7/2/24- Buffett's OXY🤔,Julie Greenwald🎶🎧,Enterprise Software,🐰🍲

The first step in Rabbit Stew is... you gotta catch a rabbit🐇.

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Buffett Continues to Buy Occidental Petroleum, OXY 0.00%↑ -

I love the teaching of Monish Pabrai on shamelessly cloning the positions of other super investors. What are successful large investors buying and selling.🤔 It is all public information. We don’t get extra points for reinventing the investment wheel. I add to performance when I make investment decisions that are RIGHT, regardless of where we find them or from whom we clone them.

After that preamble, I want to talk about Occidental Petroleum, OXY. Buffett’s Berkshire Hathaway keeps buying OXY more and more, week after week. The most recent purchase was mid June ‘24. BRK currently owns more than 28% of OXY. For the last 2 years the stock price has basically gone nowhere. And BRK keeps buying. We could buy OXY for about the same price today as BRK has been buying for the last 2 years (high 50s - low 60s). We can jump on Buffett’s coattails (Clone) as he continues to buy. But should we?

Like a good amateur journalist, I assigned myself the story of understanding if OXY is an obvious good investment prospect. (Almost like going down a rabbit🐰 hole on a hunt😏.) However, I am not an experienced investor in oil and gas or energy markets. I have a filter time funnel on new prospects of spending 10 minutes, then maybe 1 hour, then maybe 3 hours. Most new prospects get discarded after 10 minutes.

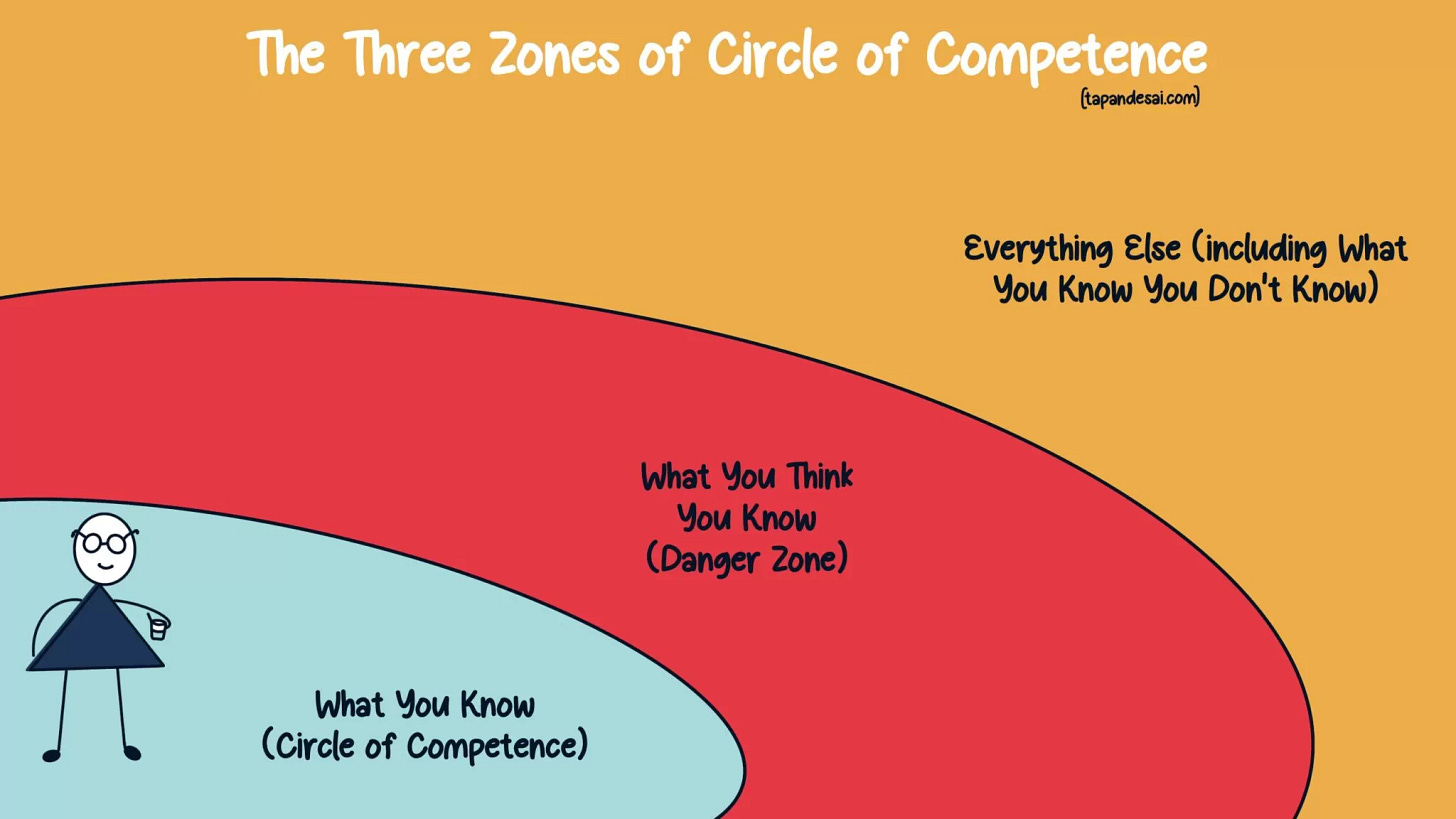

How did OXY progress through my funnel? Before I answer, let me provide a little background. I was a CFO/CPA with several decades of experience running businesses and consuming financial information. Intimate knowledge of- semiconductors, cloud/SaaS, banking/lending, housing, mining, building materials, heavy construction. No clue about- biotech, pharma, energy, utility, retail, luxury, auto, commodities, and many more. The size of my ignorance is truly MASSIVE. 😂

I spent about an hour on the OXY financials and they are like riding a roller coaster 🎢🤢. There is a lot to like, but I would characterize the P and L as cyclical. OXY showed a GAAP Net Loss 4 times in the last 10 years. I don’t want to bore you with additional details. HARD PASS.

You might be like, “Nick, you were only getting started. Did you quit too soon?” I don’t know anything about oil and gas, and the financials have hair💈🪮 all over them. I would have to be very curious about this company at this point to want to invest many more hours to learn the company, unit economics, the competitors and the industry. But, none of that is going to change the hairy financials. Given my short explanation, I am going to put this one in the “too hard for me pile.” Recall that I already have 10-15 excellent investments that I follow and already have high conviction in. I am implicitly comparing OXY to the other 10 positions.

If you know a lot about OXY and/or the oil and gas industry, this might be right down your alley. Clone, Coattail Buffett. Go for it! I freely give the idea to you to explore. Buffett clearly knows a lot about this and he is actively putting skin in the game on OXY.

The great writer and rapper Goethe said “What we do not understand, we do not possess.” I know a little bit about a few things, but I do not understand OXY, oil and gas, oil production. And that is totally fine.🙏 Munger diplomatically coaches us- “We don’t have to understand and have an opinion on every damn thing.” At this point, I am not going to spend time to bring OXY into my Circle of Competence.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

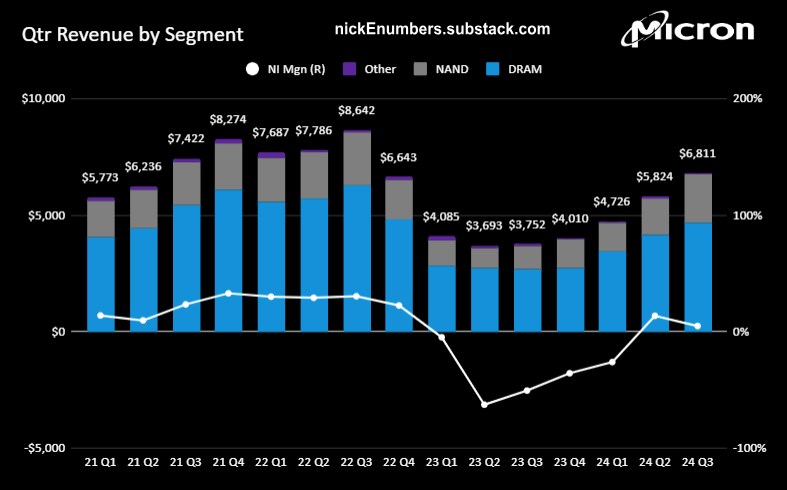

Technology- MU 0.00%↑

Others- KMX 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.)

The sites of nuclear tests. Courtesy- The New York Times

Does TV feel like you are paying MORE for less? You are RIGHT😡!

Podcasts

Julie Greenwald, CEO of Atlantic Records 1.45 hr 🎧on Rick Rubin’s podcast, Tetragrammaton. Julie is a self made success from NYC. She talks about the business of music past and present. It is excellent, link here. Artists mentioned- Bruno Mars, Cardi B, Ed Sheeran, Lil Uzi Vert, Jack Harlow, Lizzo, 21 Pilots, Billie Eilish, Fall Out Boy, Warren G.

“I always say to an artist- I need you to love the road/touring, I want you to love the road🛣️. If you don’t like touring, I don’t know how we can be super successful together.”

[If you like the business of music and sport, in my 10/2023 post, I wrote about an interview of 🎧Rich Paul — The Power Broker and Superstar Agent Behind LeBron James🏀, Draymond Green, and Others. Link here]

Videos

53 Minute, How to Buy/Sell Enterprise Software in an Hour. After about 30 seconds you will see why I am recommending Mr. Hood below. He is a master with decades of deep experience.

Sell- CIO/CFOs don’t want to buy your software, they have enough problems. So, what do CIO/CFO want from a solution provider??

Buy- CIO/CFO, easy solution is not an option. Easy is a lie. The only solution providers worth talking to are the ones who say their solution is going to be difficult, complicated, time consuming, and worth it.

(Bonus- Hood likes to teach while he walks through nature.) Buying or Selling- CRM 0.00%↑ SNOW 0.00%↑ MDB 0.00%↑ NET 0.00%↑ CRWD 0.00%↑ DDOG 0.00%↑ CFLT 0.00%↑ ORCL 0.00%↑ MSFT 0.00%↑

Books and Articles since my last edition

(Books are like loading software on your brain. If I get bored of a book I quit and move on.)

When We Cease to Understand the World by Benjamín Labatut This was a recommendation of Demis Hassabis CEO of Google DeepMind. A fictional examination of the lives of real-life scientists and thinkers whose discoveries resulted in moral consequences beyond their imagining. Fritz Haber, Alexander Grothendieck, Werner Heisenberg, Erwin Schrödinger

Irrational Exuberance by Robert J. Shiller Economics, Finance. It is a classic if you work in trading markets.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Why research new/unfamiliar companies? (Think OXY, top of post☝️)

Rather than me bore you with business and finance, lets frame this topic in some hard won common sense.

The first step in Rabbit Stew is... you gotta catch a rabbit🐇.

Else it is all water and veggies😔.

Investments that earn above average returns over time require you look👀 for them, do your homework, and find the rabbit.

The market average, like the S and P 500 is veggie soup. Above average returns don’t just jump into your cooking pot. (Put your math thinking cap🎓👒 on here, indexes are the average.)

Looking for value adding rabbits- If we endeavor to learn something new each day and go to bed a little smarter then when we woke up, we are in a good state of mind to find high performing companies. New rabbits are hard to find but not impossible. The 10-15 companies that we own might get disrupted, destroyed and transformed into veggie soup.

The rewards for finding above average returns is the ability to compound your investments much more quickly. I don’t know about you, but I will be up early tomorrow looking for Value Adding Rabbits for my Rabbit Stew!

[Below- At 10% you double your money every 7 years. 2x, 4x, 8x, 16x, 32x, 64x..]

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

“add to performance when I make investment decisions that are RIGHT, regardless of where we find them or from whom we clone them.” Thanks for the reminder! There are no bonus points for originality when it comes to investing.