12/30/24-Chamath on LLMs, Dylan Patel🗣️, Craftsman Mindset, Experts🤔

You have to want to do excellent work more than you want anything else..🙏🏻

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Chamath Palihapitiya (born 1976) is the co-host of technology podcast All-In, along with David Sacks, Jason Calacanis, and David Friedberg. Chamath was an early senior executive at Facebook, working at the company from 2007 to 2011. Estimated net worth- $3.7 billion.

What follows are some insightful comments Chamath made on a recent episode of the All-In show. (The quoted sections below have been lightly edited by me for clarity.)

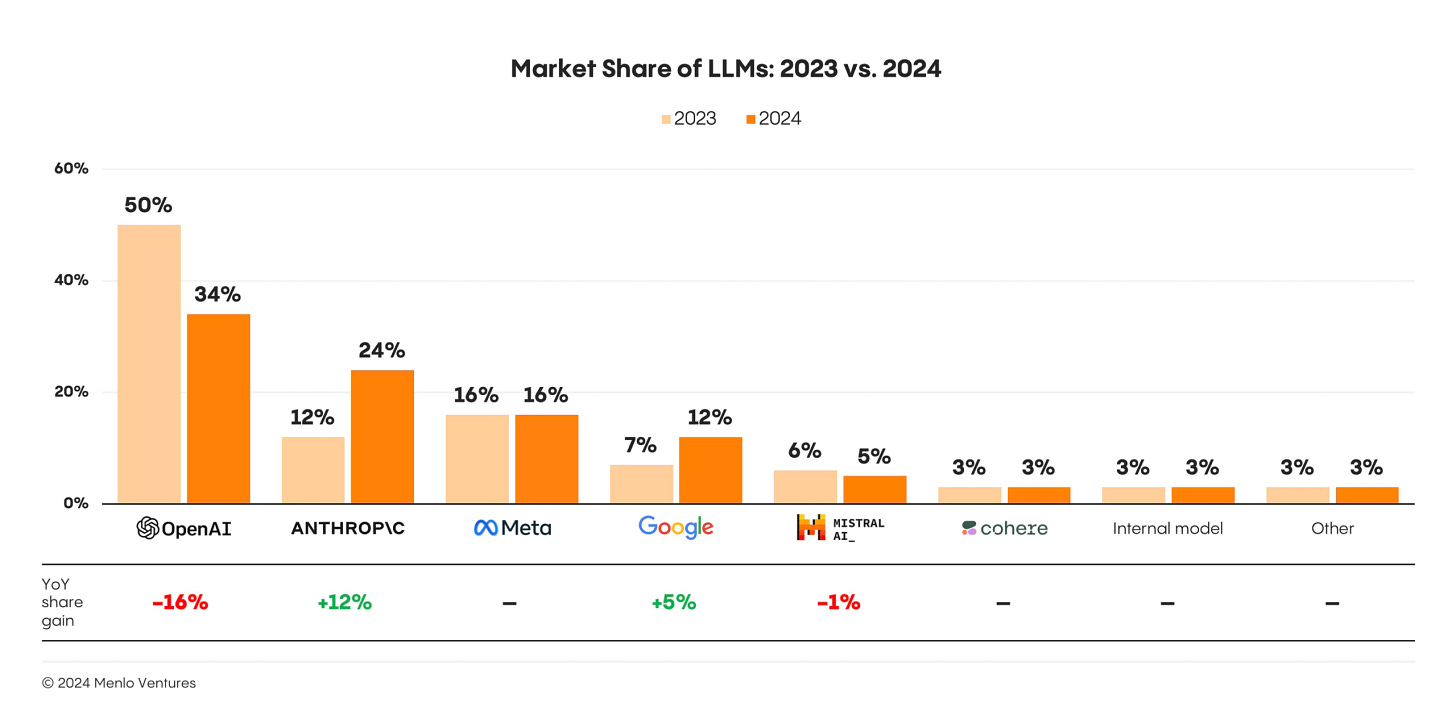

..interesting thing that really got me thinking about this (LLM/AI battle) was a chart that Menlo Ventures put out. (below)

What this shows is just what's happened in the last year. What you notice is the market share of OpenAI has changed pretty meaningfully from half to about a third. Anthropic doubled. META roughly staying the same. Google picking up steam. It started to make me think this is very similar to a chart that I would have looked at in 2006-7 when we were building Facebook (META). We had this huge competitor in Myspace that was the de facto winner. We were this upstart.

It (the chart) made me think, “is there a replay of this same thing all over again♻️ where you have this incumbent that pioneers an idea and they start with 100% share and then all of these upstarts come around from nowhere.” Then I thought “well what is better today if you are a company that's just starting versus if you were the incumbent.” I think that there's a handful that are worth talking about.

First Theme- He thinks that it creates a capital war. In a capital War he thinks the hyperscalers win. 🏆

So the first is when you look at what xAI has done with respect to Nvidia GPUs. The fact that they were able to get 100,000 to work as you know in one contiguous system and are now rapidly scaling up to basically a million over the next year. I think what it does, it puts you to the front of the line for all hardware. So now all of a sudden if you were third or fourth in line, xAI is now first and it pushes everybody else down. And in doing that you either have to buy it yourself or work with your partner. I think for the folks like META that translates and explains why they're spending so much more. It's sort of like this arms race. “If you can't spend with my competitors, I'm just going to prefer my competitor to you.” So I think that it creates a capital war.🪖 In a capital War I think the big companies like Google, Amazon, Microsoft, Meta and Brands like Elon will always be able to attract effectively infinite capital. And their cost of capital goes to zero. Which means they'll be able to win this Hardware War. Okay, so put a pin in that.📌

Second Theme- Access and control of one’s own proprietary large data is a differentiator.

Then the second thing is what happens on the actual data and experience side on the training side? If you listen to Ilya Sutskever, if you listen to Andrej Karpathy.. What they effectively are saying is there's this terminal asymptote that we're seeing right now in model quality. So what happens a lot of these folks are now experimenting on the things around the model- the user experience, how you use it, can I keep things in memory, can I cut and paste these things from here and there. Because what it says is like the data is kind of static and brittle. But it's actually not. That's what we said before because you have this corpus of data on X that's pretty unique. I suppose if Elon fed in all this kinetic data that he controls through Tesla that's very unique does that all of a sudden create this additive pool of information possibly. 🤔

Third Theme- LLM/AI Models will be commoditized quickly.

Then the third thing is when you look at what that chart says is- “hold on a second, why are corporates moving around?” What I can tell you just through the lens (of my company and our employees) is we are completely promiscuous in how we use models and the reason is because these models offer different cost/quality tradeoffs at different points in time for different tasks. So what we are seeing is a world where instead of having two or three models you rely on, you're going to rely on 30 or 40 or 50. And you're going to trade them off and you're going to use effectively like an llm router to load balance them. Yeah and to Route them, or just to manage them. Then there's an intelligence above that that's constantly tasking and figuring out prompt optimization across these models. So it's this thing where we were very reliant on OpenAI. Now we're reliant across three or four. Ideally we'll be reliant on 30 or 40. So I just see this world where it's all getting commoditized quite quickly and I'm just sort of scratching my head. Like where is the market value.

[It reminds me of Michael Porter’s concept- “Strategy is about setting yourself apart from the competition. It’s not a matter of being better at what you do, it’s a matter of being DIFFERENT at what you do.” (Unique and Differentiated)]

The themes above from Chamath seem very reasonable to me, and from it I would expect (with a very high probability) that the economic winners of this trend will include Amazon, Microsoft, Google, META, Nvidia. A different challenge is patiently timing an investment in these companies when the share price is rational. [ AMZN 0.00%↑ , MSFT 0.00%↑ , GOOG 0.00%↑ , META 0.00%↑ , NVDA 0.00%↑ ]

If you would like to watch the whole segment within the episode, it starts here 57.37 and finishes around minute 1.27.00.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Quieter Holiday🎄🎁 week in markets. Nothing notable.

(With data and charts it is not what you look at, it is what you see that matters.) Click on any of the images below to see a larger view.

Below is my data based appeal against motorcycles for safety reasons, and encouragement for anyone who has fear of air travel✈️.

Video

The Mindset of Doing High Quality Work

You have to want to do excellent work worse than you want anything else..🙏🏻

Finance and investing professionals can discover a lot in 12 Minutes with a master craftsman. Maybe it could change your relationship with your work.

..baseline your work that is either exceptional or frankly good enough🤔. And uh I don't know about you but I became happier😃 when I began to emphasize EXCEPTIONAL✨ in place of good enough.

[The video reminded me of an insightful conversation with Jim Keller, celebrity semiconductor designer/engineer. The topic was- The difference between working from a Recipe vs. Understanding. 🙏🏻 I wrote about it in my 7/2023 post here.]

Podcast

BG2 Show featuring Dylan Patel. The AI Semiconductor Landscape, 1.30hr. Dylan Patel and his team at SemiAnalysis are among some of the best subject matter experts ( Doug OLaughlin and Jon Y ). The whole episode is outstanding, but at some point Dylan says:

When you look at the cost of goods sold of NVDA 0.00%↑ their highest COGS is not TSM 0.00%↑ .. it's actually High Bandwidth Memory " 🤯 (mostly SK Hynix , then MU 0.00%↑ , finally Samsung)

🤔I would have thought TSMC was the most, and Dylan’s observation caught me by surprise. Upon further reflection, it makes sense.🙏🏻

Books and Articles since my last edition

(Reading Great books is like a conversation with the finest minds of the past.- Descartes. If I get bored of a book I quit and move on.)

The Trading Game: A Confession by Gary Stevenson Autobiography, Finance, Economics. Gary is a Citibank currency trader. The story is excellent and cautionary ⚠️.

Grey Sister by Mark Lawrence Fiction, Fantasy. Book 2 in the Ancestor series. Fun Read. ⭐

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

How and When to Engage with Some Experts

As a general principle, I think we should know a little bit about as much as possible. Yes, there are some topics that we ourselves should dive deep over time and become an expert. But from time to time we wonder or we are told that we need to hire a professional. I wanted to think about paid experts/professionals that we might consider using. I am going to give a few of my real life experiences so that we can come at the topic from a couple directions.

Do you prepare your own income taxes? I have always prepared my own income taxes, but many of the people that I know pay from $300 to more than $1K per year to have a professional complete the task. For 30 years, I have used a mass market tax software that costs $50ish per annum. When I was young my tax return was simple, and as time elapsed it became more complicated. But it is still relatively straight forward. I would think that more than 90% of Americans have income tax returns that are equal to or less difficult than mine. I have learned and gained so much from preparing my own taxes. I am also able to do midyear estimates on my taxes as a direct consequence of me having the knowledge and the software. Of course, there are some complex instances where you do need a tax professional. If someone prepares income taxes for you, after they are done, buy the $50 software and try to prepare the taxes yourself and see if you get the same result as the professional. You will learn a few things about your income, deductions and perhaps discover a couple tax strategies on your own.

After taking over as the CFO of a construction company, I noticed that we were having our external general counsel send out demand letters to customers that had fallen more than 120 days past due on their account. The lawyer demand letters were a basic form letter with the lawyer’s letterhead on top, and each letter was costing us something like $400-500. Imagine if we sent out 10 or 20 of these lawyer letters per month. I drafted my own letter, looking surprising similar to the lawyer letter 😉, on new and frightening😱 “Office of the CFO” letterhead. My collections employee sent out our internal demand letter around day 100, and we achieved a 50% success rate. At day 120 we sent 50% fewer external general counsel letters. Don’t be deluded into thinking that something simple needs to be performed by a professional.

From time to time our external general counsel would need to go to court on our behalf. As you might imagine, we paid them handsomely for their time. I would also go to court with them. I didn’t have to go, and they didn’t need me to come, but I chose to go and get a free education from the experience. I was friendly with our lawyers and had developed rapport with them over time. If we had time before our court appointment, I would buy lunch, ask questions and listen to their hard earned experience for 30 minutes. When they were in the courtroom on our behalf, I would quietly watch and listen in the front row. You can learn a lot when you stop talking and intently listen to an expert.

Are you being thoughtful about the experts that you are using? Are you curious to learn new things from them?

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

That was a particularly fun read. Thank you and blessings to you and your family in the new year.