8/13/24-Buffett's Cash👎🏽,Munger on Busts💥, Grants🎧CRE Meltdown

Buffett is 50-90% retired. With all respect to the master Buffett, it is hard to allocate cash if you are napping.😴

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Berkshire Hathaway has WAY (WAYYYyyy) too much Cash.

Just to caution you up front, unlike almost everyone else, I think BRK has too much cash! It is not cool, or exciting or shrewd strategy. It is just a straight up disappointing problem.

Here are a couple of statistics to put dimensions around BRK-

Market value is $900B vs. cash of $277B (30% of the company is in cash)

I know that Buffett wants to keep a certain amount of cash due to the insurance business, and I have heard ~$80B is a good approximate. But that leaves ~$200B extra.

Largest acquisitions of all time were $34B for BNSF Railway🚂 and $37B for Precision Castparts Corporation⚙️. Excess cash could absorb 5 of these large acquisitions simultaneously.

Stock price PE is ~13, and this is an effective earnings yield of 7.7%.

$234B in short term US Treasuries earning ~5-5.4%

Some extra cash equips an investor with optionality, but there is a limit. Cash held beyond the limit is Nonsense Cash. Why? This “option cash” comes at a real opportunity cost.

Imagine you squirreled away $100K in cold hard American cash in your home office. That is a lot of green dollars. Now, imagine instead you had a pallet of cash stored in every room of your house. Does more cash make it better? NO. More cash becomes a serious problem.

We know BRK’s cash is not physical cash, but the imagination exercise works regardless. What to do with all this cash.

Who is making the decision at BRK where and how to invest all this cash? Buffett is, right? NO, the graph at the top would suggest that he is not successful at allocating his extra cash. Plus Buffett is 50-90% retired. With all respect to the master Buffett, it is hard to allocate cash if you are napping😴. So then Greg, Todd, and Ted are allocating the cash. No. I don’t think papa Buffett gives them free and full authority.

Okay Nick, so what do you do with all that cash? Your options are: Invest it into the businesses that you already own to maintain and grow, Invest in significantly more non-control equity and debt positions, acquire whole companies, buy back stock (currently paying a higher return that the US Treasuries), or pay a very large dividend.

[In my 12/13/2022 post I wrote about the 5 Uses of Excess Cash for a business and how to prioritize the allocation, the link is here.]

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

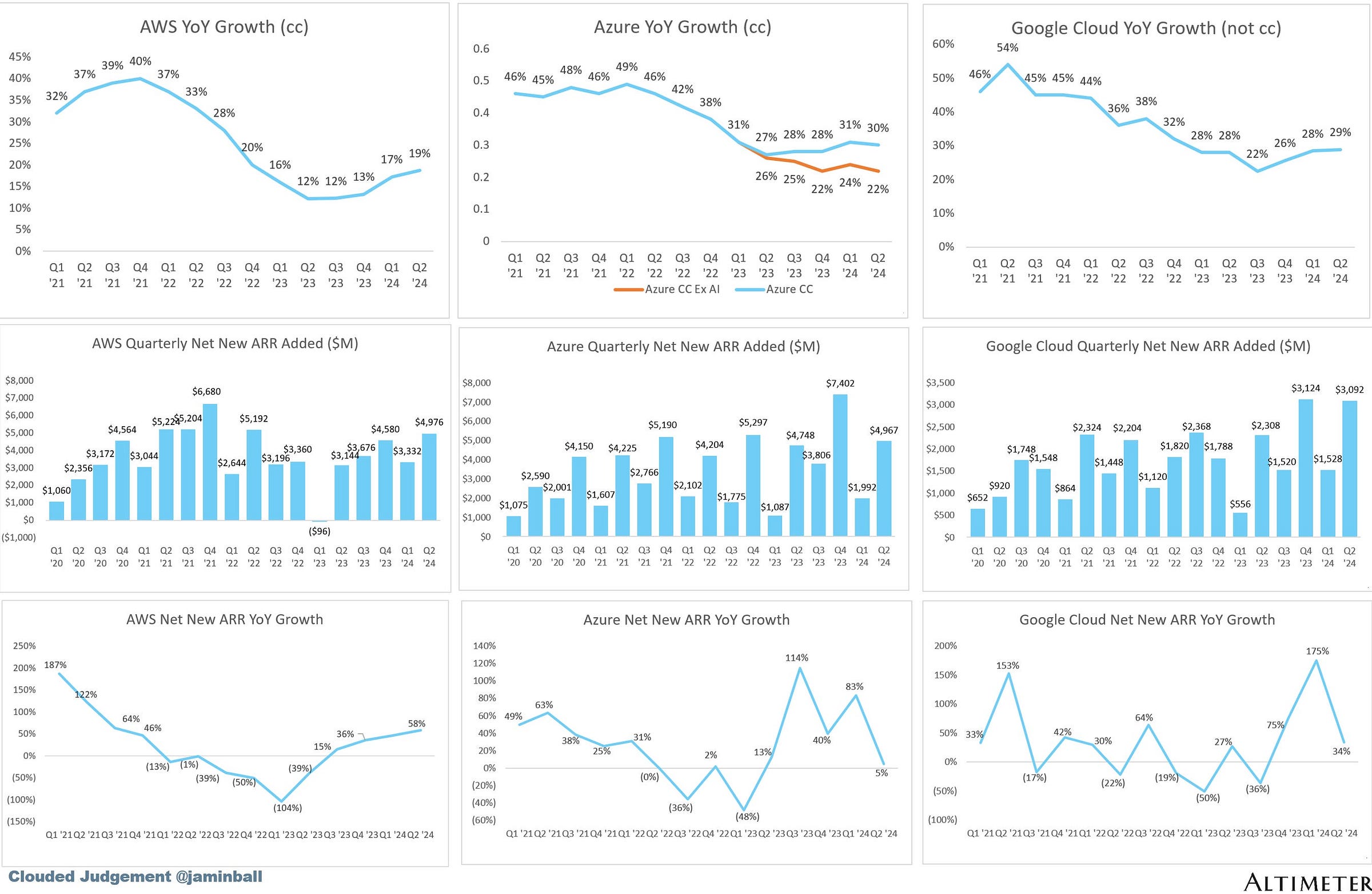

Technology- META 0.00%↑ , MSFT 0.00%↑ , AMZN 0.00%↑ NET 0.00%↑ , AKAM 0.00%↑ , CFLT 0.00%↑ , AAPL 0.00%↑ , INTC 0.00%↑

Housing / Banking - GRBK 0.00%↑ , EXP 0.00%↑ , VMC 0.00%↑ , SUM 0.00%↑ , MLM 0.00%↑

Others- $BRK.B , DIS 0.00%↑ , UBER 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.)

Click on any of the graphs below to enlarge them.

Podcasts

Grants Podcast, The Next Meltdown (Commercial Real Estate)

Excellent discussion with a thoughtful experienced investor, Richard Byrne. Richard talking about the significant struggle and concessions that commercial OFFICE landlords have to retain or find new tenants-

..if you don’t do it then your building might end up empty. And once a building gets more than 50% empty… we see where it’s fate lies. It is generally not a good answer.🧟♀️🧟☠️💀

Videos

10 Minute video, Beautiful engineering behind the Sydney Harbor Bridge. The physics behind the arch bridges is logical and the video’s use of computer graphics to visualize and explain is outstanding.

Books and Articles since my last edition

(Reading Great books is like a conversation with the finest minds of the past.- Descartes. If I get bored of a book I quit and move on.)

The Coming Wave: Technology, Power, and the Twenty-first Century's Greatest Dilemma by Mustafa Suleyman Nonfiction, Technology. Cofounder of DeepMind with Demis Hassabis

Dogs of War #2 Bear Head by Adrian Tchaikovsky Science Fiction

One Second After by William R. Forstchen Fiction. A story in which our hero struggles to save his family and his small North Carolina town after America loses a war, in one second based on an Electro Magnetic Pulse (EMP), sending America back to the Dark Ages. Great book ⭐.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Charlie Munger at the 2016 Daily Journal Annual Meeting.

Munger certainly doesn’t need me to salt🧂 his cooking, so I won’t even try. His thoughts are almost always packed with wisdom. Lets let Charlie speak for himself.

Which is worse, an economic Boom or Bust?

…and you would say what difference does it make? Well what happens is as this sickness with gambling in securities and other aspects goes on what happens is the big busts hurt us🤕🩼 MORE than the big booms help us.

We saw that when the great depression ended and the rise of Adolf Hitler. A lot of people think that Hitler rose because of the great Weimar inflation. But you know Germany recovered pretty well from the Weimar inflation. What they did is they destroyed the currency, and they just issued a new currency. It's rather interesting. They said all the people that got rid of their old mortgages and the inflation, they will put the mortgages back and they will back our new Reichsmark. And that, that worked pretty well, just like it works fairly well in Argentina or some places. Italy for that matter.

What really enabled Hitler to rise was the great depression. You put on top of the Weimar inflation the great depression and people were just so demoralized that they were subject to being snookered by a guttersnipe😈 like Adolf Hitler. So, I think this stuff is deadly serious and that these crazy booms should be nipped in the bud.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

.”With all respect to the master Buffett, it is hard to allocate cash if you are napping😴.”.

Appreciate the sci-fi rec's. Will read.