12/19/23- Homebuilders🏡, Jay Powell, 🛡️PANW CEO, Beckham⚽

In Spain people have dinner a lot later - when I return to England I'll have to eat alone at midnight. - Beckham

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

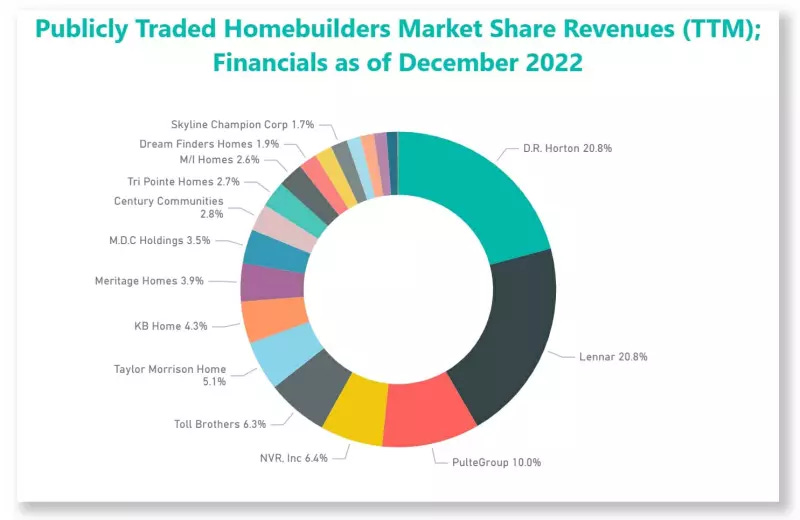

Comparing public company homebuilders in order to glimpse future share price growth?

Although public company homebuilders seem similar at first (apples to apples), they are more like apples and oranges, or fruit salad.

Let me explain with some comparison alternatives-

🚫Not Revenue because large builders and small builders have significant differences in the absolute dollar revenue number.

🚫Not Profit for the same reason.

🚫Not number of units sold as large home builders sell a lot more units.

🚫Not PE as it is too opaque as a primary metric, although it is a meaningful supporting metric. Gross Margins and Net Margins same as PE.

🚫No Adjusted EBITDA or Non-GAAP numbers as investing Master Charlie Munger labeled them Bullsh*t (most of the time.)

✅Earnings per Share (EPS) growth over time. Bingo. That is one of the best indicators that I could land on that ticked most of the boxes. As their is a high correlation between EPS growth and share price growth, we want to know if homebuilder management is maximizing and optimizing EPS over 5 plus years.

Bonus question for the A Students- What is generally easier for management to influence in the short term- Revenue or EPS? (Without giving you the answers, this is why management has to be incentivized along with the long term shareholder. If we are all pulling in the same direction, we can go very far. If we are pulling in different directions, hard pass for me.)

This method of looking at the growth in EPS over 5 years or more might also be used to compare- profitable, cashflow positive competitors in other industries.

After completing these calculations and analysis above are we ready to invest in a specific company? We are getting closer, but No. We must still value the company and compare our estimate of fair value to the market trading price.

(Mentions- DHI 0.00%↑, LEN 0.00%↑, PHM 0.00%↑, TOL 0.00%↑, NVR 0.00%↑, GRBK 0.00%↑ )

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

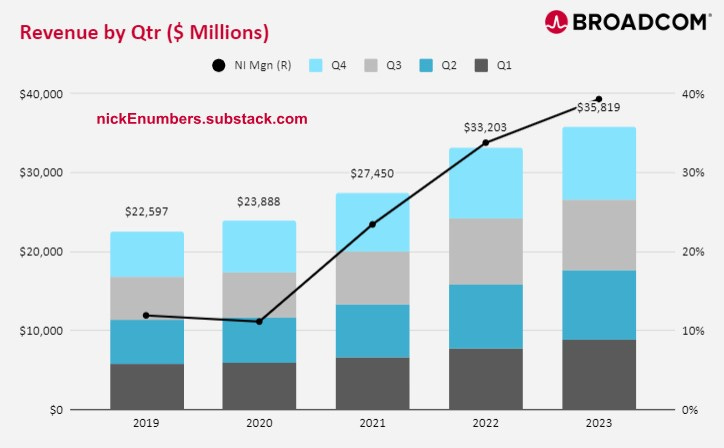

Technology- ORCL 0.00%↑ , MDB 0.00%↑ , S 0.00%↑ , AVGO 0.00%↑

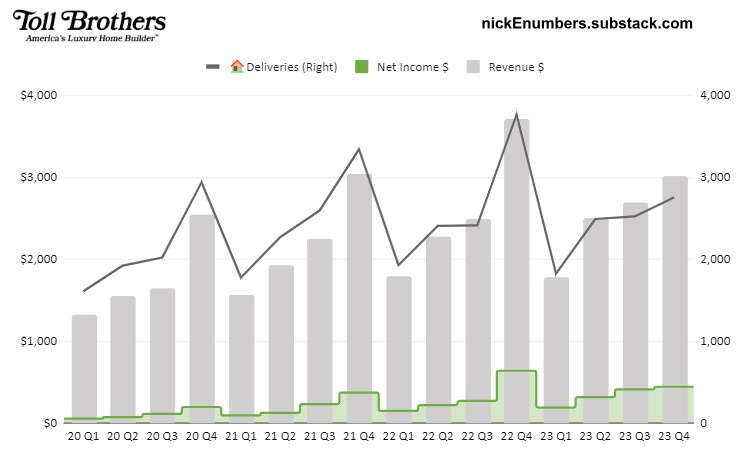

Housing & Banking - TOL 0.00%↑ , LEN 0.00%↑

Others- COST 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.)

Costco wants its revenue to rise and its net margin to remain steady. Costco gives the extra value/margin back to its customers. That is why we all keep going back 😄.

Podcasts

Nikesh Arora became the CEO of Palo Alto Networks PANW 0.00%↑ with no cybersecurity domain expertise and has grown the company from $18B to nearly $100B in under 6 years. In the episode, they discuss some of the greatest learnings from revolutionizing Palo Alto Networks into a powerhouse, his celebrated M&A strategy👍🏽✨, and stories from his wide-ranging career path. Nikesh is an experienced Operator.🤺

Prior to Palo Alto Networks, Nikesh was Chairman and COO of Softbank, working alongside Masa to make investments. Before that, he spent time scaling T-Mobile in Europe as CMO then spent a decade at Google as CBO. Hear how Nikesh has consistently succeeded in each new role and built a prolific career across industries.

Videos

4 Episode Documentary. David Beckham. I suspect you have probably already heard about this show and I am a little late to the party, but it is very good.🤩 It wasn’t what I thought it was going to be, and David was different as well. Everyone has a story, life is rarely a straight line. Respect to the Beckham family for giving us perspective from the inside. PS- if a celebrity is having lunch with their family in public, consider leaving them in peace.🙏🏽

Books and Articles since my last edition

(Books are like loading software on your brain. If I get bored of a book I quit and move on.)

The Andromeda Evolution by Daniel H. Wilson Science Fiction about nano technology.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Jerome Hayden "Jay" Powell

He has served as the 16th Chair of the Federal Reserve since 2018, navigating the US central bank through turbulent economic times. His career spans both the public and private sectors, marked by a deep understanding of finance and a commitment to economic stability.

Early Life and Education- Born in Washington, D.C., in 1953, Powell graduated from Princeton University with a degree in politics and Georgetown University Law Center with a J.D. He served as a legislative assistant to Senator Richard Schweiker before embarking on a successful career on Wall Street.

Wall Street, Government and the Carlyle Group- Powell joined Dillon, Read & Co. in 1984, eventually becoming a managing director. In 1990, he transitioned to the public sector, serving as Assistant Secretary and Under Secretary of the Treasury under President George H.W. Bush.

🎈Fun Fact🎈: During his stint at the Treasury, Powell oversaw the investigation and sanctioning of Salomon Brothers after one of its traders submitted false bids for a United States Treasury security. Powell was also involved in the negotiations that made Warren Buffett the chairman of Salomon for a short time.😎

After leaving government, Powell became a partner at The Carlyle Group, a private equity firm, where he gained valuable experience in investment and risk management (1997 to 2005.)

Return to Public Service- In 2012, President Obama appointed Powell to the Board of Governors of the Federal Reserve. He played a key role in shaping the Fed's response to the 2008 financial crisis and its aftermath, advocating for measures to stabilize the banking system and promote economic growth.

Federal Reserve Chair- In 2017, President Trump elevated Powell to the position of Chair of the Federal Reserve. Since then, Powell has faced a range of challenges, including rising inflation, the COVID-19 pandemic, and ongoing geopolitical tensions.

Career Highlights- Oversaw the gradual normalization of interest rates following the 2008 financial crisis. Led the Fed's response to the COVID-19 pandemic, implementing unprecedented measures to support the economy. Navigated rising inflation in 2020-2023, raising interest rates to combat price pressures.

Personal Details- Powell (70 years old) has been married for 38 years to Elissa Leonard. The couple has 3 children. When Jay is not working he is an avid cyclist.🚵🏽♂️ His salary at the FED is $230K per year, and his net worth is estimated between $50-100M.

Powell's Legacy- Jerome Powell's legacy as Federal Reserve Chair is still being written. He has faced a period of significant economic uncertainty, and his decisions have had a profound impact on the lives of millions of Americans. His commitment to economic stability and his ability to effectively communicate the FOMC actions/reasoning will likely be seen as his defining qualities.

In an imperfect world filled with politicians acting like children, I think Jay Powell is one of the few adults. He is doing a great job given the hand he was dealt ♠️♥️🃏. Mark me down as a Powell fan.

(If you would like to read more about finance folks, I wrote about Jim Simons and 🏦Brian Moynihan BAC 0.00%↑ in my 8/1/23 post, here. )

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.