2/10/25- Lam Research🔬, Big Short Panel📺, The Nvidia Way, 🤔Dangers of AI

You don’t bullsh*t Jensen. The appropriate answer is “I don’t know Jensen, but I will find out.”

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

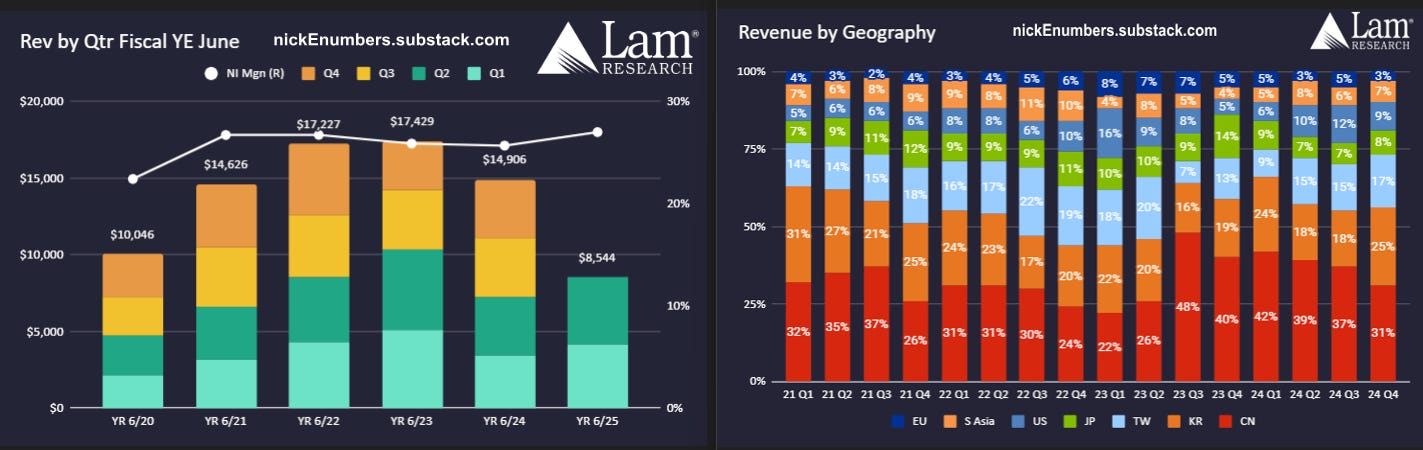

Lam Research January 2025 Earnings Call-

Lam Research Corporation, LRCX 0.00%↑ , is a leading global supplier of innovative wafer fabrication equipment and services to the semiconductor industry. They design, manufacture, and market a broad range of advanced deposition, etch, stripping, and cleaning solutions that are crucial for creating integrated circuits (logic chips and memory). Lam's equipment enables semiconductor manufacturers to build increasingly complex and powerful devices used in a wide range of applications, from smartphones and computers to artificial intelligence and automotive systems. With a strong focus on research and development, Lam Research plays a vital role in driving advancements in semiconductor technology and enabling the continued progress of electronic devices.

A couple of important remarks that I wanted to call out from the 1/29/25 earnings call-

CEO Archer- It also demonstrates the increasing strength of our product portfolio as semiconductors move into the AI era.

For example, gate-all-around and advanced packaging technologies are critical enablers for AI device manufacturing, including GPUs and high-bandwidth memory (HBM). They are also highly deposition and etch-intensive. And as a result, we saw Lam's shipments for gate-all-around nodes and advanced packaging each grow to exceed $1 billion in 2024. In calendar 2025, we see WFE spending rising slightly to approximately $100 billion.

Again, we expect technology inflections to lead to faster growth for Lam as AI applications demand greater device and package-level performance. In 2025, Lam shipments to gate-all-around nodes and advanced packaging combined should be well over $3 billion. Customer migration toward backside power distribution and dry resist processing technologies will add further opportunity in the coming year. As we look forward, we view the increasing importance of deposition and etch technology as a differentiator for Lam and an opportunity to outperform.

...

Technology inflections in DRAM and foundry logic, combined with an upgrade-focused NAND environment, create what we believe is a unique setup for Lam to outgrow WFE spending and strengthen our bottom line in calendar 2025. In NAND, the industry is looking to transition the current installed capacity to higher layer counts to achieve better device performance at lower bit cost.

Couple these items outlined above with an emerging shift of the next generation of semi technology not being lithography (ASML) constrained. Investors know ASML, and litho will still be important, but tools from LRCX, AMAT and others will be necessary to accomplish the technology needs of GAA, HBM, higher layer NAND, etc. Semi expert Doug O’Laughlin from

, has stated similar observations. LRCX 0.00%↑ AMAT 0.00%↑ ASML 0.00%↑Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

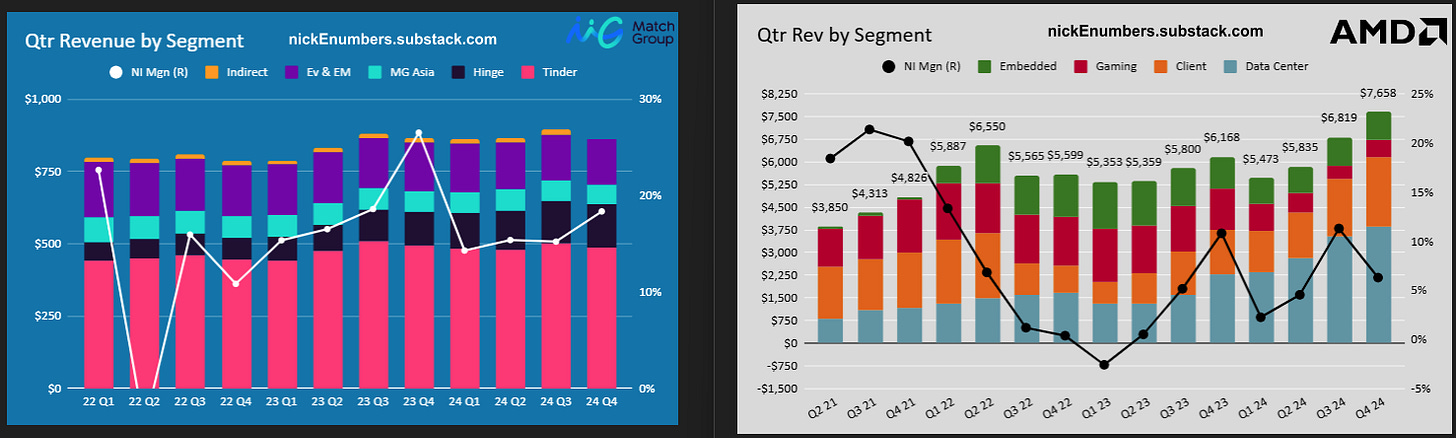

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- META 0.00%↑ , MSFT 0.00%↑ , AAPL 0.00%↑ , LRCX 0.00%↑ , ASML 0.00%↑ , INTC 0.00%↑

Housing / Banking - EXP 0.00%↑ , PHM 0.00%↑

Others- TSLA 0.00%↑ , MTCH 0.00%↑ , DIS 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.) Click on any of the images below to see a larger view.

Video

The Big Short Panel: Today’s Market, 01/30/25, 30 Min

America’s Angriest😡 Hedge Fund. The investors who famously predicted the 2008 financial crisis are back to discuss today’s markets, risks, and opportunities. Lessons from The Big Short and how they apply to today’s economic landscape. Steven Eisman – Businessman, Investor, Danny Moses – Founder, Moses Ventures, Porter Collins – Portfolio Manager, Seawolf Capital, Vincent Daniel – Partner, Seawolf Capital, Melissa Lee – 🎤 Moderator, Host, Fast Money, CNBC (It is probably a conversation but it sounds like an argument😡. Thoughts from New Yorkers?)

• Are we headed for another financial crisis? • What risks and opportunities are shaping today’s markets? • Insights from the minds behind The Big Short

..year end December, you know after the election sitting around saying okay where's the opportunity? And we did a lot of screening. You do any sort of valuation screening. And we laugh. We're one of four people that still care about valuation.

….. I think the group that's actually very interesting and I find it interesting for the first time in a long time is → Home Builders 🏡🏘️

Podcast

Big Short Movie- Best Argument Scene, 4 Minutes. Movie portrayal of the 4 guys above.👍🏻 (⚠️Bad Language🤬Alert. Lots of it.⚠️)

[If you are a Big Short fan, I wrote about Primary Information vs Secondary (or Recycled) Information in my 10/2023 post with an explanation from Anthony Bourdain in the film ‘The Big Short’. Link here.]

Books and Articles since my last edition

(Reading Great books is like a conversation with the finest minds of the past.- Descartes. If I get bored of a book I quit and move on.)

The Nvidia Way: Jensen Huang and the Making of a Tech Giant by Tae Kim Business Biography Outstanding, 👍🏻Nvidia employee talks about communicating with Jensen -

You don’t bullsh*t Jensen. If you do, your credibility is dead☠️ with him. The appropriate answer is “I don’t know Jensen, but I will find out.”

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Eliezer Yudkowsky: Dangers of AI and the End of Human Civilization | Lex Fridman Podcast #368

Eliezer S. Yudkowsky is an American artificial intelligence researcher and writer on decision theory and ethics. He is also rather cautionary on the development of AI as he fears for the ultimate safety of humans. (Think HAL 9000 or Terminator)

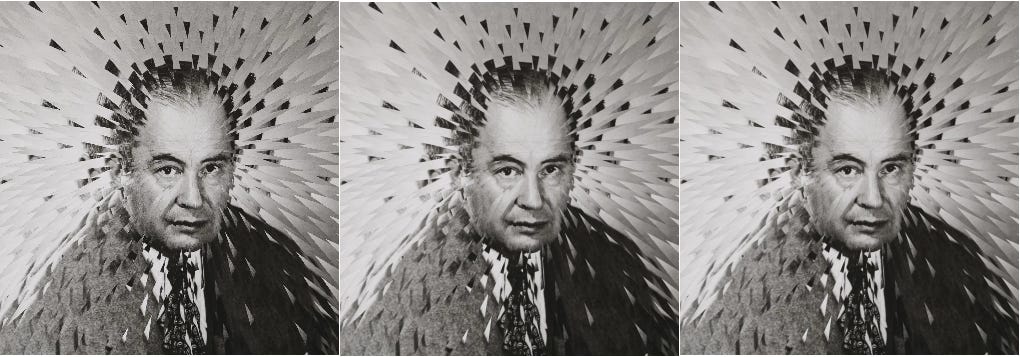

In an effort to explain AI below, Eliezer references John Von Neumann . Von Neumann, American mathematician, physicist, computer scientist and engineer. Von Neumann had perhaps the widest coverage of any mathematician of his time, integrating pure and applied sciences and making major contributions to many fields, including mathematics, physics, economics, computing, and statistics. John Von Neumann is widely considered one of the most influential mathematicians of the 20th century, often ranked among the very top mathematicians OF ALL TIME.

"Johnny von Neumann was so smart it was scary." - Edward Teller, physicist

"He was the most intelligent man I ever met; his mind was not only quick but also deep." - Stanislaw Ulam, mathematician

"Von Neumann could do calculations in his head faster than anyone I've ever known." - Richard Feynman💓, physicist

Now that we have set the table. What is wrong with a global AI arms race? How bad can AI get and can’t we just pull the power plug on the dumb machine? Eliezer has one of the best descriptions and responses to the type of intelligence that we are dealing with AI below.

…pumping intuition for what it means to augment intelligence- 🤔

John von Neumann, 🧑🏻🔬

there's a million of HIM, 🧑🏻🔬x 1 Million

they run at a million times the speed, 🧑🏻🔬x 1 Million x 🏃🏽♂️1 Million

and therefore can solve tougher problems, quite a lot tougher.

It's very hard to have an intuition about what that looks like.

You can watch the video exchange at 2.29.29 hrs here. One Von Neumann would conquer me in a minimum amount of time. 10 Von Neumanns, Fuhgeddaboudit!😓

What if this type of AI was working for your country’s enemy? What if it was in the hands of 1 villainous person🦹🏽. What if it was autonomous, and unhappy with YOU 🫵🏽?

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.