6/20/23-Dr. Lisa Su, 1st Citizens🏦, 5 Forces, Storm⛈️Waves🌊

She eats “difficult” for breakfast. 🍴😋

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

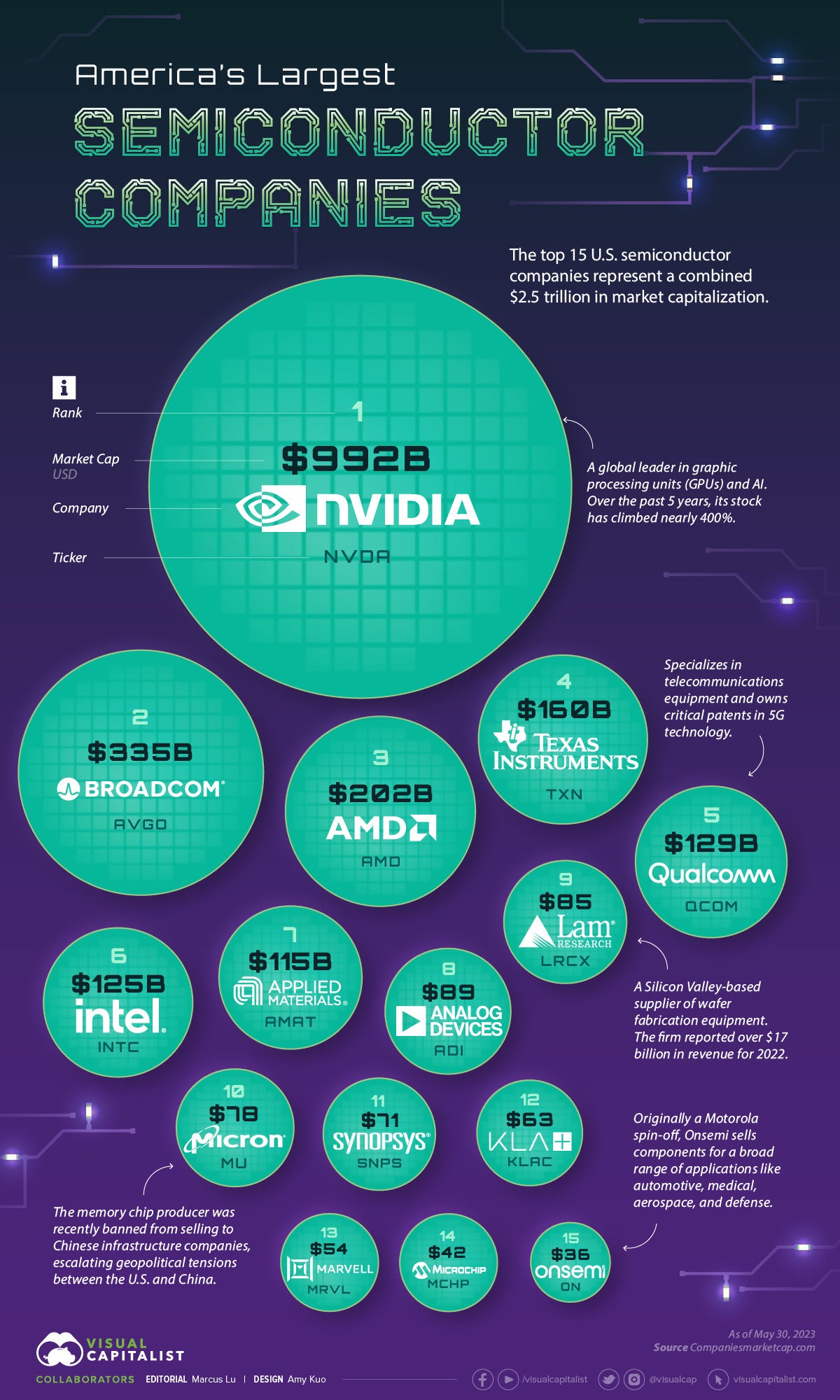

Dr. Lisa Su, CEO of AMD-

She is one of my favorite public company CEOs. Lisa is humble and down-to-earth, which may be why we don't know as much about her. However, if I owned 100% of AMD 0.00%↑ , Texas Instruments, or any number of other companies, I would choose her to be my CEO without hesitation.🪖🫡

Lisa Sue, Age 53, born in Taiwan and at age 3 immigrated to the USA (New York) with her brother and parents.

Education- Dr. Su has bachelor’s ~’90, master’s ‘91 and doctorate ‘94 degrees in electrical engineering ALL from the Massachusetts Institute of Technology (MIT).

When asked why she selected electrical engineering, she responded that it seemed like the most difficult (challenging) major. 🤘🏼 Lisa eats “difficult” for breakfast. 🍴😋

Career- ‘87 Intern Analog Devices, ‘94-99 Texas Instruments, ‘00-07 IBM, ‘07-11 Freescale Semiconductor, ‘12- (2023) present AMD.

Su has published more than 40 technical articles and was named a Fellow of the Institute of Electronics and Electrical Engineers (IEEE).

Personal Life- Su and her husband are based in Austin, Texas.

Her net worth is estimated to be north of $700M.

She uses Microsoft products at work and home.

Is she a 🎮 gamer? 😂🤣😂🤣 NO. 😐

When asked what phone she uses- Apple iPhone or Android……???

Answer → iPhone 📱

Quotes-

"Run toward the hardest problems. This approach has helped me to learn a tremendous amount from both success and failure.”

Lisa’s remarks at the 2023 CES perfectly describe her strategy- “AMD is pushing the envelope in high-performance and adaptive computing to help solve the world’s most important challenges.”

Below is a graph of the share price of AMD during Dr. Su’s tenure vs. the S&P.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information session since my last edition that I reviewed-

Technology- ORCL 0.00%↑ , ADBE 0.00%↑

Housing & Banking - LEN 0.00%↑ , BAC 0.00%↑ , WFC 0.00%↑

Others- KR 0.00%↑

Some of these companies I own, some are peers. Some of these provide decent economic indicators. In going through all of these companies there is a fair amount of Noise, but there is enough Signal to have value.📶

The title that Oracle has given to this slide below might be debatable, but the visual quality is excellent.

Podcasts

63 minutes, 🎧 Bill Nygren, Alex Fitch - First Citizens Bank: The Bank Buyers [Business Breakdowns] from Colossus.

Bill Nygren (Excellent Teacher) and Alex are partners at Oakmark Funds. They cover how banks work, the basics of investing in banks, why First Citizens [ $FIZN ]plays an important role in the banking system despite being relatively unknown, purchase of SVB, and how it is adapting its acquisition strategy to today's economic environment.

Bill describes 3 of the most significant risks that banks and most businesses encounter- 1. Credit Risk, 2. Liquidity Risk, 3. Duration Risk. They are all unique risks and have the potential to cause significant or even fatal harm. It would be like having tigers🐯 in your yard to protect you, but discovering they broke into your house, and are hungry😟🐅.

In addition to Bill’s 3 risks above, I want to provide you 3 more risks to think about as your bonus homework. Regulatory Risk, Macro Risk, and Counterparty Risk. If counterparty risk stumps you🤔, watch or read The Big Short by Michael Lewis.

Bill and Alex praise the fact that First Citizens has been under the control of the Holding family for about 100 years, 3 family generations. They point out several benefits of the long term focused decision making that has resulted. Although this might be the case with this firm and this instance, I think family control of a public company can become both a Feature⚙️ and a Bug🪲. It depends on the firm, the family and the passage of time.

Videos

12 Minute video. Holy Hypotenuse, Batman, this 10 year old kid is a math professor!

Young Prof. Soborno Isaac at about the 1m 40sec… Kid 👦🏾 + Math👨🏽🔬🧮 = 🤯

His enthusiasm while problem solving is contagious!👏🏽🥰

Books and Articles since my last edition

(Books are like loading software on your brain. I am usually reading 2 at a time, and if I get bored of a book I quit and move on.)

Understanding Michael Porter by Joan Magretta Business Strategy. Magretta provides a refresher on Porter’s Five Forces and applies them to current business examples.

A company should not attempt to be the “BEST” compared to its rivals as this results in commoditization. A company should instead attempt to be Unique and Differentiated.

Don’t be the next Home Depot or Chipotle. Be the first and only YOU.

Ingrid Bergman 👉🏽“Be yourself. The world worships the original.”

Revelation Space by Alastair Reynolds Science Fiction. Set in space around the year 2500.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

The Storm Waves of Investing

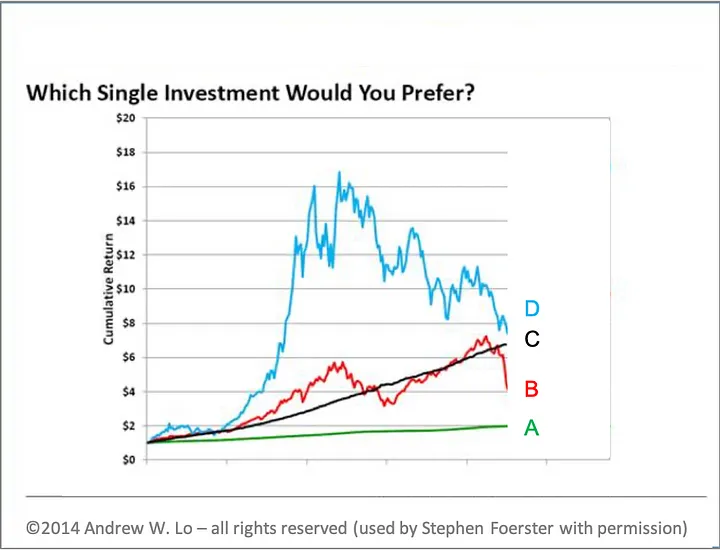

Please indulge me in a little investment lesson/thought experiment from which you might benefit. Do yourself a huge favor and don’t look too far ahead. In the graph below:

If YOU had to select one of the options- (A,B,C,D) to invest 50% or more of your retirement savings, which one would you select?

Think of an older person that you deeply care for, which option would they select to invest 50% or more of their retirement savings? (A,B,C,D)

If young parents wanted to invest for their child’s future/college? (A,B,C,D)

I suspect that many of us were drawn to choice C. Perhaps option C was your answer for ALL 3 scenario questions above.

Ask yourself why? Why was I drawn to option C? Look at the graph and think, think, Think. 🤔 You said you were drawn to option C because-

It is slow and steady, and it has currently earned the 2nd highest return.

And then you said, because option C doesn’t bounce around, it has little to no volatility. Yeah, it has almost no volatility and I like that.

You looked at option D and B and said, wow, they look like waves of crazy, rolling storm⛈️ waves🌊.

We don’t like volatility, we don’t like to lose, and we like when our investments are predictable.

Wait.

**Spoiler Alert**

🚨Spoiler Alert🚨

🚨Spoiler Alert🚨

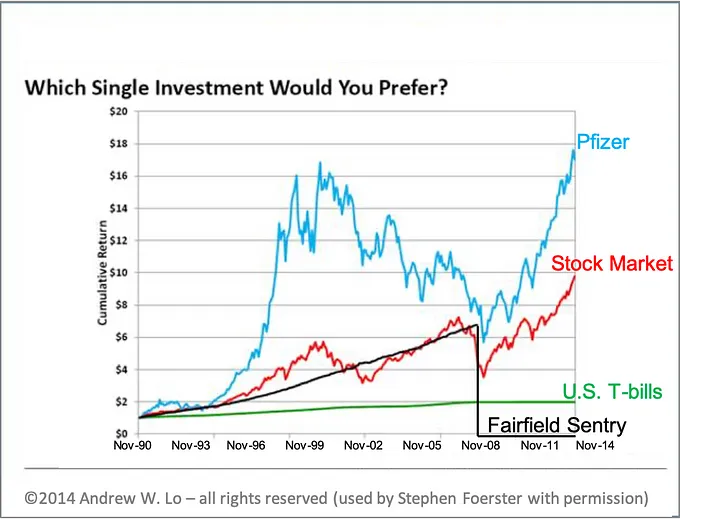

In the chart above Option C, the black line, was Fairfield Sentry. Fairfield Sentry mainly operated as the largest feeder fund into Bernard L. Madoff Investments Securities LLC (BMIS). On December 18, 2008, Sentry announced it was suspending the calculation of its Net Asset Value. It de-listed on May 28, 2009 and shortly afterwards, liquidators were appointed. Thousands of investors lost billions of dollars in one of the largest frauds in history, a fraud that lasted for at least 18 years. Prior to the blowup, Fairfield/Madoff was paying investors a predictable 10-12% per year.

Investment markets without volatility is like the ocean without rough seas. We can not control the ocean or the size of the waves at any given time, we just have to accept it and learn to live with it. And so it is with the markets.

If you are offered a relatively large return in an opaque investment wrapper with low volatility, think back to Madoff’s fraud and commit yourself to performing valuable due diligence. (Listed security, private security, real estate, etc, it doesn’t matter. Do your own homework.) From time to time the waves of volatility are going to slam into your boat during your long term journey in the oceans of investing.

You folks are all big girls and boys so I am going to give it to you straight- When you set out on the ocean, like it or not, YOU SIGNED UP FOR ROUGH SEAS.🌊 Learn to like it.

[If you would like to learn more about the Madoff Ponzi fraud, Netflix has an excellent 4-part mini series I wrote about in my January ‘23 Last Half post, here.]

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

I loved the two charts thing! But I picked D anyway before seeing chart 2 you know why? Because I like MONEY!

I really like the thought experiment you did at the end of the post. I was easily drawn to picking the Madoff line for a retirement savings, similarly to all the investors who did the same back in the 90s and early 2000s.