5/21/24-Buffett⚡Abel,Marc Andreessen🤔, R U Wrong? 3 Tools🧰

"You know, our shareholders didn't give us their money to lose it."

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Buffett and Abel on Electricity ⚡

I think of public goods as examples where the government has to be involved to some degree and the invisible hand of capitalism needs to be restrained. Some examples include local fire departments, construction and maintenance of roads/bridges, military, law enforcement and utilities (water, waste treatment, communication services, electricity.)

With these public goods we all benefit and we should all bear some of the cost. This is one of the wonderful benefits of living in a society, and standing on the shoulders of those who came before us.

Now that I have softened you up. Electricity was a topic at the recent Berkshire Hathaway annual meeting. By most measurements BRK runs an excellent electrical utility, BHE. However, in recent years the profits of BRK’s electricity division has been poor and it is mired in state regulation and expensive lawsuits.

Warren comments :

Our experience in Iowa would indicate that free enterprise has its role and that we can run a privately owned utility company that will be more efficient for society than with Public Power. But what has happened is that there's going to be enormous amounts of money spent on power. And if you're going to do it with private owners there's nobody better situated than Berkshire to satisfy the portion. But a large portion of the needs of the country and we will do it at a rate of return that is not designed to make us rich or anything like that. It's a sensible rate of return. But we won't do it if we think we're not going to get any return. It would be kind of crazy and we've seen actions in a few states where some of the costs associated with climate change are not being regarded as cost of the utility shouldn't incur. Well believe me if it was publicly owned they would have incurred it too. But we will do what Society tells us. We have got the money and we've got the knowledge to participate big in something that is enormously important for the country. But we're not going to throw good money after bad.

Greg Abel comments:

You’ve just alluded to the significant investment that has to go into the energy industry, the utility sector for many years to come and I think if we start there if I think of our different utilities and will definitely come to Utah and Pacific Corp but if you look at the underlying demand that is building in each of those utilities. The amount of dollars that are going to have to go in to meet that demand. It's absolutely incredible. So when you raised it in your letter it's a really important issue. We have to have a regulatory compact….so just to set the frame a little bit. If I think of:

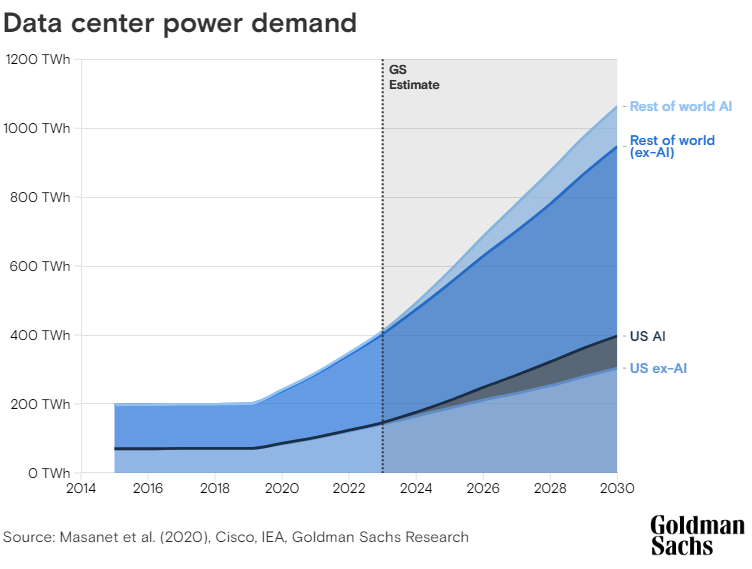

Iowa which you mentioned we've made substantial investments there. It's been very consistent with both the public policy that the state and legislator wanted and they enacted very specific laws to encourage that. But that utility is more than 100 years old right now. And if we look at the demand that's in place for Mid-American Iowa utility into the mid 2030s associated with AI and the data centers🤖💻📱. That demand doubles in that short period of time. It took 100 years plus to get where we are today and now it's going to double. That will require substantial amounts of capital from Mid-American and its shareholders. How that will function is if we have a proper regulatory compact in place which you've highlighted.

If we then go to say Nevada where we own two utilities there. If you go over a similar time frame, and you look at the underlying demand in that utility and say go into the later 2030s, it triples the underlying demand.

billions and billions of dollars have to be put in our rate base.

100 years to put the present capacity in place, with the need to double in 10 yrs in Iowa, and triple in Nevada. 😲🤯👀

Warren and Greg are not bragging and they are not giddy with excitement. They are soberly serious that this is a huge scaleup in a short amount of time, requiring a huge investment and a messy regulatory and legal environment.⚖️

Warren finishes:

Whether you earn X% or X plus or minus 0.5%, that differs by state. Some states are more attractive than others, but whether you earn X or go broke, is not an equation that works.

You know, our shareholders didn't give us their money to lose it.

(All of the quotes above have been lightly edited by me for clarity.)

We might say, I don’t live in those states, that is not my problem. Almost every state in the US has this exact same problem, and the states are connected to each other via an electric grid. In addition, most countries in the world have this exact same problem. So, like it or not, we are in this one together.

Berkshire has been an excellent role model in the electrical utility industry, and Berkshire needs to deploy large amounts of capital. The demand for electricity is expected to double and triple in just these 2 instances above. Who is the 2nd and 3rd best electric utility instead of Berkshire, also with deep pockets and honest dealings?….. Hog wash. I bet 90% of us dislike our electric utility. Familiarity breeds contempt.

Every public/private relationship to provide a community service is going to have bumps along the journey. The best approach to a long term relationship is for each party to insure that the other person (counterparty) is ALSO getting a good deal. (This applies to marriage as well 😉.)

Potential solution- regulators/utilities go visit Warren and Greg and ask them how they would solve this if they were our government. Take great notes of everything discussed. Go back to your teams and figure out how quickly you can enact some of their best solutions. It doesn’t matter where or from whom the good idea comes. Shamelessly adopt good ideas and enjoy the benefits.

Watch the whole video exchange that I have excerpted above, video link is here and it starts around minute 34 in the morning session.

[If you like Warren Buffett, in my 11/23/2023 post I wrote about— Warren Buffett and Charlie Munger on the US National Debt imagined as a Family Farm🚜🌄 (From 2005 Shareholder Meeting) Link Here.]

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

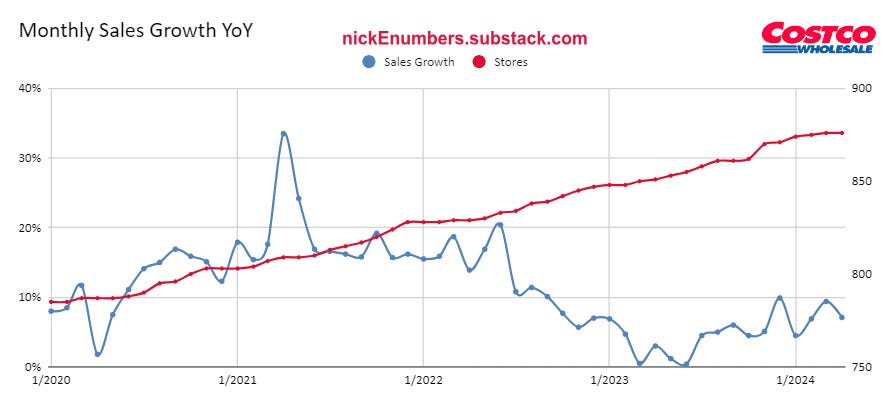

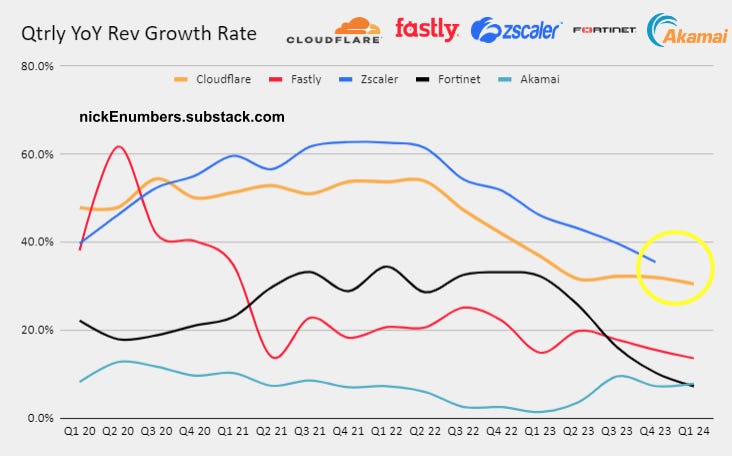

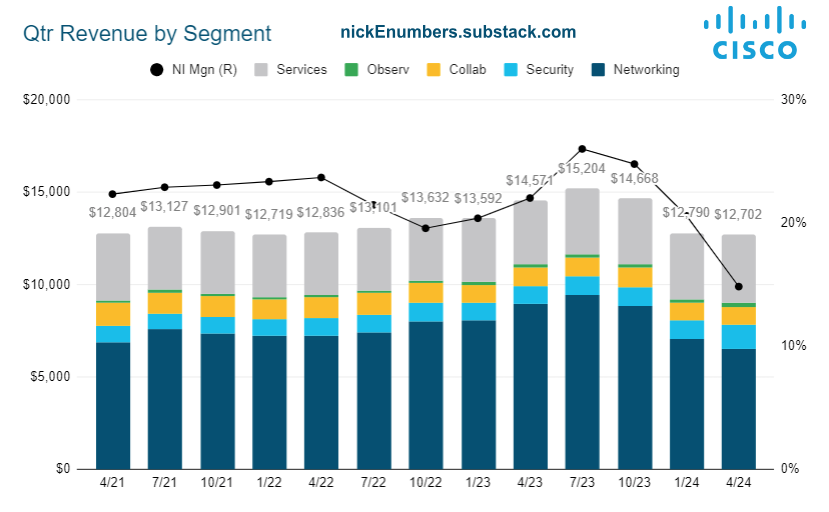

Technology- CFLT, ARM, AKAM 0.00%↑ , CSCO 0.00%↑ , AMAT 0.00%↑

Housing & Banking - UPST, AFRM, HD

Others- UBER 0.00%↑ , DIS 0.00%↑ , WMT 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.)

Podcasts

17 Min podcast 🎧with Marc Andreeson and Nicolai Tangen. AI, Disruption, US vs. Europe, and Making Money. Marc compresses so much opinion and directional thought into 17 minutes. Really outstanding and insightful. Link here.

Videos

15 Min, extraordinarily brilliant💡 Fei-Fei Li, Sequoia Professor in CS and Co-Director Human-Centered AI Institute, Stanford University speaks with Bloomberg’s Emily Chang about AI and ethics at Bloomberg Tech in San Francisco. I have heard multiple times that students love learning from and working with Fei-Fei. She is a fan favorite🥰🤩.

Emily asks “If you had to rank the big A.I. players, who do you trust the most? And who do you trust the least?” Fei-Fei below:

My trust is not placed on a single player. My trust is placed in the collective system we create together and in the collective institution we create together. Maybe that's a trap question. I'm not going to be able to call out anybody that I feel is…

You know, I think about the founding fathers of the United States. They did not place trust in a single person. They created a system that all of us can trust.

Books and Articles since my last edition

(Books are like loading software on your brain. If I get bored of a book I quit and move on.)

Day Zero by C. Robert Cargill Science Fiction, Robots, Dystopia This is the 2nd book in a series. I like it and I hope Cargill writes a 3rd.

iWoz: Computer Geek to Cult Icon by Steve Wozniak Autobiography. Woz is a brilliant engineer and a little strange. (Aren’t we all a little strange.😉)

Brad Jacobs Business Autobiography. Jacobs has created seven corporations, five of which are publicly traded: XPO Logistics and its spin-offs, GXO Logistics in 2021 and RXO in 2022; United Rentals; and United Waste Systems. [FWIW- I refuse to type the title of the book as I find it trite. Regardless the book is good and Brad is exceptional.]

In the book, Brad tells the story about a time when he was growing United Rentals by acquisition (roll-up). A leader from the competitor Hertz Rentals invited Brad to lunch and told him he was moving too fast and should slow down.🤔😠👎🏾

The Biggest Bluff by Maria Konnikova Nonfiction, Biography. The tale of how writer Konnikova followed a story about poker players and wound up becoming a story herself. Her writing of human psychology placed in her real life examples are excellent and useful. Her fawning over poker legends and her coach Erik Seidel are a little unproductive. Still, it was worth the read.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Tell me when you know your investment thesis is going WRONG-

You have invested into your selected companies or ETFs. You monitor and evaluate the total group and individual selection performance at regular intervals.

When do you know one of your investment selections is going WRONG? How do you know? Forget about all the obvious examples like bankruptcy and delisting. Many businesses go bad slowly over time. And when we make an investment decision, we humans are loath to revisit that decision and admit that we might have made a mistake. We marry 💍ourselves to that prior decision.

Here are a couple of my favorite mental models to improve our thinking regarding all of our decisions:

Elon Musk — “Always take the position that you are to some degree wrong, and your goal is to be less wrong over time.”

John Maynard Keynes — “When the facts change, I change my mind - what do you do, sir?”

Charlie Munger — “Being able to recognize that you are wrong is a godsend. I actually work at trying to discard beliefs. Most people just try and cherish whatever idiotic notion they already have because they think it’s their notion that must be good. Of course, you want to be able to change your mind, especially when disconfirming evidence comes through.”

Richard Feynman — “The first principle is that you must not fool yourself, and you are the easiest person to fool.”

What I have found to be useful for me is to journal my initial decision. I have a checklist template document and I force myself to go through the checklist item by item. There are a couple narratives that I must write to myself to memorialize my initial thinking, reasoning and ultimate decision.

When performance is flagging on an investment selection, I revisit this objective documented thesis. Have the facts changed from my initial observations. Perhaps the thesis still holds, but the macro economy has changed. The line between me being stupid vs. impatient is not always clearly obvious to ME. Maybe you can relate. ¯\_(ツ)_/¯

Let me offer 3 thinking tools that might be helpful when you are not sure if your thesis on an investment selection has gone wrong:

Imagine you just received a slug of new capital ($10K, 100K, 1M), whatever flips your switch or turns your dials. Imagine you have that money to invest. Would you repurchase your suspect position today? Be quiet and listen to yourself.

Think about the Netflix Keeper Test. It focuses on a manager's judgment about their coworkers. Here's how it works: The manager asks themselves: "If this person told me they were leaving, would I fight to keep them?" If the answer is YES, then the employee is considered a valuable asset and the manager should be actively working to keep them engaged and fulfilled. If the answer is NO, then the employee might not be the best fit for the company culture or role. Does your investment pass the Keeper test? Is it excellent and are you excited + confident about its long term future, if not… SELL IT and move on.

Remember my checklist template document above. I pretend it is the first time that I am meeting the suspect investment and I re-underwrite the checklist template as if it is a new Day One. From the start to the finish and the narratives in between. By the time I have finished this process my thinking is much clearer and the action I must take is more obvious to me.

Wishing you both skill and luck in your investing. 🙏🏻

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

This article was detailed and informative. I will use it in my course on wealth building. https://asklewis.substack.com/p/an-introduction-to-my-new-course