2/24/25- Uber🚕on Waymo🤖,Snow❄️on Databricks, Public Co LEAPS🦘Options

Fact- Any fool🤡 can spend money.

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Interview with Uber CEO Dara Khosrowshahi About Aggregation and Autonomy

I am a fan of Uber, Google and Waymo. ( UBER 0.00%↑ , GOOG 0.00%↑ ) Something that I ponder from time to time is A. how Uber and Waymo intersect in the future and B. to what degree. From my perspective, autonomous vehicles (AV) are inevitable, like taxes and putting on pants👖. It is not a matter of IF, it is a matter of WHEN.

This is from an interview with rockstar Ben Thompson, link is here. Dara is asked about autonomous cars-

Yeah, definitely. Listen, I don’t think it’s an “if”, it is a “when”, and AV is a huge opportunity for the entire marketplace. It is. These robot drivers are going to be safer. I think that they have the opportunity at scale, and scale, it’ll take a while to get to scale, to reduce the price per ride and increase the TAM of this marketplace, trillion plus dollars. We think it’s an enormous, enormous long-term opportunity.

Now, a couple of things have to happen before that opportunity actually turns into commercial business. When I say commercial, I mean something that can pay back for itself versus spend a bunch of money. That was 2017 era, right?

.. you need a high utilization network that can manage variable demand in a flexible way. We think the best way to do that, and certainly in the early days, is a hybrid of this base layer of autonomous supply, so to speak. That is then, on top of that, you’ve got humans who come in and out during peaks. The great thing about humans is, while they will eventually be more expensive on a cost-per-mile basis than let’s say a machine, you only pay for their utilization when they’re actually working, whereas with an AV, you pay, it’s kind of fixed, so just like you see in energy right now, well, you need a base layer of gas and then the electric grid then can handle the flex up and down with some of the newer energy sources, the same thing is going to be true. You’re going to need a base layer that’ll be AV, and then you’re going to need variability to meet high demand periods, and that will be ultimately we think a hybrid network of AVs and humans.

I love this imagery that Dara uses to describe the future state of a ride hailing network as the sources of power for electricity generation. I liked it enough to whip up the graphic below to demonstrate Dara’s points. In summary, 1. Robot vehicles operate ALL the time, 2. Humans come in and out during peaks. Robot vehicles are single purpose, much safer and can operate 24 hrs a day, 7 days a week, 365 days a year.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

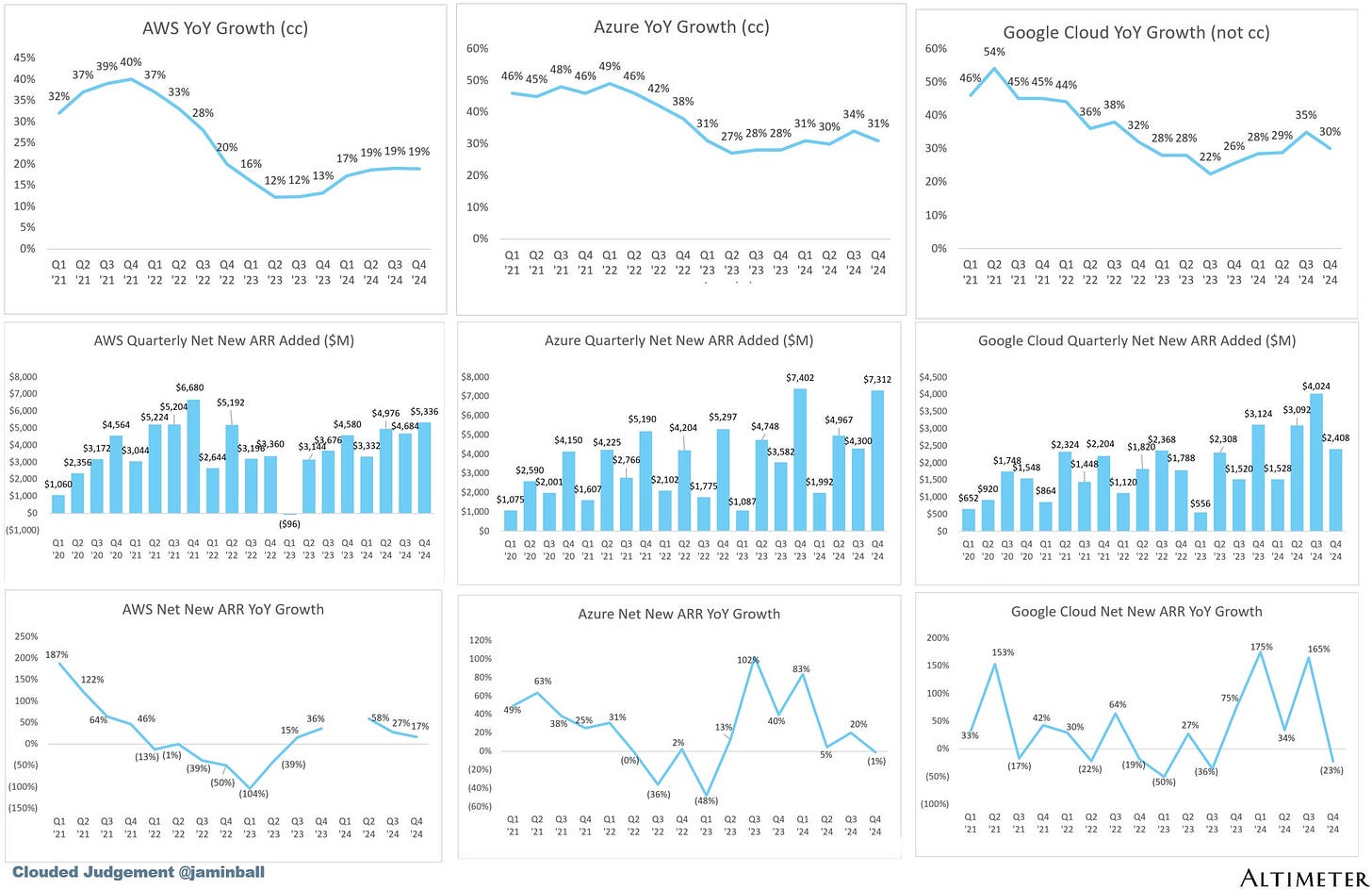

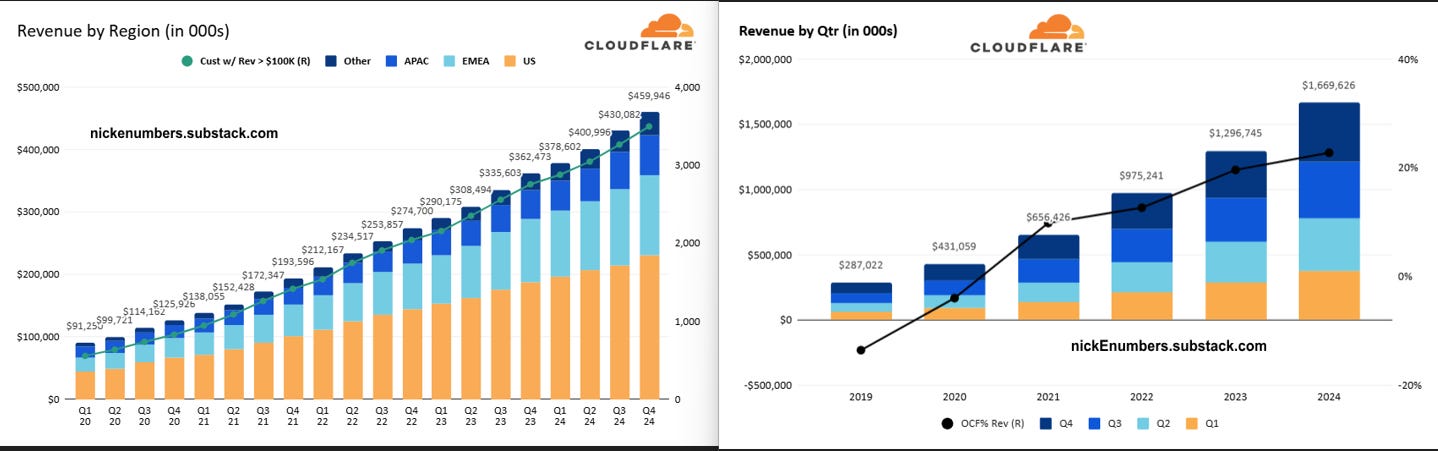

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- AMAT 0.00%↑ , GFS 0.00%↑ , ADI 0.00%↑ , CSCO 0.00%↑ , NET 0.00%↑ , AKAM 0.00%↑ , PANW 0.00%↑

Housing / Banking - TOL 0.00%↑ , VMC 0.00%↑

Others- LDOS 0.00%↑ , WMT 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.) Click on any of the images below to see a larger view.

Podcast

55 Minute, 20VC with Sridhar Ramaswamy.

The video link is below but you can find it as a podcast at your favorite provider. Sridhar Ramaswamy is the CEO of Snowflake, SNOW 0.00%↑ , and the entire discussion is excellent. About half way through veteran Sridhar sizes up late stage startups, and specifically Databricks. 🫳🏽🎤

Host Harry- ..which structure do you think aids Innovation better and aids winning better- 1. being a super late stage private today like Databricks or 2. being a public company like Snowflake?

CEO Sridhar- Innovation is not an option it's just something that we have to do. Do I have more constraints than Databricks being private? Absolutely. I mean it's very clear that they're buying👎🏽 a bunch of business. That they don't have to worry about things like-

free cash flow

they have doubled the number of sales people that we have.

But as I also tell people it's easy to lose a lot of money🔥💵🔥. It's very easy to be uncalibrated about spending money. You should be careful what you wish for.

Do we operate under constraints? Absolutely, but that's what Innovation is about is how can you drive in the face of constraints. This in some ways like Deepseek is yet another illustration that having Rich Uncles is not always a good thing

(That last section is Sridhar throwing shade on VC firm A16Z’s frequent capital raises on behalf of Databricks.)

As a former CFO and student of human nature, abundant access to what seems to be limitless capital is NOT a FEATURE… it is a huge BUG🐛🪳. Any fool🤡 Anyone can spend money. Capital is what we use when we run out of creativity!

Video

Jeff Dean & Noam Shazeer – 25 years at Google from Dwarkesh Patel

This is an in-depth discussion from 2 of the most experienced and easy to understand comp-sci professionals of our time. They are so excited and engaged it is contagious. If you are a tourist to AI and datacenters, this video is not for you. If you want to sit at the feet of 2 masters for 2 hours and perhaps gain a little more understanding, enjoy! Long GOOG 0.00%↑

Books and Articles since my last edition

(Reading Great books is like a conversation with the finest minds of the past.- Descartes. If I get bored of a book I quit and move on.)

Lucky Me: A Memoir of Changing the Odds by Rich Paul Autobiography. A memoir of will, success, and the luck we make—from the founder and CEO of Klutch Sports Group and agent to Lebron James (and many others.) Engaged to Adele, btw. [I linked to an excellent podcast with Rich Paul on 10/23, here.]

Saturn Run by John Sandford Science Fiction. A Caltech intern inadvertently notices an anomaly from a space telescope—something is approaching Saturn, and decelerating. Space objects don’t decelerate. Spaceships do. 🤩

The Windup Girl by Paolo Bacigalupi Science Fiction, Dystopian. It is often included on the long list of top Sci-Fi books. I 💯 agree. 👍🏻

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Which Publicly Traded Stocks also have LEAPS Options?

LEAPS, or Long-term Equity Anticipation Securities, are options contracts with expiration dates that are further out than standard options. While most options expire within a year, LEAPS can have expirations up to two or even three years in the future. I am aware that Zero day (0DTE) options have become the popular sexy 💃🏻🕺🏻game for some investors, but I am at the ultra opposite end 🥱of the time scale. I use LEAPS options for some of my event strategies when I want to go long on a stock and I want a couple years for the positive change to be reflected in the stock price.

You can buy LEAPS on homebuilders DR Horton, Pulte and Lennar, but not Greenbrick. You can buy LEAPS on materials companies Vulcan, Martin Marietta, but not Eagle Materials.

Here's why some public company stocks have LEAPS options that go out 2 years, while others don't:

Demand: The primary driver is investor demand. Exchanges like the CBOE (Chicago Board Options Exchange) list LEAPS on stocks where they anticipate sufficient trading volume and investor interest. If there's not enough demand for long-dated options on a particular stock, the exchange is less likely to offer them.

Liquidity: Liquidity is crucial for options trading. LEAPS need to have enough buyers and sellers to ensure that investors can easily enter and exit positions. Stocks with high trading volume and a large market capitalization are more likely to have sufficient liquidity for LEAPS.

Underlying Asset: LEAPS are typically listed on stocks of well-established, large-cap companies with a history of price stability and consistent performance. These companies are generally considered less risky and more predictable, making them suitable for long-term options strategies.

Volatility: While some volatility is necessary for options trading, extremely volatile stocks may not be ideal for LEAPS. The longer time frame of LEAPS can make it difficult to predict the price movement of highly volatile stocks, increasing the risk for both buyers and sellers.

Exchange Listing Standards: Each options exchange has its own listing standards and criteria for which stocks can have LEAPS options. These standards often consider factors like market capitalization, trading volume, and the company's financial health.

Generally, LEAPS are more likely to be available for large-cap, well-established companies with high trading volume and a history of relatively stable price performance.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

"The Water Knife" is also by Paolo excellent. Easy, relevant read. Thanks Nick!