10/21/24-Big Bank🏦Revenue, GOOG Sundar P 🗣️, Be less Wrong🔥🧨

"Always take the position that you are to some degree wrong..."

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

How do big banks like Bank of America and JP Morgan generate revenue?

Although I have been in finance and business for a long time, I have to admit that banks are complicated. The joke goes- How do banks make money? Answer- They make money on the front, they make money on the back and they make money on everywhere in-between. (Guffaw😅😂, okay it is not that funny. 😉)

Below are 2 resources to better understand big bank revenue sources.

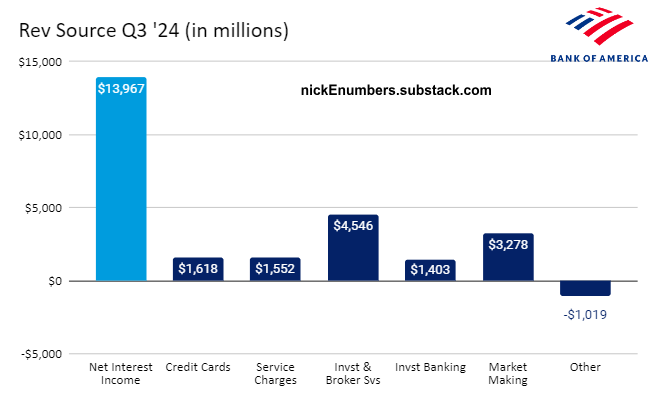

First, I have a visual for you below of the most recent Bank of America earning release, 9/30/24, to illustrate the sources of revenue.

Second, the shortest narrative I could come up with while not boring you to death. Banks generate income primarily through the following methods:

A. NET INTEREST INCOME (Interest income MINUS interest expense)

Interest Income: (Money coming INTO the bank)

Loans: Banks earn interest on loans they provide to individuals, businesses, and other entities. This includes mortgages, auto loans, personal loans, and business loans.

Investments: Banks invest in securities, such as bonds and government debt, which generate interest income.

Interest Expense: (Money going OUT OF the bank)

Deposits: Banks pay interest on cash deposited by individuals, businesses, and other entities.

Borrowing/Debt: Banks often borrow money from the federal government or another lender and they owe interest on this debt.

B. NONINTEREST INCOME

Fee Income:

Transaction Fees: Banks charge fees for various transactions, including checking account fees, ATM fees, and overdraft fees.

Investment Management Fees: For wealth management services, banks charge fees for managing clients' investments.

Advisory Fees: Banks may charge fees for providing financial advice and consulting services.

Other Fees: Banks can generate income from various other fees, such as late payment fees, wire transfer fees, and account maintenance fees.

Investment Banking and Services:

Mergers and Acquisitions: Banks advise companies on mergers, acquisitions, and divestitures, earning fees for their services.

Underwriting: Banks underwrite securities for corporations, earning fees by selling the securities to investors.

Trading: Banks engage in trading activities, such as buying and selling securities, to generate profits.

Market Making: Banks engage in market making to provide liquidity and facilitate trading in various financial markets. Market making involves buying and selling securities, such as stocks, bonds, or derivatives, with the intention of profiting from the spread between the bid and ask prices.

Card Services:

Credit Card Fees: Banks earn revenue from credit card transactions, including interest on outstanding balances and fees for annual membership, late payments, and cash advances.

Debit Card Fees: Banks may charge fees for debit card transactions, such as ATM fees or foreign transaction fees.

Other Services:

Safe Deposit Boxes: Banks rent safe deposit boxes to customers for a fee. Foreign Exchange Services: Banks may charge fees for currency exchange services. Cash Management Services: Banks provide cash management services to businesses, such as payroll processing and check clearing, for which they charge fees.

It's important to note that the relative importance of these income sources can vary depending on the bank's size, business model, and market conditions.

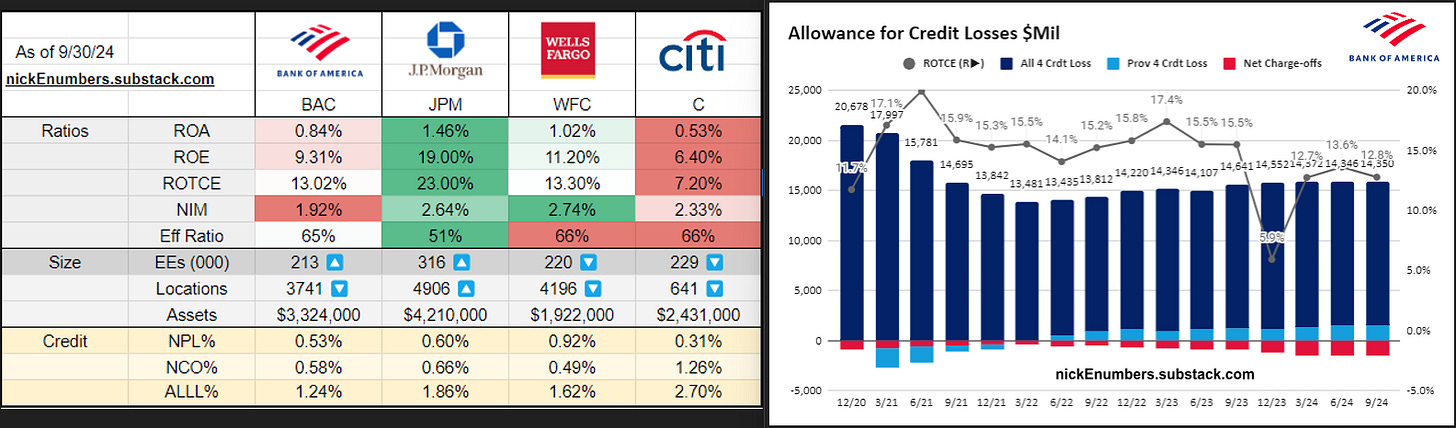

[Do you find large banks🏦 interesting? In my 4/23/2024 post you can learn about Big Bank Net Charge-offs and Allowance for Credit Losses, link here.]

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

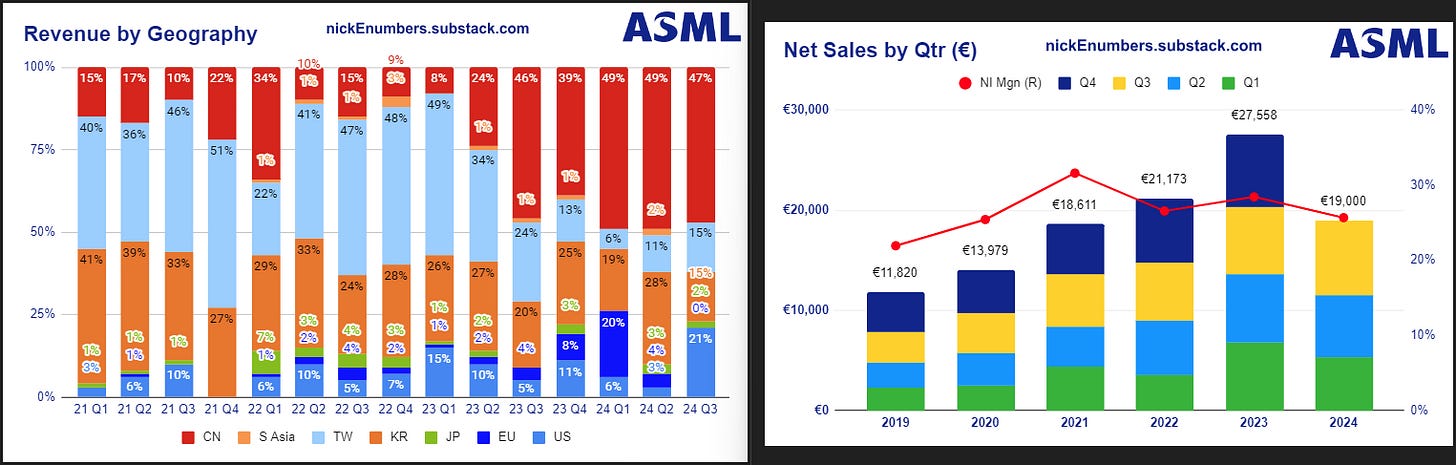

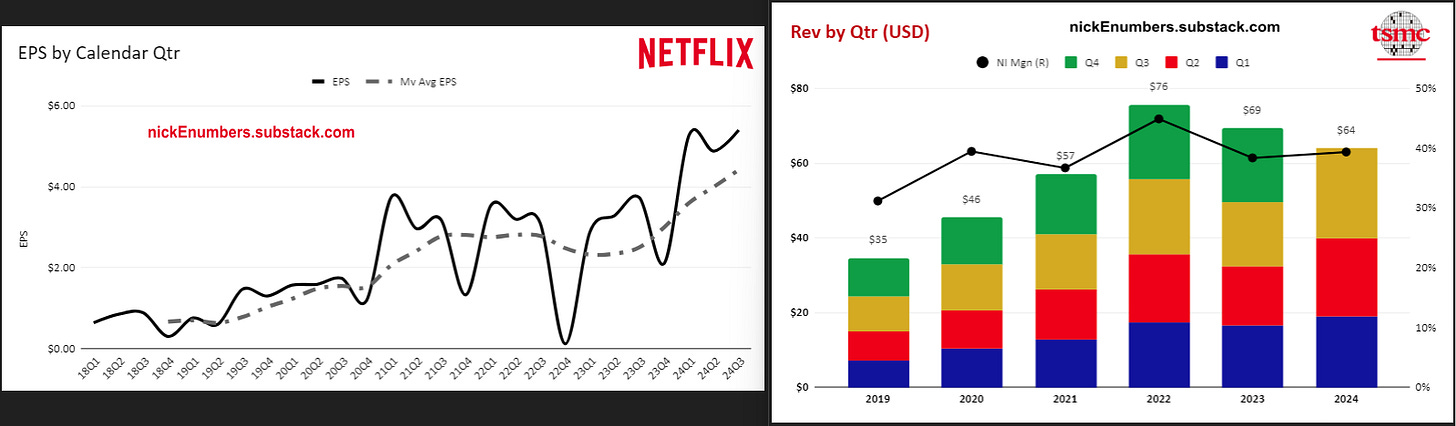

Technology- ASML 0.00%↑ , TSM 0.00%↑ , NFLX 0.00%↑

Housing / Banking - BAC 0.00%↑ , JPM 0.00%↑ , WFC 0.00%↑ , C 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.)

Pressurized Water Nuclear Reactor Visual

Podcasts

🎧28 Minute Podcast from Ben Thompson on Elon Dreams and Bitter Lessons. Link here. Ben offers excellent Original analysis on Elon, SpaceX, Tesla, Waymo and more.

The video below is a 50 second segment of Elon at a recent event.

Videos

24 Minute video interview of Sundar Pichai, CEO Google/Alphabet by David Rubenstein.

When asked about one of the lawsuits against Google, Sundar responds-

..So I expect it to take some time. Where we can figure it out in a constructive solutions, I think we will. Where we think it really harms our ability to innovate on behalf of our users, we are going to be vigorous in defending ourselves and it's going to take time for it to play out.

David asks about Sundar’s parents-

David- I think they must be pretty proud of you. You are the CEO of Google and Alphabet. Do they call you all the time with advice or what do they do?

Sundar- You know, I am fortunate. I'm very close to them. I see them almost every week. My dad is amazing, he's 82. He relentlessly reads everything.

Books and Articles since my last edition

(Reading Great books is like a conversation with the finest minds of the past.- Descartes. If I get bored of a book I quit and move on.)

The Worlds I See: Curiosity, Exploration, and Discovery at the Dawn of AI by Fei-Fei Li Biography, Nonfiction. Excellent 🤩. Fei-Fei Li has been called the godmother of AI for her pioneering work in computer vision and image recognition. She also shares a few of the challenges in her personal life. Everyone has a story. 🥲

Riding the Rap by Elmore Leonard Fiction

How Big Things Get Done: The Surprising Factors That Determine the Fate of Every Project, from Home Renovations to Space Exploration and Everything In Between by Bent Flyvbjerg Business Nonfiction.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

Our Goal → Be less Wrong

Someone said: Stupid decisions are like running thru a dynamite factory with a burning match🔥🧨. You may live, but you're still an idiot.

It brings to mind stupid memories from my youth and even some when I was old enough to know better. Specific to markets and investing, I also have scars in the form of money lost or opportunity missed. When we look back on many of those experiences we cringe at the calamity that occurred or what COULD have gone wrong but narrowly didn’t.

Elon Musk, love him or not, has a framing around this concept that I find valuable. “Always take the position that you are to some degree wrong, and your goal is to be less wrong over time.” ⌚

Bet when the odds are in your favor, learn from mistakes, don’t make the SAME mistakes and know that there is ALWAYS more to learn in the future.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.