1/27/25-Public Co Mnthly Data📅, Inflation v. Default, Cadets at West Point🫡, Far East History

..that option would be Voldemor*👿, I mean "he who will not be spoken of."

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

What does the SEC think about companies like TSMC and Costco publishing MONTHLY sales/revenue?

The SEC doesn't explicitly "allow" or "disallow" companies to publish monthly sales/revenue in the sense of granting special permission. Instead, it operates within a framework of regulations that primarily focus on quarterly and annual reporting. Here is my summary of how I understand it works:

SEC Reporting Requirements:

Mandatory Quarterly and Annual Reports: Public companies in the US are required to file quarterly reports (10-Q) and annual reports (10-K) with the SEC. These reports contain comprehensive financial information, including revenue, expenses, profits, and other key metrics.

No Mandate for Monthly Reporting: The SEC does not mandate monthly reporting of sales or revenue. Companies are not legally obligated to release this information monthly.

Why Some Companies Choose to Report Monthly:

Investor Relations: Some companies, especially those in retail, automotive or other industries with volatile sales patterns, choose to release monthly sales figures to provide investors with more frequent updates on their performance. This can help investors track trends and make more informed decisions.

Transparency and Communication: Companies may believe that providing monthly updates fosters transparency and strengthens communication with investors.

How the SEC is Involved:

Regulation of Voluntary Disclosures: While the SEC doesn't mandate monthly reporting, it does regulate how companies present this information if they choose to release it. This includes rules about accuracy, consistency, and avoiding misleading statements.

Focus on Material Information: The SEC's primary focus is on ensuring that investors have access to "material" information that could affect their investment decisions. *Important SEC perspective*- While monthly sales data can be useful, it's not considered as critical as the comprehensive financial information provided in Quarterly and Annual reports.

In the case of TSMC and Costco:

TSMC: As a foreign private issuer listed on US exchanges, TSMC follows the reporting requirements of its home country (Taiwan) as well as certain SEC rules. Monthly revenue reporting is a common practice for Taiwanese companies.

Costco: As a US-based retailer, Costco has adopted the common industry practice of releasing monthly sales data to keep investors informed about its performance.

In summary:

The SEC’s stated mission is to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation.

The SEC doesn't specifically permit or prohibit monthly sales reporting. Companies choose to do it Voluntarily for various reasons, primarily related to investor relations and industry practice. However, if they choose to release this information, they must adhere to SEC rules regarding accuracy and transparency. The SEC's main focus remains on the mandatory quarterly and annual reports that provide a more complete and audited picture of a company's financial health.

If I were a public company CFO I suspect the effort and liability of monthly reporting would discourage my participation. (Is the juice🍹 worth the squeeze?🍊🥵) As a consumer of financial information I look forward to receiving monthly sales reports from the few public companies that provide them. I wish more companies provided the monthly information. ( TSM 0.00%↑ , COST 0.00%↑ )

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- TSM 0.00%↑ , TXN 0.00%↑ , NFLX 0.00%↑ , SK Hynix

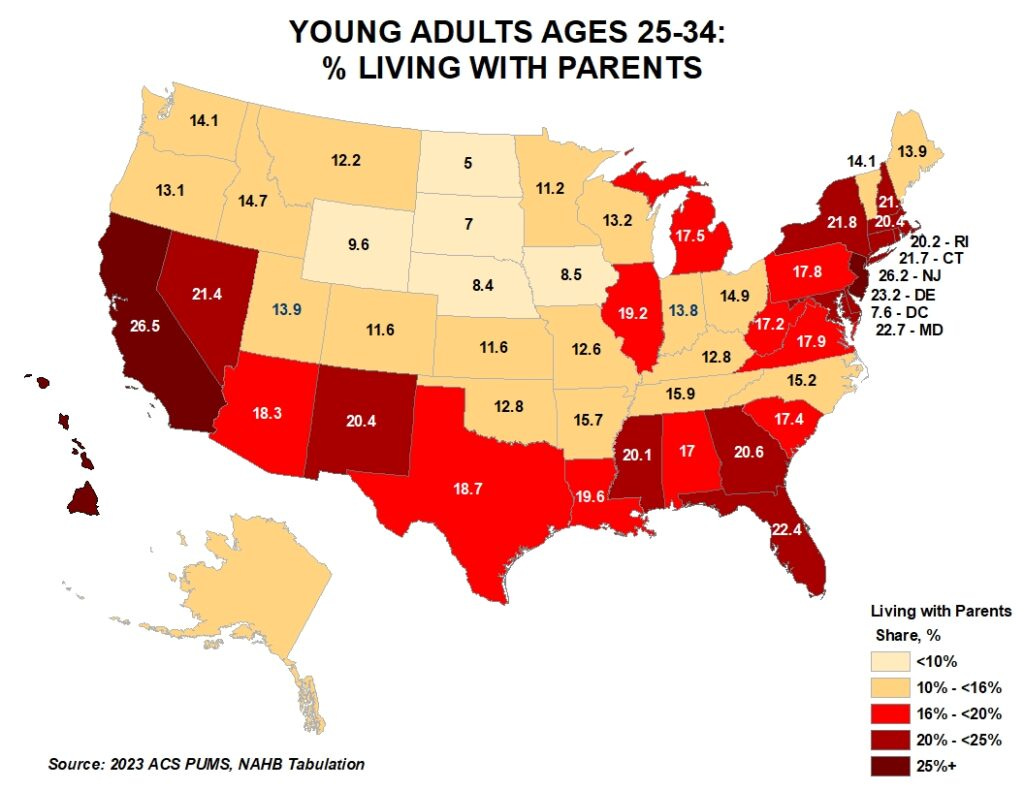

Housing / Banking - BAC 0.00%↑ , JPM 0.00%↑ , WFC 0.00%↑ , DHI 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.) Click on any of the images below to see a larger view.

Podcast

The Julia La Roche Show- Rick Rule: "I Am Cautious" - Holding Cash For The Coming Squeeze (Episode link here.)

Regarding the US economy and all roads leading to inflation:

Inflation. Or there is a different way you can have a monetary reset… Depression. In that circumstance you really truly admit defeat. You say to the $36T in bond holders → “Sorry🥺, we default. By the way, we are nuclear⚛️🚀 armed🪖. Try to seize your collateral.😈” We acknowledge that we can not meet the operating expense of the US Government, never mind the entitlement expense. We have a depression. We have DEFLATION and we reset to liquidation value of our assets. That seems highly unlikely to me. Americans are positive people and they would prefer to kick the can 🥫🦶🏽down the road.

It seems to me that Rick is describing possibilities and not advocating for them. In the spirit of brain storming and analysis, I want to give Rick full marks. That being said, I think this sequence described above is so bad with so many other additional negative consequences it is off the table for civilized people in a civilized world society. If this were Harry Potter, that option would be Voldemort, I mean “he who will not be spoken of.” Why? Because the best environment is when there is a seamless web of trust. Promises are made, promises are kept.👨🏻🏫 (Summary- Some inflation is less bad than default + depression.)

[Charlie Munger talked about the dangers of a Depression at the 2016 Daily Journal Annual Meeting.😳🤯 I wrote about it in my 8/13/24 post, link here.]

Video

2.15 hrs video, The War For India.

(YES it is long, and worth it. If you don’t know Sarah Paine, you are in for a treat. She is whip smart and harder than woodpecker lips. I am a fan.)

How the rivalry between China, India, Russia and Pakistan reshaped Asia forever. A lightening⚡fast lecture series by Professor Sarah Paine of the Naval War College, followed by a deep Q&A session with

.One thing you should know about warfare. You think the winners win it.🤔 NO. Actually, it is when the losers decide they have had enough. That is when a war ends.

Books and Articles since my last edition

(Reading Great books is like a conversation with the finest minds of the past.- Descartes. If I get bored of a book I quit and move on.)

Active Measures: The Secret History of Disinformation and Political Warfare by Thomas Rid Nonfiction, History

Breaking History: A White House Memoir by Jared Kushner Nonfiction, History

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Cadets at West Point Are Trained To Typically Provide Only 4 Responses-

West Point, located in NY, is known for being the home of the United States Military Academy (USMA), which trains cadets to become army officers.

There are traditionally four responses that West Point cadets, particularly plebes (freshmen), are expected to use when addressing upperclassmen or officers. These responses emphasize discipline, respect, and accountability. They are:

"Yes, Sir/Ma'am": Used to acknowledge a statement or order.

"No, Sir/Ma'am": Used to deny a statement or indicate the inability to comply with an order.

"No EXCUSE, Sir/Ma'am": This is used to acknowledge a mistake or failure to meet expectations. It signifies taking full responsibility without offering justifications.

"Sir/Ma'am, I do not understand": Used to respectfully request clarification if an instruction or question is unclear.

These responses are ingrained during Cadet Basic Training (CBT) and are meant to instill a sense of discipline and adherence to the chain of command. They emphasize the importance of taking responsibility for one's actions and seeking clarification when needed. They eliminate the ability to give long explanations (word salad🗣️🥗), when the bottom line is sufficient.

I suspect that investors can learn a lot from this concise framework for communication and accountability. Of course, the easiest person to lie to about the truth is yourself.🤔 With your past, present and future investments, run them through the West Point cadet filters. Is your investment progress and the outcomes outstanding. Have you allowed excuses and justifications to become part of your way of operating? Have you become a word salad chef 🥗👨🏽🍳, handing out explanations and no solutions. Can you admit your mistakes? (When was the last time your have done so?) Can you ask for help when you do not understand and you need more information?

In essence, these four responses serve as a foundation for communication, teaching all of us how to be concise, respectful, and accountable. Happy investing!

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.