4/9/24-Google☠️??, BG2🎧, US New Housing🏘️

I recommend zero based re-regulation of the nuclear fission market.⚖️⚡🤔

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Google is so over!!??? (That is what all the cool kids say.)

Google is an excellent company with excellent management. But they are not perfect and all knowing. Even the most powerful and well built ship on the ocean is subject to the waves and storms of capitalistic forces, including creative destruction and new trends (LLM, Generative AI.) What matters is the teams ability to OODA loop (observe, orient, decide, act) quickly, over and over again. While this is not investment advice, I am going to argue that Google will not only return from this perceived setback, but they will ultimately be recognized as one of the dominant providers.

There is something else here at play beyond the facts and fiction of a technological trend. In narratives like this, there is momentum selling, media repeating the negative opinion without adding any critical thinking and dumb money selling on the way down. In short, a negative emotional reaction.

I wanted to share a two other company examples of this in hopes that we might recognize a pattern.

Costco is so over!!???

In 2017 Amazon announced it would purchase Whole Foods Market and the narrative at the time was that Amazon would erode Costco’s business. Lots of people sold COST 0.00%↑ . Costco is an excellent company run by excellent management. Costco has always had to contend with competition.

Meta is so over!!???

In late 2022 Meta announced that changes that Apple had made to app tracking would negatively impact advertiser spending on its family of apps. The narrative at the time was that Meta was spending too much on AR/VR, ad revenue was declining, and the conclusion was that META’s best days were behind it. Lots of people sold META 0.00%↑ . META is an excellent company run by excellent management and they know how to OODA loop (observe, orient, decide, act) quickly. META is a fierce competitor.🤺

The question in front of investors is- Do you think Google can respond to this competitive trend and will Google be a stronger company in the future? Google is not the new AI guy in town having just fallen off the turnup truck. They are strong, smart and shrewd. My estimate gives GOOG 0.00%↑ a high probability of being able to sustain their competitive advantage, and grow their market share of LLM, Generative AI. Not to mention that a growing cloud & AI market is more demand for the Google infrastructure/datacenter machine.🚂

[Wondering how an excellent company relentlessly grows value over time? I wrote about the 5 🖐🏽alternatives in a post on 12/2022, link here.]

Many of us like an underdog story (OpenAI, et al), but the advantage should often go to the experienced champion(s) (Google, Microsoft, AWS). This is a version of the classic innovation challenge- Can the Innovator get distribution before the Incumbent can get innovation?

My rational, unemotional opinion is Google will survive, adapt, and I can sleep well owing it.

(PS- A different question would be- Nick which larger company do you think has its best days behind it and is in decline?)

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- AVGO 0.00%↑ Investor Conference, NET 0.00%↑ Developer Week

(With data and charts it is not what you look at, it is what you see that matters.)

Broadcom taking a swing 🤜🏽at NVDA 0.00%↑ ‘s InfiniBand.

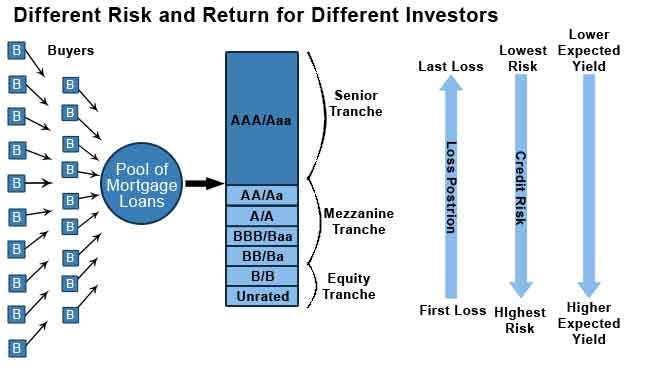

Visual below of securitization is excellent refresher of process/functioning for MBS, ABS, CLO, etc.

Which line do you put yourself in?

Podcasts

In his recent podcast he republished a memo from 2020 - You Bet! (🎧 link here), Howard Marks, Oaktree Capital, explained what it means to “think in bets,” as he discussed the many parallels between investing and games of chance. 🎲♠️🃏♟️

Howard Marks is a great teacher, mentor in all of his memos and interviews. Marks has a net worth estimated at a cool $2.2B.🥶🤑

Videos

68 Minute, Bill Gurley and Brad Gerstner on all things tech, markets, investing & capitalism. This week, they discuss the challenge of forecasting the AI Supercycle, Stargate and the massive AI supercomputer build out, AI demand overhyped or underhyped, and current market valuations. Fantastic conversation. (Quote below has been lightly edited by me for clarity.)

I love to visit France as much as the next person but if it's not the height of embarrassment the French are driving more Innovation and more efficiency out of nuclear fission than the United States and we pride ourselves on Innovation. That should be a shock and a national embarrassment.

In case anyone who is listening has any Authority whatsoever, I would just highly highly recommend that there be a consideration of a zero based re-regulation of the market. It's clearly the problem. I don't think there's anyone in the energy Market that doesn't think the bureaucracy and regulation is the problem in the American nuclear fission Market

Books and Articles since my last edition

(Books are like loading software on your brain. If I get bored of a book I quit and move on.)

The Last Watch by J.S. Dewes Science Fiction, space drama.

Common Stocks and Common Sense by Edgar Wachenheim Business, Investments Book full of wisdom from a proven value investor earning > 18% p.a. for over 20 years.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

US New Home Construction Drivers

We all come across bits and pieces of housing starts/homebuilder data from time to time, and I wanted to summarize it all in one place as a reference to you and to myself. It was also an excellent exercise in me double checking all the logic and the math for myself. (Writing is thinking… If you are not writing, you are not thinking……as well as you could be.✍🏽⌨️ Me included.)

US Population🧑🤝🧑🧔🏽♂️👱🏽♀️👩🦳Metrics

336 Million people live in the USA

→ ~0.5-0.7% per year growth rate (Births, less deaths, plus immigration)

→ 1.2 - 1.9 Million more people, every year [ Remember this number for later.]

New Housing 👷🏽♀️🚧🏠🏘️🏘️Metrics

146 Million housing units in the USA

→ ~1.5 Million Annual Housing units needed, driven/derived by 2 things

1.2 Million more people per year (population growth) [From above]

400K housing units torn down per year due to Age🏚️, Fire🔥, Flood🌊, Style/Design

Total ~1.5 Million Annual Housing units needed

→ 1.4-1.5 Million appears to be the soft upper limit of the US home builders capacity, and housing starts. Why? Labor shortage, materials shortage, electrical transformer shortage, and it is very difficult to get land permitted and developed. Maybe over the next 10 years the capacity could be positively increased. ¯\_(ツ)_/¯

→ But wait, there is more. The US substantially underbuilt for about 12 years (2012-2024), as a result of that, there is a shortage estimated of 3-4 Million housing units. If homebuilders attempted to meet that shortage over the next 10 years - 3 Million / 10 Years = 300K additional housing starts per year.

→ 1.8 Million New Housing units per year = 1.5 M + 0.3M shortage. 😬

New homebuilders are struggling to meet a 1.5 Million housing starts number, expanding to a 1.8 Million level for 10 sequential years, doubtful. Despite the fact that housing is rate driven and cyclical, I think the US new housing demand is generally going to remain strong for a very long time. Moreover, I think some of the public homebuilders are going to be excellent long term investments. 🏠🙏🏽

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

I really like the explanation of the US new home construction drivers because you explain the history of how we got to the point of a shortage. On a basic level most might think that demand is strong and there is not enough supply, but their is a long history leading up to this point.