3/10/25-Option Pricing🧮,Old Dams🦫, Bad News vs Small Success🤔

Bad news is a headline, and gradual improvement is not.

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Dividend Yield Impact on Option Pricing (Calculator🧮)

If that title doesn’t get you excited, I don’t know what will. It reminds me of the joke about the finance person who comes home to a spouse who surprising asks- “Talk dirty to me.😉” So, the finance person says- “Options, derivatives, CDOs, synthetic structures-ssss.😀” (I am a better finance person than a comedian.)

From time to time I use long call LEAPS options on public company stocks. I use publicly available option calculators to determine the pricing based on the inputs. One of the inputs to the option pricing model is dividend yield. Some stocks pay dividends and others do not. We know how to look up the dividend yield and plug it in, but why? How does it affect the option pricing and why does it impact the calculus in such a way? These were the questions that interested me this week and I wanted to share them.

When calculating the value of a long call option, the expected payment of a dividend by the underlying company typically REDUCES the call option's price. Here's why:

Understanding the Impact of Dividends

Stock Price Reduction:

When a company pays a dividend, the stock price generally drops by the amount of the dividend on the ex-dividend date. This is because the company's assets are reduced by the cash paid out.

Call Option's Dependence:

A call option's value is directly related to the underlying stock's price. If the stock price decreases, the potential profit from a call option (the right to buy the stock at a specific price) also decreases.

Reduced Upside Potential:

Because a dividend payment reduces the stock price, it reduces the potential upside for a call option holder. If the stock price doesn't rise as much as it would have without the dividend, the call option's value will be lower. Put differently, paying a dividend reduces retained earnings, and not paying a dividend increases retained earnings.

That being said, some investors ignore the dividend yield input on option pricing models, and are thus OVERPAYING for call options. If the company pays a dividend, it is a systematic expected reduction in the retained earnings and should be taken into consideration in the option pricing calculator.

[If you are interested in Long Option LEAPS, I discussed some of my strategies a little more in my post on 6/2023, link here.]

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- NVDA 0.00%↑ , SNOW 0.00%↑ , CRWD 0.00%↑ , ZS 0.00%↑ , AVGO 0.00%↑

Housing / Banking - GRBK 0.00%↑

Others- BRK

(With data and charts it is not what you look at, it is what you see that matters.) Click on any of the images below to see a larger view.

Podcast

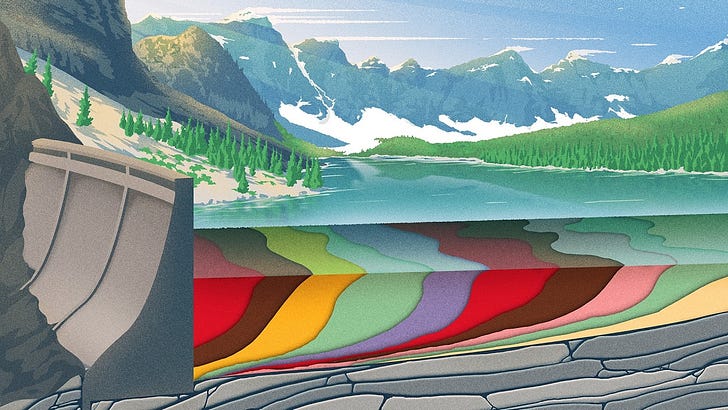

15 Minute Practical Engineering. Civil Engineer Grady Hillhouse is one of my favorite infrastructure engineers and his working models are outstanding at illustrating his topic. All Dams are temporary. 🦫 What? That doesn’t seem right. Watch the video and let Grady explain. I love this stuff!

Video

3 Minute video, Cool time lapse video of the construction of a large cruise ship.

Books and Articles since my last edition

(Reading Great books is like a conversation with the finest minds of the past.- Descartes. If I get bored of a book I quit and move on.)

The Last Days of Night by Graham Moore Historical Fiction. From the a16z 2025 reading list.

Columbus Day by Craig Alanson Science Fiction, Space, with a bit of humor.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Bad news is a headline, and gradual improvement is not. I often return to this wonderfully stated observation from Bill Gates.

The news can often be thought of as a machine that generates outrage (bad news.) Why? Because it captures attention. (I wish you could hear me chuckle when I read the negative morning news. 😅😂)

Gradual improvement is happening at all times, all around us. The spotlight rarely falls on gradual improvement. Improvements are often kept quiet and used to dig a bigger moat filled with more alligators 🐊.

Long term investing is best suited to optimists. These are the people that wake up every morning excited to see what the day has in store.😃

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.