6/6/23- NVIDIA, 🎧Asianometry, The Bond King👑, Option LEAPS, Chess Master

An important thing worth doing is worth doing poorly🤦🏽😖 until you learn to do it well🌄.

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

I am thinking about NVIDIA 5/24/23 earnings call and CEO Jensen’s predictions and comments. As it has been over a week since the event, we have all perhaps listened to the call and certainly read summaries from other writers on their highlights. It often seems as though NVIDIA/Jensen/TheTeam is multiple steps ahead of the competition. I am not sure if competition is even a fair description as NVDA 0.00%↑ is in a class of its own, albeit in the short term. On the call Jensen describes-

The other thing that's important is these are models, but they're connected ultimately to applications. And the applications could have image in, video out, video in, text out, image in, proteins out, text in, 3D out, video in, in the future, 3D graphics out. So, the input and the output requires a lot of pre and postprocessing. The pre and postprocessing can't be ignored.

And this is one of the things that most of the specialized chip arguments fall apart. And it's because the length -- the model itself is only, call it, 25% of the data -- of the overall processing of inference. The rest of it is about preprocessing, postprocessing, security, decoding, all kinds of things like that. And so, I think the -- we -- the multi-modality aspect of inference, the multi-diversity of inference that it's going to be done in the cloud on-prem, it's going to be done in multi-cloud.

We can attempt to describe this opportunity as a large and growing market. But that significantly understates the opportunity. We could describe it as early days, but that also is an underwhelming description. This will be enormous. You take my point. Jensen goes on to describes how NVIDIA is positioned-

We have 400 acceleration libraries. As you know, the amount of libraries and frameworks that we accelerate is pretty mind-blowing.🤯 The second part is that generative AI is a large-scale problem and it's a data center scale problem. It's another way of thinking that the computer is the data center or the data center is the computer.

It's not the chip, it's the data center. And it's never happened like this before. And in this particular environment,

your networking operating system,

your distributed computing engines,

your understanding of the architecture

of the networking gear, the switches, and the computing systems,

the computing fabric,

that entire system is your computer. And that's what you're trying to operate.

And so, in order to get the best performance, you have to understand full stack and understand data center scale. And that's what accelerated computing is. The second thing is that utilization, which talks about the amount of the types of applications that you can accelerate and the versatility of your architecture keeps that utilization high. If you can do one thing and do one thing only incredibly fast, then your data center is largely underutilized, and it's hard to scale that out.

NVIDIA's universal GPU, the fact that we accelerate so many of these stacks, makes our utilization incredibly high.

(Lightly edited for clarity and emphasis.)

I am not trying to sell you on NVIDIA but I am inviting you to imagine the future as Jensen describes it. He is a one-of-a-kind Communicator, CEO, Technologist, all in one. A rare find.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information session since my last edition that I reviewed-

Technology- PANW 0.00%↑ , ZM 0.00%↑ , ADI 0.00%↑ , NVDA 0.00%↑ (see📊👇🏽) , SNOW 0.00%↑ (see📊👇🏽), MDB 0.00%↑ , HPE 0.00%↑ , CRWD 0.00%↑ , ZS 0.00%↑ , S 0.00%↑ , OKTA 0.00%↑ , CRM 0.00%↑ , AVGO 0.00%↑

Housing & Banking - TOL 0.00%↑ , LOW 0.00%↑

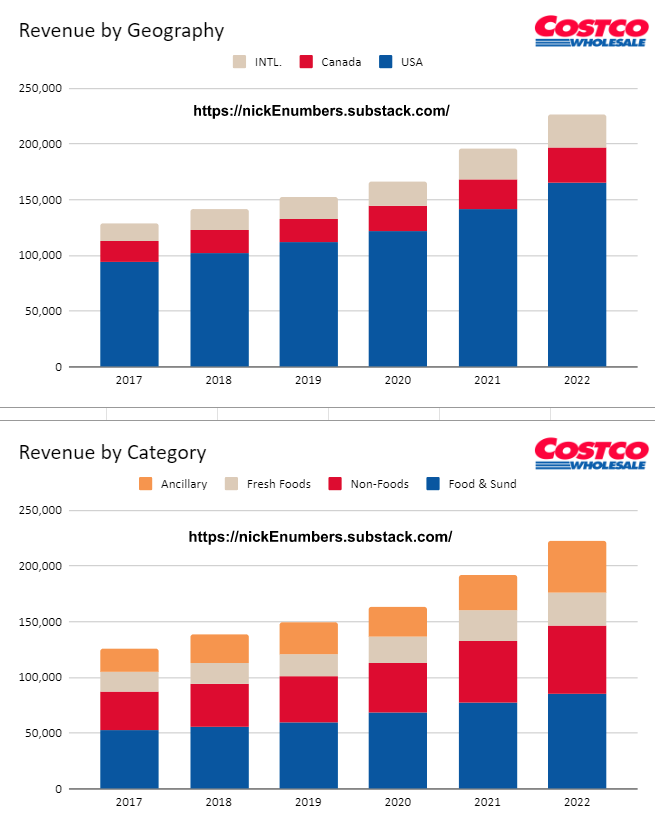

Others- HEI 0.00%↑ , KSS 0.00%↑ , $PSH , COST 0.00%↑ (see📊👇🏽),

Podcasts

48 minutes, 🎧How The Rise Of AI Will Affect Taiwan's Semiconductor Industry from Startup Island TAIWAN Podcast.

Host:

, Deep tech channel with 484k followers, the YouTube channel for technology documentaries and explainers is outstanding.Guest:

Dylan Patel, Chief Analyst at SemiAnalysisDiscussion Topics- Current events in the semiconductor sector, What is a Deep Learning Powered Recommender System?, The importance of hardware for large language models running in the Cloud/ Edge/ IOT / on your phone, x86 v ARM v RISC-V, Dylan’s thoughts on TSMC and the larger industry. The conversation is wide ranging and Dylan demonstrates his command of the respective companies and technologies. I am constantly learning from both of them.

Having Asianometry and Dylan Patel together is like peanut butter and jelly or semiconductor superheroes.

Videos

4 Minute video below. Grandmaster Maurice Ashley🤩 plays NYC chess trash talker 🗣️🗣️in Washington Square Park. Such a cool video. Small Bonus- GM Maurice catches him cheating😳….. Like Lebron James blocking a shot- “no, No, NO… Not in my HOUSE!” 🫡

[I wrote more about the chess hustlers in Washington Sq. Park in my post on 3/28/23, here.]

Books and Articles since my last edition

(Books are like loading software on your brain. I am usually reading 2 at a time, and if I get bored of a book I quit and move on.)

The Bond King by Mary Childs Business Biography about Pimco’s Bill Gross🤪. I remember when the book came out in 2022 and Mary was on the promotional interview circuit. My reluctance was that I was modestly aware of Gross and reading about Bill seemed to be about as interesting as a lecture on the history of lawn gnomes. 🥱I was not aware of the talent and curiosity of author Mary Childs. Mary uncovers the full story of Bill Gross🤪🤪and Pimco in a way that is captivating, including Mohamed El-Erian’s short tenure as CEO at the firm😯😬. I like finance books so I might be biased. Just as Carl Icahn is presently struggling to hold on to what he has built, Mary tells the story of Bill Gross inside the walls of Pimco as an arrogant, bully, spiraling into paranoia. Gross🤪😜 couldn’t imagine a life where a successor would takeover from him. Near Bill’s exit🤪😜🤡 Pimco is described as a “flaming pit of chaos.” Mary’s writing, story telling and delivery was remarkable. In the future, I will devour anything Mary Childs writes as soon as it is published.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

LEAPS Long Call Option as a Tool in the Toolbox

For this section I am going to assume that your experience level with the derivatives called stock options is intermediate to advanced. Options are complicated, complex and a great way to turn a large pile of money into a small pile of money if they are not properly respected. Although I am going to fly past the option Greeks🏛️🔱, their influence on the return of this strategy is significant. You can paper/pretend trade these instruments while you are gaining experience with how they behave.

With that caution behind us, let’s get on with the story. I get questions at times regarding the wide variety of companies that I follow. Semiconductors, housing, retail, etc. I don’t follow 90% of the economy, but I do indulge my curiosity and often I discover valuable unexpected insights. Over-scheduling your time and neglecting your curiosity might cause you to miss out on serendipity. The knowledge of a diverse set of companies over time can compound, and when a news event happens we might be in a position to take advantage of the event. In the biz, I have heard this termed “Event Arbitrage.”

I run a pretty concentrated account with less than 15 positions, but keep a little cash available in case something unexpected happens in the markets. I am generally pleased with my long term positions and I don’t want to trade out of them. The potential return for my cash from a news event, no matter how small the invested capital has to be large enough to “move the needle” for me, else why bother.

I have an example from the wild🦁🐯🐼 of real life to help illustrate this. Costco is a great company, run by great management. COST 0.00%↑ has been a good investment for its owners over time, and my family is a happy customer visiting the warehouse about once a week. I was not a shareholder of COST as its trading price was persistently above my estimate of fair value. I remained a fan, and review the financials quarterly.

In June 2017 Amazon announced its acquisition of the grocery chain Whole Foods. The narrative was that the world of grocery retail was going to change forever. Mark me down as skeptical.🤨🫤 In response to this announcement the share price of many of the grocery chains (KR, WMT, TGT, COST, etc), were all down 10% to 30% over the subsequent weeks. Costco specifically was down 15% over a 30-45 day time interval. I thought about how the Amazon news might affect Costco in the future and I promptly bought a 2 year option position on COST.

I didn’t want to make COST a primary position, but a 2 year option with an allocation of some cash with an opportunity for significant return seemed like a “Heads I win, tails I don’t lose much.” How much cash to invest? It is up to you. In an example account with about $1M and 10 positions, each of $100K, maybe an option position of $5-10K. And, you could scale this up and down by an order of magnitude depending on the size of your account/fund. Account $100K, $1M, $10M, etc. This is just food for thought to illustrate the example.

By January 2018 COST had recovered from the 15% decline and was up an additional 8%. Although I was originally prepared to hold onto my position for ~18 months, I was able to close it out in 6 months for a delicious profit😋. There certainly was a fair bit of luck that went my way with the fast turn around.

I don’t get the chance to use the LEAPS call option tool often, but it is one that I have used over the years. To be sure, most of the time the potential situation or event is discarded during my process. Perhaps I am able to patiently deploy this strategy 2-4 times per year.

I suspect that some of my dogmatically conservative readers will be a little uncomfortable with me writing about having a LEAPS call option in the toolbox, and yes, this is several steps further out on the risk spectrum. I am conservative, but lets all repeat this together- “If we are going to wait for every traffic light to be green🚦 before we leave the house, we will never leave the house🟡🟢🔴.” I am comfortable with a small allocation of capital that I am able to lose to a high probability, high return position. Heads I win, tails I don’t lose much.

Cloudflare announced earnings at the end of April 2023 with ~$60 share price. Over the next few days NET 0.00%↑ was down over 30%, to ~$40. I am a long term shareholder of NET, and I follow the company closely. I purchased some 2 year LEAPS Call options on NET near the $40 bottom. Now, a month later, Cloudflare has recovered and it is trading around $67. I have at least 18 months to figure out how long I want to hold this. (Delicious😋)

Have I ever lost money on this strategy? Sure. I have lost some money on all of my strategies. An important thing worth doing is worth doing poorly🤦🏽😖 until you learn to do it well🌄. But, I understand this strategy well and it has been net positive to me.

If you would like to learn a bit more about LEAPS, famed Hedge Fund investor Joel Greenblatt discusses them in his excellent book with a cheesy name- You Can Be a Stock Market Genius, chapter 6.

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

The Bill Gross book sounds like fun! Also is it too late to buy NVIDIA?