1/14/25-House Prices🏠,Elon Mindset⛓️💥, Kurosawa📽️,10Y Rates🙏🏻

The candy🍬🍭 isn’t worth the game.

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Has My First Home Gotten Less Affordable?

We all hear a frequent theme that homes in the US (and many other countries) have gotten less affordable. I am almost numb to the message when I come across it. BUT, a week ago I was inspired to actually do the math for myself.

Forget about the mushy subjective media words on housing affordability, I wanted to resurrect my original first home- purchase price + annual incomes of my wife and me. Somehow we managed to pull it off back in 1998 (modest 3 bedroom, 2 bathroom similar to the home pictured above). Is this exact same home out of the reach of the younger 2025 version of me?🤔

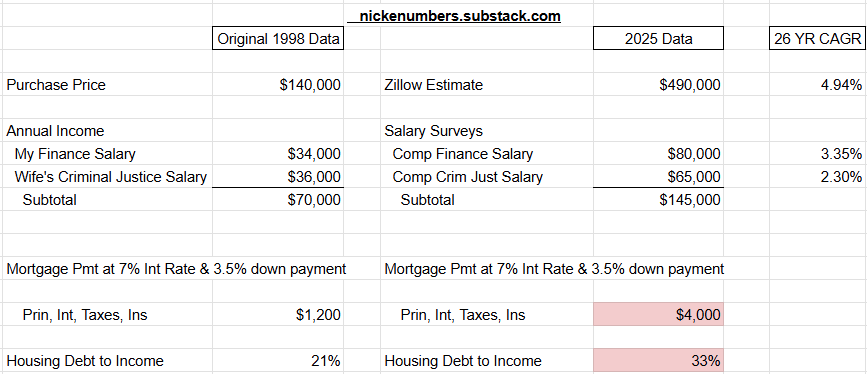

What follows is my attempt to compare 1998 with 2025. Interest rates were about 7% when we purchased the house in 1998, so I used that for both 1998 and 2025 to better isolate the factors. You guys are all smart and thoughtful. I am not going to explain the rest of the numbers or the labels below. Take 4 minutes and walk yourself though it. I was a little shocked and disappointed by what I discovered.

Incomes for the job positions that my wife and I held did not keep up with the rate of home inflation over the last 26 years. More over, we would have to allocate 12% more of our annual income (fully 33% of our annual income) just to afford this same house in 2025. Never mind the fact that the house is now 26 years older 👨🏽🦰→👴🏼.

What does this mean Nick? The trend is not good! But I don’t have a quick and easy summary. This one is complicated. The US housing population is still growing. We need more housing supply. In general, houses need to be located within a reasonable commuting distance from a job, and that job should pay enough to afford the mortgage payment.

Consider doing this same math on your first home purchase, or that of your parents. Figure out the annual salaries and calculate the DTI. What did you discover about housing affordability? The numbers have to make sense to the next generation… otherwise the candy🍬🍭 isn’t worth the game (in that geography.)

[I wrote more about the population math and Drivers of US New Home Construction in 4/2024, link here.]

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Housing / Banking - KBH 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.) Click on any of the images below to see a larger view.

Podcast

Sharp Tech with Ben Thompson- Understanding Tesla’s approach to an autonomous driving future, Why some observers think Tesla is ahead of Waymo today, Strategy that Starts with the Dream, Questions about Market Structure and regulation concerns as the future of transportation takes shape. Link Here.

This episode is from 10/24, but I have listened to it a couple times. Ben brings original analysis, synthesis and opinion like few others. Ben’s WORDS add more.. clarity and understanding to subjects/topics. Ben says ~minute 35:

What Elon is doing is taking this fundamental financial equation of technology, a silicon mindset..

That mindset is 1) a large up front investment (CapEx) and 2) then low or NO marginal cost for each incremental unit produced. Maybe the marginal cost of each unit is free, or just sand, or electrons, or steel, or just power. Elon is taking that model for software development..

and applying it to cars🚙🚗, and applying it to space🚀🛰️📡.

Tesla, xAI, SpaceX, Starlink. It is very hard for a new competitor to enter and compete with an incumbent that has technological superiority and low or NO marginal costs.

Video

30 Minute, created by Ray Dalio. It you have not seen it before, it is certainly worth the time.

Simple and easy to follow animated video answers the question, "How does the economy really work?" It breaks down economic concepts like credit, deficits and interest rates, allowing viewers to learn the basic driving forces behind the economy, how economic policies work and why economic cycles occur.

Books and Articles since my last edition

(Reading Great books is like a conversation with the finest minds of the past.- Descartes. If I get bored of a book I quit and move on.)

Hold'em Wisdom for all Players by Daniel Negreanu Nonfiction, Games

Rubicon by J.S. Dewes Science Fiction

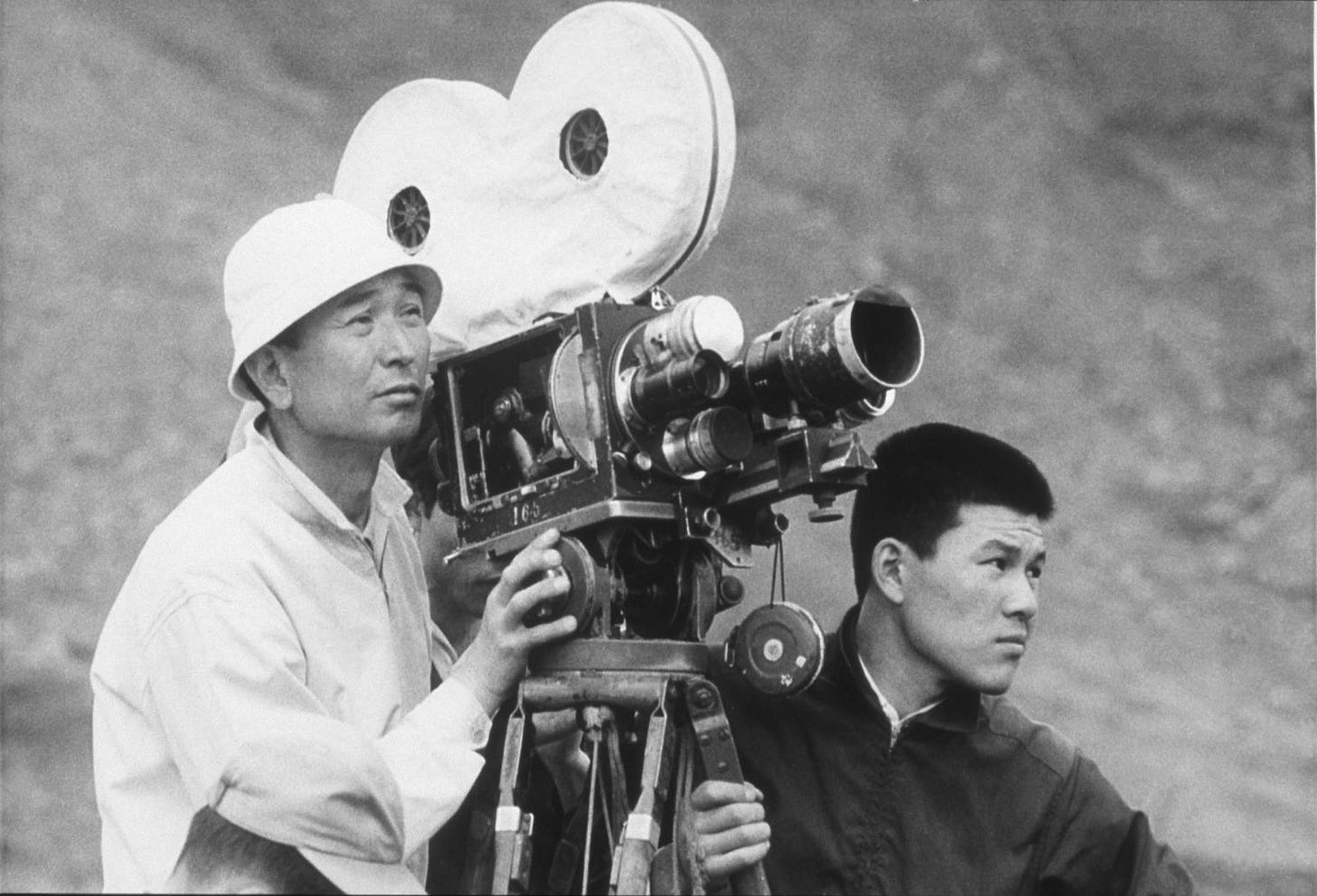

Something Like an Autobiography by Akira Kurosawa Autobiography. Even though he is a distinguished filmmaker and artist, his memoir is fun, authentic and humble. Looking for a Kurosawa film to begin with- Seven Samurai🥷🏽⚔️!! Seven Samurai is regarded as one of the greatest and most influential films in cinema history. Yes, it is black n’ white in Japanese and yes, watch with subtitles. But, after the first 10 minutes, there is a 90% likelihood that you are going to get sucked into the adventure and love it! 🙏🏻

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

How high can the 10 year go?

There has been a lot of discussion about the rise of the 10 year in the last 5 months, and specifically in the last 60 days.

Below is a great chart on 10 Yr yields from

showing the recent 12 months trends.I am not going to bore you with more reasons for the rise, or how high it might go. Below is a graph of the 10 year over the last 24 years. 10Y has been over 6% within this time range.

Two items as food for thought. Mortgage rates are priced based on the 10Y. (My rule of thumb is to take the 10Y rate and add 2.5% to it as an approximate 30Y mortgage rate.) Second, there has been talk that the US Treasury needs to start to issue more debt at the longer end, and certainly some at the 10Y duration. Generally, as supply goes up, prices go down and yields go up.

How high will 10Y yields go? I dunno. I put it in the too hard pile like the speed/direction of the wind and popular styles at fashion shows👖🥻👕👒.

The 10Y will keep going higher until it can’t go up any more, and then it will eventually begin to go down.🤭

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.