9/9/24-Track IT Progress📊,Private Credit Black Hole🕳️, NFL Begins 🏈

There is no asphalt boulevard to success.

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Sources to Rank and Track IT/Computing Progress

There are lots of opinions on IT hardware and software leadership. If we are going to make decisions based on opinions then lets go with mine😉. Why not? But, reasoning based on metrics, and NUMBERS.. now we are talking!😍 Numbers can be more objective. In this post I wanted to share some of the number based sources I use to track and monitor the changes in the computing💻🖥️ ecosystem. I hope that you find them useful, or at least interesting. 🙏🏽

Database Engine Ranking the most popular and widely used DBs currently. Link Updated Monthly.

At the current pace, Snowflake will overtake Redis in the next year to become the 6th ranked DB. But Oracle and MySQL are strongly intrenched as 1 and 2. Ranking criteria can be found here.

LLM Leaderboard (Try to say that 4 times 😂) Link. Updated Weekly

There are only 6 or 7 organizations remaining in this foundational model category.

Ranked-Most Powerful Computer Systems in the World Link. Updated 2x / year.

Rmax petaflops is a metric used to gauge the potential computational capabilities of a high-performance computing system. It appears to be the ultimate dimension for the above ranking.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

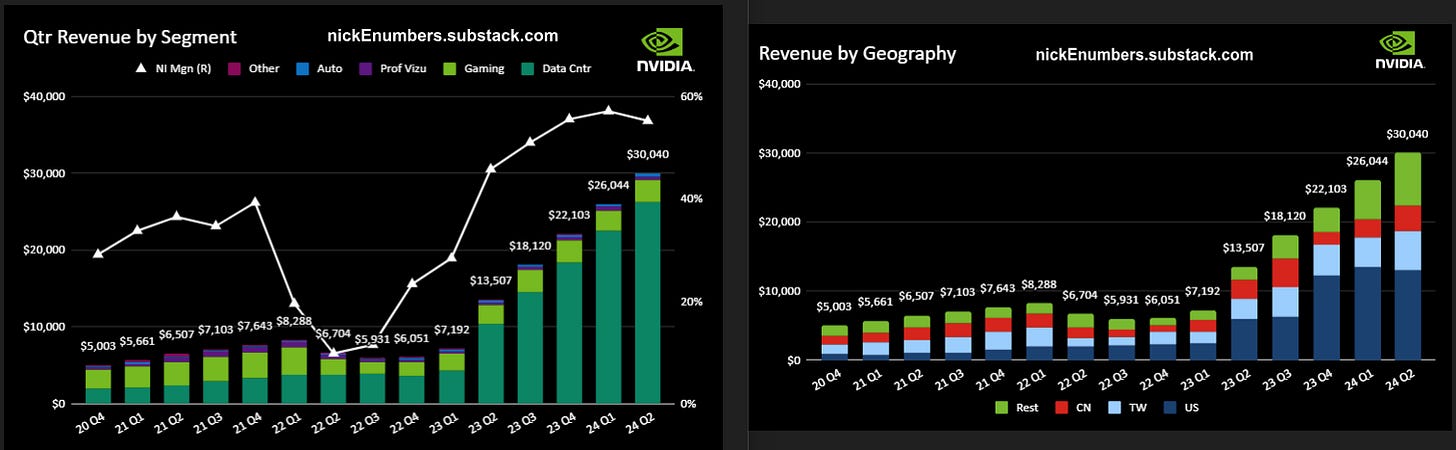

Technology- NVDA 0.00%↑ , MDB 0.00%↑ , CRWD 0.00%↑ , ZS 0.00%↑ , DELL 0.00%↑ , HPE 0.00%↑ , AVGO 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.)

[Click on any of the charts below to enlarge them.]

Happy NFL Football🏈 to all those who celebrate🥳. Also, good luck to the Fantasy Football participants.

Podcasts

50 Min 🎧- Bloomberg Odd Lots, The Black Hole of Private Credit That's Swallowing the Economy Very interesting discussion. 20 years evolution from obtaining credit with your local banker, to syndicated credit, and returning back to a single (private credit) lender.. Finance fans enjoy.

In a new paper called "The Credit Markets Go Dark," co-authors Harvard Law School professor Jared Ellias and Duke University School of Law professor Elisabeth de Fontenay argue that the $1.5 trillion market for private credit is already having a big impact on the economy — and not in a good way. They say that the rise of private credit marks a seismic change for corporate governance and dynamism.

Videos

Waymo Robotaxi Depot Shenanigans

3 Minutes. You know how when your airplane lands and everybody rushes to get out of their seat all at once thinking they'll somehow get off the plane faster but all it does is cause traffic in the aisles and slow everybody down???? yeah... 😂🤣Hysterical!

BTW, overall the Waymo cars are amazing. I can’t wait until they come to Virginia.

[If you are interested in Waymo’s growth and what it might mean for GOOG 0.00%↑ , I wrote about it in my 7/30/24 edition, here.]

Books and Articles since my last edition

(Reading Great books is like a conversation with the finest minds of the past.- Descartes. If I get bored of a book I quit and move on.)

The People's Tycoon: Henry Ford and the American Century by Steven Watts Biography

Everybody Lies: Big Data, New Data, and What the Internet Can Tell Us About Who We Really Are by Seth Stephens-Davidowitz Nonfiction, Business

Walt Disney: The Triumph of the American Imagination by Neal Gabler Biography

Nexus by Ramez Naam Science Fiction

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

4 Thoughts Offered from the Famous Book above-

(The below quotes have been lightly edited by me for clarity.)

A person can excuse his mistakes only by capitalizing them to his subsequent profit.

Weapons change (Companies Change), but strategy remains strategy on the NYSE as on the battlefield. 🫡

The

speculator'sinvestor’s deadly enemies are: Ignorance😶🌫️, Greed🤑, Fear😱 and HOPE🤞🏽.There is no asphalt boulevard to success. [Nick’s thoughts- “Oh indeed, it is a rocky, narrow way, requiring you to cut your own path.”]

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.