12/29/25- Invention vs Reverse Engineering, Jim Chanos, Homebuilding Volume or Margin 🤔

OpenAI is King of Losing Money? 🫳🏻🎤

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Invention/Discovery vs. Reverse Engineering Technology

The difference between original invention and reverse engineering can be better understood by thinking about the search space and the existence proof. When you are inventing something from scratch, you aren’t just looking for a needle in a haystack—you don’t even know if the haystack contains a needle, or if needles can even exist in hay.

Here is why that psychological and technical gap is so massive:

1. The “Existence Proof” (Psychological Certainty)

The moment you know someone else has done it, the nature of the problem changes from “Is this possible?” to “How did they do it?” Think about Chinese competitors attempting to copy ASML 0.00%↑ ’s EUV process, for instance. The physical reality hasn’t changed; the certainty of the goal has.

Cognitive Fuel: In original invention, “failure” feels like a dead end (maybe the idea is just impossible). In reverse engineering, “failure” is just a temporary lack of understanding. You persevere longer because you know a solution exists.

2. Unbounded vs. Bounded Search Space

Invention requires navigating an unbounded search space. If you are trying to create a large language model, your “hypothesis” could involve anything from videos of humans talking and reading books to directing a transformer algo to crawl the entire internet.

Original Invention: Create a “self-attention” mechanism that allows neural networks to analyze entire bodies of text simultaneously. You must decide which variables even matter.

Reverse Engineering: The search space is bounded by the results in front of you. You can see the input window, the dimensions, and the outputs. Even if the internal mechanism is a “black box,” you can measure what goes in and what comes out. You are no longer guessing what to build, but how the existing pieces interact.

3. The Burden of “False Positives”

When inventing, many hypotheses look promising but lead to “local maxima”—solutions that work a little bit but can never be scaled or perfected. You might spend years on a dead-end path because you don’t know there’s a better way.

In reverse engineering, you are looking at a global maximum. You know you are aiming for a version that is already optimized for the real world, which prevents you from getting stuck in “good enough” traps. (LLM Leaderboards and test results.)

[A suggestion for 2026 on independent thinking and how I consume financial statements in a throwback post from 3/2024, link.]

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

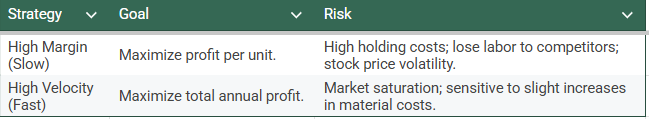

Technology- MU 0.00%↑ , ACN 0.00%↑

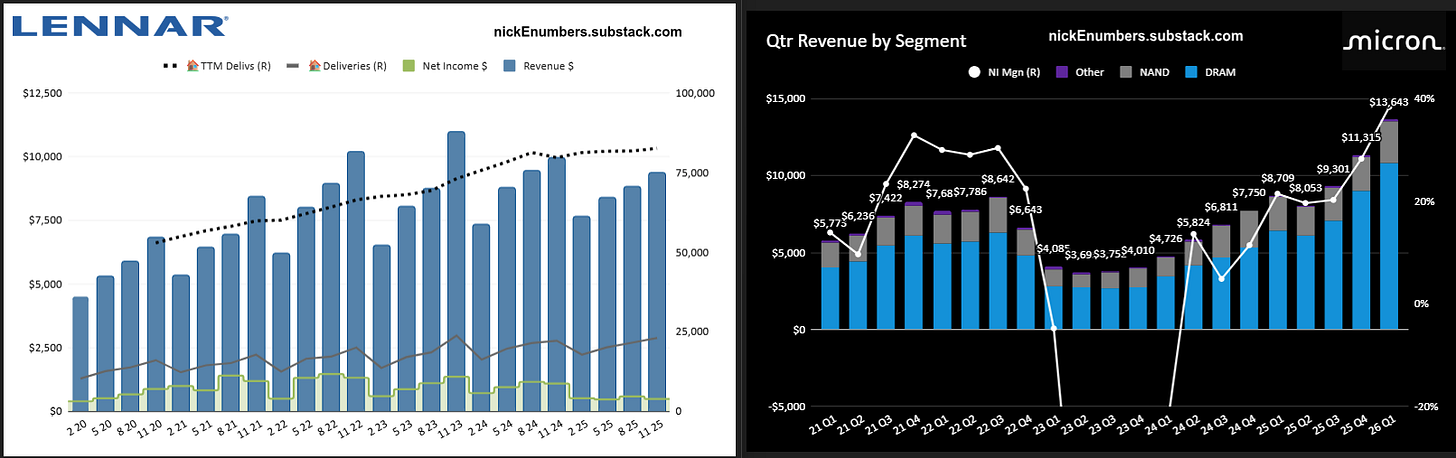

Housing / Banking - KBH 0.00%↑ , LEN 0.00%↑

Others- KMX 0.00%↑ ,

(With data and charts it is not what you look at, it is what you see that matters.) Click on any of the images below to see a larger view.

Video- OpenAI is King of Losing Money? Warning From Jim Chanos

Chanos breaks down why hosting GPUs is a commodity business with low returns and why the depreciation of AI chips (like Nvidia’s) creates a massive financial risk for companies like CoreWeave and Oracle. He also discusses the dangers of private credit, the accounting tricks at Live Nation, and why the “unprofitable” nature of today’s AI customers makes this cycle riskier than the Dotcom era.

“Private Credit Reminds Me of Michael Milken”

Books and Articles since my last edition

(Reading Great books is like a conversation with the finest minds of the past.- Descartes. If I get bored of a book I quit and move on.)

Breakneck: China’s Quest to Engineer the Future by Dan Wang Nonfiction, Economics, China. Interesting read.

The Storied Life of A.J. Fikry by Gabrielle Zevin Fiction. Outstanding writing.

The Universe Speaks in Numbers: How Modern Maths Reveals Nature’s Deepest Secrets by Graham Farmelo Nonfiction, Mathematics, History

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Large national homebuilders (like D.R. Horton, Lennar, and Pulte) prefer "velocity" (speed and volume) over "margin" (profit per house). Why?

Large national homebuilders have fundamentally shifted their business models over the last decade. They no longer view themselves as real estate speculators who wait for land to appreciate; instead, they view themselves as Industrial Manufacturers. DHI 0.00%↑ , LEN 0.00%↑ , PHM 0.00%↑

1. Asset Turnover and ROI (The Grocery Store Model)

In finance, there are two ways to make a lot of money: have a high profit margin on a few items (like Ferrari) or a tiny profit margin on millions of items (like Walmart).

The Math: If a builder makes a 20% margin on 100 homes that take two years to sell, their Return on Investment (ROI) is slower than a builder who makes a 10% margin on 400 homes in the same two years.

The Result: By moving inventory faster, they can reinvest that capital into new land and new projects. Large builders prioritize Internal Rate of Return (IRR) over simple profit margins.

2. High Holding Costs (”Carry”)

Holding onto a lot (land) is expensive. Every day a house isn’t built, the builder is losing money to:

Property Taxes: They pay taxes on the land regardless of whether a house is on it.

Financing Costs: Most builders use massive lines of credit. They pay interest on the money used to buy and develop the land.

Opportunity Cost: Money tied up in a “reserved” lot is money that isn’t being used to buy the next piece of land in a hotter market.

3. Maintaining the “Machine” (Labor and Supply Chain)

Homebuilding requires a massive, complex network of subcontractors (plumbers, framers, electricians).

Labor Loyalty: Subcontractors want steady, predictable work. If a national builder slows down to “wait for higher prices,” those crews will go work for a competitor. Once a builder loses their reliable labor force, it is incredibly difficult and expensive to get them back.

Volume Discounts: Builders get massive discounts from suppliers (like Whirlpool for appliances or Mohawk for flooring) because they promise to buy thousands of units per quarter. If they slow their pace, they lose their “bulk-buy” bargaining power, which actually raises their costs.

4. Stock Market Pressure

Most large builders are publicly traded companies. Wall Street punishes “lumpy” earnings.

Predictability: Shareholders want to see consistent quarterly growth in closings and revenue.

Absorption Rates: Analysts track “absorption”—how many homes a builder sells per community per month. If that number drops because a builder is “holding out,” the stock price usually tanks, even if the eventual profit per home is higher.

5. The “Land Light” Strategy

In the past, builders bought huge tracts of land and held them for years. Today, many use Option Contracts.

They pay a small fee to a land developer to “reserve” lots, but they don’t actually buy the lot until they are ready to start the foundation.

This means they don’t “own” the land in the traditional sense; they just have the right to build on it. This forces a “use it or lose it” mentality—if they don’t build at a certain pace, they lose their options on the future lots.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.