5/7/24-🤩Henry Singleton Tenders, Prank🫢Confession,🎧Zuck & Dwarkesh

🎶“It was all a dream, I used to read Word Up! magazine.."

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Why strong public companies rarely attempt large tender offers to repurchase their shares-

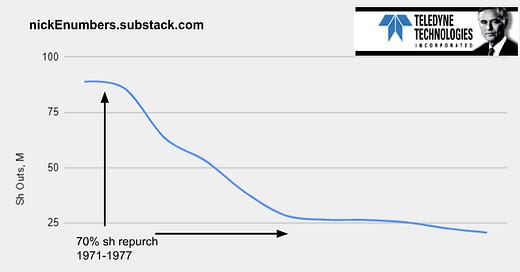

In order to set the table for the topic lets use one of my hero’s Henry Singleton from Teledyne. During the 1971 to 1984 time period, Teledyne, led by CEO Henry Singleton believed Teledyne’s stock price was undervalued by the market and that repurchases were a good way to invest in the company’s future. Singleton engaged in a very aggressive stock repurchase program. See the table below of the 9 different tender offers Teledyne made and their basic terms. Teledyne financed these repurchases primarily through its cash flow from operations but Singleton was also comfortable accelerating/juicing🍊 the size of the repurchase by taking on debt.

From 1971 to 1977 they bought back a significant portion of the company’s outstanding shares, estimated to be ~70%. See illustration below.

By repurchasing shares, Singleton increased his percentage ownership of the company and also made it more difficult for a hostile outside takeover. The many tender repurchases could have been a signal to investors that management believed in the company's long-term prospects.😉

From 1963 to 1990, Singleton delivered a 20.4% compound annual return to his shareholders, compared to an 8% return for the S&P 500.

🎈Fun Fact🎈- Claude Shannon, legendary mathematician/electrical engineer, was friends with Henry Singleton and sat on the Teledyne board.🧑🤝🧑 I wrote about Claude Shannon’s 6 Strategies for Creative Thinking in my 4/25/23 post, link here.

Why don’t strong public companies attempt large tender offers to repurchase their shares in 2024? What market conditions have to exist for a company to consider a tender offer?

There are a list of factors below, but the strongest reason is that the company stock has to enter a multi year sell off period. 2, 3, 4, 5 years. This environment is one of the best setups for a large tender offer to repurchase their shares. Public capital markets rarely offer this multi year opportunity for a strong healthy company. As a consequence many public companies engage in ongoing Open Market Repurchase programs.

Open Market Repurchase vs. Tender Offer

Flexibility- Strong companies can buy shares gradually over time in the open market, allowing them to react to market fluctuations and adjust the repurchase program as needed. You can also think of this like a dollar cost average program. (Tender offer: involve a set timeframe and price range, which can be less flexible.)

Cost- In an open market purchase companies don't have to pay a premium over the market price to acquire shares. (Tender offer: sometimes involve a premium to incentivize shareholders to tender their shares, increasing the cost.)

Transparency- Open market repurchases are a little less transparent as companies don't have to disclose specific details about the day to day activity of the buyback program until the end of the quarter. (Tender offer: require more public disclosure about the program's purpose, timeline and size.)

Coordination- Open market repurchases are simpler to administer, as they don't involve managing individual shareholder tenders. (Tender offer: require managing the tender process, including evaluating and potentially pro-rating tenders if the offer receives more shares than desired.)

There are other influencing factors to be sure, but this is a good summary. A related action that does seem to be deployed in current markets is the “Take Private.”

Taking a company private refers to the process of converting a publicly traded company into a privately held one. This means the company's shares are delisted from stock exchanges and are no longer available for trading by the general public. This might occur if the management team or some board members want to effectively take control of the whole company and create/capture juicy future value. This is often enabled through the use of debt and private equity.

If you are interested in stronger public companies that have meaningful open market repurchase programs, check out: Housing/Construction- GRBK 0.00%↑ , TOL 0.00%↑ , EXP 0.00%↑ Semis- AMAT 0.00%↑ , LRCX 0.00%↑ Banking- BAC 0.00%↑ Mag 7 - META 0.00%↑ , GOOG 0.00%↑

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- NET 0.00%↑ , TXN 0.00%↑ , LRCX 0.00%↑ , META 0.00%↑ , AMZN 0.00%↑ , AAPL 0.00%↑ , AMD 0.00%↑ , QCOM 0.00%↑

Housing & Banking - PHM 0.00%↑ , GRBK 0.00%↑ , BZH 0.00%↑ , MLM 0.00%↑ , VMC 0.00%↑

Others- TSLA 0.00%↑ , BRK

(With data and charts it is not what you look at, it is what you see that matters.)

Podcasts

The podcast below between Mark Zuckerberg and

has received significant media attention. Although I avoid repeating the media headlines, I generally listen to the Dwarkesh Podcast and I am a Zuck fan. This discussion is outstanding and Zuck is in excellent teacher mode👨🏻🏫. Listen and Enjoy!Videos

21 minute video, great simple explainer of how a CPU executes instructions to the beat🥁 of the system clock. There are only 2ish moments that put the nerd🤓 meter into the red, but they pass quickly. Stick with the video and I think you will get a lot out of it. I really enjoyed it.

Books and Articles since my last edition

(Books are like loading software on your brain. If I get bored of a book I quit and move on.)

The Dream Machine: J.C.R. Licklider and the Revolution That Made Computing Personal by M. Mitchell Waldrop History, Technology This was a Andrew "Boz" Bosworth CTO META 0.00%↑ reading recommendation. Book mostly follows JCR Licklider Ph.D. Lick (MIT, ARPA, etc) has been called "computing's Johnny Appleseed", for planting the seeds of a human-computer symbiosis transforming the course of modern science and led to the development of the personal computer.

I Love Capitalism!: An American Story by Ken Langone Entrepreneur and New York🍎 legend Ken Langone tells the compelling story of how a poor boy from Long Island became one of America's most successful businessmen and co-founder of Home Depot.

"Capitalism is brutal. It’s survival of the fittest. What’s a successful business? More money coming in than going out. If it’s the other way around, you’re out of business—simple as that."🫳🏽🎤

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

I Gotta Confess a Prank🫢-

I recently saw The Notorious B.I.G. album cover above and it immediately reminds me of 2 things:

The song Juicy [link]-

🎶“It was all a dream, I used to read Word Up! magazine

Salt-n-Pepa and Heavy D up in the limousine..”🎶

…and it conjures up a memory of a prank I played way back when.

I was the CFO for a tech enabled B2C company with about 75 employees. The IT Director and I were in the on-premises server room and I saw a small CD player up against the wall. It was powered up and had cables running from it to the wall mounted office phone system. I peeked at it and the CD was spinning/playing but no sound was coming out. I asked the IT Director, who happened to be a friend, to explain the set up to me. He said that CD was our office hold music, the CEO liked marching band🎺🥁📯 music, and the disc repeated🔁 every ~hour… 😈🦹🏽

Sometimes, mischief finds us. What can I say? We had to change the music, right, the universe demanded it of us.. I think we spent about a week discussing album alternatives. We selected The Notorious B.I.G. Ready to Die album. I know, what the hell were we thinking? Who knows. We were stupid. But, if you are going to be a bear, be a Grizzly BEAR 🐻.

Now, we didn’t just pull the CEO’s album out and slap the new album in, this was a prank, not self-destruction. We waited until Friday afternoon at about 5pm. We switched marching bands for a 69 minute Notorious B.I.G. album on repeat 🔁.

The Notorious album played about ~60 times that weekend to anyone interacting with the phone system. Monday morning, bright and early we went in and switched back to marching band🎺🥁📯 music.😇

I think we sat on pins and needles for the next few days waiting to see what might happen. Answer= nothing. The majority of our customers were in their 20s. Perhaps they loved the weekend hold music. ¯\_(ツ)_/¯ Who knew I was a little bit of a rebel.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

I think Henry Singleton's repurchase plans over the years were very interesting because of the multiple ways investors can view them. For the most part they can be viewed in a positive light because capital gains are taxed more favorably than dividends for shareholders and it can be seen as a positive signal for the future. However, preventing hostile takeovers and entrenching management is anti-shareholder in a lot of ways.