reading Great books is like a conversation with the finest minds of the past.- Descartes. If I get bored of a book I quit and move on.)

Hackers: Heroes of the Computer Revolution by Steven Levy Nonfiction, History

Red Sister by Mark Lawrence Fiction, Fantasy 5⭐, great story. Book 1 of 3 story series.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏- The OpenAI Soap Opera

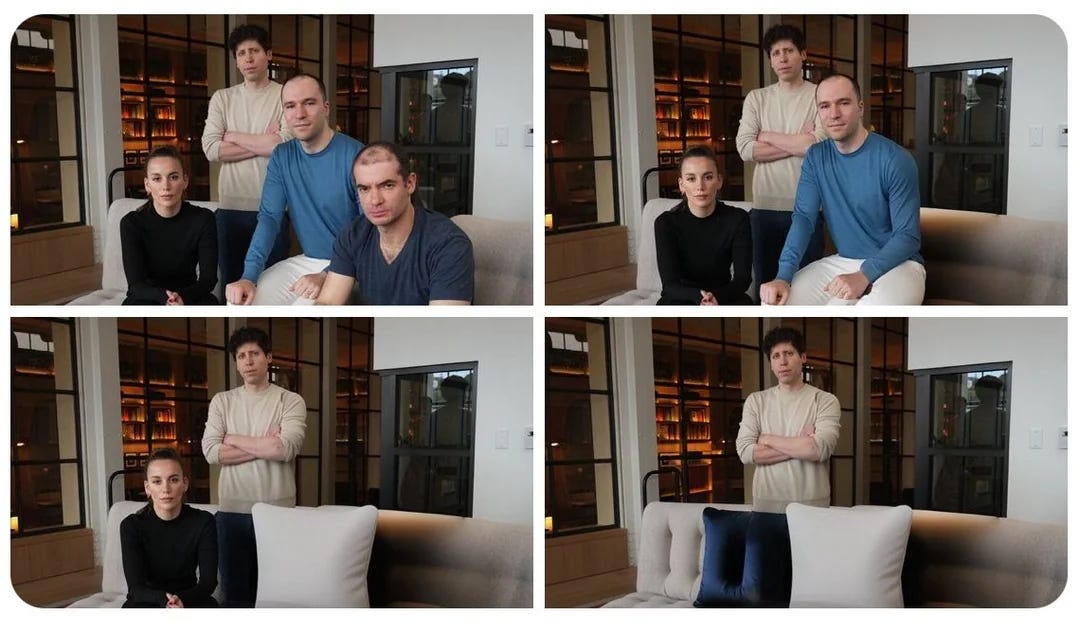

I don’t know who to give credit to on the above photo of the OpenAI disappearing senior leaders😶🌫️, but I LOVE it.

The TLDR to this photo/story is that Sam Altman has succeeded in becoming the only one left. As of this past week the remaining senior leaders in the above photo have left the company. (BTW, I have a lot of respect and admiration for Ilya Sutskever, Mira Murati and Greg Brockman. Vanishing in the photo above.) Sam is rumored to be a shrewd operator.

OpenAI, owner of popular ChatGPT, looks like it has put itself in the land of the sharp knives🗡️. But is OpenAI as strong now without the above leaders? If they were strong as a group of 5, and now there is only 1, I would argue they are probably significantly weaker. In addition, if things were great with Sam, why have 4 left? Ergo, things were not great with Sam and they are not great, and we should be cautious.

Microsoft is a part owner in OpenAI and certainly exerts some influence over Altman. My hope is that Microsoft, CEO Satya and CTO Kevin Scott exist as a check on the power of Sam Altman. From my perspective OpenAI spinning apart slowly or quickly is certainly on the table.

It is also possible that Sam Altman might have his way with team Microsoft. Cue cartoon villain laugh.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.