7/16/24-Reinvest♻️Dividends?, Gates on AI🤖,Grand Cayman Island🏝️

How we do Anything is how we do Everything. 🙏🏽

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Active Investors Should NOT Automatically Reinvest♻️ Dividends

This is a bit of strategy intended for active investors that select specific companies in which to invest. This is not for index investors or for those new to investing.

Call this a bit of housekeeping🧹🫧🧽 for active investors, or perhaps continuing education. Most of us start out in investing and we learn to automatically reinvest any and all dividends that we might receive back into the issuing company. Why not? We don’t need the dividends and therefore just auto reinvest. Delayed gratification should result in more compounding. 🧑🏽🎤🤘🏽 Plus our brokerage account makes the reinvesting process so simple.

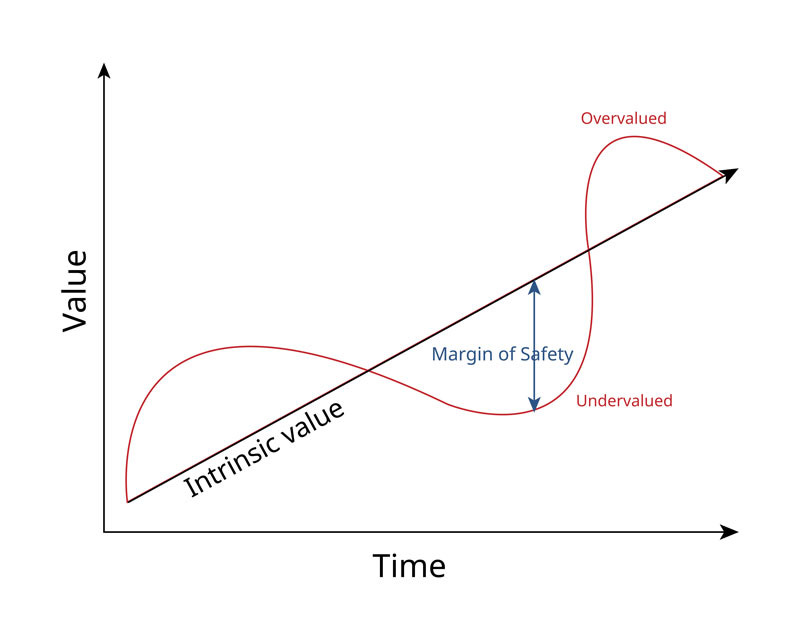

But, what if your portfolio companies are trading ABOVE their fair value? (Z Best stock at $100 fair value, trading at $125 or $150). If you had a slug of new cash would you be purchasing Z Best stock at $150? No way. So, if Z Best stock issues a dividend why are you automatically reinvesting it back into Z Best at $150? I argue that it is often better to receive the cash dividend and actively consider how to best allocate the cash.

You will notice above that I have assumed that you have a method or a system to determine a fair value (range) on your own. Perhaps you perform DCFs, use Morningstar, use multiples and comparable companies, etc. But independent of the trading price, you have an opinion on the fair value (aka Intrinsic Value.)

Maybe you view the cash generated by dividends as trivial and not worth this special attention. Your dividends might be $4K, $40K or $400K. But, How we do Anything is how we do Everything. 🙏🏽

Now, what to do with the cash from the dividends. The answer is easier than you might think. Of the 10-15 companies that I own, there is almost always 4ish that are trading below their fair value. I allocate the dividend cash to these. Why not? I know the 4 companies well, I own them, they are priced below their fair value. Invest the cash with them.

Cash is cash no matter if it arrives as a dividend, a bonus or a stock sale. Put yourself in the position to earn the highest possible return on it and allocate it well.

Bonus- As a check against the logic above, recall that Buffett’s Berkshire Hathaway does not automatically reinvest dividends. No no no. They receive dividends in cash and then shrewdly allocate the capital themselves.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information sessions since my last edition that I reviewed-

Housing & Banking - JPM, WFC, C

(With data and charts it is not what you look at, it is what you see that matters.)

TSMC’s revenue is up 28% YTD through 6/24 vs 6/23.

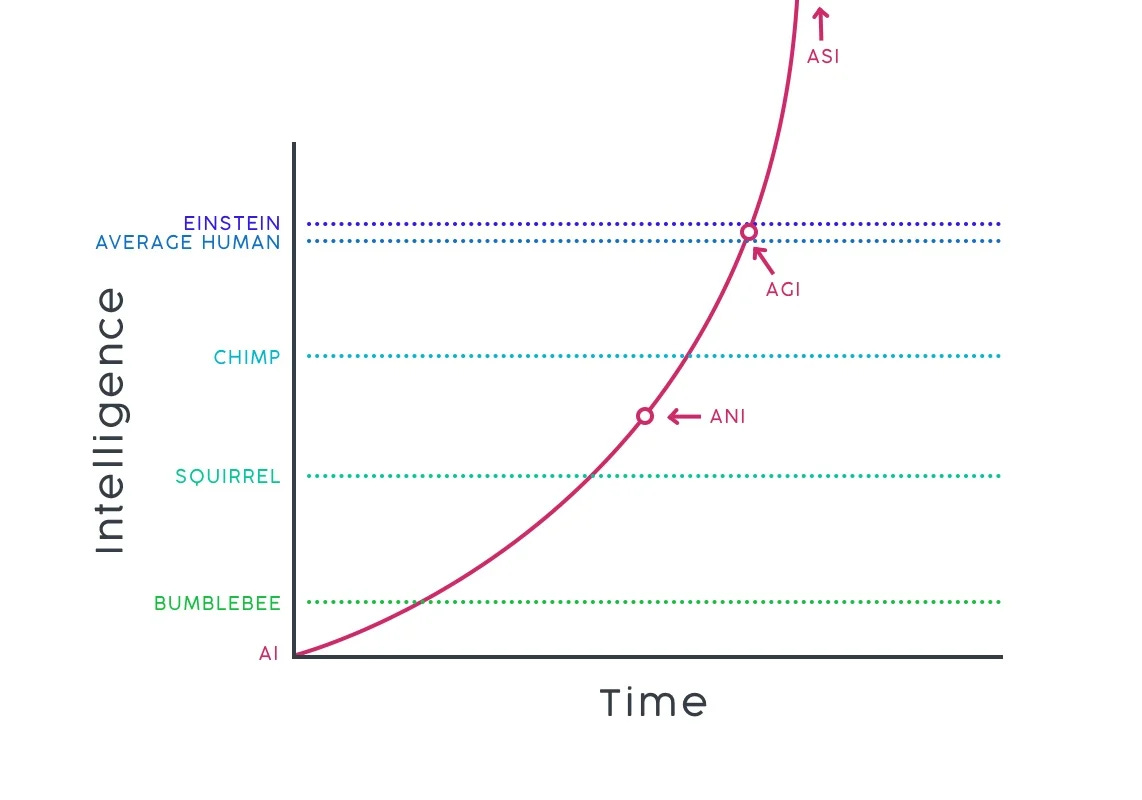

The chart below is intended to illustrate the progress of AI relative to the average human🧔🏽♂️👩🏻🦰. ✅ASI- Artificial Narrow Intelligence has been around for a while. We are proceeding toward 🔜or have arrived at AGI- Artificial General Intelligence. The next stop on our ride is ASI- Artificial Superintelligence is a system that has superhuman intelligence that surpasses human capabilities in all areas. [BTW, your computer is so much faster💻🤖⚡ than YOU! Find out how much faster here.]

Podcasts

57 Min. Bill Gates discusses the future of AI and how it's closer than you think. Next Big Idea Podcast, link here. (or video link below) Learn about his thoughts on superhuman AI and advancements in technology. Bill is one of the few founding members of the computing age (brilliant💡🌞 as ever) who frequently shares his opinions and perspective. The interviewers ask him a question about what new products and services is AI going to provide soon to humans? Bill-

..you just demo okay here's image editing and no I'm not teaching you 59 menus and dialogues in Photoshop to do editing. I'm telling you type “get rid of that green sweater”👕 and people are like (humorously) “oh I don't know if I could do that I mean that sounds very hard to me.” You know and when you show people that it's like “WHAT! 🤯”

To make that photo bigger.. I didn't take.. I didn't take a shot that was bigger but I'd like the PHOTO🖼️ to be BIGGER so fill in the missing piece to make it BIG and it's like “WHATTT! 🤯”

You know or patient follow-up🥼💊. You know where it calls you up and talks you about “Did you fulfill your prescription? How are you feeling?” 🤯

..People may get saturated if they really try and expose themselves to the various examples. ..Then you think okay when I call up to ask about my taxes, when I want my medical bill explained. 🤯

..White collar work is almost free type mentality is the the best way to kind of predict what this thing suffuses to. Even though I fully admit there's a footnote there that it's in some ways still a little bit of a crazy🤪 white collar worker. BUT, we're going to get rid of that footnote over a period of years.

Videos

7 Min. As a fan of math, science and engineering, I like objective facts. Can AI really help speed up code development by 50 or 100%? Mark me down as skeptical. 🤔In this video, Martin discusses how generative AI enhances software development productivity with tasks like code generation, debugging, and more. After the video, I came away more convinced of How and Where the productivity boost happens. 😀👍🏽50 to 100% code speed up seems likely!

Books and Articles since my last edition

(Reading Great books is like a conversation with the finest minds of the past. Descartes. If I get bored of a book I quit and move on.)

Tomorrow, and Tomorrow, and Tomorrow by Gabrielle Zevin Contemporary Fiction. Recommendation from the Bill Gates reading list.

Mistakes Were Made, but Not by Me: Why We Justify Foolish Beliefs, Bad Decisions, and Hurtful Acts by Carol Tavris, Elliot Aronson Psychology, Nonfiction. The easiest person to lie to is…. yourself.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

[In my 3/28/23 post, link here, I wrote a little bit about Las Vegas and the battle between Caesars and MGM. We visited Arizona and Nevada around that time also.]

Grand Cayman Island

My family enjoys beach vacations and over the last few years we have enjoyed several of the wonderful Florida beaches (South Florida and the Gulf Coast.) This year we returned to the Cayman Islands in the Caribbean.

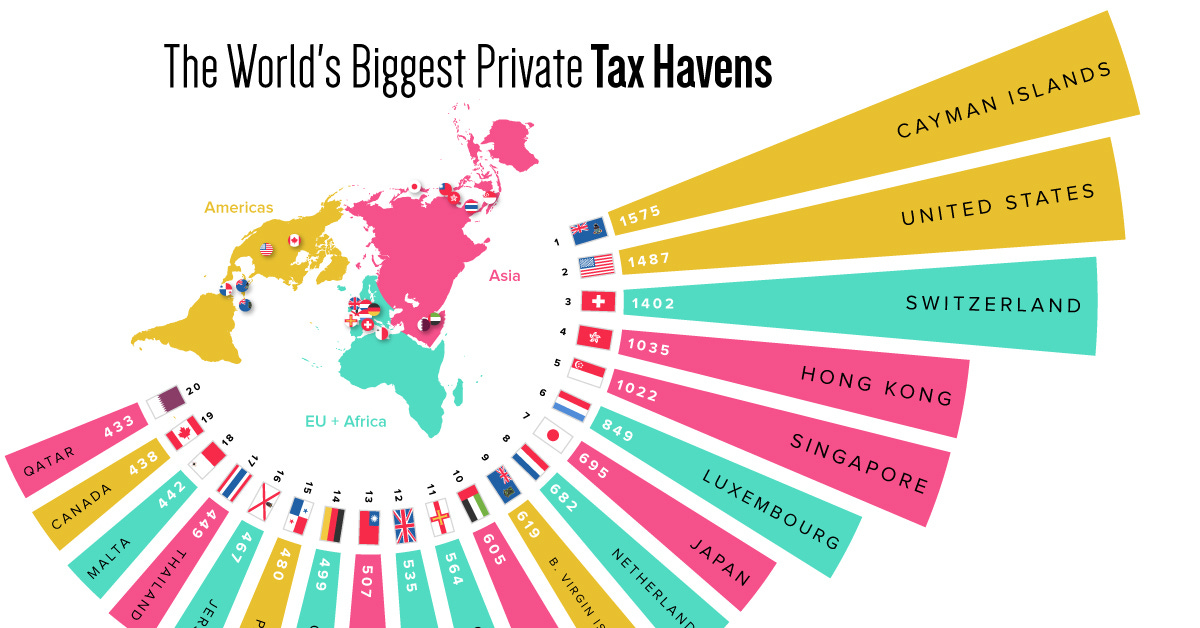

The Cayman Islands, a British Overseas Territory, encompasses 3 islands in the western Caribbean Sea. Grand Cayman, the largest island, is known for its beach resorts and varied scuba diving and snorkeling sites. Famously, they are a dominant offshore banking territory. I first visited Cayman regarding an insurance investment.

The real GDP per capita for Cayman is one of the highest in the world. Financial services contributes about 50% to the country’s GDP.

We are here for the relaxing beach, wonderful people, great food and cold drinks 😉🍹🍹 Enjoy your summer my friends 🍻

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.