6/3/25-Important & Knowable, China's Apple, Demis+Sergey

Climb high, climb far. Your goal the sky, your aim the stars.✨

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

🔍Focus on Important AND Knowable.

It disappoints me a little to have to say this but much of what we encounter in the news and general conversation is Not Important, Not Knowable or both.

Like what Nick? Give me some examples.

Not Knowable- the future (especially the distant future). High confidence direction of macro economics (Why? Because markets are a complex adaptive systems.) Direction of geopolitics, especially over longer periods of time. There are many others.

Not Important- "Get Rich Quick" Schemes. What almost all “talking heads” say about yesterday’s news. The majority of daily interest rate and stock movements. Getting "likes" on social media. Debating the "correct" way to load a dishwasher.

Instead, focus on things that are Important, Knowable and best of all, BOTH.

Rather than me explain the why, I am going to defer to Warren and Charlie. Warren begins-

No disrespect but we just don't think about those things very much. We just are looking for decent businesses and incidentally our views in the past wouldn't have been any good on those subjects. We try to think about two things. We try to think about things that are Important and things that are Knowable.

Now there are things that are important that are not knowable. In our view those two questions that you raised fall on that. There are things that are knowable but not important. We don't want to cut our minds up with those. So we stay with what is important and what is knowable.

What among the things that fall within those two categories can we translate into some kind of an action that is useful for Berkshire. There are all kinds of important subjects the Charlie and I we don't know anything about. And therefore we don't think about them. Our view about what the world will look like over the next 10 years in business or competitive situations, we are just No good.

We do think we know something about what Coca-Cola is going to look like in 10 years or what Gilettes’s going to look like in 10 years or what Disney's going to look like in 10 years or what some of our operating subsidiaries are going to look like in 10 years. We care a lot about that. We think a lot about that. We want to be right about that. We're right about that the other things get to be uh you know, they're just they're less important. And if we started focusing on those we would miss a lot of big things.

Charlie concludes-

Yeah. We're not predicting the currents that will come. (Rather) just how some things will swim in the currents, whatever they are.

If you would like to watch the whole 3 minutes segment, the link is here.

[If you would like to read a little more that Warren and Charlie have to say about patience, there is a segment in my 3/2023 post. Link here.]

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

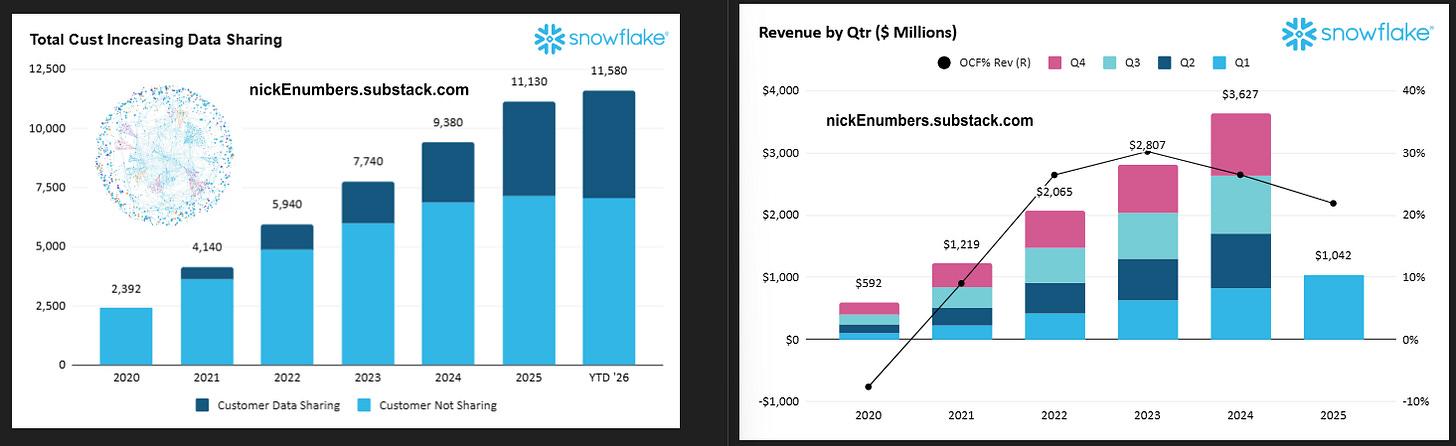

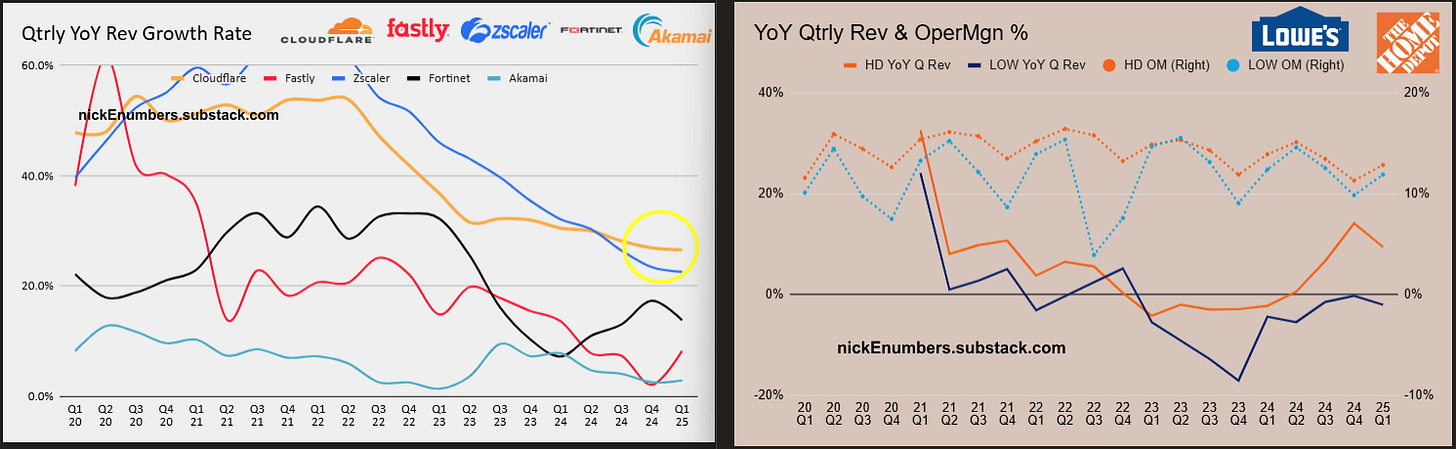

Technology- SNOW 0.00%↑ , NVDA 0.00%↑ , ADI 0.00%↑ , ZS 0.00%↑ , S 0.00%↑

Housing / Banking - EXP 0.00%↑

Others- COST 0.00%↑

(With data and charts it is not what you look at, it is what you see that matters.) Click on any of the images below to see a larger view.

Podcast

Does China OWN Apple? Steve Eisman with Patrick Mcgee

50 Min, you can also find the show on your favorite podcast platform. Outstanding interview. AAPL 0.00%↑ Patrick says-

I think Apple is really in a position where there's no winning formula. There's no obvious move to get out. You (China) encircle your opponent so that they can no longer make any strategic moves. I think that is where Apple is right now.

They cannot do anything to move to the US. They cannot make major moves to India. China has them captured. 🧟

Video

DeepMind CEO Demis Hassabis + Google Co-Founder Sergey Brin: AGI by 2030?

30 Minute , Demis Hassabis, the CEO of Google DeepMind, and Sergey Brin, co-founder of Google. Both join Alex Kantrowitz for a live interview at Google's IO developer conference to discuss the frontiers of AI research. Tune in to hear their perspective on whether scaling is tapped out, how reasoning techniques have performed, what AGI actually means, the potential for an intelligence explosion, and much more. Tune in for a deep look into AI's cutting edge featuring two executives building it. GOOG 0.00%↑

Books and Articles since my last edition

(Reading Great books is like a conversation with the finest minds of the past.- Descartes. If I get bored of a book I quit and move on.)

I am currently in the middle of a CS/finance book and a Stephen King book. Will share them once I complete them.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

We took a nice graduation trip for my son graduating university. 🎓🎉

Congratulations to all the recent high school and university graduates:

Climb high, climb far. Your goal the sky, your aim the stars.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.