11/4/24- LLM is not Search🚫,Unreal Engine CGI🍿, Homebuilder Land Banks🤨

David is here to kick ass and chew gum…and he’s all out of gum.

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

LLMs: A Powerful Tool, But Not a Search Engine Replacement

In a recent episode of IBM’s show titled Mixture of Experts, host Tim Hwang makes this very interesting skeptical observation about LLM powered SEARCH.

Maybe I'll play skeptic for a moment. I do think that one of the really funny things about LLMs is that everybody has rushed to use it as a search interface.

But, out of the box, LLMs are not concerned with information retrieval.

They're not really concerned about facts.

They're not really concerned about validation or verification.

There's no notion of like a page rank that would even give kind of like a sense of credibility between different sources.

So. I'd love to hear some kind of the counter argument. LLMs are not the future of search because LLMs do something that's just so fundamentally different from what you want out of search. We're in this weird situation. We've got this technology, we're trying to bolt search like features onto this tech.

The whole video episode can be found here and I queued it up for minute ~25 when this discussion occurs. I lightly edited the above for clarity.

Host Tim is making the statement above in a manner to stimulate discussion and opinion. He is not claiming it to be 100% correct.

My intuition is that his observation rings very true to me and my behavior. When I need to run any normal search, I continue to go right to Google and knock that out fast and efficiently. That Google search leads me to 10 blue links of high quality and I am usually delighted with the options and variety presented.

But, I use Google Gemini (or another LLM) when I want to summarize a multi page article, generate an image, perform multi step math in a word problem format, generate ideas for a title based on several paragraphs of text, or get personally tutored on a subject like :

Please explain this measure to me- "Producer Price Index by Industry: General Freight Trucking, Long-Distance Truckload"or :

Why would EUV with fewer mirrors be beneficial and are there disadvantages?I am extremely impressed with LLMs and generative AI, but I think it is a different tool than basic search.

What do you think about Host Tim’s question- Are LLMs the future of search? Are you performing the majority of your previous Google searches now instead in an LLM? Has your partner, or family ditched Google Search in favor of LLM search?

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- LRCX 0.00%↑ , TXN 0.00%↑ , GOOG 0.00%↑ , AMD 0.00%↑ , AAPL 0.00%↑ , MSFT 0.00%↑ , AMZN 0.00%↑

Housing / Banking - PHM 0.00%↑ , DHI 0.00%↑ , GRBK 0.00%↑ , EXP 0.00%↑ , MLM 0.00%↑ , VMC 0.00%↑ , SUM 0.00%↑

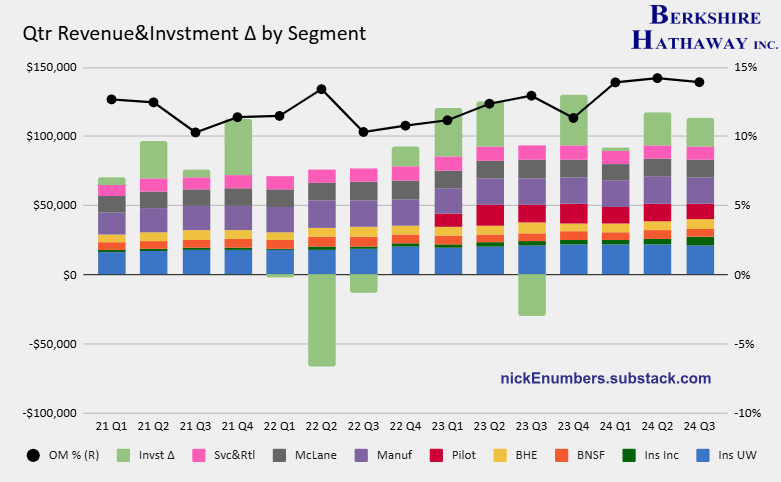

Others- TSLA 0.00%↑ , UBER 0.00%↑ , $BRK

(With data and charts it is not what you look at, it is what you see that matters.) Click on any of the images below to see a larger view.

Podcasts

🎧Why Home Insurance in Florida Is a Mess from Odd Lots, link here.

“Florida has been struck by two big hurricanes🌀🌪️ this year, setting off a wave of damage and, of course, new insurance claims. As we all know by now, insurance rates in places like Florida, Louisiana, and California have jumped in recent years thanks to a combination of more natural disasters, higher replacement costs, and other factors. But Florida has become a particularly expensive market, with roofing scams supposedly pushing up rates for everyone, and a string of private insurers exiting the market. So what's the future of this messy market?” Listen to an expert.

Videos

Gundam Requiem for Vengeance, 6 episode show on Netflix.

The story and show is interesting and entertaining. 👍🏼 I am also recommending this because the production uses Unreal Engine 5 for its CGI animation, and the result is an almost life like film production. I would suspect that much of the processing and rendering was performed using NVIDIA GPUs and animation integration. The news media wonders when AI investments will begin to produce value… it has already quietly become part of our lives and its influence is increasing. NFLX 0.00%↑ and NVDA 0.00%↑

Books and Articles since my last edition

(Reading Great books is like a conversation with the finest minds of the past.- Descartes. If I get bored of a book I quit and move on.)

Situational Awareness: The Decade Ahead by Leopold Aschenbrenner AI, Science. Aschenbrenner, a wunderkind who allegedly was fired from OpenAI 😳, valedictorian of Columbia when he was 19, a researcher and analyst. The book is focused on the race toward technology AGI, global trends and strategy. The guy is exceptionally brilliant.

The Traitor by Stephen Coonts Military Fiction, Mystery. 🕵🏼⭐

The Dragon's Banker by Scott Warren Science Fiction Fantasy, Banking, Business. This was a Patrick McKenzie recommendation. Fun read.👍🏼

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Homebuilders On or Off balance sheet land and development-

The US home market🏘️ has been underbuilt for more than 10 years. In addition most US public homebuilders are caught up in the trendy fashion of owning less land themselves, preferring instead to transact with a “land bank”, essentially off balance sheet land financing. But not homebuilder Greenbrick Partners, GRBK 0.00%↑ .

David Einhorn’s comments below will offer a lesson on the practice. David is here to kick ass and chew gum…and he’s all out of gum. (Excerpted from the Greenlight Capital, Q3 2024 letter, dated 10/15/2024)-

Green Brick Partners (GRBK) was the other significant winner during the quarter. GRBK reported quarterly earnings of $2.32 per share, which beat analyst estimates of $1.77 per share. The company continues to lead the industry in gross margins and has distinguished itself from its peers, who are increasingly focused on appearing to be “land light.” GRBK believes that being land light is very expensive at the gross margin level. Rather than pay high rates to third-party off-balance sheet land bankers, GRBK owns most of its land and lots while maintaining a very low-leveraged investment-grade balance sheet. As a result, it earns all of the development profits in addition to the homebuilding profits. Despite being “land heavy,” the result is a return on equity that is near the top of the industry. Even more exciting, GRBK has had a very successful period of land acquisition, and as a result the prospects for it to continue delivering industry-leading margins remain promising. This quarter, GRBK shares advanced from $57.24 to $83.52.

(Curious about Einhorn, I wrote more about him in my 4/11/23 edition, link here. His 3rd grade teacher grabbed him by the arm😠and took him aside… Find out why.)

The visual below is taken from GRBK 0.00%↑ ‘s most recent earnings presentation, and it illustrates the fact that off balance sheet land bank financing comes at a significant cost or loss of gross margin to the homebuilder’s shareholders.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.