7/3/23🫡- Mandelbrot📊,Snowflake🌨️,Outlive📘,Tom Cowan🎧

Greater knowledge of danger💀 permits greater safety.🦺⛑️

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

A few of Benoît Mandelbrot’s observations on trading markets🤩. Mandelbrot, Polish-born French-American mathematician and polymath. Here is Benoît on financial models-

"Most financial models say little with much.🤣 They input endless data, require many parameters, take long calculation. When they fail, by losing money, they are seldom thrown away as a bad start. Rather, they are 'fixed'. They are amended, qualified, particularized, expanded and complicated. Bit by bit, from a bad seed a big but sickly tree is built, with glue, nails, screws and scaffolding. That people still lose money on these models should come as no great surprise."

That description above reminds me of this cartoon below on the precarious “Modern Digital Infrastructure” by XKCD.

Dr. Mandelbrot continues:

“The risk-reducing formulas behind portfolio theory rely on a number of demanding and ultimately unfounded premises.

First, they suggest that price changes are statistically independent from one another…

The second assumption is that price changes are distributed in a pattern that conforms to a standard bell curve.

Do financial data neatly conform to such assumptions? Of course, they never do.”

I want to put a sharper point on Mandelbrot’s lesson here-

Finance, EMT, and academia assume that prices are continuous like calculus- 1,2,3,4, etc. [They are not….. always.]

Market prices jump and leap- 52, 56, 62, 72. [….sometimes.]

Participant emotions like fear😨, panic😱, and euphoria😃 influence the market/security.

And, power laws can be at play.⬆️ 1,5, 15 or ⬇️100, 95, 75, 45 [calls to mind momentum investing and perhaps meme stocks.]

The assumption of continuous math is not absolute and old investors will warn us that from time to time continuous incremental math is a joke [Limit down]

Here are some real world investing examples-

If you are using stored automated orders [triggers, limit order types] in your investing account, big price jumps up or down can harm your outcome.

There is a start and end to a trading day, and there is no rule that the opening price has to be the same as or close to the prior day’s closing price. Think of earnings announcements after the close, or news events in afterhours.

Recall Market/Security circuit breakers💥for significant large price moves and a potential opening price after the pause interval that is a Limit up or down movement.

Finally, don’t get me started on the Option Markets reactions to all of the above. Think of the normal price movement of the underlying security and potentially square it⏹️ or multiply it by 10 for an option.

Benoît offers us a path through these investing perils-

“Greater knowledge of danger permits greater safety. For centuries, shipbuilders have put care into the design of their hulls and sails. They know that, in most cases, the sea is moderate. But they also know that typhoons arise and hurricanes happen. They design not just for the 95% of sailing days when the weather is clement/mild, but also for the other 5%, when storms blow and their skill is tested.”

If you would like to learn more about Dr. Benoît Mandelbrot, his book is below. It is not a “page turner”, but it was worth it for me. I also found a nice timeline graphic of Benoît’s life. I didn’t even scratch the surface of his amazing contributions and accomplishments to our world. Find the graphic below.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- Snowflake Summit Conference SNOW 0.00%↑ , MU 0.00%↑

Housing & Banking - KBH 0.00%↑

Others- FDX 0.00%↑ , KMX 0.00%↑

A couple interesting slides below from the Snowflake Summit and Investor Day.

One of the takeaways from the slide below that SNOW called out was that they are taking share from competitor Databricks (part of Spark #1/2)

Cool illustration below from

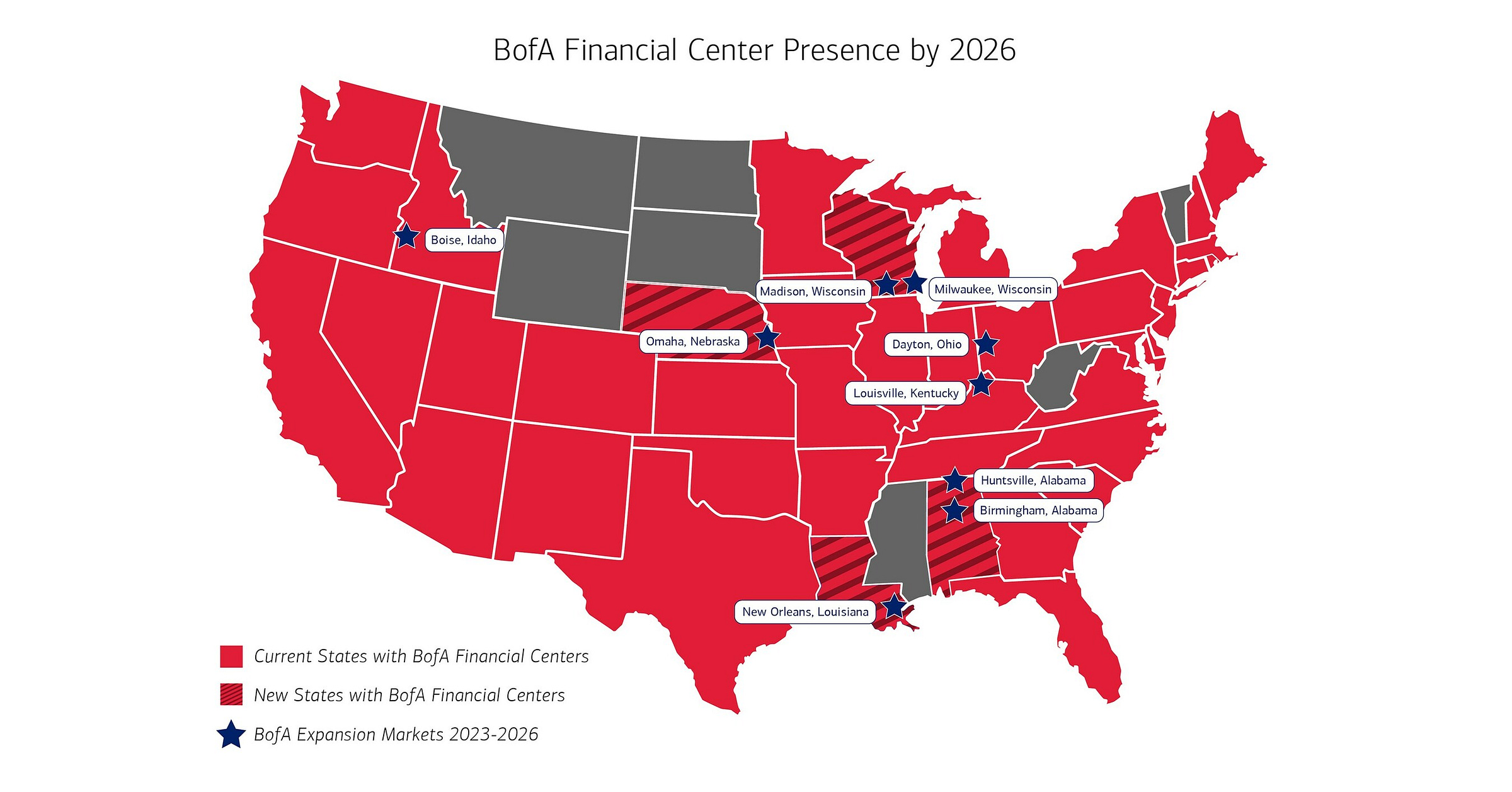

of AI Computer Chip design. 💻 The number of combinations Chess < GO < CHIP 🙏🏽Expansion plans for Bank of America to reach more Americans 🫡. BAC 0.00%↑

Podcasts

Tom Cowan of TDM Growth Partners, is unique. Long term oriented, closed to new money🤯😁, focused on compounding. It is a great interview by Ben and David from Acquired (ACQ2).

I don’t want to try to summarize the interview too much as I think you should just listen to the whole thing. It was excellent!

🎧Comparing the Dotcom Crash to Today (with Tom Cowan from TDM)

Videos

IBM- Big Brains. Small Films. Benoît Mandelbrot, The Father of Fractals, 4.3 min

Mandelbrot’s work is used in- Weather Prediction⛈️, Design and Special Effects, Antennas📡📶, Camouflage, Solar Power🌇, Medicine👩🏽⚕️

🤩🙏🏽🙏🏽

Books and Articles since my last edition

(Books are like loading software on your brain. I am usually reading 2 at a time, and if I get bored of a book I quit and move on.)

Outlive: The Science and Art of Longevity By Peter Attia Health/Nonfiction. Published 3/2023, SUNDAY TIMES AND NEW YORK TIMES BESTSELLER. Food, Preventative Care, Medicine, Exercise, Sleep, Mental Health. 👏🏽👏🏼

I hold investor Bill Ackman in high esteem🤩. On 4/1/23 Bill Ackman said-

There are a few times in life when you read a new book and realize that your life will be transformed if you follow its teachings. PeterAttia MD’s Outlive is such a book. It can save, or at a minimum massively improve, your life. I can’t imagine a better investment for 28 bucks.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

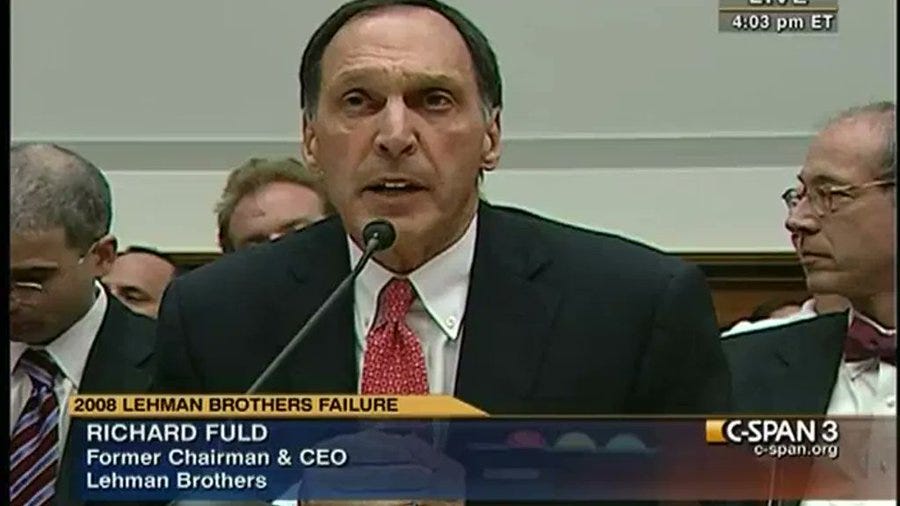

Richard S. Fuld Jr. (born 1946), Former Chairman & CEO of Lehman brothers. Fuld worked for Lehman nearly 40 years, slowly working his way up from the bottom.

Fuld told the story about how when he was younger he sat at a blackjack table🃏 and watched a gambler in Las Vegas🏜️ lose $4.5 million, doubling every lost bet in hopes his luck would change. Fuld took notes on a cocktail napkin, recording the lesson:

“I don’t care who you are. You don’t have enough capital.”

Fuld received nearly half a billion dollars in total compensation from 1993 to 2007. In 2007, he was paid a total of $22M, which included a base salary of $750K, a cash bonus of $4.250M, and stock grants of ~$17M.

According to Bloomberg Businessweek, Fuld "famously demanded loyalty of everyone around him and demonstrated his own by keeping much of his wealth tied up in the firm", even buying Lehman shares on margin.

Lehman Brothers filed for Chapter 11 bankruptcy protection on Monday, September 15, 2008. ⌛ Richard S. Fuld, Jr.-

When I find a short-seller, I want to tear his heart out and eat it before his eyes while he is still alive.

😳👀

If you are interested in learning more, I believe the book Too Big to Fail by Andrew Ross Sorkin is a good resource.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

It is crazy that Richard Fuld (and many of the culprits of the 2008 financial crisis) did not own up to any wrongdoing, instead blaming a "perfect storm" in the markets. I find it even crazier that he is the CEO of another company today!