5/9/23- Cloud Mkt Size⛅, Cloudflare, Jim Grant, Ilya Sutskever, Rick Rubin, B. Pascal

The prepared remarks are what I call “The Good News Parade 🥳💇🏽💇🏽♀️💃🏽☀️🌈” YAWN!🥱

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

It is Very early days in cloud computing☁️⛅🌥️.

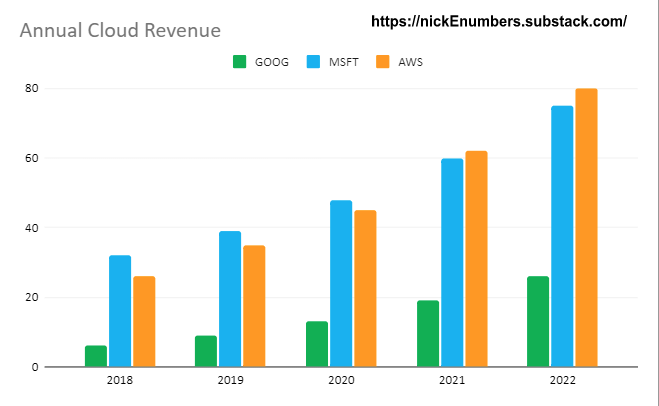

This past week many of us listened to Google, Microsoft and Amazon’s earnings calls and we paid special attention to their cloud computing business segments. How fast are they growing? How do they compare to each other? The 24 hour business media new cycle also discussed the results.

I am not going to repeat the same numbers or comparisons below.

Something that peaked my curiosity about cloud computing came from a comment that Amazon’s CEO, Andy Jassy made on the earnings call-

The new customer pipeline looks strong. The set of ongoing migrations of workloads to AWS is strong. The product innovation and delivery is rapid and compelling, and people sometimes forget that 90-plus percent of global IT spend is still on-premises. [..]

And so, if you believe that equation is going to flip, it’s mostly moving to the cloud. And I also think that there are a lot of folks that don’t realize the amount of consumption right now that’s going to happen and be spent in the cloud with the advent of large language models and generative AI. I think so many customer experiences are going to be reinvented and invented that haven’t existed before. And that’s all going to be spent in my opinion, on the cloud.⛅

Despite the fact that the combined (GCP+AZURE+AWS) annual spend is $~200B, 90% of global IT spend is still on-prem. 🤨🤔

For the moment, lets forget about how much market share each hyperscaler has. Instead I want to know: About how big is the overall market? How fast is it growing? How large could it be in ~2030?🤔

Several research reports offered growth paths that approximated each other. Some were apples to apples🍎, some were apples to oranges🍏🍊, and some were just fruit salad=🍇🍍🍈🍋🍎🤪. Below is the version I compromised on, and it offered a range of potential futures. (Note: this graph was published 1/2022, but I still think it is relevant). Pick the scenario path that makes sense to you and defend it with your thoughtful assumptions.

My takeaway is that something between $750B to $3T over the next 7 years is on the table. That would be a CAGR of about 30% per year over that time period at the top end.

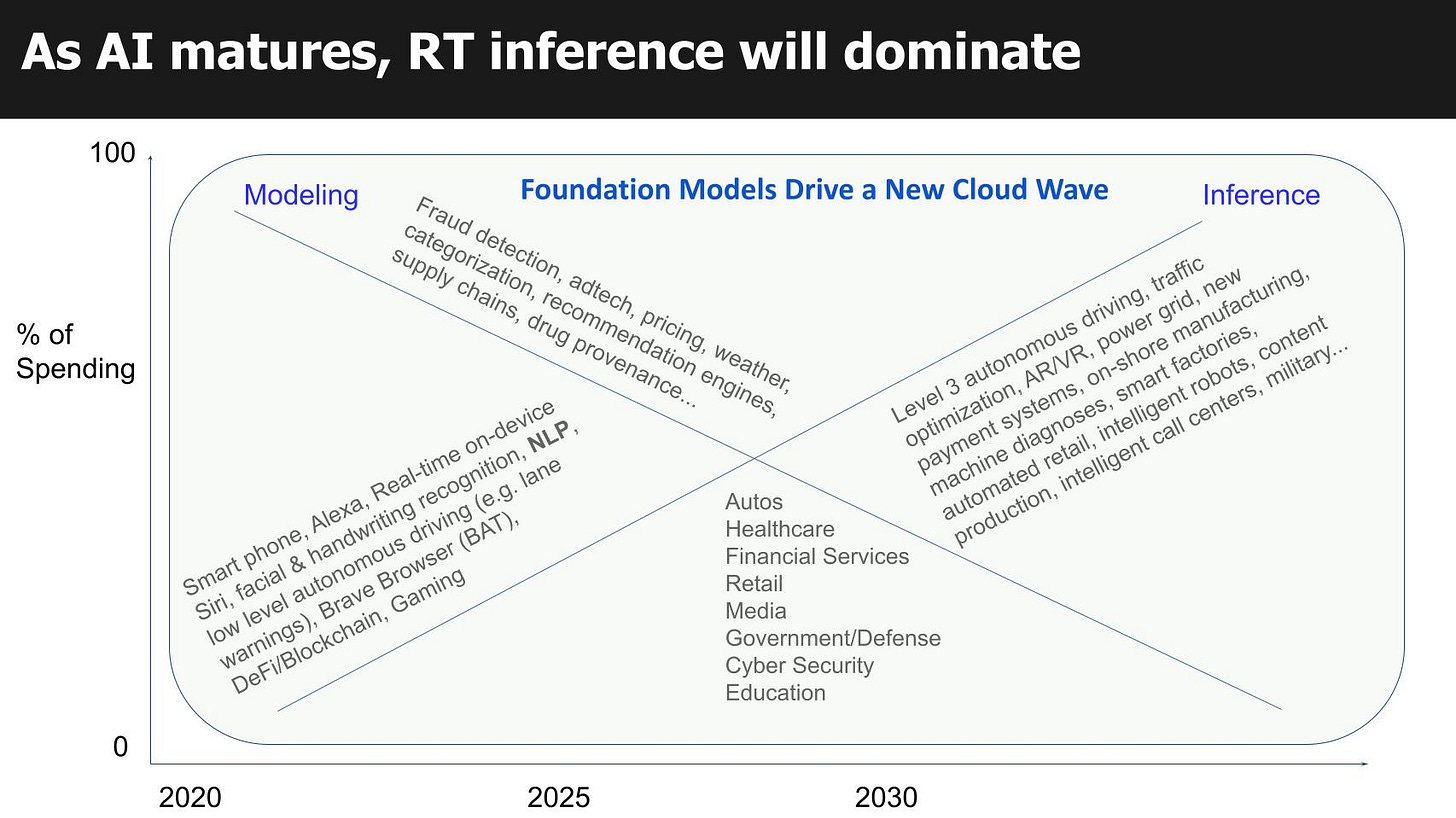

In addition to the early and ongoing migration of legacy use cases to the cloud, we are in very early innings for new use cases enabled by the cloud, all of which grow the need for additional cloud storage and compute. The visual below provides a fair summary (RT= Real time).

As we are often staring at GCP+AZURE+AWS, the 3 large planets in our solar system, lets remember to pause. Step back and look at the night sky🌌 and how large the galaxy of cloud enabled solutions might be. It is likely to be enormous and have room for many winners. GOOG 0.00%↑ , MSFT 0.00%↑ , AMZN 0.00%↑

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information session since my last edition that I reviewed-

Semiconductors- INTC 0.00%↑ , TXN 0.00%↑ , KLAC 0.00%↑ , NXPI 0.00%↑ , ON 0.00%↑ , QCOM 0.00%↑ , AMD 0.00%↑

Technology- GOOG 0.00%↑ , MSFT 0.00%↑ , AMZN 0.00%↑ , NET 0.00%↑ (below), META 0.00%↑ , SNAP 0.00%↑ [👎🏽🗑️🚽], FSLY 0.00%↑ , AAPL 0.00%↑

Housing & Banking - PHM 0.00%↑ , GRBK 0.00%↑ 🟢🧱

Others- $VISA , MC 0.00%↑ , UBER 0.00%↑ , VMC 0.00%↑ , MLM 0.00%↑ , $BRK

Being critical can be a good thing. NET 0.00%↑

Cloudflare CEO, Matthew Prince said-

[..] Digging in with Marc (new President of Revenue), we've identified more than 100 people on our sales team who have consistently missed expectations. Simply put, a significant percentage of our sales force has been repeatedly underperforming based on measurable performance targets and critical KPIs. That's obviously a problem.[..]

Matthew said more on this topic beyond this excerpt. He also received questions regarding it from the analysts on the Q&A. To hear the whole exchange listen to the call.

After the earnings call Cloudflare was down over 21%.

Some have said that Matthew should not have added this information to the call. They regard this to be an unforced error as this information could have been kept quiet while corrective action was being taken. The optics on an earnings call are bad and it creates drama for the finance community to worry about. The trope is that Wall Street needs clarity and situations need to be spun in order to seem under control at all times. Reminds me of famed investor Howard Marks quip- “Kids like Candy.” 👅🍭

I have to push back. I welcome and enjoy the bad news. When a CEO or CFO talks about bad news they are telling me the truth. Telling the truth speaks to their high integrity and I only want to own companies with high integrity leaders. We know these smart, high integrity leaders are certainly going to fix the bad news.

When listening to an earnings call, I often skip right past all the prepared remarks and go directly to the analyst Q&A. Why? Because the prepared remarks are what I call “The Good News Parade 🥳💇🏽💇🏽♀️💃🏽☀️🌈”. All sunshine and rainbows. YAWN!🥱 You readers have all worked for companies, it is not sunshine and rainbows all the time. It is often hard work and hard problems. And, if you are fortunate enough to have a good team, together you navigate and you overcome the problems.

Any CEO+CFO singing sunshine and rainbows on the earnings call makes me a little nervous and skeptical🤨. Matthew is delivering the Bad and Good news and that is how I know I can trust him.🤝

Podcasts

Grant’s Current Yield Podcast- Jim Grant is a media Ambassador for Investing. He is like your favorite brilliant professor/teacher that has high standards but is patiently willing to help you succeed. Jim has been writing a 2x monthly journal for ~40 years.

I will warn you, this podcast is for investing math fans, the mathletes 🧮. Topics- Convexity, Position Sizing, Duration Arbitrage and more. Jim’s special guest Harley S. Bassman. 34 Min 🎧- Non-Linear Returns

Duke William Green also conducted an excellent interview a couple of years ago with Jim Grant. No math, 😉, wonderful discussion. 1hr 54 Min🎧-Fear the FED

Videos

52 Minute video below. Jensen Huang, CEO of NVDA 0.00%↑ , interviews Ilya Sutskever co-founder and Chief Scientist of OpenAI. (ChatGPT, GPT4) Jensen takes a back seat in this interview (rare for Jensen), because Ilya is a one of a kind virtuoso in AI. Watch and see. 😉

In addition to his technical accomplishments, Ilya Sutskever is an engaging communicator who is helping to make AI more accessible to the public.

Books and Articles since my last edition

(Books are like loading software on your brain. I am usually reading 2 at a time, and if I get bored of a book I quit and move on.)

Orbital: Station Breaker II by Andrew Mayne Fiction, and sequel to Station Breaker. “Orbital is a fast-paced blend of space action and mystery thriller set in the fast-emerging aerospace age.” It is a fun read and a page turner.

The Creative Act: A Way of Being by Rick Rubin- I enjoyed it. I assumed that it was going to be a traditional book that perhaps followed Rick’s life, or maybe each chapter had a central focus about which Rick would tell stories. The book was none of those things. Rick was not trying to make this a mass market book. It is more a discrete series of thoughts, each of which is meaningful, with a central book theme, “the creative process”. I would read a few pages per day and set it down to think about what Rick was unpacking and describing. Rick reinforced a philosophy that I have discovered over the years- a mechanistic execution of a role/task [step 1, 2, 3] often is less ideal. Instead, we should permit and encourage a bit of artistry in the task to improve the outcome.😍

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

A Model of Investors as Ladies and Gentleman of Leisure👩🏽👨🏿🦰 (It has an elegant ring to it, right?)

Why is everyone so busy? Busy sounds productive.. “Don't confuse activity with results. There is no reason to do a good job with something you shouldn't do in the first place.”

About 13 years ago, Steve Forbes (SF) interviewed value investor Mohnish Pabrai (MP) on his process and progress. The full video link is here. Random fun fact I discovered about Mohnish-

If Charlie Munger can not make his regularly scheduled bridge game🃏♣️ in Los Angeles, Munger calls Mohnish to serve as Munger’s personal substitute.Back to the Steve Forbes interview. I heard it many years ago, and although I don’t remember much of the interview, I do remember this exchange below. Enjoy!

SF- What do you think you bring to value investing that others perhaps don't that give you a unique edge?

MP- I think the biggest edge would be attitude. So you know Charlie Munger likes to say that you don't make money when you buy stocks and you don't make money when you sell stocks you make money by waiting. So the biggest, the single biggest advantage a value investor has is not IQ, it's patience. Waiting, waiting for the right pitch and waiting for many years for the right pitch.

SF- What's that saying of Pascal that you like about just sitting in a room…

MP- Yeah, all (humanity)'s misery stem from his inability to sit in a room alone and do nothing. All I'd like to do to adapt Pascal is- all investment managers miseries stem from the inability to sit alone in a room and do nothing.

SF- So you don't feel the need to pick ten stocks a quarter or one stock a quarter? Just what turns up..

MP- You know actually I think that the way the investment business is set up, it's actually set up the wrong way. The correct way to set it up is to have gentlemen/(ladies) of leisure who go about their leisurely tasks and when the world is severely fearful, is when they put their leisurely tasks aside and go to work. That would be the ideal way to set up the investment business.

[The above has been lightly edited by me for emphasis and clarity.]

Pascal, referenced above, was more than just a fiercely fabulous mathematician.🙏🏿 Check out the 3 minute biography video of him below to get some inspiration 🪄.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

Wow those cloud growth numbers are bonkers! Glad I have invested in those companies although I still am not sure I know what cloud computing actually is!

Also happy you posted a link to your goodreads. I was trying to find you on the platform a few weeks ago so I could friend you but could not find. Just sent a request!

I really do like Mohnish Pabrai's ideal set up for the investment business. Focusing on leisurely tasks most of the time, and investing when the world is severely fearful is best way to see constant returns on investments. Versus actively investing which can possibly lead to greater risks.