4/7/25-Altman's Warning 🔥, Micron Fab Tour 🏭, AR & Inventory👀, Kirkland Brand

A sale is not a SALE until you have collected the CASH MONEY. 💵

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Altman's Warning: OpenAI's Compute Capacity Can't Keep Up with User Growth

In the final days of March Sam Altman posted that OpenAI has so much demand their “GPUs are melting.” 🔥🔥🧑🏼🚒 And now in the first few days of April Sam posted the following:

I know disruptive tech companies are known to exaggerate demand, but due to Sam’s high profile I think we have to take him at his word on this one.

So what? Why does it matter? Well it is a proof point on the trend line of what the hyperscalers have been saying about DEMAND being greater than supply. And it confirms what Nvidia has been saying about growing use cases, adoption, and system scaleup overall.

I am a skeptic when it comes to exponential sales projections. We are reminded that “trees don’t grow to the sky.” And, “Don’t believe anything that you hear, and only half of what you see.” 🙈🙉🙊 But, I have to believe that Sam’s statements above are anecdotal evidence of on going demand growing faster than growing datacenter supply. ( MSFT 0.00%↑ , GOOG 0.00%↑ , AMZN 0.00%↑ , NVDA 0.00%↑ )

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

US Tariffs commentary dominated the last 2 weeks. No company specific information or conferences stand out. US Tariff commentary might continue to dominate the conversation into the near future. 😝🥴

(With data and charts it is not what you look at, it is what you see that matters.) Click on any of the images below to see a larger view.

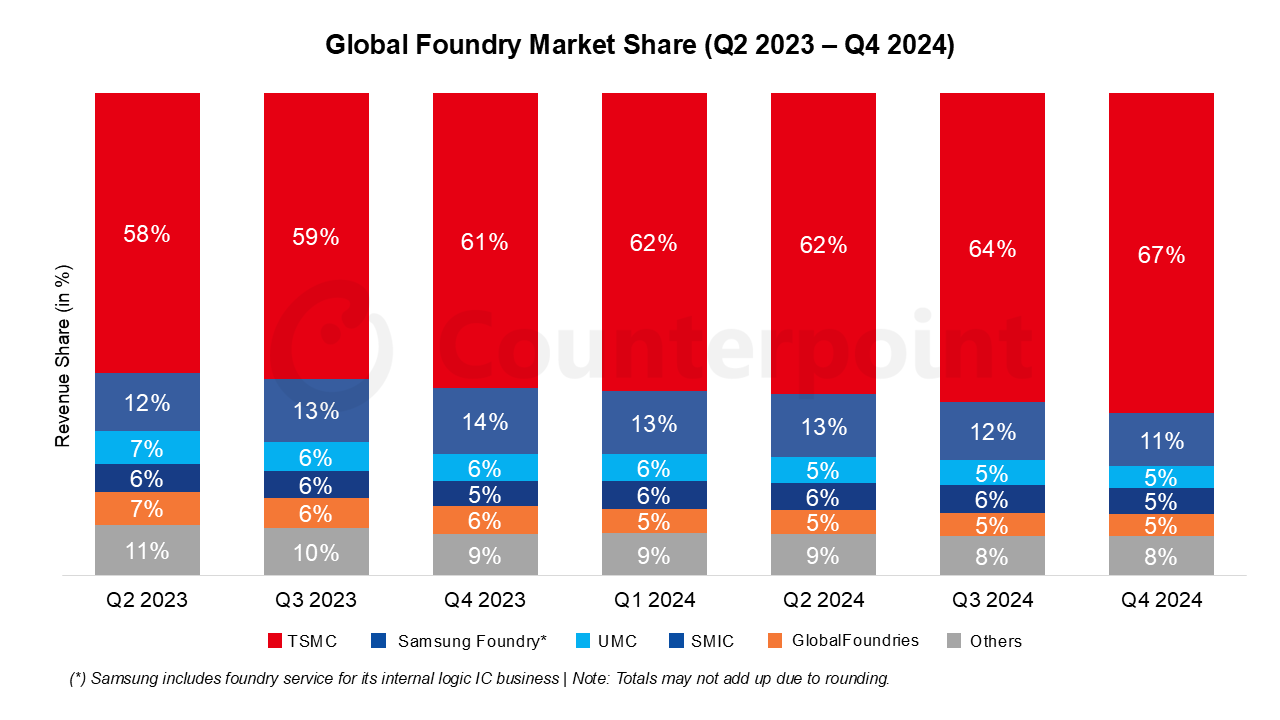

TSMC gaining market share over time. I don’t see anything to stop this in the near term.

DoorDash dominates food delivery, but Uber Eats is slowly gaining.

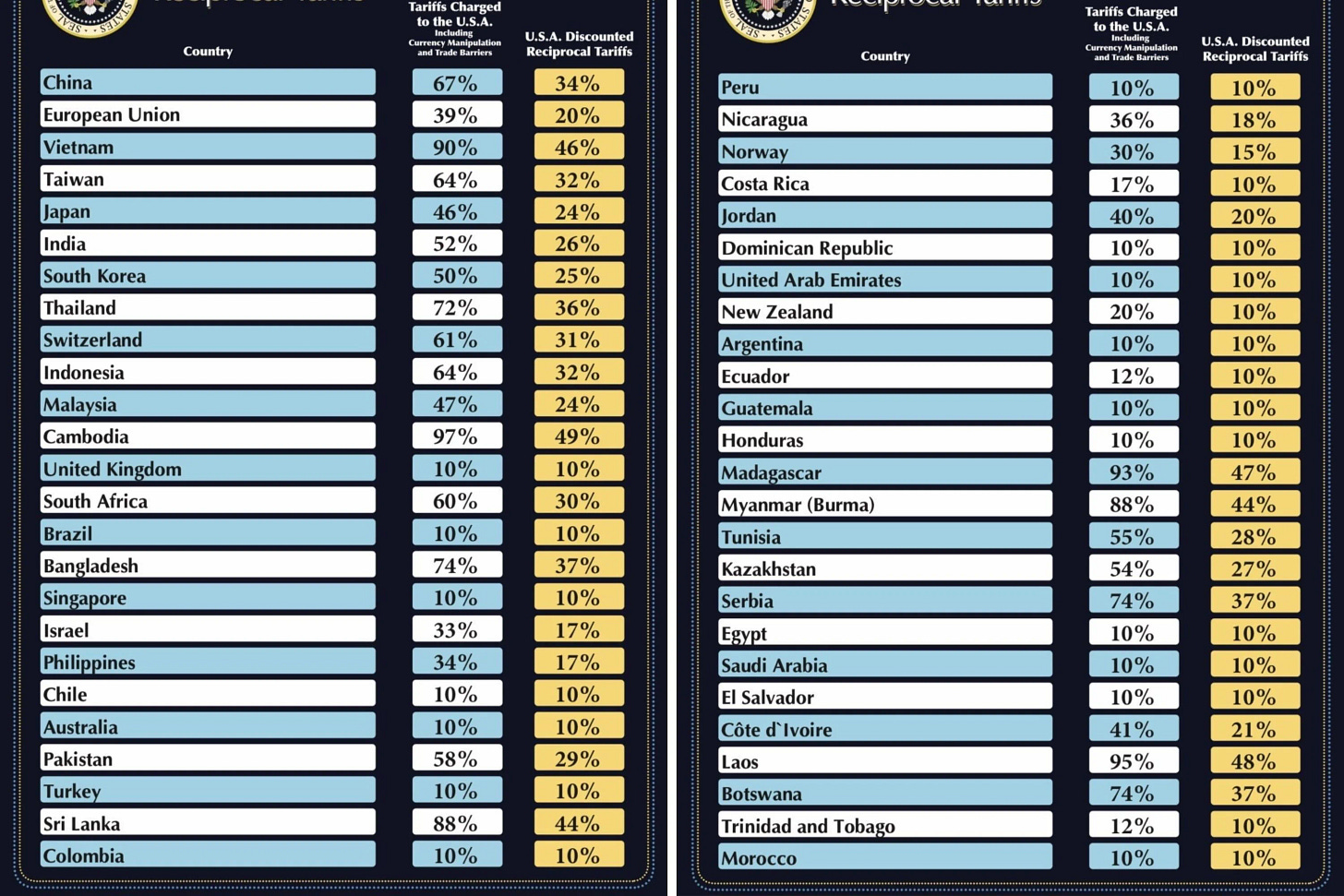

I would be a bad finance person if I didn’t include the tariff chart below.

Inside Micron Taiwan’s Semiconductor Factory

20 Min tour inside Micron’s Fab in Taichung Houli, Taiwan. This is one of the most complete and well done tours I have seen. Production using ASML’s EUV to create DRAM and HBM memory. Clear and high production quality. Follow the process from start to finish. Referenced to MU 0.00%↑ and TSM 0.00%↑

[If you are interested in semiconductors and SemiCap, I wrote about the key 3-4 trends that equipment supplier LRCX sees next in my post on 2/2025, link here.]

Video

9 Minute, case study on Costco’s private label (house brand) KIRKLAND. The history and the strategy. Brilliant. COST 0.00%↑

Costco went against industry standards in 1995 with the creation of its private label, Kirkland Signature. With $86 billion in sales last year, Kirkland is now a bigger brand than Proctor & Gamble and Kraft-Heinz. Compared with other mass retailers like Target and Walmart, which have multiple brands, club channels like Costco and Sam’s Club are winning the private-label food and beverage space by consolidating.

Books and Articles since my last edition

(Reading Great books is like a conversation with the finest minds of the past.- Descartes. If I get bored of a book I quit and move on.)

Winners Dream: A Journey from Corner Store to Corner Office by Bill McDermott CEO of ServiceNow NOW 0.00%↑ . Wonderful leader! Curious why he wears the tinted glasses😎? Here is the link to the reason.

Influx by Daniel Suarez Science Fiction. Suarez is an accomplished sci-fi writer, and this one was good also.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Keep an Eye on Balance Sheet AR and Inventory

First and foremost, you have to review the quarterly financial statements of your positions and watchlist companies. Income Statement, Cashflow Statement and Balance Sheet. No excuse. 🫵🏼

Now that I got that out of my system, I wanted to offer a couple pro tips😃 on Accounts Receivable (AR) and Inventory. I am not going to define them as I expect you are all intermediate to advanced investors. And all of my comments relate to comparing the absolute number to the prior quarter and prior year time frames.

AR is growing. Growing by how much? Are sales growing, and AR is up by a similar rate? That might be okay. But, if sales is NOT growing or if AR is growing by a rate greater than sales. BEWARE. It is easy for management and the sales department to sell to customers on loose AR credit terms. Will the AR be collected? How long will it take for the AR to be collected, 45 days, 120 days? Are sales numbers being achieved because credit is being granted to low credit quality customers? Anyone can sell more by granting easy credit, collecting the AR is what matters. Collecting the AR is hard. And remember, a sale is not a sale until you have collected the CASH MONEY. Selling on AR credit terms is like slow dancing with your cousin. 😉 Meh!

Inventory is growing. What do you mean inventory is growing? Keep an eye on this one. Is the company building up inventory before the holidays, or for spring selling season? Does the company inventory have a risk of obsolescence like clothing, or computer hardware technology? I generally don’t like to see inventory build at a faster rate than sales. I certainly don’t like to see too much inventory build with semiconductors, home builders, and shoe/clothing companies. Increasing inventory can be an early sign that sales efforts are failing and write off are coming. 🥴

When I am looking at quarterly numbers for AR and inventory, these are some of the thoughts that are running through my brain🏃🏽🧠. Of course there are many more things to keep in mind when reviewing financial statements. Start with the understanding that you have and keep learning. Your knowledge compounds over time.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

The Costco video was very interesting. I have never thought of their ability to use Kirkland as a leverage tactic against suppliers.