4/23/24-♟️Bank Charge-offs,🎧Nvidia,📺AVGO, 🚫Misusing LLMs

You can't FOLD ♠️♥️♦️♣️ your way into the big money💰. You gotta play.

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Big Bank Net Charge-offs and Allowance for Credit Losses

Earnings season started this week with the big banks, and per usual, significant attention is paid to Net Charge-offs. We all understand their importance as a sign of bank credit health and as an indicator for the larger economy.

But, often media and the investing community paints🎨 banks as bad businesses pointing at Net Charge-offs as the proof. Visuals below of the flow and trend for JPM, WFC and BAC Allowance for Credit Losses.

Net Charge-offs🔴 (NCOs) are the cost of doing business for a bank. NCOs are the Pawns♟️. Pawns were best described in the infamous HBO show The Wire by D’Angelo Barksdale:

Wallace: So how do you [pawn] get to be the king?..

D’Angelo Barksdale: Nah, yo, it ain’t like that. Look, the pawns, man, in the game, they get capped quick. They be out the game early.

Pawns are to be used to advance play and sacrificed to extract greater value. Focusing on the loss of pawns is to miss the bigger picture, miss the long term strategy.

Big Banks are complicated, multi-dimensional, and NCOs are built into their model. Take another look at the other metric that I have mapped on the visual above. Return on tangible common equity, (ROTCE.) JPM 0.00%↑ ~20%, BAC 0.00%↑ ~13-15 %, and WFC 0.00%↑ ~12% (BTW, WFC is still on US Gov 🚨house arrest⛓️.) Pretty respectable returns.😀

Credit card companies budget for loss and charge offs in their models. And almost all companies that extend credit to a customer, AKA accounts receivable, have an allowance for doubtful accounts. Why doesn’t the investing media report on credit losses for the other 495 S&P companies.

I really don’t care to change the opinion or news reporting on big banks, but I would like for you to reconsider how we think about NCO’s and the larger Allowance for Credit Losses.

If a company accepts absolutely no risk, they earn no above average returns. Big Banks🏦 are playing chess and Net Charge-offs are the pawns that they risk/manage/sacrifice on the way to their continued higher ROTCE returns.

[Interested in more chess and investing? In my 3/28/23 post, I wrote about 3 Investing Thoughts <link here> I had from friend and 💫 author Anne Kadet’s live interview with NYC Chess Hustlers in NYC Washington Square Park. Anne’s substack →CAFÉ ANNE .]

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- ASML 0.00%↑ , TSM 0.00%↑ ,

Housing & Banking - JPM 0.00%↑ , BAC 0.00%↑ , WFC 0.00%↑ , C 0.00%↑ , GS 0.00%↑ , DHI 0.00%↑

Others- KMX 0.00%↑ , NFLX 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.)

As of Q1 2024, deposits increased for all, but JPM and BAC are the clear leaders.

Podcasts

🎧60 minute -Doug O’Laughlin on Podcast-Software Snack Bites (below.) Doug writes Fabricated Knowledge and is an analyst who can bridge the gap between finance and the semiconductor ecosystem. Doug is brilliant, well researched and easy to understand.

Mentions- NVDA 0.00%↑ , MU 0.00%↑ , TSM 0.00%↑ , AMD 0.00%↑ , GOOG 0.00%↑ , INTC 0.00%↑ , ASML 0.00%↑ , OpenAI, and more.

Videos

25 minute video, from The Asianometry Newsletter on Broadcom: The $600 Billion AI Chip Giant. The best history and summary of Broadcom and CEO Hock Tan😎. AVGO 0.00%↑

Broadcom is a publicly traded private equity fund, masquerading as a semiconductor company. They have a portfolio of strong technology franchises. They acquire new ones, slim them down, focus them, and then leverage them to buy new franchises. They grow whenever they buy something new.

🤘🏽🧑🏽🎤😝🤑

Books and Articles since my last edition

(Books are like loading software on your brain. If I get bored of a book I quit and move on.)

The Noble Hustle: Poker, Beef Jerky, and Death by Colson Whitehead Mostly Texas Hold’em Poker

"You can't FOLD ♠️♥️♦️♣️ your way into the big money💰. You gotta play." - Colson Whitehead

Warren Buffett LLM😂 translation- When it's raining gold, reach for a bucket🪙🪣, not a thimble.

The Worst Ship in the Fleet by Skyler Ramirez Science Fiction

Sleeping Giants by Sylvain Neuvel Science Fiction, 4.5 ⭐👍🏽

Vanderbilt: The Rise and Fall of an American Dynasty by Anderson Cooper Nonfiction, History, Biography. Interesting, messy family.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Please Don’t Use LLMs/Generative AI for these Things-

Before I offer my short list, I am sure you know that I am a huge fan of technology in many forms. Software, hardware, etc. It is a tool🧰, a lever/a wheel that helps us be more productive. (Summary- Nick is not a luddite.)

Second, here are a few Brilliant💡 uses of GenAI -

Brainstorming ideas about a topic, Improve/rephrase your writing, Summarize a new or complicated subject, Co-pilot/debug/explain code or math, Language translation, Generating art as a starting point, and I hope for intelligent/efficient customer service Chatbots in the future (the holy grail).

However, I don’t see why you would want to use LLMs/Gen AI for:

Contract Summarization Example- complex documents, agreements, legal letters and leases.

Email AI agent to read, recap and highlight messages from your work team, manager, and family/friends. (I will call these people your “core relationships”.)

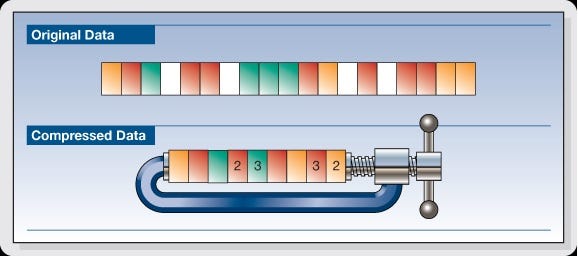

Why, what is different about those 2 Nick? The visual below helps us imagine how we can take something that is large and compress it. The hope is that we can save time during our day and are able to end work early for a cold drink🍷🍸🍻🍹 with friends or a relaxing walk🌄🌳 in nature.

But, I could argue that information in contracts and emails from your core relationships is already in the 2nd compressed state. Summarizing it more would be to lose information, and create future confusion.

Contracts- who likes to read contracts, I certainly do not. But every word in these complicated, confusing and sometimes horrible documents MATTER. Contracts explain the terms of an agreement, the mode of operating and the joint expectations. Lawyers have packed the agreement full with assertions and disclaimers. Summarize and compress a legal document at your own peril. [I can hear all the lawyers cheering me as they read this. 😆] The only way to understand what you are committing to is to read and understand every word….. unfortunately.

Emails from your core relationships- Of all the emails/messages that I have received over my career from my work teams, managers, and family/friends, the super majority have been high information signal. Some of the messages have certainly been long, and some of the messages have been filled with emotion, BUT there was still valuable information in those paragraphs. Coming at it from a different direction, I do not think that my/your core relationships wake up in the morning and say “How can I write the longest, most boring and silly message today to Nick [or insert your name]?” No. People are high integrity and they are working to get things done. When core relationships communicate with me/you they need help or they want to share something in words with us. I do not need or want an LLM attempting to “compress” and summarize it to me. Hard Pass.👎🏽

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

“Messy family,” haha! That’s an understatement. But I suppose most families are messy.

And thanks for the shoutout Nick!