1/2/24-Bezos Metrics, Marks🎧Annie Duke,📘 Lyn Alden,🪙Gold Hedge🤔

"Being right once says nothing about the decision-making ability of an investor."

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Metrics- a Skeptical vs Complete perspective-

Metrics can be valuable.

How much cash (or debt) should we keep on the balance sheet? What PE is too high? What is the best ‘days inventory outstanding’, DIO? Should we focus on Net Income, Operating Cashflow, or EBITDA? Humm..🤔 it all depends.

In a recent podcast with Lex Fridman, Jeff Bezos ( AMZN 0.00%↑) unpacks this concept like a master-

Jeff Bezos …the skeptical view of proxies. One of the things that happens in business, probably anything where you have an ongoing program and something is underway for a number of years, is you develop certain things that you’re managing to. The typical case would be a metric, and that metric isn’t the real underlying thing. And so maybe the metric is efficiency metric around customer contacts per unit sold or something like. If you sell a million units, how many customer contacts do you get or how many returns do you get? And so on and so on. And so what happens is a little bit of a kind of inertia sets in where somebody a long time ago invented that metric and they invented that metric, they decided, “We need to watch for customer returns per unit sold as an important metric.” But they had a reason why they chose that metric, the person who invented that metric and decided it was worth watching. And then fast-forward five years, that metric is the proxy.

Lex Fridman The proxy for truth, I guess.

Jeff Bezos The proxy for truth. Let’s say in this case it’s a proxy for customer happiness, but that metric is not actually customer happiness. [..]

And so you’ve got to constantly be on guard and it’s very, very common. This is a nuanced problem. It’s very common, especially in large companies, that they’re managing to metrics that they don’t really understand. They don’t really know why they exist, and the world may have shifted out from under them a little and the metrics are no longer as relevant as they were when somebody 10 years earlier invented the metric.

🎞️Video Link starting 1.24 hr mark, <here>

My brain often goes to this concept of metric as a proxy when someone asks in investing- What is a good/bad number? How much is too high/low? Should I look at this or that ratio? No, no. You need to know it all. If you are learning, asking questions is wonderful. If you are investing your real money, you need to know. You need to get back to base reality and understand everything that is going on. We can not outsource our thinking to another person, or sustain exceptional results with a simple set of ratios. I go back to the checklist concept that I wrote about in my 5/23/23 post below:

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- MU 0.00%↑

Others- KMX 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.)

Podcasts

🎧Oaktree Capital- Special Episode with Annie Duke and Howard Marks (50 min)

Don’t skip this podcast, it was excellent. Howard has a lot in common with former professional poker player Annie Duke and it is fun to watch the 2 worlds collide💥!

Howard Marks founded Oaktree Capital, writes widely with his dry wit and has a net worth of ~$2.2B.

PhD Annie Duke won the World Series of Poker Main Event🃏♠️♥️, wrote bestseller “Thinking in Bets”, and is a highly sought after advisor to companies and individuals.

During the discussion, Howard Marks says the following:

.. you can’t tell the quality of a decision from the outcome. Poor decisions end in success often. And we all know people, especially in the investment business, where we say, “Well, he was right for the wrong reasons.” That’s what that means. Or I always say that our industries full of people who got famous for being right once in a row. Being right once says nothing about the decision-making ability of an investor.

Videos

Branch Education- How do Video Game Graphics Work?

Have you ever wondered how video game graphics have become incredibly realistic? How can GPUs and graphics cards render such incredibly detailed scenes? Well, in this video they're going to explore how just a bunch of data in your computer gets turned into realistic graphics. Additionally, they'll take a quick look into Ray Tracing, DLSS or Deep Learning Super Sampling, and many other complicated aspects of video game graphics. This is also an indirect glimpse into NVDA 0.00%↑ products/use cases. (20 Min) 5 ⭐!

Books and Articles since my last edition

(Books are like loading software on your brain. If I get bored of a book I quit and move on.)

Broken Money: Why Our Financial System is Failing Us and How We Can Make it Better by Lyn Alden Economics A Comprehensive Overview of the Past, Present, and Future of Money. Lyn is both brilliant and an excellent teacher.

Traffic: Genius, Rivalry, and Delusion in the Billion-Dollar Race to Go Viral by Ben Smith Nonfiction, Business

A Closed and Common Orbit by Becky Chambers Science Fiction. An AI with conscious awareness posing as a🤖=👩🏽 human trying to figure out how to fit into a community. Really thoughtful.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

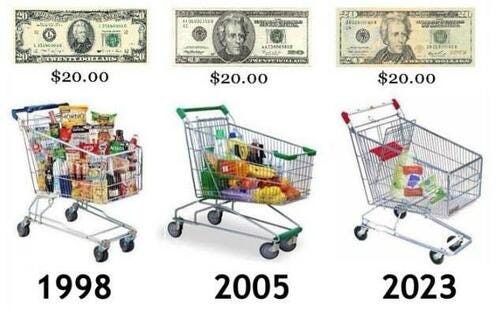

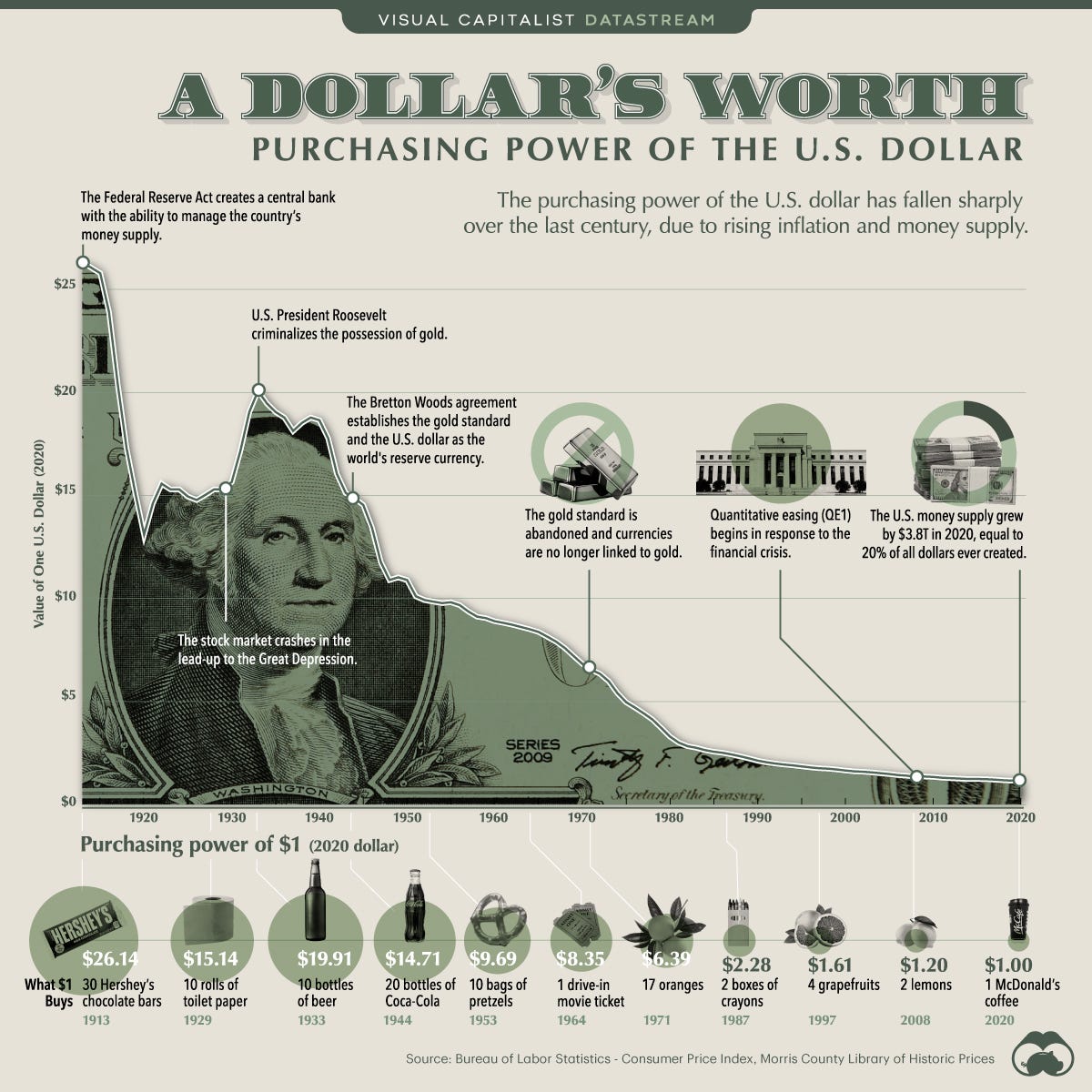

Value of a dollar over time and gold as a hedge.

The purchasing power of the dollar (like most fiat currencies) is decreasing over time. The stated goal of 2% inflation engineers a depreciating dollar into the outcome. But, as we have all seen in the last 3 years, when inflation runs higher, the purchasing power of the dollar depreciates more rapidly.

In the visual above, my favorite data point is that in 1933 one dollar could buy 10 bottles of beer, 🍻🍻.

It is fairly certain that we could build a currency hedge with commodities including Gold🥇🪙. But like most things the devil😈 is in the details. How do we implement this position among the various alternatives? At what carrying/opportunity cost? Are we introducing new risk? Timing the entry and exit of the hedge profitably. On, and on.

Buffett and Munger have fielded this question often at the annual meetings, but one of the best instances was the 2011 meeting. Below is my summary of Buffett’s views from the video and there is a link below to the actual video:

Conversation between Andrew Ross Sorkin, Warren Buffett, and Charlie Munger about investing in commodities, particularly gold:

Question: Why hasn't Berkshire Hathaway invested more in commodities like gold, given their recent appreciation? Expresses belief that commodities will continue to go up as long as Ben Bernanke keeps printing money.

Warren Buffett's response:

He compares the current value of gold with its past value, implying it still has room to grow, but emphasizes the importance of considering different investment categories before choosing specific assets.

He identifies three major investment categories:

Currency-related investments: He criticizes these due to inflation and historical devaluation of currencies.

Non-productive assets like gold: He argues that buying such assets relies on others paying more in the future for something inherently unproductive.

Productive assets like businesses and farms: He sees these as the most appealing due to their ability to generate ongoing value.

He explains Berkshire Hathaway's focus on productive assets and their belief that these will outperform non-productive assets over time.

He acknowledges the psychological appeal of rising prices but warns against basing investment decisions on such trends.

Charlie Munger's agreement:

He echoes Buffett's points and finds it illogical to rely on an asset that benefits only from a negative global scenario.

He humorously suggests alternative, unproductive investments like paintings of soup cans.

Additional points:

Buffett compares the value of all gold in the world to the value of US farmland and ten ExxonMobil s, highlighting the relative size of these asset classes. What do we want to own? All of one, some of each?

He concludes by expressing his preference for owning productive assets over a large lump of gold.

Overall, the conversation emphasizes Buffett and Munger's philosophy of investing in productive assets for long-term value creation, rather than chasing speculative trends in non-productive commodities.

📺 2011 ANNUAL MEETING A big cube of gold ( Link )

There are certainly several successful investing paths up the mountain.🌄 Reasonable people can take the path that suits them. I can see the merits of owning some gold, commodities and perhaps Bitcoin, but taking it from the theoretical to the actual present reality is where I stumble. I find myself in the Productive Asset category owning businesses. Owning Gold goes in the “Too Hard Pile”, for me. ¯\_(ツ)_/¯

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

I definitely think it is common for people to focus on whether one metric is a good or bad number. While they should be looking further into the context of that number, identifying comparable numbers, and how it relates to other metrics. One metric does not tell you very much, but many metrics together tell a story.