9/12/23- Student Loan Pmts😬, Ackman🎧, Broadcom, Stephanie Pomboy📺, Future IPOs?

In order to make money in investing we must avoid losing money. (Not trivial.)

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Student Loan Debt Repayment Will Further Slow the Economy-

Student loan debt payment expectations have restarted as of 9/1/23 with a theoretical payment due 10/1/23 for many Americans. I know that there are some programs out there to modify and extend this payment restart. And we know that some students are unable or unwilling to pay. But, lets dive into some of the statistics around student debt so that we have a baseline. As you read this, consider what Americans will forgo in order to make their student loan payments. (Credit Card Debt Pmts, Travel, Entertainment, Dining Out, Car Loans, Gambling, etc 🤔)

Loan payments for many students stopped around 3/2020 (3.5 years ago)

As of March 2023, student loan borrowers in the United States owe a collective $1.78 trillion in federal and private student loan debt. It is growing at a rate of about 3.3% per year.

The terms of a student loan is 10 to 25 year repayment time period, and the average term is 20 years.

The median student loan debt balance is $20-25K, and the average balance is $33K.

The chart below illustrates that about 1/3 of Americans 18-29 years old currently have a student loan. 1 in 3. Total of 43.5M people. This chart is from 2018, but I approximated it on my own for 2022/2023 data also. (Very important fact #1, to me.)

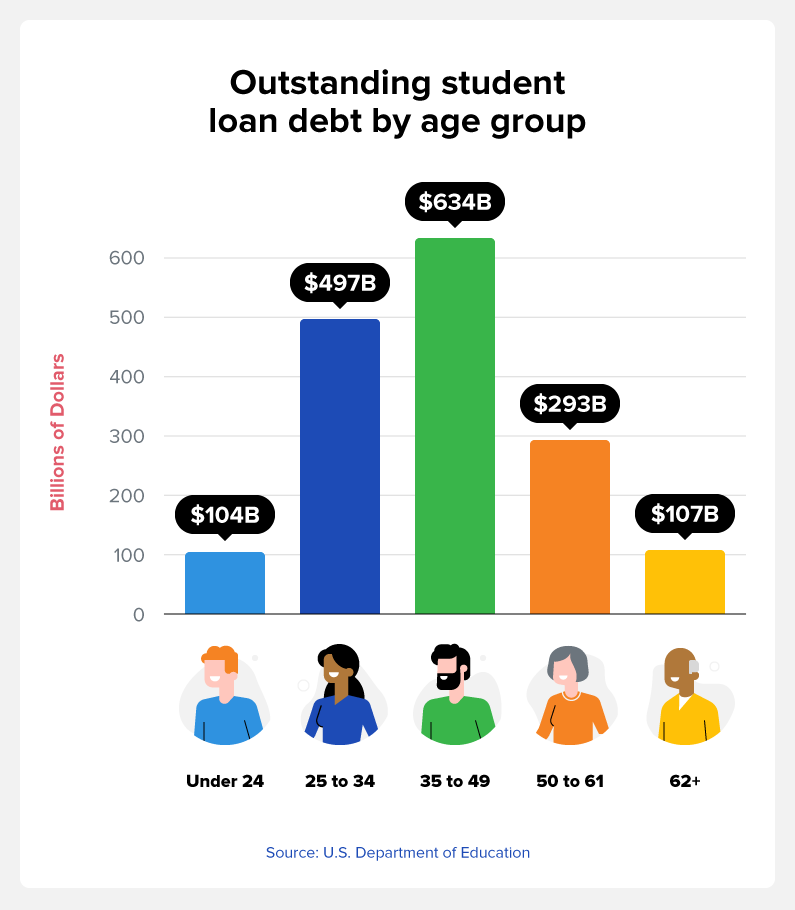

The chart below shows the total amount owed by each age cohort.

Below is a chart showing the average monthly payment by degree type. This is great information, but I mostly care about the Associate’s and Bachelor’s degree average.

The average loan payment due for an Associate’s is $436

The average loan payment due for a Bachelor’s is $621

While I believe this reliable BLS source information, my research approximated $300-400 per month. Similar, but a bit lower.

(Very important fact #2, to me.)

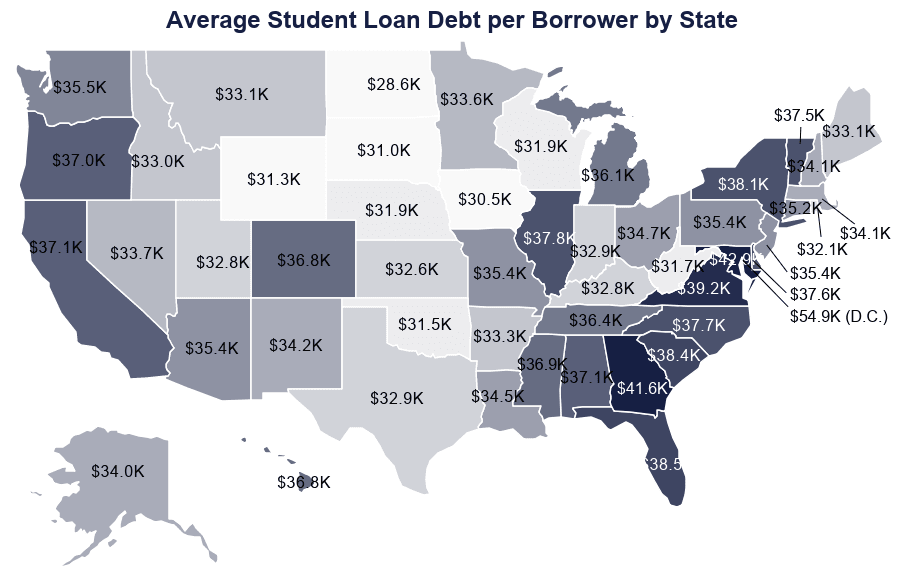

Finally, because we are putting the nerd meter into the red, below is a chart of average student loan debt by state. This is interesting so I wanted to share it with you, but I don’t know how much it adds.

I think a loan payment restart of $300-600 per month is significant for the large majority of people. Month, after month, after month. 43.5M Americans, 33% of 18-29 year olds.

How do they service this monthly payment? Cut back or eliminate travel, dining out, entertainment, recreational gambling. Do they sell their car in an attempt to downsize and engineer a lower monthly payment. Do they stop paying their car loan or credit card debt. I don’t know, but I do know it will further slow the economy. No doubt about it.🤔

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- CRWD, ZS, S, MDB, TWLO, HPQ, AVGO, VMW, DELL, ORCL

Housing & Banking - PHM,

Others- HEI, KR, GME 🤢

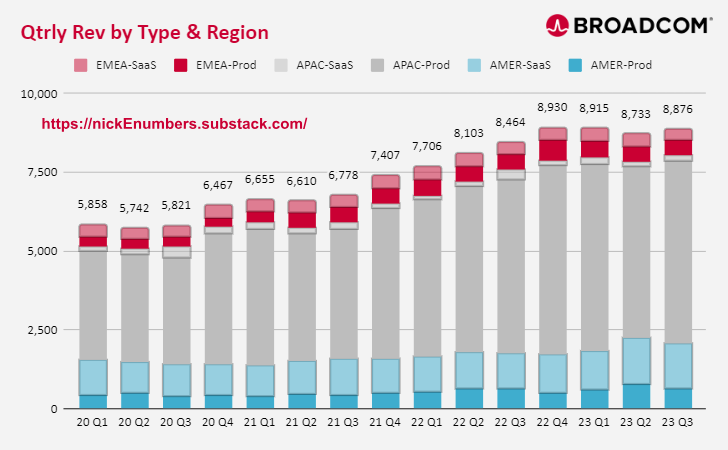

Broadcom Chart- why is APAC product revenue so large?

TSMC Revenue by month thru 8/23 below. The current 2023 year (red) is trending up.

Median Net Dollar Retention- All SaaS- Net dollar retention rates across public SaaS have continued to decline and are at their lowest point in years at a median of 115%. Upsells have decreased and churn and contraction have increased.😰

Podcasts

🎧Bill Ackman On Activist Investing, The Economy, And Learning From Mistakes. The Julia La Roche Show. Great interview. I think Ackman is exceptional.🤩

Videos

Interview with analyst Stephanie Pomboy. She's CEO of MacroMavens, thoughtful, experienced and at the top of the list of most popular expert to insiders. She has vision that is original.⭐

Books and Articles since my last edition

(Books are like loading software on your brain. If I get bored of a book I quit and move on.)

American Icon: Alan Mulally and the Fight to Save Ford Motor Company by Bryce Hoffman Biography of Mulally’s efforts to turn around FORD. Great book. Ford’s culture was complicated, bureaucratic and even messy. Near the end of the book, famed investor Kirk Kerkorian smells value and buys up ~6.5% of FORD, ~$1B. (I wrote about Kirk and his biography back in edition 3/28/23, here). What Mulally was able to accomplish is exceptional!👏👏📣

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Future IPOs?

After a break of a year or so, we are starting to hear the drum beat (albeit soft) of IPOs again. Companies like ARM, Instacart, and Klaviyo are on deck. Maybe Databricks and Stripe will be next.

These companies are going to be dressed up pretty, polished and shining. Their C-suite is going to be coached up, and crafty. Their arms are going to hurt they will be so busy patting each other on the back. Essentially, we are going to be sold these IPOs. But, should we buy them?

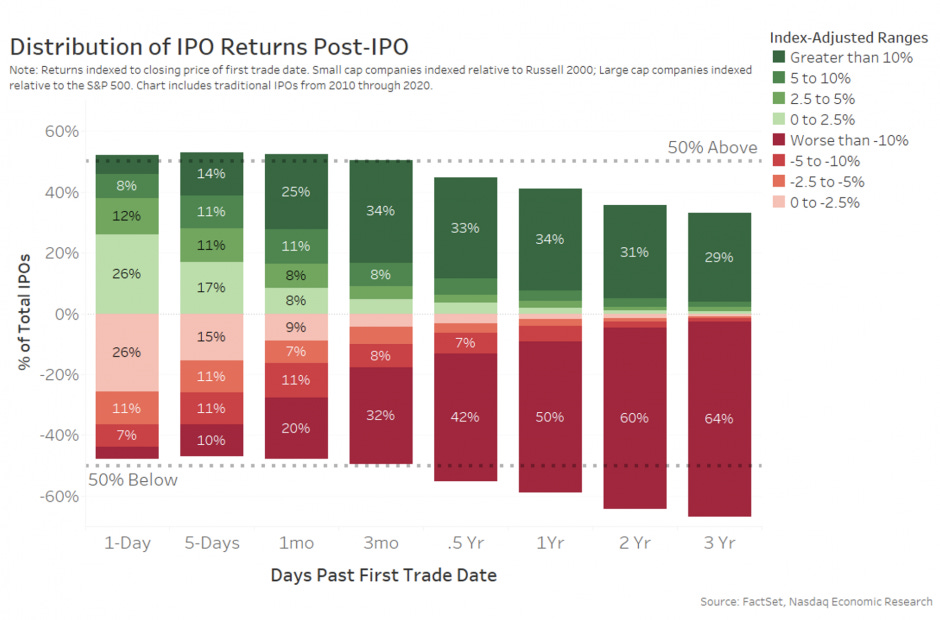

As a caution I wanted to point out some research that Nasdaq provided through 2020. The summary of the below chart is that 3 years after IPO date 64% of the companies are underperforming their index by more than 10%. 👎

Warren Buffett and Charlie Munger are not fans of the investment bankers that bring these IPOs to market. Below are a couple amusing things that they have had to say about these IPO agents.

“Investment bankers are money-shufflers. They don't create anything. They shuffle paper around and charge a lot of money for it."

"Investment bankers are the termites of capitalism.🐜They destroy value without creating anything."🐜

“I think Wall Street investment banks make money on the front, the back, and in the middle. They make money on the front by charging fees for underwriting new stock offerings and mergers and acquisitions. They make money on the back by earning interest on the money they lend to companies and governments. And they make money in the middle by trading securities for their own account. I think these fees and profits are often excessive, and I don't think investment banks provide enough value for the money they charge."

Is the price you are paying for this newly public company going to grow quickly over the next 10 years. If it is, why are the VC and Private Equity owners selling it? Investing is often a negative art- in order to make money we must avoid losing money.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

Very interesting article, Nick. I question the monthly repayment numbers, however. Your chart assumes that 10% of gross income goes towards student loan repayment. Recent income-based repayment plans allow for much lower loan repayment rates. I have a friend who makes a little over $30K per year and he will have to pay zero dollars on his $45K student loan.

Nerdwallet has a student loan repayment calculator - https://www.nerdwallet.com/article/loans/student-loans/discretionary-income-calculator

A single person has to hit about $33K in AGI before needing to make any payments under the new REPAYE plan. At an AGI of $50K, the maximum payment is still under 2% of AGI.

I don't know if the majority of outstanding loans qualify for these income-based repayment plans. Do you have any sense of this?