January 2023 First Half

"I have never done anything like that before! I don’t know how we are going to do that👆🏼. But, we will solve it in the future.🪄"

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

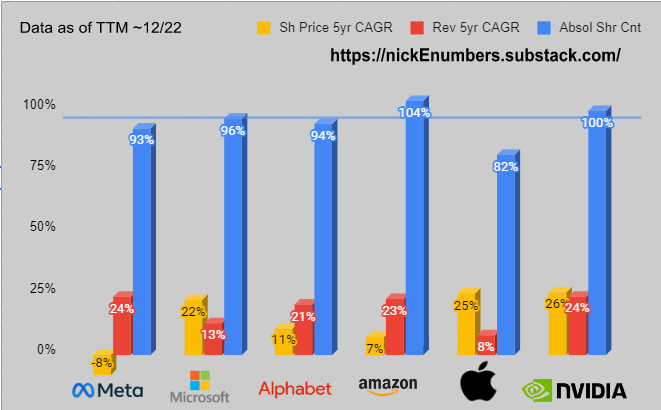

What do we learn by an initial glance at a few of the mega cap FAANG stocks? Despite what mass media might have us think, I don’t believe we can draw any absolute rapid conclusions. META 0.00%↑ MSFT 0.00%↑ GOOGL 0.00%↑ AMZN 0.00%↑ AAPL 0.00%↑ NVDA 0.00%↑

Share Price 5 Yr TTM CAGR (Yellow)- NVDA, AAPL and META hold first, second and last place, respectively. This is over a 5 sequential year time period. Wait, we are not done yet.

Revenue 5 Yr TTM CAGR (Red)- META and NVDA are tied for first place with AAPL coming in last. Now that is curious. META and NVDA compounded revenue at an average growth rate of 24% for 5 years. AAPL was only able to grow revenue at a fraction of the pace, and last among this group.

Share Count, absolute change over 5 years (Blue)- This metric generally speaks to companies repurchasing their own stock to reduce the share count, and it also could illustrate a large merger/acquisition with stock used as the method of payment, thus increasing share count. This metric also captures some dilution due to employee stock options and grants.

Before I looked at the data, I would have assumed AAPL, GOOG and MSFT had reduced their share count the most over the past 5 years. I would have been wrong. AAPL has reduced the most and META is 2nd for share count reduction. META 2nd?? I know, right!

Every quarter, a company like MSFT spends $5-8B on share repurchases, but at the same time they are granting employees stock options as part of compensation. With 220K employees MSFT is repurchasing about $110K/yr/employee with their $5-8B quarterly share repurchase. Many of the companies above grant employee stock options also. In some ways it is like the company is just treading water on its absolute share count. To put a sharper point on this✏️, don’t just cheer when you see a company repurchase a portion of its own stock with some of its free cash flow, also look at the share count over time and to what degree it is decreasing. If water is coming into our canoe as quickly as we are bailing it out, we should not declare victory. (I feel much better after this short rant on share counts, thank you.)

Finally, AMZN has had the most share count increase over this 5 year time period, but I wouldn’t be too quick to criticize them because they also have had 23% revenue growth. I can tolerate a bit of share dilution for significant revenue growth. AAPL has reduced their share count the most, but their revenue growth is anemic compared to the rest.I found value in looking at a 5 year time period for this analysis. These are well run companies that are leaders in their respective areas. A time frame of 1 year or less would not reveal enough and might be misleading.

Finally, it is worth acknowledging that all of these companies are not the same size market cap. A visual comparison below demonstrates the point well.

What conclusions can we draw overall? Be skeptical of any analyst claims of victory or collapse for any of these companies in the next 12 months. “It’s not supposed to be easy. Anyone who finds it easy is stupid.” - Charlie Munger.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

A couple of readers have asked me about the companies that I follow (tickers posted below.) Generally I have listened to the company quarterly earnings call and analyzed their financial statements. In some instances, I gained marginal value from the time investment and in others significant value, but it is difficult for me to estimate the value in advance. In

's publication he does a great job of illustrating the theme of serendipity that can occur when we are experimenting, curious and open minded.Also, I recoil a bit from attempting to summarize my thoughts about the company results as I suspect that my rough word map🗺️ won’t resemble the actual complex company territory🌄⛰️🌊. (Plus, what the hell do I know.) The value that I gain is by chopping my own analytical wood and carrying my own water and I don’t want to deprive you of those same benefits along your journey. Regardless, moving forward with the ticker I will attempt to provide a few short words or sentences as a guidepost.

Interesting companies that hosted earnings results or information session since my last edition that I reviewed-

Technology- TSM 0.00%↑ Simply the best semi fab operator, but I dislike the level of red queen/never ending capex.

Housing- KBH 0.00%↑

Banking- The quality of information that banks provide is excellent and the CEO/CFO sophistication is outstanding. Banking data and the earnings call Q&A is like taking something between a stethoscope🩺 and an X-ray🩻 to the economy. C 0.00%↑

JPM 0.00%↑ If bankers were utensils, Jamie Dimon (CEO) is an oversized steak knife🔪. I am a fan of Jamie with his big, opinionated personality!

Charlie Scharf, CEO. Jamie Dimon successfully recruited Scharf multiple times during Dimon's ascent over the years, and Scharf & Dimon worked together for ~16 years at various banks.

Wells Fargo remains on house arrest 🚨👮🏼👮🏿♀️with their regulators as roommates. Hard to make the government leave after they move in.😬

BAC 0.00%↑ Cleanest reporting, best intuitive use of graphs and visuals.

Household excess savings chart below- good visual of personal savings rates and excess savings declining. 📉

Videos

Light & Magic - DisneyPlus.com, 6 episode series. DIS 0.00%↑ TXN 0.00%↑ ADBE 0.00%↑ Pixar NVDA 0.00%↑

Showcasing the people of Industrial Light and Magic, the special effects division of Lucasfilm. This series takes us back in time as they create the effects for some of the biggest and most successful films of the last 45 years.

A Special Effects Artist was reviewing a movie storyboard- “I see this scene here. I have never done anything like that before! I don’t know how we are going to do that👆🏼. But, we will solve it in the future.🪄 For now, keep going to the next scene.”Excellence evolves over time. It is not a destination. I have found Excellence to be more of a journey, and as long as we don’t quit along the way, we are often able to discover more on the path than we ever thought was possible.

George Lucas found amateur film makers, artists, dreamers and engineers. He explained the basic vision of some of the special effects scenes that he wanted and then he left them to figure it out. They tinkered, hacked and they invented. The only 2 requirements seemed to be:

The film scene had to be magnificent.

There was a pencils down time deadline. “Real artists ship!”

In one episode George Lucas was talking to an artist about a new innovative idea on an effect. The artist was being painfully stretched out of their experience comfort zone. Both George and the artist wanted excellence.

George says- “Just try it. I know you’re in pain, I recognize your pain, and I appreciate your pain… but let’s do it.”Again and again these filmmakers delighted all of us with the magic that they created. With each new ILM film they raised the expectation of what an Excellent film was because they brought with them what they had learned on the previous ILM film. The artistry and innovation in the series is breathtaking.

Can you discover more excellence in what you do? Is your pursuit sometimes a bit painful and uncomfortable?

Books and Articles since my last edition

(I am usually reading 2 at a time, and if I get bored of a book I quit and move on.)

Draft No. 4 by John McPhee Book about the activity of writing📝, but it is about so much more than just writing. McPhee wrote for the New York Times for many years and he is a master storyteller and professor at Princeton University. Draft No. 4 was recommended to me when I told someone home much I liked Stephen King’s book On Writing: A Memoir of the Craft. Both books are so well written, amusing and interesting I think I would read them both again.

Coders at work by Peter Seibel Written in an interview style where each chapter is a different expert coder. (Coder, programmer, software engineer, scientist, the job titles are used throughout.) The interviews are excellent and the final chapter is with world famous Donald Knuth. The discussions generally follow a biography of the speaker and focus significantly on software development. Although I am not a coder, I picked up a few new thoughts and ideas from the book.

The Institute by Stephen King Science Fiction, not horror. 👍🏼👍🏼👍🏼

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment History by Lawrence Levy (CFO of Pixar) DIS 0.00%↑ AAPL 0.00%↑

In 1986 George Lucas was strapped for cash, and this motivated him to sell the fledgling🚼 Pixar to…. Steve Jobs. While we are on the subjects of Disney, George Lucas, and filmmaking (see the Light & Magic section above), I want to strongly recommend this book by Levy. (H/T to Founders Podcast, David Senra. David does a great job of summarizing the book <podcast here>, but even David will strongly recommend that you invest the time to read it.)

From Goodreads-

“Hi, Lawrence?” the caller asked. “This is Steve Jobs. I saw your picture in a magazine a few years ago and thought we’d work together someday.”

After Steve Jobs was unceremoniously dismissed from Apple, he bought a little-known graphics company called Pixar. One day, out of the blue, Jobs called Lawrence Levy, a Harvard-trained lawyer and executive to whom he had never spoken before, to persuade Levy to help him get Pixar off the ground.

What Levy found was a company on the verge of failure. To Pixar and Beyond is the story of what happened next: how, working closely with Jobs, Levy produced and implemented a highly improbable plan that transformed Pixar into one of Hollywood’s greatest success stories.

Set in the worlds of Silicon Valley and Hollywood, the book takes readers inside Pixar, Disney, law firms, and investment banks💵💰. It provides an up-close, firsthand account of Pixar’s ascent, how it made creative choices, Levy’s enduring collaboration and friendship with Jobs, and how Levy came to see in Pixar deeper lessons that can apply to many aspects of our lives.

I think this summary above is a good description of this excellent book. I don’t need to salt🧂 the writer's cooking🍲. In 2006 Disney bought Pixar for $7.4 Billion.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

I found the graphs comparing the FAANG stocks very interesting. Especially the fact that META is 2nd for share count reduction. It makes me wonder how much of that is from the past year with there price being cheaper than before or if their shares have been decreasing at a constant rate.

I love Jamie Dimon too!

And I keep hearing about John McAphees book I will have to check that out.