Welcome to my newsletter. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

If we were putting together a tool box🧰 of financial analysis, there is a lot that I want to be in there. ROIC, DCF, EPS, Share Dilution, Rev Growth, Gross Margins…. but the one I want to shine the light on is… 💡5 year comparison financials🔦.

It might be easy to want to skip 5 years of data. Do the old years really matter? Aren’t the 2 most recent years the most relevant? Some would argue that the 2 most recent quarters are all that is relevant.

If I am analyzing a company in order to allocate capital, 5 years of comparison CF, P&L and BS are critical. Why? Because they show me enough history to reveal a trend. 1 or 2 years are just datapoints. Without 5 years of comparison financials I feel vision impaired.

The data is easily available for 5 years. Take the time to look at it and then… ask the data great questions. Truth walks towards a person with the questions that they ask.

What is something that would be in your financial analysis tool box?

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks. And, Peter Lynch frequently reminds me that if I have spent 15 minutes on market macro, I have wasted 13 minutes. With that self caution, let us press onward.)

Interesting companies that hosted earnings results in the last month that I reviewed-

Technology- AMD 0.00%↑ GFS 0.00%↑ AKAM 0.00%↑ FSLY 0.00%↑ NET 0.00%↑ PLTR 0.00%↑ AMAT 0.00%↑ NVDA 0.00%↑ QCOM 0.00%↑ ADI 0.00%↑ CRWD 0.00%↑ ZS 0.00%↑ SNOW 0.00%↑

Housing & Banking - GRBK 0.00%↑ DHI 0.00%↑ UPST 0.00%↑ AFRM 0.00%↑

Others- $BRK.B WMT 0.00%↑ TGT 0.00%↑

Some of these companies I own, some are peers. Some of these provide decent economic indicators. In going through all of these companies there is a fair amount of Noise, but there is enough Signal to have value.📶

The FRED graph below charts the US personal savings rate over the last 4 years. 2022 trend has been down. So, it would appear that US personal savings is declining, INTO an oncoming potential recession, with rising unemployment.🤨😬

Podcasts

There are a number of podcasts that I enjoy, but this newer show below from Ben Thompson and Andrew Sharp is particularly good. The conversation is thoughtful and engaging. Ben’s analysis and insights are brilliant and original. If you are not familiar, Ben has been writing about technology for many years and he is well respected. Stratechery.com

I would recommend starting with The Cult of Iger episode and go from there. I am confident that you can listen to this on your podcast app of choice- AAPL 0.00%↑ GOOG 0.00%↑ SPOT 0.00%↑ , etc.

Videos

6 Minute video below, worth watching. John D. Carmack II, former CTO of Oculus VR. [Now part of META 0.00%↑ ] He is an American computer programmer and video game developer. Lead programmer of games Wolfenstein 3D, Doom, Quake, and their sequels. Carmack made innovations in 3D computer graphics.

"There's a quality to obsession that is really hard to match any other way... Mastery comes from practice and even if you're doing the same boring thing for the 50th time, if you're self-aware about it you can sort of hill climb your way to a better skill set by working on it. So I urge you to embrace the grind, pay attention to the details, fill your products with << GIVE A DAMN >>. You're building the future!"🤘🚀Video The Algorithm That Transformed The World- The Fast Fourier Transform is used everywhere but it has a fascinating origin story that could have ended the nuclear arms race. And a quick reference near the end to math master C.F. Gauss.

Books from the past month

(I am usually reading 2 at a time, and if I get bored of a book I quit and move on.)

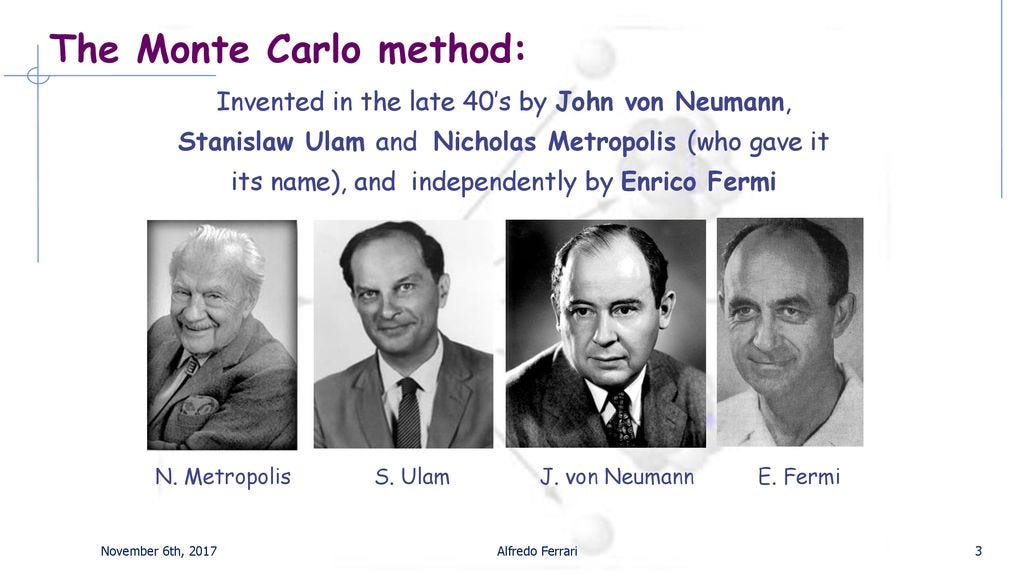

The Last Man Who Knew Everything: The Life and Times of Enrico Fermi

At lunch, Fermi couldn't recall the exact formula for X-ray refraction. A colleague had seen it in a textbook next door & offered to get it. Fermi told him not to bother-Fermi would derive it FROM BASIC PRINCIPLES.🧑🎤

In 6 steps, Fermi was DONE. 🤯

Railroader about Hunter Harrison, Bill Ackman, CP 0.00%↑ CNI 0.00%↑

Don’t think “boring railroad”, think fast network like GOOG 0.00%↑ AMZN 0.00%↑ NET 0.00%↑

The goals of Hunter Harrison are as follows:

Consolidate rail networks

Boost asset velocity

Reducing crew members to maximize on employee capabilities

Improving fuel efficiency

Follow a point-to-point delivery tactic

Improving capacity dispersion

With all of that being said, the main target or “mission” if you will, was to lower a company’s operating ratio (shortened to OR). This is how the railroad industry measures operational efficiency.

Reprogramming the American Dream by Kevin Scott, CTO MSFT 0.00%↑

A Shopkeeper's Millennium, historical book about Rochester NY ~1830

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

The Peripheral season 1 on AMZN 0.00%↑ is pretty good. It has some science and technology themes and a bit of the metaverse.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

"Truth walks towards a person with the questions that they ask." Love this!

As a business journalist, one tool I've employed in my financial analysis toolbox is how "on it," helpful, transparent and responsive the company's PR team is. There is for a sure a correlation between this and steady growth.

Unfortunately this window is not accessible to most. And now that I've devoted my journalistic "skills" to reporting utter nonsense for my newsletter, it's no longer available to me either!

Nice find on Carmack, I haven't see that one yet.