11/3/25-Andrej Karpathy🤩, Hacker Interview🧑🏻💻, Simple Investing⏳

You make money when you wait. 🫡

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Andrej Karpathy’s Thoughts are Fascinating🤩

Dwarkesh Patel recently interviewed legendary computer scientist Andrej Karpathy (former director of artificial intelligence and Autopilot Vision at Tesla TSLA 0.00%↑ , co-founded and formerly worked at OpenAI). The whole interview is outstanding so if you are interested, please check it out here.

A few of Andrej’s thoughts and comments stuck with me and I wanted to share them with you.

At the point of conception for humans or animals (when the egg becomes fertilized), all of the parent’s knowledge is NOT passed to the child. What is passed is more of a series of algorithms. Or a zip-file🗜️ of algorithms. And over time with evolution, it is an ever optimized set of algorithms being provided to the child. The child then uses the algorithms to analyze, understand, and acquire knowledge.

[I like the way that he described that. Interesting and makes a lot of sense.]

AI- We have not landed on the best algorithm for artificial intelligence, or even the complete set of algos. But we are on a path, adapting and evolving our way up to better algorithms and a more complete set.🪜

[You generally don’t find if your not looking. The world is looking, searching now 🔎🔦 for good, Better, BEST AI methods.]

Reinforcement learning is like sucking reward through a straw.😩

[Sparce and Delayed. Inefficient and Noisy. Low Bandwidth. Contrasted with Human Learning: Karpathy points out that humans don’t learn this way. When we solve a complex problem, we engage in detailed review, identifying which specific intermediate steps were good and which were errors, which provides a much denser and more precise supervision signal at every point.]

Being awake is like a full context window and DRAM/HBM loaded with ideas and memories. When we go to sleep🥱😴 at night our brain wipes🧼🫧🧽 most of it clean and weights the days experiences into longer term memory. When we wake up we have some memories and we have context from the day before.

[It is like the Disney movie, Inside Out. I mean… that is perfect🎯. ]

Visionaries like Andrej encourage us with his ideas and perspective. His personality is super likeable as well. I enjoy how he uses analogies of humans in his observations of what should be possible and what still is not working yet. It makes the cutting edge of his field easier for the rest of us to understand.

I encourage you to listen to the whole interview, check it out here.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

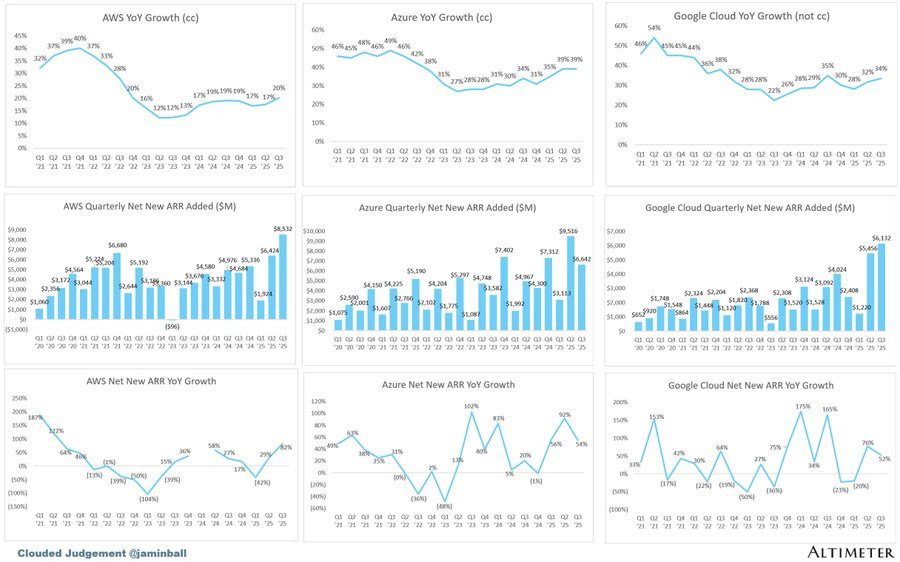

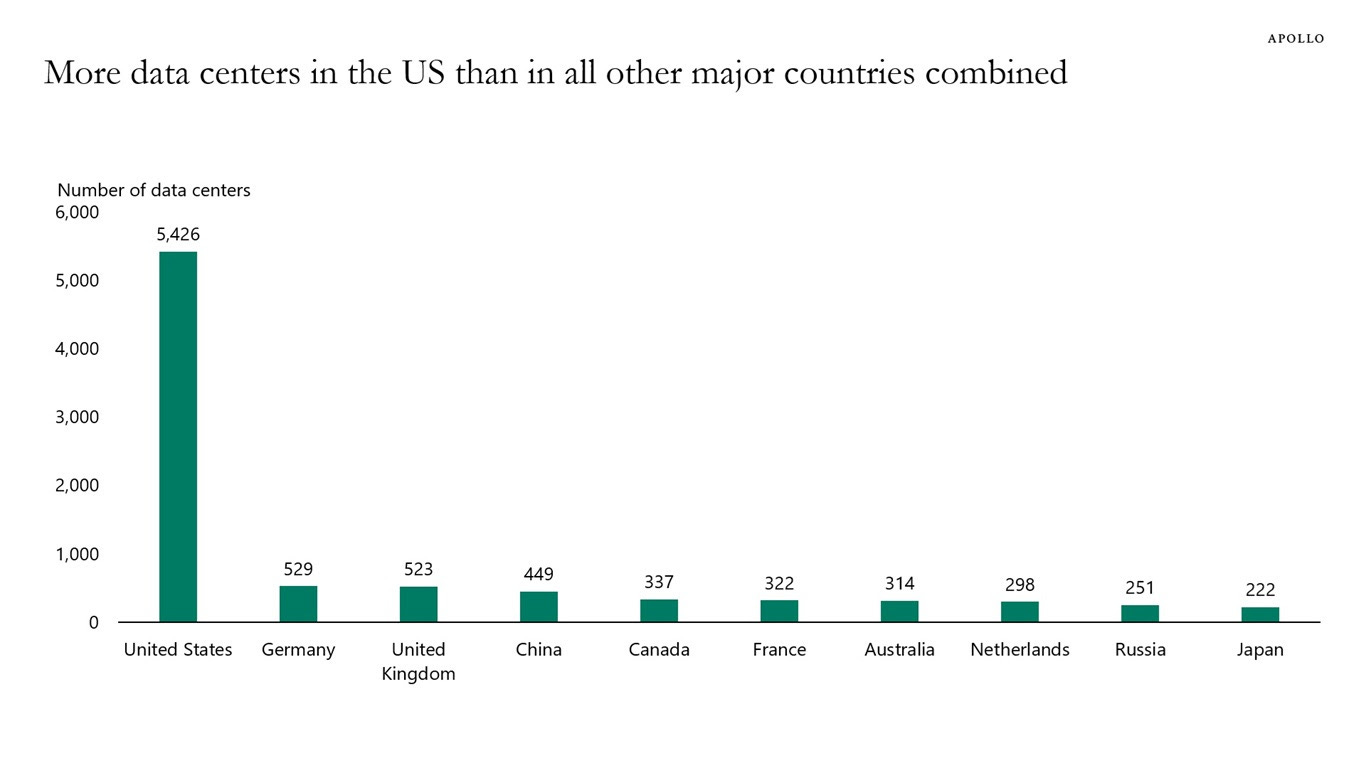

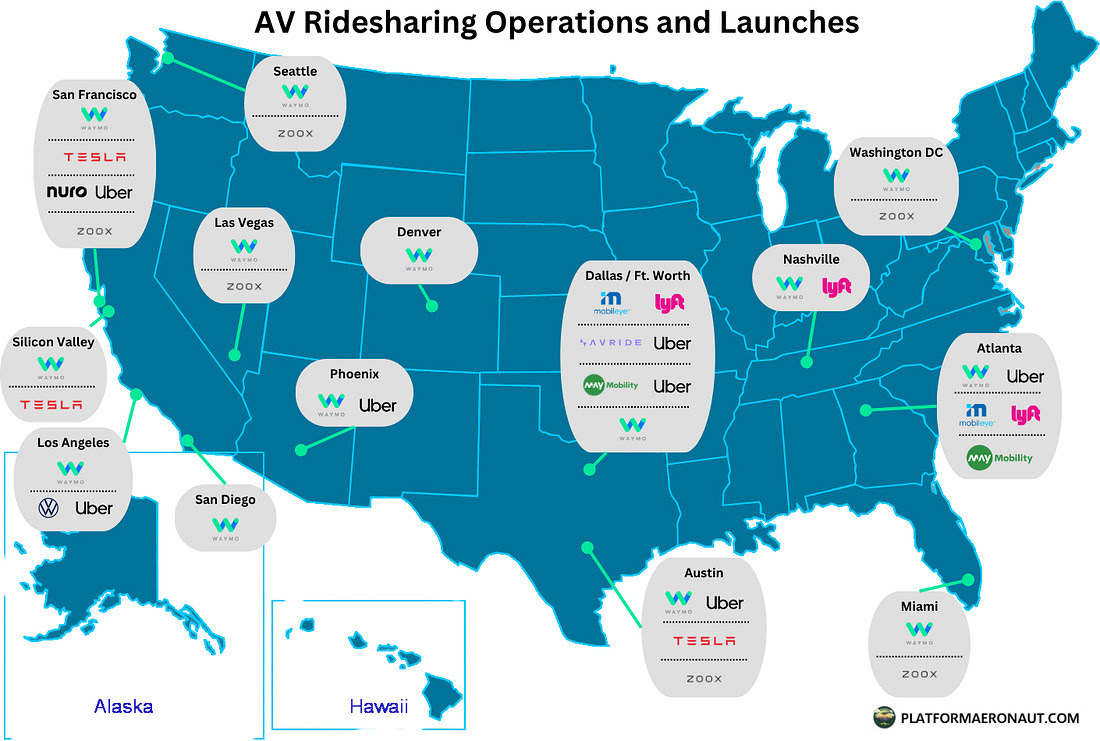

Technology- GOOG 0.00%↑ , META 0.00%↑ , AMZN 0.00%↑ , MSFT 0.00%↑ , SK Hynix, $TOELY , AAPL 0.00%↑ , NET 0.00%↑ , LRCX 0.00%↑ , CFLT 0.00%↑

Housing / Banking - DHI 0.00%↑ , PHM 0.00%↑ , GRBK 0.00%↑ , EXP 0.00%↑

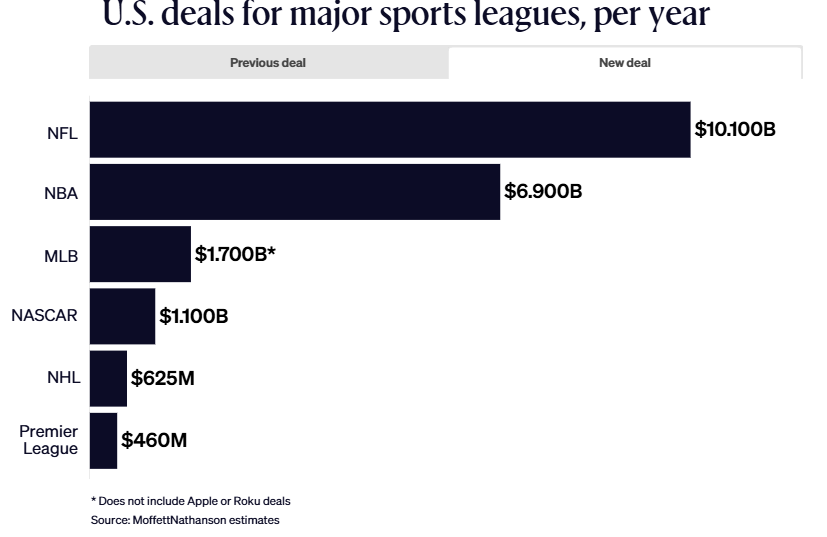

I have a lot of graphs and visuals of many of these companies that I have posted in the last couple of weeks. If you want to check them out you can see them on X, here.

(With data and charts it is not what you look at, it is what you see that matters.) Click on any of the images below to see a larger view.

DRAM Market Share by Revenue, Q3 2024 – Q3 2025

[I am reminded of a conversation Warren Buffett had with Greg Abel about electricity ⚡generation growth ~ a year ago. They are not only candid responses but Berkshire is perhaps the most capable to supply experienced capital in the sector. The link to the 5/2024 conversation is here.]

Podcast- Steve Eisman with Craig Moffett and Michael Nathanson from MoffettNathanson

55 Min. They discuss Apple’s lack of an AI strategy, MAG 6, why Cable stocks are such a disaster, the demise of traditional Ad agencies, the rise of youth unemployment because of AI, the need for streaming consolidation and why Verizon suddenly fired its CEO.

Video- Hacker Interview

60 min. Hacker Steve Sims discusses- Zero days, OMG Cable, Marketplaces, Cryptography, Dark Web, Crypto and more. I always learn some new things and come away more frightened😨😩. Long CRWD 0.00%↑

Books and Articles since my last edition

(Reading Great books is like a conversation with the finest minds of the past.- Descartes. If I get bored of a book I quit and move on.)

Genius Makers: The Mavericks Who Brought AI to Google, Facebook, and the World by Cade Metz Business, Technology

This Is How They Tell Me the World Ends: The Cyberweapons Arms Race

Nicole Perlroth Nonfiction, Cybersecurity It is interesting, but a little long. If you have an interest, go for it.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏- Keep Investing Simple

Some times my positions are doing very well, like this year. Other times we might be in a stormy market with decreasing prices and short term uncertainty. Through it all, good times and challenging times, I remind myself (and you) of the following:

What are we trying to do when investing?

Find a good business,

and one that I can understand why it’s good,

with a durable💪🏻, competitive advantage,

run by able and honest people,

and available at a price that makes sense.

While the above thesis holds, do not sell for as long as possible.

The above should be our foundation, everything else is either buttons and whistles🪀 or distracting noise that should be ignored.

I want to give Charlie Munger the final word on this as I believe he drives the overall lesson home superbly-

You don’t make money when you buy stocks, and you don’t make money when you sell. You make money when you wait. 🫡

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

Karpathy's foundation at Tesla is still visible in how FSD handles edge cases today. His insight about reinforcement learning being like sucking reward through a straw explains why Tesla pivoted so hard toward vision transformers and end to end neural nets. The algorithmic zifile concept fits perfectly with how autopilot keeps improving without massive architecture overhauls.

GOOG's recent earnings showed solid cloud growth and AI integration across their product suite, which validates the longer term thesis. The market tends to overreact to quarterly noise, but the fundamentals around search moentization and cloud expansion remain strong. Munger's advice about making money by waiting feels especially relevant when looking at Google's position in the AI infrastructure race.