1/30/24-Disney Next CEO🐁, Semis💻, Hired Gun🎸🎶, Quartz

If you are not amazed, it is because you are not paying attention. 🎆

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Who Should be the Next Disney CEO?

Walt Disney CEO is presently Bob Iger, age 72. Much has been made about his past and present tenure at Disney, but who will be selected to succeed him is one of the major concerns. DIS 0.00%↑

Iger is not perfect, but if I could wave a magic wand, I would keep Iger as the CEO for another 10 years. Iger understands all aspects of Disney down to the last detail. However, Iger says he will 'definitely' step down at the end of 2026.

So, who will replace him? A couple of the internal candidates that I have seen are lack luster. The external candidates that are rumored are equally uninspiring. I have taken it upon myself to generate a small slate of potential CEO candidates that I would like Disney and you to consider:

Sheryl Sandberg, age 54. A Harvard prodigy, rose from tech mastermind at Google and Facebook to become a global icon for women's empowerment. She built Facebook's ad juggernaut, championed equality in the workplace through LeanIn.Org, and inspired millions with her books and resilience in the face of personal tragedy. She is a mega cap operational trailblazer.

Ruth Porat, age 67. From British-American beginnings, Ruth Porat rose to financial wizardry, conquering Wall Street as CFO of Morgan Stanley before weaving magic at Google, guiding its finances to global dominance. Now, as President and Chief Investment Officer, she steers the tech giant's future, her sharp mind and steady hand ensuring continued innovation and sustainable growth, all while leaving her mark as a powerful force in the male-dominated world of finance.

Bill Gurley, age 57. From engineering whiz to Silicon Valley kingmaker, Bill Gurley carved his path. First, designing chips at Compaq, then wielding financial acumen at Hummer Winblad and Benchmark, he became the Midas of tech, backing giants like Uber and GrubHub. His investment savvy is legendary, his "Above the Crowd" blog a bible for venture capitalists, and his voice a powerful force shaping the tech landscape. Sharp, outspoken, and unapologetically bold, Gurley remains a true original, a legend in the world of finance and strategy.

Reid Hoffman, age 56. From Palo Alto prodigy to Silicon Valley sage, Reid Hoffman navigated the digital tide. Member of the PayPal Mafia.🤵🏽♂️ He co-founded LinkedIn, the professional network that reshaped careers, then became a venture capitalist kingpin, Midas-touching startups like Airbnb. A champion of entrepreneurship and a voice on AI and politics, Hoffman remains a complex figure: Silicon Valley titan, philanthropist, and thought leader, carving his path with equal parts brilliance and controversy.

Other names that I strongly considered that deserve an honorable mention-

John Malone, age 82. The Wizard. Probably too old.

Reed Hastings, age 63. Excellent, but significant conflicts with Netflix.

Michael Ovitz, age 77. The Captain, The Hammer. Probably too old.

Michael Dell, age 58. He might have too much to learn in the entertainment industry, but Dell is outstanding and underrated by many.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

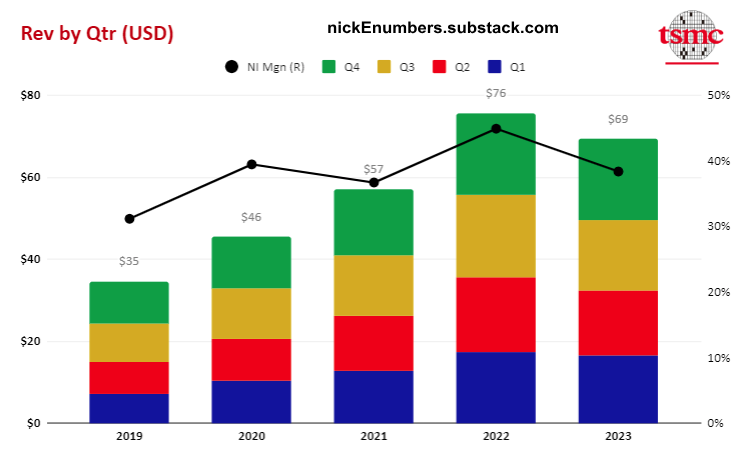

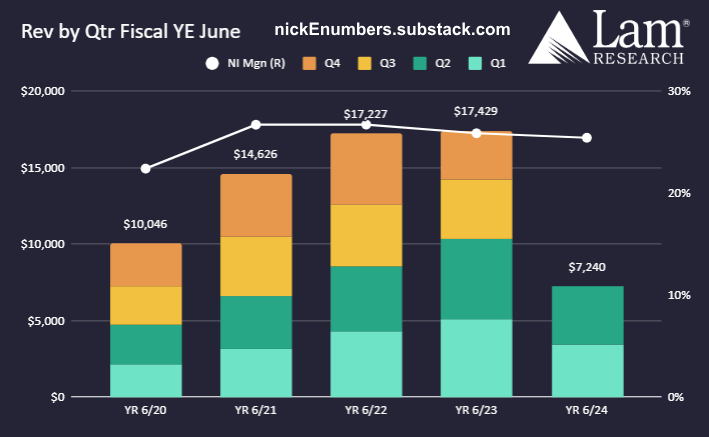

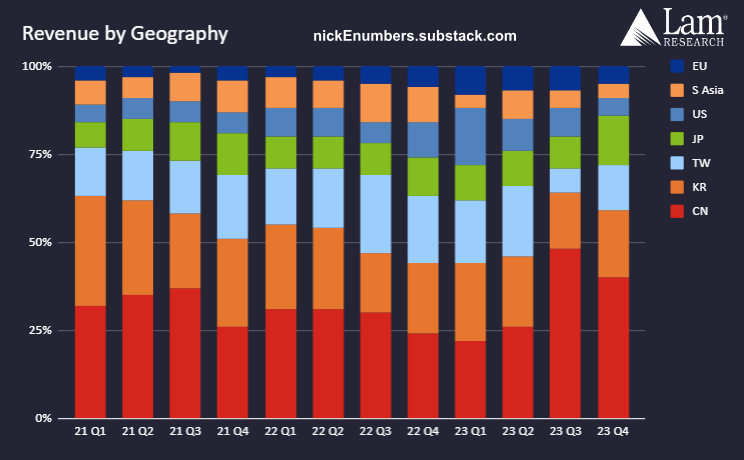

Technology- TSM 0.00%↑ , TXN 0.00%↑ , ASML 0.00%↑ , INTC 0.00%↑

Housing & Banking - DHI 0.00%↑ , SOFI 0.00%↑

Others- TSLA 0.00%↑ , NFLX 0.00%↑ , EXP 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.)

Netflix should have a positive upward trend on the 12 month moving average EPS to be taken seriously. I am a fan, but lighting money on fire for growth is unsustainable.

Videos

I mean… 😮🤯 15 minutes of clear explanations, beautiful visuals, and unbelievable technology that we use every day. Quartz. If you are not amazed, it is because you are not paying attention. 🎆

Books and Articles since my last edition

(Books are like loading software on your brain. If I get bored of a book I quit and move on.)

Zero Sum Game by S.L. Huang Fiction.

Stress Test: Reflections on Financial Crises by Timothy F. Geithner Nonfiction, business biography. Accounts like this one of the financial crisis gives us a view of how the government and its leaders communicate and react to financial crisis. As an investor, what they do is more important than what they say. At the margin, governments are not designed for truth, they are designed for order and public safety. I don’t read a book like this because it is an exciting story, I read it because it provides a playbook of what to look for in the future.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

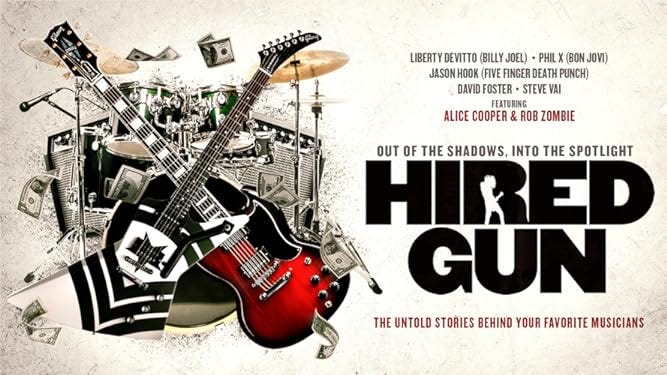

Hired Gun, 1.4 hr Movie. A documentary film about session and touring musicians that are hired by well established bands and artists like- Metallica, KISS, Billy Joel, PINK, Bon Jovi, Steely Dan, John Cougar Mellencamp, Earth Wind & Fire, Michael Jackson.

These hired guns may not be household names, but are still masters of their craft. Everyone wants to be a super star, but few want to pay the price. These musicians practice and play for years and years, often for multiple small bands simultaneously.😬 Every day they chop the wood and carry the water on their way toward greater mastery. (See more about mastery in my post on 1/16/24, Dave Chapelle the Master, Link)

If a musician is excellent and persists long enough, from time to time a famous band has an opening. The inside of most communities get very small quickly, and a short list of the top candidates is circulated.

“…you have to be a great musician. I mean, you just do. There's just no two ways about it. You can't be mediocre. Because there's, you know, good is the enemy of great. So, if you're only good,… there's a thousand great people that are gonna take your place.”🧑🏾🎤🤘🏾👩🎤

Like in most important, profitable ventures; everyone wants simple fast and easy. But, simple fast and easy is immature nonsense, moreover it is not even an option. Long slow hard uphill is the only path.⛰️

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.