2/27/24-Poker♣️& Investing,💻Semis, Data💎Asset🎧, Zuck🤔😀

Prosperity comes from everybody working FOR everybody else.🙏🏽

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Texas HoldEm and Investing.

Games can be a good proxy for investing. None are a perfect match. Some teach you a little more of this and others teach that.

Games like Chess, Spades, Bridge, The Pit, Monopoly, Blackjack and Risk.

But I believe the poker game Texas Hold'em has a higher correlation to investing than many. I will assume you know how to play, and if not, I would suggest you learn to play a little bit. There are good enough Texas Hold'em game simulators on the internet for FREE.

I am not a professional player, rather more of an experienced amateur. A couple times a year, I will play at a friend's Saturday night game, tournament style. Cash buy in of $50 per person, ~14 players.

Although there are many aspects of the game that I find fascinating, there are 2 aspects that I want to think about with you. 1. How often we should play our hand or fold. 2. How a chip bully can change the nature of play.

In real life, I am a cautious player and also a cautious investor. Although bluffing plays a role in poker, at our level of investing (sub $billion trades), bluffing is irrelevant. For that reason, I am going to assume my normal cautious player role below.

Fold a lot of hands- generally speaking, if your hand isn't really good, FOLD IT! The stack of chips in front of you is not unlimited. In a tournament, champion Texas Hold’em players fold about 85-90% of the time.😲 But they are a champion?! You need to patiently wait to receive a really good/great/excellent hand before you bet your money. Many people play bad hands. Why? Because they are excited, they want to get into the game, folding is boring. If you are playing against good players, your hand needs to be really good to have a chance of winning. Playing a fair or poor hand is a waste of chips/money. All of this maps perfectly to investing. You need to research and explore many companies as potential investments. Most of them will be interesting, cool, or exciting. But they are a hand that you fold. Learn and move on.

“It is likely, however, that the investors in the habit of overturning the most stones will find the most success.”- Big Short Investor, Michael Burry

“I call investing the greatest business in the world because you never have to swing. You stand at the plate, the pitcher throws you General Motors at $47! U.S. Steel at $39! and nobody calls a strike on you. There’s no penalty except opportunity lost. All day you wait for the pitch you like, then when the fielders are asleep, you step up and hit it.”- Warren Buffett (No Called Strikes)

Every now and then, you will discover a company that is so good, relative to everything else that you have seen, you will know and your checklist will prove that this is a company worth investing in. Only after looking at 100 or 500 companies might you find 1 that is worthy of your capital. (If you want to see what type of hand I am searching for, I wrote about it in my post on 10/23/23 Find Able & Honest Leaders, Link Here.)

Chip bully- Later in a tournament there might be 7 players remaining, and 1 person might have 3X or 4X more chips in front of them than everyone else. Down to 6 players, then 4 players remain. This person with a large stack of chips/Chip Leader can choose to act like a chip bully.

A "chip bully" describes a player who uses their large stack size to exert pressure and manipulate other players at the table. Their goal is to force opponents into folding or making suboptimal decisions out of fear of losing against their significant chip advantage.

Playing against the chip bully in a poker game can be frustrating, as it is easier for them to bluff you, push you around and because your chip pile is so much smaller, you have more to lose on each hand. Being the Chip bully can be a lot of fun because if you are still playing smart you can exploit your significant chip advantage in many hands, accelerating your potential win. Investing doesn't have a chip bully. You are not sitting at a tournament table with the other players. You have time to think, and time to research. You might be buying/selling from a retail investor or a billion dollar hedge fund, who knows. In investing, you are playing your own game in a liquid market with many buyers and sellers.

Happy investing!

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

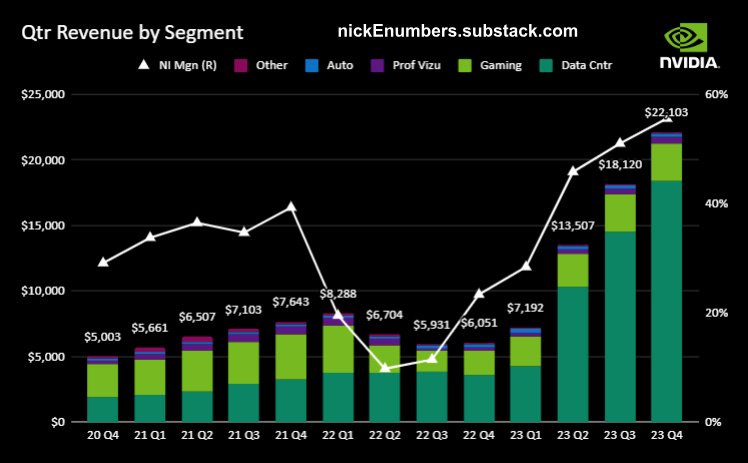

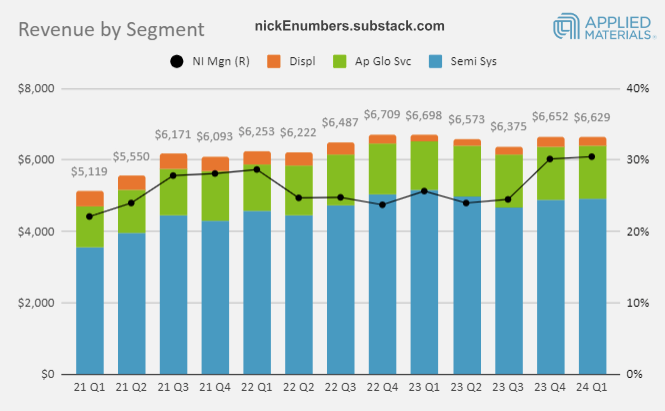

Technology- AMAT 0.00%↑ , PANW 0.00%↑ , CSCO 0.00%↑ , ADI 0.00%↑ , NVDA 0.00%↑

Housing & Banking - TOL 0.00%↑ , UPST 0.00%↑

Others- WMT 0.00%↑ , HD 0.00%↑ , TTD 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.)

Podcasts

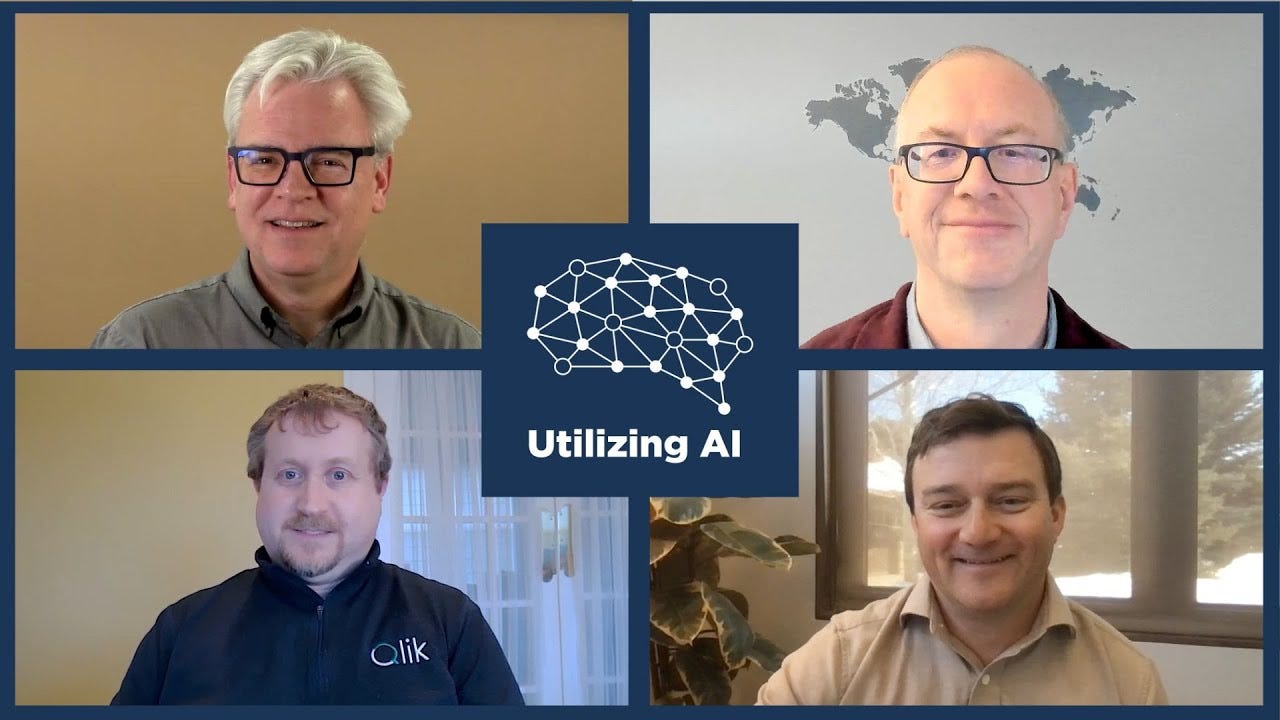

40 Min- Utilizing AI 🎧The Bedrock of AI is DATA. This is perhaps one of the best explainer episodes of why a firm’s own DATA is valuable. When I have heard others talk about LLMs and enriching with unique enterprise data, they would often hand wave👋🏽 over this advantage and the complexity. This episode explains why an enterprise’s high quality data (and process of data collection) can become a unique advantage. Why an enterprise might want to store more data on more business processes. And some of the challenges of how to get the data to a final state where it might be useful to an LLM. (All data quality is NOT the same.) 🤔- SNOW 0.00%↑ , AMZN 0.00%↑ , MSFT 0.00%↑ , GOOG 0.00%↑ , NVDA 0.00%↑

Data is the foundation on which AI models are built, and integration of enterprise data will be the key to generative AI applications. Enterprises sometimes worry that their data will never be ready for AI or that they will feed models with too much low-quality data, and overcoming this issue is one of the first hurdles. [..] But what if a flood of data causes the model to make the wrong connections?

Videos

44 Minute, The International Space Station is taken apart via CGI (amazing visual effects) to uncover its engineering secrets. Mind blowing creative problem solving with human life at stake. ✊🏽🙏🏽

Books and Articles since my last edition

(Books are like loading software on your brain. If I get bored of a book I quit and move on.)

The Half-life of Facts: Why Everything We Know Has an Expiration Date by Samuel Arbesman Nonfiction, Science. Surprisingly, Facts change all the time. He takes us through a wide variety of fields, including those that change quickly, over the course of a few years, or over the span of centuries.

The Rational Optimist: How Prosperity Evolves by Matt Ridley Economics, Nonfiction. This was a Bill Gurley recommendation. Prosperity comes from everybody working for everybody else. The habit of exchange and specialization—which started more than 100,000 years ago—has created a collective brain that sets human living standards on a rising trend. The mutual dependence, trust, and sharing that result are causes for hope, not despair.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

41 Min Mark Zuckerberg Takes On Apple Fanboys, Tech Layoffs, Raising Cattle & More. Mark is brilliant and thoughtful. Forget all that meme noise about him you have heard, and take a fresh listen to his thoughts and perspective. Memory Mark shares below I had not heard before, Mark:

“I was pretty convinced when I was in college that… I like building stuff and I thought I was going to go through college, become an engineer and go work at Microsoft.😶✊🏽 [..] My mom actually bet me that I was going to drop out of college.”

Mentions- META 0.00%↑ , AAPL 0.00%↑ , MSFT 0.00%↑ , NVDA 0.00%↑

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.