3/26/24-Think🤓, Jensen $NVDA🧑🏽🎓,Uncle Sam 🫵🏽Your LP

Jensen says, "Students- I wish upon you ample doses of pain and suffering."🙏🏽

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Independent Thinking🤓

Media and entertainment has a fascination with the concept of a “Stock Tip”. You have seen this pattern before many times yourself- The unsophisticated investor is saying- “Tell me what to buy”, and the media person is saying- “Here are my two hot stock selections, my 2 trade ideas for you.😉”

😑😠No. NO. This is a waste of your time.

Some other newsletters provide stock ideas and trade suggestions. These can be good for idea generation, but if you have to turn to others to always know what, how, when.. You don’t have confidence in what you own and WHY. If the stock pick goes up or down by 15%, should you buy more or sell? When should you buy or sell? But, if it all comes from inside you, you have a process, a method for your investing. And, most of all, you have confidence, and that confidence impowers you.

Many times people have said to me- “Nick, I own Tesla, Apple or XYZ stock. It has gone up a lot. Should I sell it?”

I am not telling you, my reader, what to do with your capital. I want to think along with you, or at least show you my pattern of thought. I invite you to work toward your own conclusions, or research more to improve your clarity.

We do not want to look to the media or other people in general to tell us WHAT TO THINK. Examples- What to buy, when to buy, how much, and what to sell. No. If others tell us what and when to think, or worse, if we outsource MOST of our thinking to them, we are at THEIR mercy. Just drones🧟🧟♀️, helpless. Outsourcing our thinking to others is lazy and the definition of dumb money.

But wait, there is hope! When we think for ourselves we have a unique advantage, an edge.

Our alpha (out performance) comes from our ability to think, analyze, compare, question, create, and imagine💡on our own. That unique insight belongs to us, and we can profit from it.

So roll up your sleeves, open up your financial modeling tools, and dive into company research.🏊🏽

🚨Nick Tip🚨 I consume financial statements in this order- 1. Profit & Loss (Flow) 2. Cash Flow (Flow, it is in the name 😉) 3. Balance Sheet (Stock/Snapshot)

The media opinion is a distraction. Our edge, our alpha comes from our own perspective and knowing how to think.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- ORCL 0.00%↑ , S 0.00%↑ , ADBE 0.00%↑ , MU 0.00%↑ , NVDA 0.00%↑ GTC Conference,

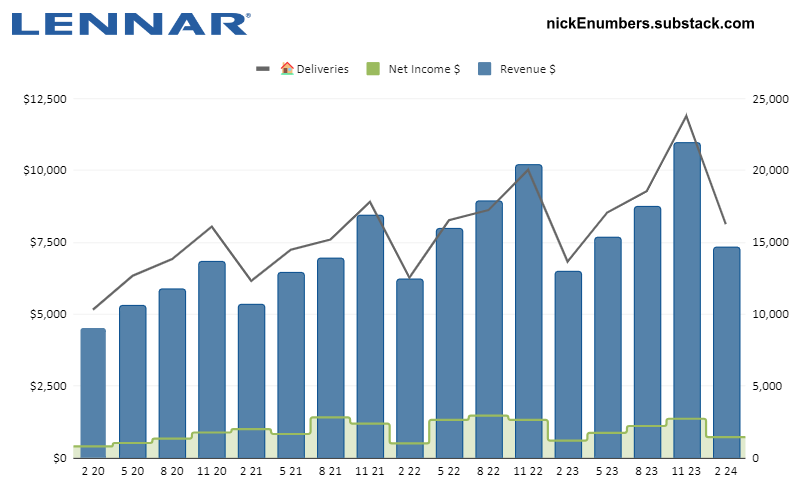

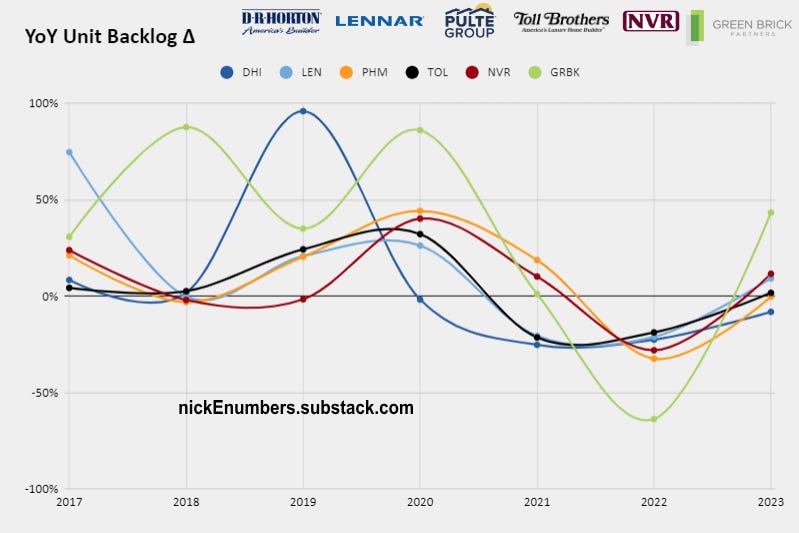

Housing & Banking - LEN 0.00%↑ , KBH 0.00%↑

Others- BRK.B, FDX 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.)

Podcasts

How the Hawaiian Power Grid Works

~15 minute video. Although this is not really a podcast it is am outstanding explainer. Large national or global challenges can be difficult to wrap our minds around and really grasp the whole dynamic system with its inputs and outputs. But simplifying the size of a problem to say, just an island🏝️… that is way easier to understand.

Grady from Practical Engineering does just that, explaining how the Hawaiian power grid works. He gets into⚡a few of the complexities involved in managing a mini power grid.

I suspect that the lessons learned in this video can inform us as we endeavor to improve the electrical webs 🕸️ that spread across our continents and countries.

Videos

55 Minute Stanford interview with Jensen Huang from 3/7/2024. The discussion was fresh and Jensen was visionary and on point. NVDA 0.00%↑ I think I am a Jensen fanboy.😃

During the interview, Jensen is talking about success coming from RESILIENCE and low expectations. How do we develop resilience? Jensen says-

Students, I wish upon you ample doses of pain and suffering.🙏🏽

PS- Did you know that when Jensen Huang was 9 years old he was sent to reform school😯, in rural Kentucky🪕. I wrote about it in a post 2/2023, Link Here.

Books and Articles since my last edition

(Books are like loading software on your brain. If I get bored of a book I quit and move on.)

How Innovation Works: Serendipity, Energy and the Saving of Time by Matt Ridley Economics, Nonfiction, Business. This was a 2nd Bill Gurley book recommendation. The beginning 2/3rds of the book describes examples of product/sector innovation through history, B- as it is a little slow. Final 1/3rd of the book brings it all together at a high level, economy, nation, globe. He integrates examples with philosophy and insights, A.

Animal Farm by George Orwell Classic, Fiction, Dystopia, Philosophy. I have read this a few times. If you have not read it, I would recommend it. In a strange way, it is similar to the HBO show Succession (same vector space.) From the farm- 4 Legs Good, 2 Legs Bad ✊🏽

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Uncle Sam Is My Financial Partner.

As income tax time is upon us in the USA, I wanted to share my philosophy on tax and it has been strongly influenced by reading Warren Buffett. I also have newsletter readers in the UK, Canada, India and Spain, and this also applies to your countries.

I grew up listening to adults complain about paying their income taxes, and that persists to this day. While I understand the sentiment, I would like to suggest a reframe of the subject.

I would like to suggest that you view your country as your partner. In my case that is the USA, Uncle Sam for short. Uncle Sam agrees to provide me with rules, laws, national defense, private property rights, law and order, roads/infrastructure, among many other public benefits. I might even go so far as to say that the country provides the environment in which I can make a living or even become rich. And, in exchange Uncle Sam wants about 30% of all of the income that I generate every year.

I don’t want to manage and maintain my own army, or build my own roads, or police the laws. I like living in a relatively safe country. So, I generally view a 30% payment of my income to my partner, Uncle Sam, as a fair exchange.

Uncle Sam’s tax laws also allow me to delay/defer paying income taxes on capital gains until I sell a position. So it is possible that he provides defense, roads, courts, etc for me now, and I can defer my payment to him until far in the future. Nick likes that😁.

Inevitably, the time will come that I will owe an income tax to Uncle Sam, and as that happens, I am happy to pay for all the benefits that I have received from the USA, my country. I hope that helps to take a little bit of the sting🐝 out of paying your income taxes.🙏🏽

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.