2/13/24-My 10 🏘️Rentals &😬Leverage,📊Mag7,🎧Einhorn,🗣️Big Short Interview

Youth doesn’t know the limits of what can happen.

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

2007 Residential Real Estate and Leverage-

Once upon a time, many years ago, I purchased more than 10 residential rental properties. Most of them I was self managing/landlording. I put a minimal amount of cash down, and I assumed that they would appreciate by 2% per year. Why not? US real estate on average went up by 2% per year for a very long time. (Conservative assumption😉 .)

10 Properties X $250K Purchase Price each = $2.5M at 5% down payment = $125K down payment investment from me

For the sake of this post, assume I rented them all out and they were cashflow neutral. (In reality, several of them were slightly cashflow negative.)

2% per year appreciation = $50K total per year for the 10 🏡 = $50K/125K down payment investment = 40% annual ROE (theoretically)Sweet ROI right! Generally conservative assumptions.

About a year after I assembled the collection of 10 or more properties, the great financial crisis (GFC) of 2007 hit. Foreclosures climbed, home prices declined and then fell off a cliff. 📉At the bottom my homes were down about 25% in value.

Original 10 Properties X $250K Purchase Price each = $2.5M

Prices decline by 25% 10 homes x $187.50 = $1.875M

My value decline is $2.5M - 1.875 = $625K

My total down payment $125K

Cash requirement from me if I wanted to sell $625K - $125K = $500KHow can this be? How can my initial investment of $125K cause a $500K loss? Leverage my friends. Leverage. 🤠

Now, I can tell you have a couple of questions and so lets work our way through those questions.

Q- Nick why don’t you just walk away from the $500K differential and let them keep your $125K down payments.

A- Interesting idea, but a residential mortgage doesn’t enable you to do this. The mortgage company has recourse against you for the unpaid differential. All of your other potential assets can be targeted to repay that short fall.

(In the coming months of 2024 we are going to learn which commercial office real estate owners have recourse and nonrecourse debt. Jingle mail will show up at banks with keys🔑 to office buildings.)

Q- Couldn’t you file bankruptcy and discharge the financial debt that way?

A- Many people were forced to do this as they had no other viable alternative. I was fortunate to have other assets making this not a strategic option.

Q- What did you do?

A- After I stopped crying like a baby 😭😢… My wife and I came up with a plan and we decided to play the long game. I knew how to landlord. All of my properties were rented and cashflow neutral. I still had a day job with income. We would wait the storm out. And that is what we did. 4-5 years later we started selling the homes one and 2 at a time. Sometimes we broke even and sometimes we took a small loss. Year after year, we sold 1 or 2 properties and at the end we were making respectable profits as the market had improved dramatically. It took us 10 years to get out of this position.

Q- Why did you do something so stupid?

A- Youth doesn’t know the limits of what can happen. Sometimes you can learn from others or by reading (often this is less painful and less costly to you.) And sometimes you learn by making a bad decision yourself and you pay a high tuition cost for a valuable lesson.

Closing thoughts- You want me to say that leverage is bad, but it is not. Leverage is a tool in the toolbox🔨✂️🪚🧰. If we don’t fully understand what the tool is capable of, wait to use it and keep learning about it. Another lesson that I learned is that I don’t like being a landlord as it is too much work.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- MSFT 0.00%↑ , GOOG 0.00%↑ , META 0.00%↑ , AMZN 0.00%↑ , AAPL 0.00%↑ , AMD 0.00%↑ , UMC 0.00%↑ , QCOM 0.00%↑ , ON 0.00%↑ , CFLT 0.00%↑ , NET 0.00%↑

Housing & Banking - PHM 0.00%↑ , BZH 0.00%↑ , AFRM 0.00%↑

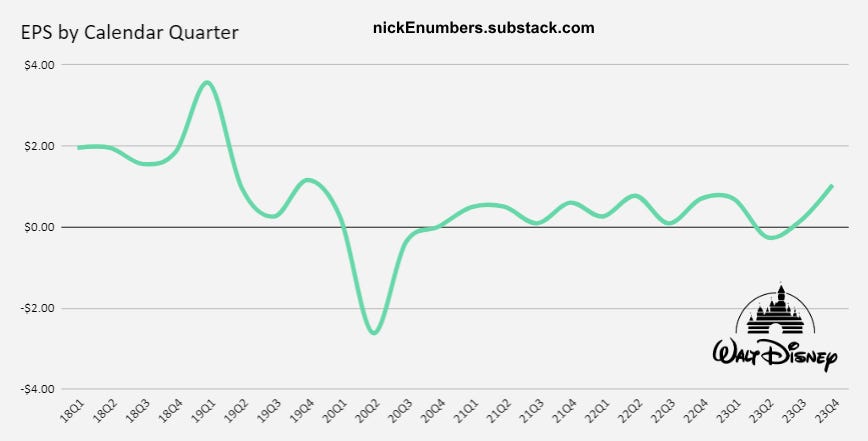

Others- CAT 0.00%↑ , UBER 0.00%↑ , DIS 0.00%↑ , SNAP 0.00%↑ (snap financials are so bad, they are painful for me to look at. Clown Show 🤡🤡🤹🏽♂️🎪.)

(With data and charts it is not what you look at, it is what you see that matters.)

Podcasts

60 Min 🎧 Masters in Business: David Einhorn Net Worth ~$1-2B. He is brilliant, thoughtful and measured in his engagement with the public. His interviews are always packed with knowledge. I am an Einhorn fan.🤩

Market structures are broken and value investing is dead. That's the view from David Einhorn. On this episode, the president of Greenlight Capital sits down for a wide-ranging discussion with Bloomberg Radio host Barry Ritholtz. Einhorn is also chairman of the boards of Greenlight Capital Re Ltd. and Green Brick Partners Inc GRBK 0.00%↑ .

David- “I think the opportunity now is as good or better than it has ever been.”😃

(Curious about Einhorn, I wrote more about him in my 4/11/23 edition, link here. His 3rd grade teacher grabbed him by the arm😠and took him aside… Find out why.)

Videos

Steve Carell (center picture above with team), aka Mark Baumin in the movie is based on a real person who asked his name to be changed for the film, Steve Eisman. While at FrontPoint Partners LLC, which was a trust fund of Morgan Stanley, Eisman ran the team. Based in Greenwich, Connecticut, FrontPoint Partners bet against subprime mortgages during the 2007-2008 financial crisis and profited over $1B 💰💰 .

In the 25 minute video below the band is back together again.. for a rare interview. They are fantastic, brilliant 💡 and remain contrarian skeptics. One tells a story about 2008-

Karrie Killinger, the CEO of WAMU came into our office probably like 3 months before it failed, right. And he came in and he's like white as a ghost. 👻🤒🤢

Steve goes “KARRIEeeee looks like you need a hug!” 😆🤣😂

We did shorting with the smile! 😃

Books and Articles since my last edition

(Books are like loading software on your brain. If I get bored of a book I quit and move on.)

Fed Up: An Insider's Take on Why the Federal Reserve is Bad for America by Danielle DiMartino Booth Nonfiction, finance. Insightful perspective from a talented Wall Street veteran who switches careers for an opportunity to work at the FED. TLDR- Most of the FED are academics without real investing/trading experience. As the title would suggest, Danielle moved on from her job at the FED.✨

Why Nations Fail: The Origins of Power, Prosperity, and Poverty by Acemoğlu and Robinson Nonfiction, economics, history. A little long, but reminds me of why capitalism is the BEST of all the bad alternatives.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

Very interesting to hear about your experience during the financial crisis and how you played the long game. Most stories from the time are about people choosing your second option and filing for bankruptcy.