8/29/23- Brutal👊Retail, Snowflake❄️, Meta🎧, Bluetooth🪄, References🧾

"First we check and then we Double check. After we Double check, we Triple check."

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Consumer Retail is Brutal

In the past few weeks some of the public department stores have released their quarterly earnings. Walmart, Target, Kohls. They always get me thinking..🤔🤔

I grew up shopping at department stores, probably like many of you. (I am in the Gen X age cohort.) Below is a short list of some of the department stores from my memory in northern Virginia up to the present. I suspect that you will know many of these.

What observations can we make from this small sample list above?

Old age has led to the death of many. Upper life span of ~120 years. (👀 Yes, I am looking at you, Target.😬)

Some of the older names are in bankruptcy, likely leading to death.

I know the one data point of Circuit City doesn’t make a trend, but I suspect it has become more difficult to be a big box electronic retailer competing against the department stores (+ AMZN) that also have an electronics department.

Target, Kohl's, and Best Buy's Moody credit ratings suggest that my intuition is correct - these three retailers are not performing as well as others.

Darwin survival of the fittest-

Birth👶, growth, decline, death☠️.

Add a little adaption and fresh capital💰

→ Rinse and repeat♻️.

Why does this keep happening to established recognizable companies? Too much growth, lack of innovation, bureaucracy, disinterested future management, lack of customer obsession.

Have you discovered that a store in your area went out of business and you said “Of course it did. I knew that was going to happen.” I also am an armchair retail merchandiser.😏 Here is my short list of when I throw the warning flag🚩 on a retail department store-

Crowded/disorganized isles for what ever reason. The store was neat and tidy and now it is hard to walk through because of stuff in the customers way. Do I feel claustrophobic?

Dirty shelves, floors and corners.

Dirty and/or in need of repair bathrooms.

Darkness because ceiling lights are out.

Products are out of stock. The shelves are often missing the product that I am looking for.

The checkout experience should be fast and easy. Make it easy for us to hand you our money🫴💵. Frustrating the customer at checkout is troublingly counterproductive.

What indicators are signs to you that a store is going out of business? [Leave feedback in the comments below.]

At present I think Amazon, Walmart and Costco are differentiated enough from one another to be able to carve out a unique spot in the minds of mass market consumers. Most markets are competitive, but retail consumer markets are brutal.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- CSCO, AMAT, ADI, SNOW, NVDA

Housing & Banking - HD, LOW, TOL, AFRM

Others- WMT, M

SNOW 0.00%↑ - One of their networks is data sharing. As they are growing large customers, large customers are sharing more and more with one another.

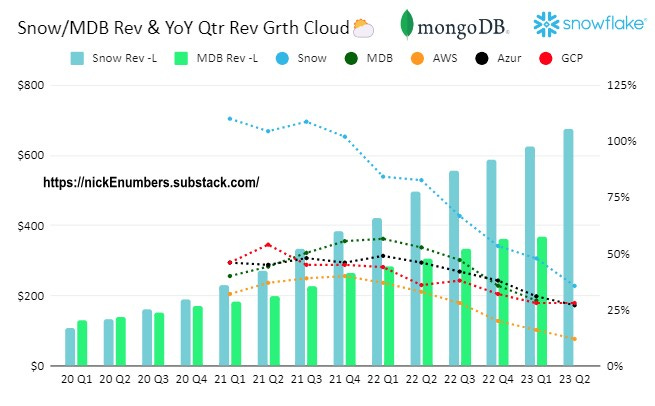

SNOW/MDB/AWS/AZURE/GCP- Revenue growth is slowing, as the law of large numbers would predict. But the bar chart of revenue is getting larger and larger (land grab.)

NVDA 0.00%↑ - Just wow!

Revenue Growth for some of the cyber security players. 🤫- SentinelOne is rumored to be in trouble (after only 2 years as a public company) and looking to be taken private.

Podcasts

Friend and brilliant curatorLiberty’s Highlights hosted an excellent conversation with a fellow investor MBI Deep Diveson Meta. MBI has deep knowledge and thoughtful opinion. The magnificent 7 (Big Tech) also drift in and out of the conversation. META 0.00%↑

Time and again, Zuckerberg has shown his ability to take pain, his capacity to suffer. It's almost unmatched in all the Big Tech land because none of the Big Tech is currently run by founders anymore. Shareholders are going to come after you even if they don't have much of a say because of the size of these Big Tech companies. But I would say it's still like Zuckerberg's capacity to suffer is probably under appreciated.

Videos

20 Minute video. Branch Education has mastered the use of computer graphics in order to explain the ultra complicated. This is just an amazing explainer. The underlying technology is even more amazing, magic even. 🔮🪄

Books and Articles since my last edition

(Books are like loading software on your brain. If I get bored of a book I quit and move on.)

Illuminae by Amie Kaufman and Jay Kristoff Science Fiction. 5 ⭐ Book 1 of a 4 book series.

Defy the Stars by Claudia Gray Science Fiction. Excellent.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Invest the time to Check References

In addition to stock investing, my wife and I have owned a variety of real estate over the years. Most of the time, we managed it ourselves in order to keep the costs down. We advertised, screened and interviewed many prospective tenants. I was trained early in my career in public accounting and later making hiring decisions for companies to always check references. Why ask for them if you are not going to check them?

Why does all this matter? Answer- you are entering into a longer term relationship with that person, set of people, or in financial terms “counterparty.” Renting to a commercial/residential tenant or hiring an employee is not like taking an Uber ride for 20 minutes or getting a haircut at your barber shop. You are essentially entering into a long term contract relationship with that person and tying parts and pieces of your life to one another. Committing to a rental agreement with a tenant is a vote FOR that person. Hiring a new employee is a vote FOR that person.

Why don’t people check references? I suspect that the biggest reason is that they think they can trust their gut. They had a great conversation with the person and they think they can save a bit of time by not calling the references. (Read the book- Thinking Fast and Slow) Corner cutting can be costly. In instances like this, I take my lead from the US Military Officer🫡 who said-

I'm from the Army, first we check and then we Double check. After we Double check, we Triple check.

We heard horror stories from other real estate investors who often failed to check references. For us, more than 50% of the time, the reference checks were clean, helpful and positive. Sometimes the reference told us “something nuanced” about a prospect. Hey, stuff happens. I get it. And, sometimes the references were just false, fake or fraud. For example-

Monthly income isn’t even close to the source documents (bank statements, etc.)

Phone number provided for a work or personal reference-

doesn’t work, nonfunctional phone number

says that the person doesn’t work at the firm

goes to a mobile phone number supposing to represent the HR function of a recognizable corporation name

a family member of the prospect answers and offers to confirm any facts.

ask open ended questions and then be quiet🤐 and listen👂. If you are talking excessively, you are not learning much.

As we all know, checking something off our list, doing a deal, can feel exciting and even fun. But, getting out of a bad deal, or discovering that you don’t like your counterparty, well that is just a mess! These principles carry over to any type of investing you are doing. Do your due diligence and check the references.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

Haha your list of warning signs describes every location of every chain store in NYC!

Glad you liked the pod, thanks for listening! 💚 🥃