12/3/24-LAND & Expand🤔,Scott Bessent🏦, BG2🎧, Investing Music🎶

Because of (financial analysis and) math, I may not know what will happen tomorrow, but I know what will happen over time.

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

LAND and Expand

When the technology press talks about “Land and Expand”, I think there is a pattern of just equally weighing the 2 verbs. Moreover, once an investor understands the concept of Land and Expand, I suspect that we are guilty of paying it lip service and nodding along “Land and Expand, of course. OF COURSE. Hear hear.”

Lets think about the LAND component. Landing a new customer is not fast, easy or simple. Often there is an incumbent service provider that already has a relationship with the prospect customer. The incumbent provider has been integrated and inertia has set in at the customer. Landing a new customer can often feel like pushing a bolder up hill🪨.

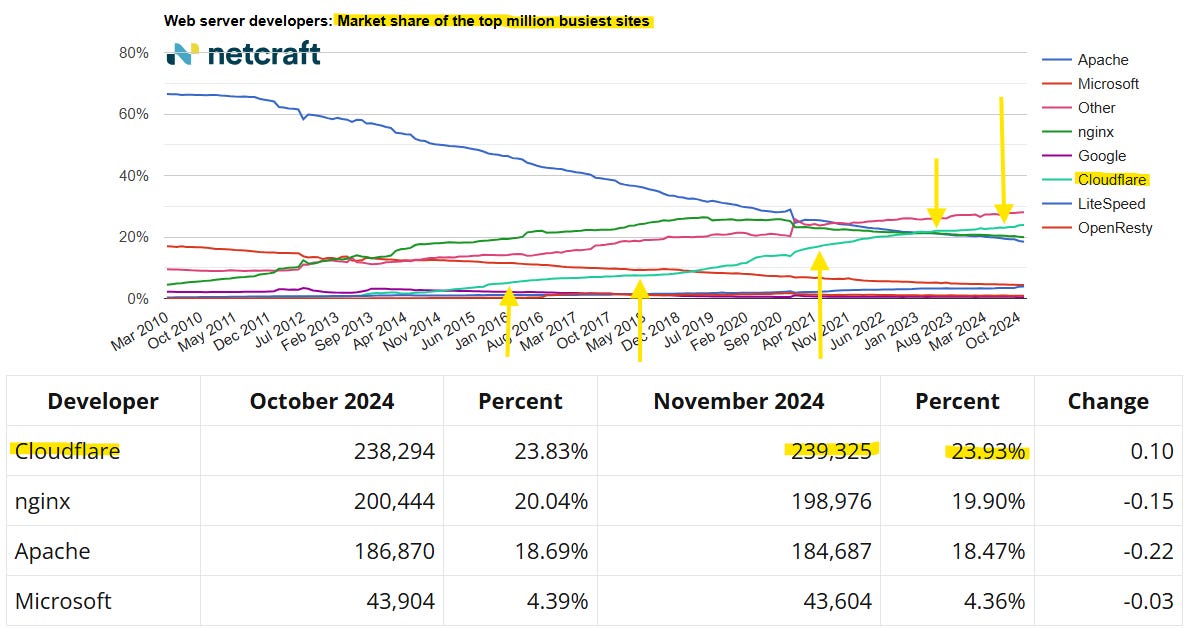

Below is one of the best objective graphs that I have seen that tracks landing new website web servers. Cloudflare NET 0.00%↑ is the green/blue color that has shown consistent gains from 2016 through November 2024. See the graph of websites Landed below.

Of the top 1 million busiest websites, Cloudflare has gone from zero 15 years ago, to 239K or almost 24% of the total, today November 2024. What does it mean to land new customers? This graph illustrates Landing over time. And this also means that 1 in every 4 websites that you visit this week will be served to you by Cloudflare. 😮

Now that the service provider has landed the new customer they can begin to expand the relationship. In the case of Cloudflare below is a slide from their investor deck that describes potential product solutions that can grow a customer’s relationship.

In the case of Crowdstrike CRWD 0.00%↑ below is a slide from their investor deck that describes potential product solutions that can grow a customer’s relationship.

The Expanding relationship is exciting. Often the expanding relationship is where the higher gross margins are with close to zero marginal cost. Mouth watering 🤤😋.

But, none of it is possible without first Landing and delivering value to a new customer.

[If you want to read more about Landing and selling new customers, I wrote about Snowflake SNOW 0.00%↑ CRO Chris Degnan methods in my 12/4/2023 post, here.]

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

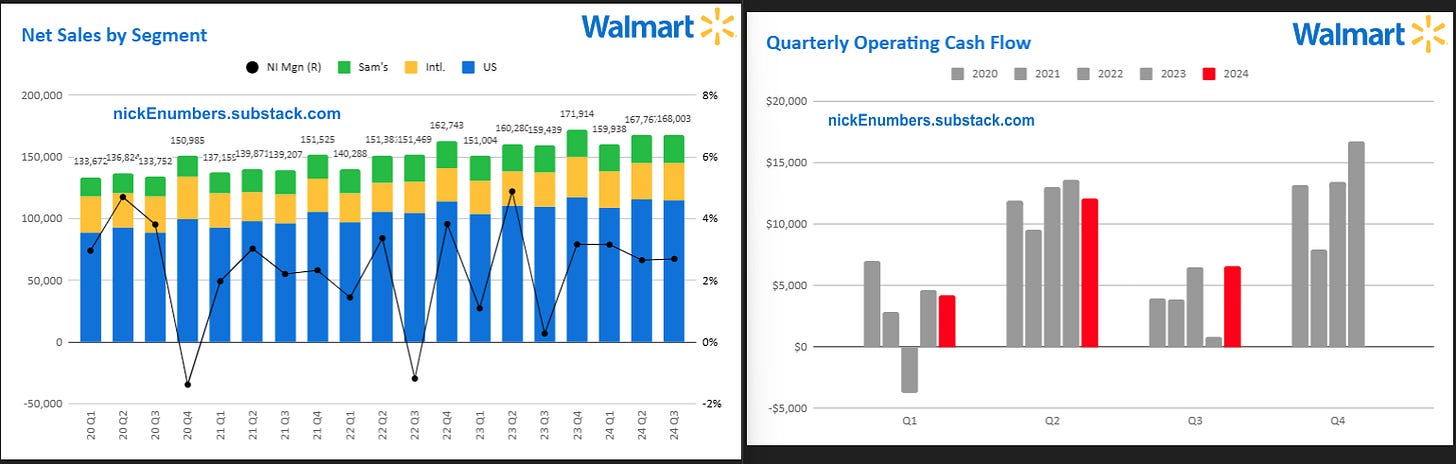

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- NVDA 0.00%↑ , CRWD 0.00%↑ , ZS 0.00%↑ , SNOW 0.00%↑ , ADI 0.00%↑

Others- WMT 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.) Click on any of the images below to see a larger view.

Podcasts

Bill Gurley and Brad Gerstner discuss China, DOGE, Governor Newsom’s EV Tax Credit, Service Titan IPO, FedNow, Tariffs, Anthropic Open Source, Warren Buffet’s Thanksgiving letter, Conspiracy Theories, Invest America, & more. IMO the information quality from these 2 is high. 👏🏼

Videos

Scott Bessent Nominee for Treasurer Secretary.

Janet Yellen is the current Treasury Secretary and has a long career working, almost exclusively, in various roles for the government. Scott Bessent is the CEO and CIO of Key Square Group and a renowned global macro investor. His 40-year investment career has included two stints at Soros Fund Management, the first for a decade under Stan Druckenmiller and the second for five as CIO. Scott also worked for the noted short seller Jim Chanos. Scott Bessent's net worth is estimated to be around $1 billion.

"I had the ability to imagine a different state of the world and believe it could happen."

I am impressed by his knowledge and experience. [If you want to read more about Scott’s legendary investing mentor Stan Druckenmiller, I wrote about him in my post on 11/18/24, here. That post also has a link to a recent hour long podcast of Druckenmiller.]

Books and Articles since my last edition

(Reading Great books is like a conversation with the finest minds of the past.- Descartes. If I get bored of a book I quit and move on.)

Idea Man: A Memoir by the Cofounder of Microsoft is a memoir by Microsoft co-founder by Paul Allen Autobiography. Bill Gates + Paul Allen… lets say it is complicated.

Culture Series book #8 - Matter by Iain M. Banks Science Fiction. The book is very good and the Culture Series is some of the best science fiction writing overall. If you have ever wondered where Elon Musk gets the crazy names for his floating rocket 🚀landing platforms 🤔, it is from the Culture books.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Fundamental Investing in 2024

2024 has been a good year for stock market indexes, and it has also been a good year for my investment returns. If you follow my writing you know I am a bottoms up, fundamental investor and I own less than 15 positions. This quote below is a guiding star ✨of mine-

Because of (financial analysis and) math, I may not know what will happen tomorrow, but I know what will happen over time.

Hard work in pursuit of this philosophy and PATIENCE are a large portion of my investing strategy. When the outcome is successful, like in 2024, it sounds like sweet music 🎶in my ears.

Some people stare at the piano when the performance is over and marvel. What amazing music that piano 🎹plays. The music isn't in the piano. (Source- Alan Kay) Annual investing performance music isn’t in the piano, it is in the patient financial analysis and math.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.