December 2022 Last Half

👧🏽"I’m here independently, the school is not sponsoring me. Can I stay and compete?"🤺

Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Holding Too Many Positions Undermines Your Compounding.

For an actively managed individual/fund, often the best structure is to own a small number of high conviction positions. (Let's say less than 20 positions.) I want to offer a couple paragraphs to explain why.

But, before I start explaining I wanted to meet the alert critics up front. I think investing is a big tent and there are a lot of investors with different objectives and strategies that can exist simultaneously within it. Investing in an S&P index ETF like VOO 0.00%↑ can be correct, Target Age Funds, splits of Stock/Bond/Alternative Asset, Passive like the QQQ 0.00%↑ , Dividend strategies, the list goes on. All of these have a place and time depending on the requirements of the investor. But, all of the different strategies are not playing the same game. You don’t need me to explain all of these different strategies, but you take my point.

For an actively managed individual/fund, often the best structure is to hold less than 20 positions. But Nick, I own 40 positions, or my actively managed ETF owns 75 positions. Why do you believe it should be less?

The TL;DR version-

Math Impact of a home run stock with a small allocation on the total fund is minor,

Diversification/Correlation on number of positions after 5 stocks has significant diminishing returns

Compare your new 11th stock idea to your prior 10 GREAT ideas, and new 11 should probably be discarded.

Math Impact-

In order to keep the math nice and simple for me (I am lazy), assume a $100K investment fund.

10 positions, 10% allocation to each position of $10K.

If 1 of the positions has a 25% annual return, that is amazing. The impact on the fund is 2.5% holding everything else constant.

20 positions, 5% allocation to each position of $5K.

If 1 position has a 25% annual return, that is still amazing. The impact on the fund is 1.25% holding everything else constant.

Pretty soon the impact is trivial on the total. And this is with 1 homerun 25% return stock. As the farmer said “The juice isn’t worth the squeeze..”🧑🏻🌾🍊

Why do the Superinvestors on Dataroma for value investors own so many positions? Quick Answer- They are not playing the same game as the actively managed individual/fund. Their incentives and your incentives are misaligned. [Share your comments below if you want to discuss this more.]

Correlation Impact-

In one of the accomplished investor, Joel Greenblatt's book he argues that you need fewer than 10 stocks to eliminate most of the systemic risk that you face while investing in stocks. Greenblatt found statistics that showed owning:

Only 2 stocks can eliminate 46% of non-market risk

4 stocks this number climbs to 72%

5 Stocks yields 81%

16 Stocks results in 93%

32 stocks eliminate 96% of non-market risk

500 stocks 99%

Greenblatt's point is there seems to be a pattern of diminishing returns after a certain number of stocks.

Berkshire Hathaway’s Charlie Munger has said that “a well-diversified portfolio needs just four stocks.” How is that for conviction! [Munger's Daily Journal Positions can be monitored <here> and presently a few of them are BAC 0.00%↑ WFC 0.00%↑ BABA 0.00%↑ USB 0.00%↑ ] At the same time, Charlie Munger is so brave he would charge hell😈🔥🔥 with a bucket of ice water 🪣💦.

Compare your new 11th stock idea to your prior 10 GREAT ideas (FOCUS)-

Imagine that you have collected 10 great stocks. They are excellent companies, earnest managers, growing moats and you purchased them at a fair price. The patience and focus to accomplish this can not be overstated. In addition, the investor (you) must remain focused on these 10 stocks and monitor their progress in order to remain successful over the coming years.

You have a new 11th stock idea. It is the new shiny thing. Before you race off and make it a new position by siphoning capital from some of your prior 10 stocks, STOP. Ask yourself, is new 11 better than stock 10, or 9? If it is not, then don’t invest in 11. I would argue that most of the time, the new shiny thing is subordinate to your existing positions.

Warren Buffett has spoken of having 2 main teachers influence him, one being Philip Fisher. Fisher says it best in his book Common Stocks and Uncommon Profits:

“There are a relatively small number of truly outstanding companies…any holding of over twenty different stocks is a sign of financial incompetence. Ten or twelve is usually a better number. As an individual’s holdings climb toward as many as twenty stocks, it nearly always is desirable to switch from the least attractive of these stocks to more of the attractive.”

Concluding Thoughts

To be clear, I am not at all saying that this structure that I have outlined above is easy, it is not. It is far from easy. Nevertheless, here is the ground on which we find ourselves.

Share your thoughts and reactions in the comments below.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks. And, Peter Lynch frequently reminds me that if I have spent 15 minutes on market macro, I have wasted 13 minutes. With that self caution, let us press onward.)

Interesting companies that hosted earnings results or information session since my last edition that I reviewed-

Technology- ADBE 0.00%↑ MU 0.00%↑

Housing & Banking - LEN 0.00%↑

Others- FDX 0.00%↑ KMX 0.00%↑

Macro- US Financial Health. (Great Visual Below)

Friends, I don’t understand how and why a nation can/should spend more than it takes in for an extended period of years. I am certain that the situation is very complicated and socially difficult. But, we are naive as a civilization to pretend that this can go on indefinitely.

Podcasts

Finding a Path (with Tatiana Toro) - Numberphile Podcast

Dr. Tatiana Toro grew up in Bogotá, Colombia with a passion for math at a young age. Besides math, she learned to speak English, French and her native Spanish. She tells a story about when she was a girl and her home country Columbia had been invited to its first International Math Olympiad competition some weeks in the future. She discovered that four 12th grade boys were selected to represent her country and not her.

“So I found room in the car, I went and I explained my situation. I’m here independently, the school is not sponsoring me. Can I stay (and compete)? And they said I could. Around 186 kids (from all nations competed in that year hosted in the USA), only maybe 6 or 8 of the 186 were girls.”👧🏽💪🏽

[The above quote has been lightly edited for length and clarity.]

She tells this and several other amazing stories with a humble delivery, but her courage is unmistakable. I would love to have her as my math teacher but to have her teach my university age son or high school age daughter would be even better. Listen to her inspiring interview.

Toro was born in Bogotá, Colombia and received her BS equivalent from the Universidad Nacional de Colombia. She earned her PhD from Stanford University in 1992. Toro has held positions at the Institute for Advanced Study, UC Berkeley, and the University of Chicago before joining the University of Washington faculty.

Books and Articles since my last edition

(I am usually reading 2 at a time, and if I get bored of a book I quit and move on.)

It is a well recommended book and it is an easy read.

Dave Packard tells the HP history from the beginning, mixing personal and business stories along the way.

Guess how Bill Hewlett and Dave Packard decided who’s name would go first in the company name? Coin Flip!🪙🤯

Fun Story not in the book- When Steve Jobs AAPL 0.00%↑ was in high school, he cold-called Hewlett-Packard’s co-founder Bill Hewlett to request some leftover electronic parts and, to his surprise, Hewlett picked up the phone.😲 At first, the exec was amused, and soon after, taking the young man more seriously, he offered Jobs an internship. “He laughed and he gave me the spare parts to build the frequency counter AND he gave me a job that summer at Hewlett-Packard."🥰

HPQ 0.00%↑ and HPE 0.00%↑

A Man Called Ove by Fredrik Backman Fiction about an old grumpy man that has new young neighbors move in. You learn about yourself while observing Ove. The book also reminds us to try not to judge…. because everyone has a story. 😐

Art of Stock Picking by Charlie Munger. This is the link to the 18-page article. H/T

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

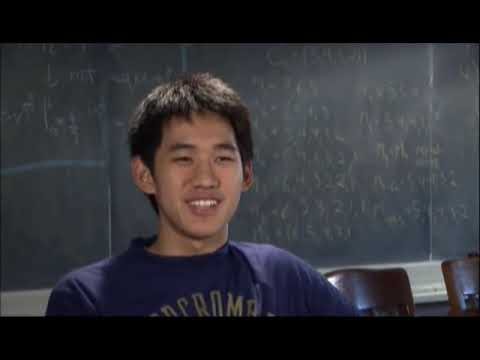

International Math Olympiad (IMO) Documentary 2006 US Team, [1 hr 20 min]

While we are talking about math competitions, below is a documentary that tracks the 6 US students who were selected and coached to represent the USA for the 2006 IMO.

The video is interesting and engaging, including all the amusements of peeking inside the lives of high school students… but these students are math-magical! 🧮🪄

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

I enjoyed how your reasons were conveyed very clearly for why owning a smaller number of positions is better for actively managed funds.

I still need to read Digital Minimalism.. Not sure if I should, as I've heard so many podcasts by Cal that I've probably gotten most of it through that medium, but I quite like So Good They Can't Ignore You and Deep Work. So I probably should anyway!

That HP book seems interesting. We forget what an influential company they were at the time!

Cheers 💚 🥃