11/20/23- OpenAI 🏴☠️, AMAT ⛅, Dr. Fei-Fei Li, Big Data 🚗 Recycling

"..., but I am content to multiply my money slowlyyy.🐢"

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

OpenAI, ChatGPT, CEO Sam Altman are good at Selling😠😠😡

**[News UPDATE- Sam Altman has been fired from OpenAI, Friday 11/17/23, and the subsequent events have been a circus🎪 (News Link). I had this section below written last week, I promise 🙏🏽. Despite the events on Friday, I think the writing below is still very relevant. ]**

Just to set the table up front-

OpenAI was founded in 2015 as a non-profit by research engineers and scientists, with major donations from highly successful entrepreneurs, including Altman, Elon Musk, Reid Hoffman (LinkedIn co-founder), and Peter Thiel (PayPal co-founder)

Original stated philosophy—> “OpenAI is a non-profit artificial intelligence research company. Our goal is to advance digital intelligence in the way that is most likely to benefit humanity as a whole, unconstrained by a need to generate financial return. Since our research is free from financial obligations, we can better focus on a positive human impact.”

Around January 2019, OpenAI switched to a for-profit model with a “cap.”

OpenAI hosted a developers day about a week ago. (Video Link Here) It was pretty good, no it was Really Good for a young company with a young CEO. It left me feeling very impressed with Sam, the OpenAI sales motion, and product market calibration.

How and when did Sam get so good at selling? It is like Sam left the quiet non-profit world and stepped onto the used car lot.🤑

To be clear, I like Sam Altman and his whole team at OpenAI. I like Microsoft and Nvidia. BUT, it is like OpenAI raised a bunch of money to buy a pirate ship🏴☠️🦜 and head off on a voyage. And then they figured out the trip was going to be very difficult, probably fail and so they made a deal with the West India company and joined their Navy🥸🥸. (Microsoft)

Maybe you are thinking- What about the people who gave them money toward the stated non-profit pirate ship purpose? 🖐🏽✋🏽(hand wave) These aren’t the droids you’re looking for. 🖐🏽✋🏽

Satya CEO of MSFT has always been a profit seeking knives out organization.🔪 Sam is now For-Profit, but before Sam was for-profit, he was non-profit. 🧐

And, as the weeks proceed I am discovering that he is very good at selling the for-profit products of OpenAI. Sam seems comfortable selling, maybe gifted at selling.

I don’t know. It makes me uncomfortable. What else might OpenAI change in the future? It pains me to say this but I am glad Microsoft has some influence on these pirates newly turned commercial Navy.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Technology- AAPL, GFS, DDOG, ARM, AMAT, PANW, CSCO

Housing & Banking - DHI, AFRM, UPST, HD

Others- UBER, LYFT, DIS, RBLX, TGT, WMT

(With data and charts it is not what you look at, it is what you see that matters.)

I will update the chart below in a couple of weeks when CRWD 0.00%↑ and ZS 0.00%↑ release earnings 📰.

From Palo Alto Networks. Volume of attacks UP, Payment demands UP, Increased Speed. 😩

Semi equipment company Applied Materials is thoughtful and professional. I get a lot from their earnings calls, AMAT 0.00%↑ .

Podcasts

In this conversation, Li describes her transformation from a poor young immigrant to an influential figure in AI. The conversation explores the birth of ImageNet, a pivotal step that bridged the gap between visual intelligence and accessible AI technology. This episode peels back the layers on the human side of AI, offering a rare glimpse into the personal and professional realms of a pioneer shaping the AI landscape. I can see why her students love her.

Videos

30 Minute video. The Future of Vehicle Recycling - Cars stripped, boxed and on eBay within hours! AND, it is all data driven. Integrated databases, prediction and statistics. From car purchase, to parting, disassembly labor time targets, to the storage and ultimate resale. Think Snowflake and AWS meets cavernous recycling warehouse. Where else will integrated data systems be used in existing industrial, manufacturing, and construction companies? 🤔

Honorable mention 30 min video- AI Hardware summit, 9/12/23. Listen to Tenstorrent CEO Jim Keller discuss how AI models are graphs and how they built their own software and hardware to give customers a fundamental advantage. 🤓🤯

Books and Articles since my last edition

(Books are like loading software on your brain. If I get bored of a book I quit and move on.)

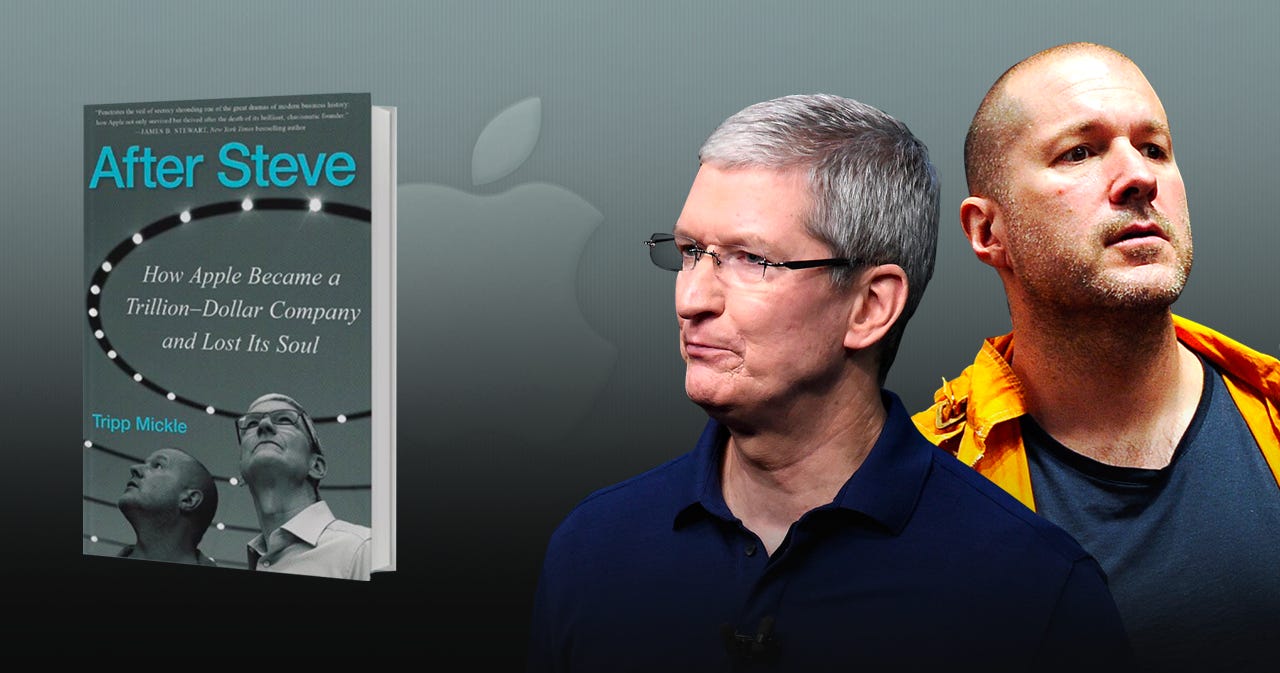

After Steve: How Apple Became a Trillion-Dollar Company and Lost Its Soul by Tripp Mickle Business Nonfiction about Apple after Steve Jobs. Follows the progress of Apple over time, alternating the story between Tim Cook and Jony Ive. Quote about Apple Watch showing the high standards-

“Jeff, if you left your phone at home and got to the office without it, would you go back and get it?” he asked. “Yes,” Williams said. “If you left your watch at home, would you go back to get it?” Dauber asked. Williams paused and thought. “No,” he said. “I’d get it when I got back home.” “That’s why we can’t ship this,” Dauber said. “It’s not ready. It’s not great.”

Sea of Rust by C. Robert Cargill Dystopia, Robot🤖 Science Fiction. If you like this category of fiction, I think you will enjoy this book. 5⭐

The Wager: A Tale of Shipwreck, Mutiny and Murder by David Grann Nonfiction, History from ~1740s. This is a Best Seller and it comes highly recommended. It reminds me of Lord of the Flies and the tv show Survivor. 😬

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

What type of investments am I/Nick looking for?

Over the last year I have been slowly uncovering for you the types of investments in which I am interested. Some of the companies I know well, occasionally I express an opinion on them, and from time to time I share my confusion or reservations with others.

In the spirit of addition by subtraction let me directly state the styles of investment that I am NOT- Momentum, Macro, Technical, Index Based (S&P or ETF), Large Number of Diversified Positions, and I do not delegate my Investment decisions to a Manager/Advisor. I am not critical of any of these styles, rather I enjoy and admire many of them. These styles have a place and a time depending on the facts and circumstances of the person/group.

I run a concentrated selection of a small number of companies.

My strategy is to find

a good business/company,

and one that I can easily-understand why it's good,

with a durable, competitive advantage, 🏰

whose earnings are virtually certain to be materially higher five and ten years from now

run by able and honest people,

When no one is looking, do they do the right thing? Do they decline to advantage themselves in favor of instead advantaging the company?

[How can you possibly determine a manager is able and honest from afar? You have to listen to their interviews and read a lot about them.]

and available at a rational price that makes sense

You must calculate/estimate the fair value of the company

Compare it to the trading price

hopefully be able to buy it at a meaningful discount to the trading price, or at least at an acceptable IRR.

If a prospect investment fails any of these filters, HARD PASS. 🫷🏽

I am a long term shareholder. Think.. Marriage👰🏽💍🏡. If I am not willing to own a stock for ten years, I don’t attempt to trade a stock for 10 minutes. Some are attempting to get rich quick, but I am content to multiply my money slowlyy.🐢

There are many paths to happy investing. This is the one that works for me.🙏🏽

(I wrote a little more about the types of companies I am looking for on 8/15/23 in my section → That is a product, not a company.)

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

It is very interesting that you wrote about OpenAI and Sam Altman right before the recent events. Even though Microsoft invested heavily into OpenAI, I think they still capitalized from the fiasco by hiring Sam Altman and Greg Brockman. They made the most out of the recent situation but it will be interesting to see how OpenAI fares.