4/11/23- David Einhorn, Comm RE, Bard v ChatGPT, Spell🐝& Sundar

“The present is the past rolled up like a spring.”

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

I am thinking about David Einhorn’s 🎧podcast interview titled “The Long and Short of Investing” on Patrick O'Shaughnessy’s show. It is outstanding.

David is the President of Greenlight Capital, a long-short hedge fund that he cofounded in 1996. He's a prominent value investor with a reputation for rigorous security analysis. His net worth is in the neighborhood of ~$1.5B. In 2002, he revealed a short position in Allied Capital, which was ultimately proven correct. And similarly, in 2008, he told the Sohn conference to short Lehman Brothers [8 min CNBC interview of David on Lehman here🔥].

When David talks he often shares with you the process of how he thinks, and that is why I have been a fan for a long time. David presently believes that the market is not spending enough time and effort to discover what traded stocks are worth based on the underlying company fundamentals.

Before I dive into a couple of highlights from the interview I wanted to level-set some thinking on the stock trading market.

Mr. Market-

Buffett and others built on Ben Graham’s characterization of The Market from Graham’s book The Intelligent Investor, Chapter 8. In the market you’re going to have a partner named “Mr. Market”, you can also think about him as a neighbor 5 doors down. And the beauty of him as your partner/neighbor is that he’s kind of a psychotic hard drinker. He is not psychotic all the time, often he is brilliant. And he isn’t always hitting the bottle. But, he will do very weird things over time (Emotion + Alcohol) and your job is to remember that he’s there to SERVE you and not to advise you. Would you ask an emotionally unstable neighbor🤪 if you should buy or sell $100K of Microsoft? No, that is nonsense. The market is there to serve you not to advise or direct you.

If you can maintain a level head, you will see that Mr. Market is offering you thousands of prices every day on every major business in the world. He makes mistakes, and he makes them for all kinds of weird reasons. Sometimes he is euphoric and he wants to pay way too much for your business. Often he thinks the world is coming to an end, or he has a liquidity crisis and will sell very cheap. You can take advantage of these mistakes to buy stocks at a discount or sell them for a profit.

So it’s built into the system that stocks get mispriced. And if you make your buy and sell decisions based on what YOU think a business is worth, and you stick with businesses that you think you can understand and value, you have an advantage against Mr. Market, sometimes.

Mr. Market is wrong in the short-term, but he figures it out. It might take 3 months or 10 months but he always figures it out and gets smart in the long-term. -Joel Greenblatt

With that introduction and characterization, lets get into a couple of the discussion topics from the podcast.

David: [..] And now looking at it, sitting here today, the amount of trading that's done based upon people trying to figure out what companies are worth, which is different from what they will trade for, everybody who's trading has an opinion of what the trading value will be. But there are very few that are actually basing that decision based on what they think the company is actually worth. That robust debate has essentially left the building.

💨🏭

A teacher is allowed a little exaggeration to make their point and focus the students.

David: [..] So I have added more macro thinking into what I'm doing, and I try to take a bigger view of all of the positions relating to the top down as opposed to just the bottom up. And then it's compounded on the long side of the book, where just in the last couple of years, I've had the realization that with some of these stocks, nobody's ever going to care. Nobody is paying attention, nobody is doing the work, nobody cares what the company says. There's just nobody home.

So we can't make money by trying to buy something three months or six months or a year before other long-only investors figure it out because they, either aren't there, or they don't have any capital or they're turning into index funds or whatnot. So we've had to reconstruct our long book in a way that is designed, at least in theory, to earn a return based upon just what the companies are able to pay us as opposed to relying on other investors to figure it out.

Patrick: [..] Does that imply that, through dividends and buybacks, things like that, return of capital, that you're going to be holding things for a lot longer on average, prospectively than you would have before?

David: Look, there's an off chance that I'm wrong and that other people will figure it out. There's also what happened to a couple of our companies last year, which is private equity comes in and pays a big premium. And then we have to go find something else to do. But the more likely case, I think, for a lot of our companies is there's x number of shares outstanding now. And a year from now, there'll be 20% fewer shares.

And two years from now, there'll be 35% fewer shares. And in three or four, five years, there's going to be half as many shares or quarter as many shares, or in some cases, there might not be any shares at all than the last year. And we'll just have to see how that goes. I think it does lead to much more discipline in terms of what we're willing to pay for things or hold things at. And I think it requires probably even longer holding periods.

Housing 🏘️🏠and GREENLIGHT’s 🟢largest position ~$560 MM, GREEN🟢BRICK PARTNERS GRBK 0.00%↑ 😉. Greenlight owns ~37% of GRBK 0.00%↑ , I presently own some shares also, so I guess I am David's junior partner on this one. -

Patrick: You've obviously studied homebuilders and have a large exposure to stocks or at least one position in the homebuilding world. Is that a big important trend in your mind for the country? And if not, what are the big important trends that you're watching that you're interested in that may or may not impact your investing?

David: Housing is a basic thing. Everybody needs to live somewhere. Whether it's a rental or whether it's an owned house, we need housing. We've had a housing shortage for a good long time, particularly in markets where people are moving to. I happen to be the Chairman of a homebuilder and we're in Atlanta and Dallas and Florida and Colorado. And these are places where people are moving to.

And so there's a steady demand for new housing and there's been a shortage. There was probably too much housing built in 2006 and 2007 bubble, and that actually was a bubble. But since then, the build rates have come down a lot and they've stayed well below the long-term trend. Population keeps growing.

From my perspective, it's a very lumpy business, but it's a very high-quality business. And the market perceives it as a low-quality business because it is true that depending on macroeconomic circumstances, you don't really know what the profits are going to be a year from now or two years from now or even necessarily six or nine months from now, which makes it challenging for investors.

But on the other hand, the company we're involved with is Green Brick Partners, we earned over a 30% return on equity last year. This year, people think it's going to be worse and have our return on equity, according to analysts, at 15%. So it seems to me, though, if you can make 30% in a good year, 15% in a bad year, that's a pretty good situation.

And yet we trade a little bit over book value and nine times this year's consensus or something like that and five times what we made last year. To me, that seems, like, a very good place to be invested. It's the old comment you want a smooth 8% or 6% or a lumpy 15%. This is the lumpy 15%.

Fed Tightening Monetary Policy. In addition to the Fed’s 2 main explicit goals, they also have a more nuanced responsibility for financial stability (= an Art🖼️🎨🧑🏾🎨🎭🎶) -

David: [..] The issue is they can tighten only until it risks financial stability. Because at the end of the day, they can talk about their two mandates being inflation and jobs, but the real mandate is to preserve the idea that the treasury is solvent and that the financial system is stable. So that's actually job #1.

And when you get into a situation where people become nervous about financial stability, that actually has to become the priority of the authorities. So now we're left at a point where they're probably going to have to shift or reduce how much they're tightening, but they're going to do it in the face of not yet having solved the inflation problem.

Poker. There are similarities between poker and investing. They're like two slices of bread, but one of them has a little more butter on it. 🍞vs 🥪-

David: [..] I was hanging out with my friend at his house. He said, "In a year, why don't we go play in the World Series of Poker," like it's a bucket list kind of thing. "Let's train for it." So we practiced a bit. We went to a couple of more local, smaller tournaments and stuff like that.

And then in 2006, it was time for this bucket list, one-time event at the World Series. And so I entered the main event, and I had the most incredible run of great luck that I ever had in my life playing cards, and I somehow finished 18th out of, I don't know, 8,500 people, and it was really amazing. And I guess from there, I kind of knew I'm going to spend the rest of my life trying to replicate that. So I play a bunch of poker and have a good time with it.

Patrick: What do you think separates great from very good in poker? What are the attributes that allow someone to get great?

David: There are a lot of players who are a lot better than I am. Now you've got computer training. There's all this game theory and studying hand combinations and stuff like that. Many of the top pros are technically way better players than I am. So you have to recognize where your strength is and what you're doing at the table and how they are going to perceive you.

And when I play against top pros, they generally perceive me probably to be pretty weak. My advantage is that I care less. This, for me, is a hobby. For them, it's their livelihood. So I can be relaxed and I'm going to make my best decision. And if it doesn't work, it doesn't work, and then I'll be done with my vacation and I'll go back to my day job, so that's fine.

For them, like in the main event of the World Series, that's their validation. If I do well in that event and I'm a pro, this proves that I’m a great pro or it proves me versus my peers because they have a lot of pressure, they have a lot of pressure on them. And you can take advantage of that in a poker game. If you can feel the pressure that the other person is under, because then they're going to make inferior decisions. That's what my edge is, which isn't as good as their edge, but it allows me a pretty good shot.

Patrick asks- What's the kindest thing that anyone's ever done for you?-

David: That is an awesome question. My third-grade teacher one day, grabbed me by the arm as we were getting ready to go to recess. And she said to me, you're probably smarter than everybody else in this class, but you'd be better if you didn't tell them that. And that really stuck with me. [..] It created a self-awareness that I didn't previously have. How do I come across to other people and how do you behave in the sandbox. It kind of shook me a little bit, but it was really, really kind of her to point that out, and she did it in a nice way where I was able to hear it. That's particularly important.

David still remembers his 45 year old lesson from a wonderful teacher. A wise person walks with their head bowed in humility. 🙏🏽🤔😔

The entire podcast discussion was excellent. Beyond knowing how to think about a company and an investment, successful investors also need to know, when it is time to SELL. 🏃🏽♀️💨🚪This is a less discussed element of the process of investing.

Patrick asks David “How do you sell? Is there a good reason that you've discovered is the right way to sell a security for you?” But, in order to hear David’s answer, you will have to check out the podcast😉🪝 <link here>

David had ~54% of his fund allocated to 4 positions, it is public information as of 12/31/22 and a link is provided <here> if you are curious.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information session since my last edition that I reviewed-

Technology- MU 0.00%↑ , I liked this descriptive summary on Micron from the Morningstar analyst- “Although we remain positive on long-term memory demand growth from key trends such as:

artificial intelligence, 🤖

5G, 📲

electric/autonomous vehicles, and ⚡🚗

cloud computing, ☁️⛅

we now expect revenue to fall 50% in fiscal 2023 before rebounding in fiscal 2024 and thereafter.”

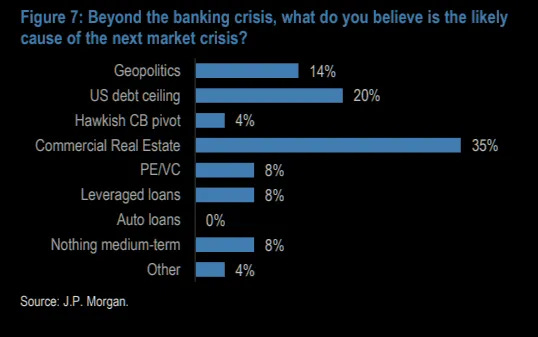

Next crisis. JPMorgan clients believe commercial real estate will be the cause of the next market crisis. (H/T to Daily Chartbook ) Commercial Real Estate issues-

use of leverage

debt maturing moves from low interest rate past to higher rate present

banks tightening lending standards leads to a restrictive credit feedback loop ♻️

longer term shift to more WFH and less square foot needed at office buildings

anticipated recession with job layoffs and potential corporate bankruptcies

Podcasts

Sundar again is thoughtful, measured and brilliant. It is worth the time to listen.

“Am I concerned? Yes. Am I optimistic and excited about all the potential of this technology? Incredibly.”

Videos

Documentary, 1 hr 20 min- Spelling the Dream on Netflix.

This one surprised me because I was expecting to see all the stereotypes of the tiger parents🐯 motivating the kids to perform. But, generally parents were loving and supportive, and it was the children that were driven and competitive. I was also unaware that the Indian-American community dominates spelling bees. 🐝 Who knew. ¯\_(ツ)_/¯ The Scripps National Spelling Bee is an annual event held in ~May/June in Washington DC. It began in 1925 and is open to participants 15 years old and under.

One of the parents🧔🏽♂️-

I was so happy that there is a chance that exists to entertain🤩 this kid in an area that he’s interested in. At the same time, instill the habits which will actually come and live with him for later in his life. The benefit of hard work, the work ethic and all that stuff. So I was really, really happy.

One of the kids👦🏾-

You can’t be a champion just by putting an hour a day. Whether it’s in sports or in spelling, you have to put in the effort. And what you see time and time again is people who have, more or less, devoted their whole lives to spelling become Spelling Bee champions, and I think that really is a testament to the benefits of hard work.

🙏🏾🙏🏾Indeed. I wish there were a couple more episodes because the show was entertaining😁 and engaging.

Books and Articles since my last edition

(I am usually reading 2 at a time, and if I get bored of a book I quit and move on.)

Fooling Some of the People All of the Time, A Long Short Story by David Einhorn David Einhorn, see the top of this post about David, details his short sale of Allied Capital and his subsequent attempts to expose alleged fraud by Allied management. Would Allied hire a private investigator to intimidate David and discourage his activist efforts against Allied?🤔 He also provides insights into the inner workings of Wall Street and the financial media. Mentioned in the book- Bill Ackman , Whitney Tilson, and Dan Loeb.

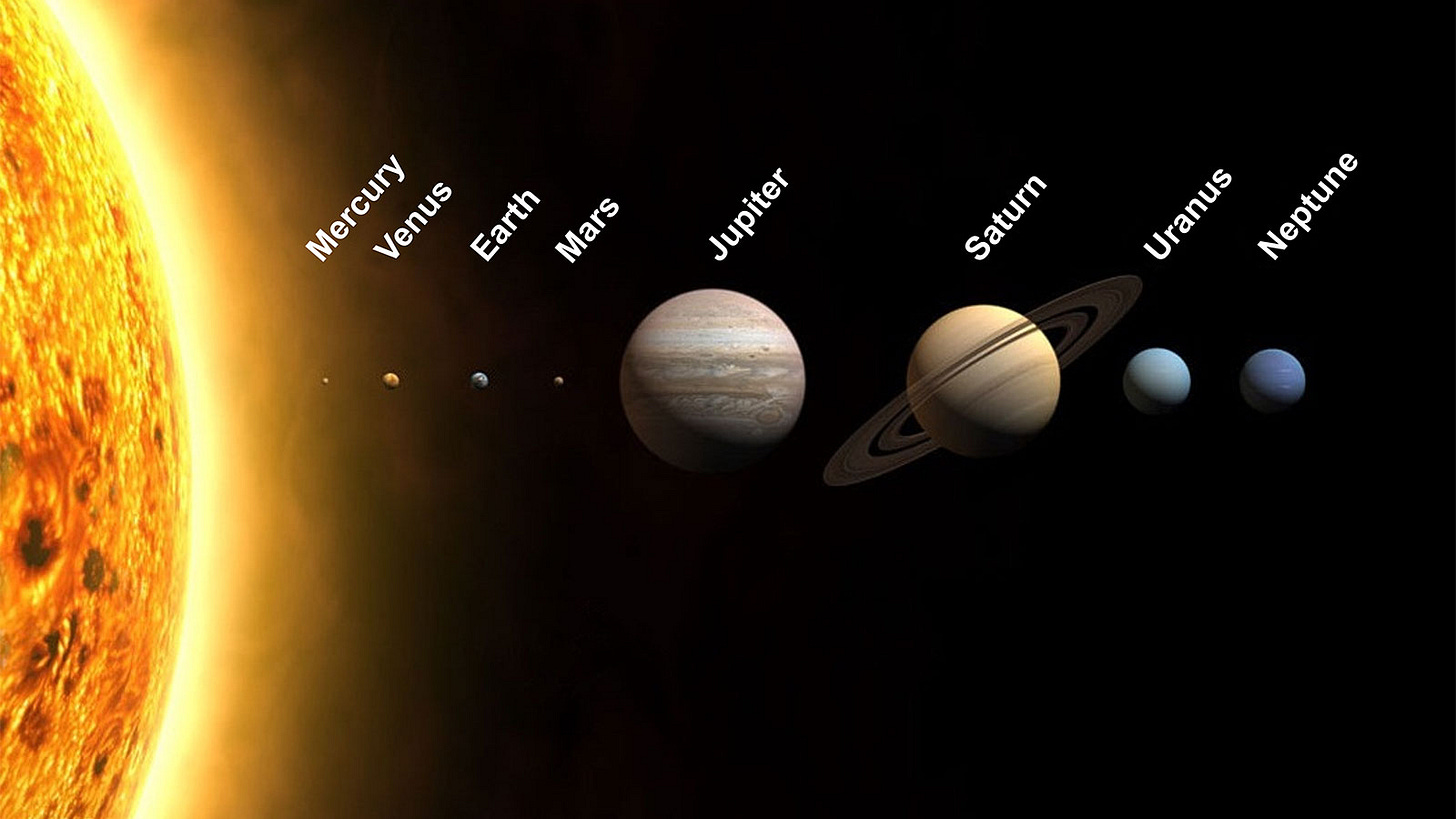

A Short History of Nearly Everything by Bill Bryson It is a popular science book that explains some areas of science in an easily understandable and amusing way. It covers topics such as the size of the universe, the history of geology and biology, and the possibility of the Earth being struck by a meteorite. We are still learning about the universe and our place in it. Scientists are constantly making new discoveries, and there is still much that we do not know.🧬🌌

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Sundar Pichai, CEO of Google-

I suspect that most of us view successful company leaders in their present state. Powerful, confident, and probably rich. Someone said- “The present is the past rolled up like a spring.”🐚 Similar to seeing a world class athlete as superhuman. 🦸🏽🦸🏽♀️🦹🏽♀️ But everyone had to start by learning to hold a pencil or throw a ball.

Sundar Pichai was born in Madurai, India, on June 10, 1972. When he was a boy, his family did not have a phone.🚫☎️ This was not unusual in India at the time, as many families could not afford a phone. One way that they would communicate was by writing letters. He would take great care in writing his letters, and he would often include drawings and other creative elements.

Another way that Pichai and his family would communicate was by using public phones. They would often go to the local post office or to a store that had a public phone in order to make calls. This was not always convenient.

Pichai has said that his childhood without a phone taught him the importance of communication and creativity. He also said that it taught him the importance of being resourceful and finding ways to overcome challenges.

Pichai was described as a bright and curious child, and he loved to tinker with electronics. Pichai's father was an engineer, and both his parents instilled in him a love of learning and a strong work ethic. They encouraged him to pursue his dreams, and they were always supportive of his endeavors.

Pichai attended Jawahar Vidyalaya Senior Secondary School in Ashok Nagar, Chennai. He was a good student, and he excelled in math and science. He also captained his school's cricket team, leading it to win regional competitions.

After graduating from high school, Pichai attended the Indian Institute of Technology Kharagpur, where he studied metallurgical engineering. He graduated with a bachelor's degree in 1993.

“My father spent the equivalent of a year's salary on my plane ticket to the US so I could attend Stanford. It was my first time ever on a plane," Pichai said.

💰💰✈️🤯

He received a master's degree in materials science and engineering from Stanford in 1995.

Pichai went on to earn an MBA from the Wharton School of the University of Pennsylvania in 2002.

One of Sundar’s first jobs was at…. Applied Materials AMAT 0.00%↑ a leading semiconductor equipment manufacturer. You thought I was going to say Google GOOG 0.00%↑ 😜. I am a fan of Sundar and also of Google's CFO Ruth Porat.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

I really liked what the advice David's teacher had for him. If someone has to keep reminding everyone that they are smart, it is probably not true! So staying humble even when you are the smartest is the best way to prove yourself.

I love the Mr Market analogy. I often ask myself why do I invest--the market is so crazy!!! But I guess that’s the point!