9/23/24-AMAT and LRCX🗣️, Sergey Brin, AVGO's Hock Tan🤘🏽

"Every percent of energy-efficient computing improvement is worth a lot."⚡

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Applied Materials and Lam Research Present at Goldman Sachs Communacopia + Technology Conference 2024 AMAT 0.00%↑ and LRCX 0.00%↑

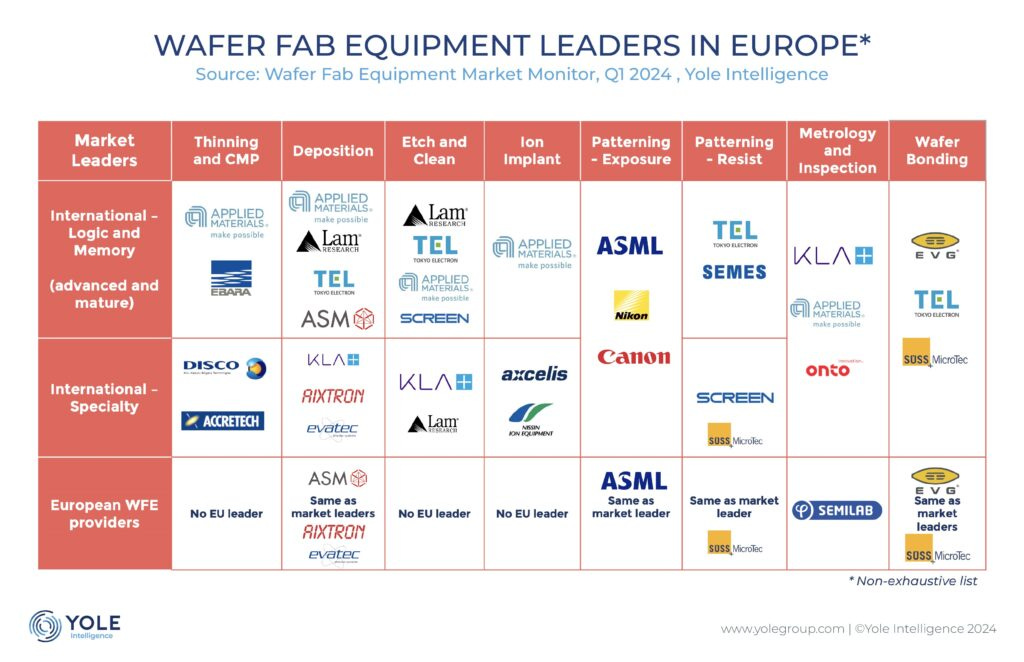

Applied and Lam are colleague/competitors in the small community of companies that provide equipment to make semiconductors/computer chips and memory. Customers include TSMC, Samsung, Intel, Global Foundries, Micron, etc. AMAT and LRCX are 2 of the largest suppliers, as you can see in the visual above.

Both companies participated in a Goldman Sachs conference in September. Below are my key takeaways from each company. There is significant overlapping🧑🤝🧑 narratives between the two.

Applied Materials- Gary Dickerson, President and CEO

Key takeaways:

Continued Focus on Energy-Efficient Computing: Applied Materials' customers remain focused on developing more energy-efficient computing solutions. This is driving significant growth in the semiconductor industry. "Every percent of energy-efficient computing improvement is worth a lot."

Strong Market Position: Applied Materials has a strong market position in key areas such as high-performance logic, DRAM, and advanced packaging. They are well-positioned to capitalize on the growing demand for these technologies.

Material Innovations: Applied Materials' ability to innovate with new materials is crucial for enabling energy-efficient computing. Their connected portfolio of technologies gives them a unique advantage in this area. "The semiconductor industry moves at a pace of no other industry on the planet."

Increasing Capital Intensity: The complexity and capital intensity of semiconductor manufacturing are expected to continue increasing, which could lead to higher spending on wafer fab equipment.

Positive Outlook for China: Despite recent challenges, Applied Materials remains optimistic about the long-term growth prospects of the Chinese semiconductor market.

Lam Research- Doug Bettinger, EVP and CFO

Key takeaways:

Strong WFE Market Outlook: Lam Research maintains a positive outlook for the wafer fab equipment (WFE) market, projecting mid-$90 billion spending in 2024. They anticipate continued growth in leading-edge foundry and logic, DRAM, and NAND, with some regional variations. "The industry is getting paid for the innovation and the value that it's delivering. And so if you think about from an affordability standpoint, is this investment amount level affordable, it absolutely is."

Focus on Technology Inflections: Lam Research is investing heavily in research and development to capitalize on key technology inflections like gate-all-around, backside power, and advanced packaging. These areas offer significant growth opportunities. "It's getting more expensive to create these structures. What do I mean? Planar went to FinFET is now going to gate-all-around, backside power is showing up."

China's Growing Role: Despite some near-term challenges, China remains a crucial market for Lam Research. The company sees long-term growth potential in the region due to ongoing investments in semiconductor manufacturing.

Increasing Capital Intensity: Lam Research expects capital intensity in the semiconductor industry to continue rising as manufacturing processes become more complex and advanced. "Everybody is excited about AI. And certainly, I am as well. At the end of the day, these great big accelerator chips consume a lot of wafer capacity, leading-edge wafer capacity, which drives a lot of demand for equipment.”

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- ORCL 0.00%↑ , AMAT 0.00%↑ , NVDA 0.00%↑ , LRCX 0.00%↑ , SNOW 0.00%↑ , NET 0.00%↑

Housing / Banking - BAC 0.00%↑ , JPM 0.00%↑ , LEN 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.)

Podcasts

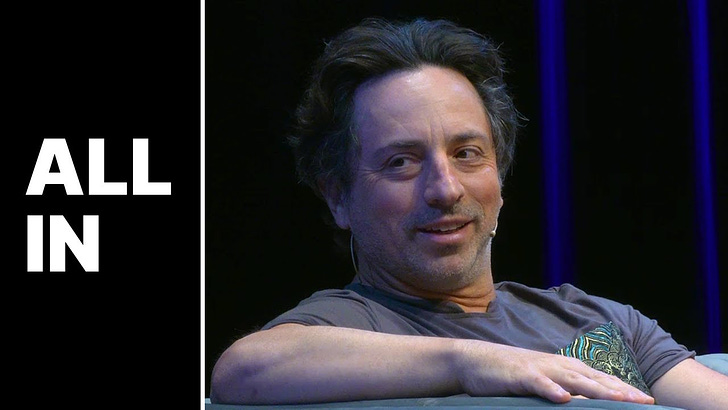

Google’s Sergey Brin | All-In Summit 2024 , 20 minutes.

Introverted Google Co-Founder Sergey Brin rarely participates in interviews. This discussion from last week is outstanding. Topics include Google’s progress, LLMs, Shipping Faster, and more. Sergey remains thoughtful and engaged at work.😃 GOOG 0.00%↑

"As a computer scientist, I've never seen anything as exciting as all of the AI progress that's happened in the last few years."

Videos

4 Min Video- The Simple Solution to Traffic. If you are not familiar with the creator CGP Grey, you are in for a treat. Brilliant, funny and well researched. Enjoy.

Books and Articles since my last edition

(Reading Great books is like a conversation with the finest minds of the past.- Descartes. If I get bored of a book I quit and move on.)

Material World: The Six Raw Materials That Shape Modern Civilization by Ed Conway History, Economics. 🚧Sand, Salt, Iron, Copper, Oil, and Lithium.🏭 These fundamental materials have created empires, razed civilizations, and fed our ingenuity and greed for thousands of years. Without them, our modern world would not exist, and the battle to control them will determine our future. ⭐

Salvation Lost by Peter F. Hamilton Science Fiction. It is popular and very good.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Hock E. Tan President and CEO of Broadcom AVGO 0.00%↑

“We believe that acquisitions are an important part of our growth strategy. By acquiring complementary businesses, we can expand our product portfolio and strengthen our market position.”

“Our strategy is to focus on high-growth markets and to leverage our technology leadership to drive innovation and create value for our shareholders.”

In recent years, Hock Tan is often the highest paid US CEO ($162M in 2023.) As of 2023, Broadcom, under Hock Tan's leadership, has completed over 20 acquisitions. These acquisitions have played a significant role in expanding Broadcom's product portfolio and market reach. Some would say that Broadcom is one of the few challengers to certain areas of the Nvidia business. NVDA 0.00%↑ So, who is Hock Tan?

Early Life and Education

Hock Tan was born in Penang, Malaysia, in 1951 or 1952. He displayed an early aptitude for academics and secured a scholarship to study at the prestigious Massachusetts Institute of Technology (MIT) in 1971. Tan graduated from MIT in 1975 with a Bachelor's degree in mechanical engineering and earned a Master's degree in the same subject later that year. He furthered his education by obtaining an MBA from Harvard Business School in 1979.

Work History and Accomplishments

Tan's career trajectory has been marked by his exceptional leadership skills and strategic vision. He held management positions at General Motors and PepsiCo before venturing into the technology sector. In 1983, he became Managing Director of Hume Industries Ltd. in Malaysia, and subsequently co-founded Pacven Investment, a venture capital firm in Singapore, in 1988.

Tan's career took a significant turn in 1992 when he joined Commodore International Ltd. as Vice President of Finance. This experience laid the groundwork for his future roles in the semiconductor industry. In 1999, he became President and CEO of Integrated Circuit Systems (ICS), a publicly-traded timing solutions IC company. Under Tan's leadership, ICS achieved remarkable success, culminating in its acquisition by Integrated Device Technology, Inc. (IDT) in 2005.

In March 2006, Tan assumed the role of President and CEO of Broadcom, a leading semiconductor company. His tenure at Broadcom has been characterized by a series of strategic acquisitions (Over 20) and a focus on expanding the company's product portfolio. Under Tan's guidance, Broadcom has become a global leader in semiconductor solutions for broadband communications, wireless, and storage applications.

He is married and the couple has three children. Two of their children have autism and Hock and his wife donate generously to Autism Research.

If you would like to learn more about AVGO 0.00%↑ I linked to a video in my 4/23/24 post here. In the video, creator

beautifully describes the company:“Broadcom is a publicly traded private equity fund, masquerading🎭 as a semiconductor company. They have a portfolio of strong technology franchises. They acquire new ones, slim them down, focus them, and then leverage them to buy new franchises. They grow whenever they buy something new.”

If you're curious, I suggest listening to AVGO's earnings calls. Hock Tan's responses are often insightful and well-articulated. 🙏🏽 Below is a visual of some of the largest acquisitions in Broadcom’s history.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.