Welcome back. In a busy world we can be distracted with the trivial many things or we can focus on The Vital Few.

Something that I am thinking about

Revenue by segment

Top line revenue for a company is all we usually hear about, but I often look at the revenue by source/segment/business unit. In addition, I can understand it much better in a visual graphical format.

The graphical presentation illustrates not only the performance and growth of absolute Total Revenue, but also the component share, trended over time and respective segment growth.

Take a look at Apple AAPL 0.00%↑ .

I can think about the revenue differently now, understand it more granularly. Did you know iPhone revenue was so lumpy?

What about a graph of Alphabet revenue (Google parent company). GOOG 0.00%↑

We hear a lot about it’s Search based advertising revenue. I don’t know if we hear as much about the revenue that Google generates from YouTube and Cloud (GCP, Google Cloud Platform).

Finally, I wanted to look at NVIDIA. NVDA 0.00%↑

If we only look at total revenue, we are going to miss something interesting happening. Nvidia’s Data Center revenue (green) has grown from a smaller contributor to a majority driver of revenue, while Gaming revenue (red) has decreased. I am not going to explain WHY this is happening, but if we are not aware of the segmented reality, we will not know to go and investigate the cause.

Investing, Companies, Market Past/Future

(I invest in Companies, not in stocks.)

Interesting companies that hosted earnings results or information session since my last edition that I reviewed-

Technology- All of these were meaningful earnings calls and reporting- META 0.00%↑ , AMD 0.00%↑ , NET 0.00%↑ , AMZN 0.00%↑ , GOOG 0.00%↑ , AAPL 0.00%↑ , QCOM 0.00%↑ , ON 0.00%↑

Snapchat, SNAP 0.00%↑ , just WHY?? Yep, Why? 🏃🏼♂️🏃🏾♀️ RUN away! 😖

Housing & Banking - AFRM 0.00%↑ Affirm is trying to do something difficult and Amazing. I am a fan of Max Levchin, CEO. He is a one of a kind thinker and an incredible software engineer. Max is one of the founding members of the PayPal Mafia. (Post in the comments if you know which mega famous person is missing in the picture below.😏 ) If you are curious about Levchin, PayPal history or any of the others in the photo, Jimmy Soni has a wonderful book- The Founders.

Others- UBER 0.00%↑ , PLTR 0.00%↑ Palantir, another PayPal diaspora, Peter Thiel financed.

DIS 0.00%↑ <- Disney, ugg. More on that in a bit. 🤦🏻

Below is a graph from the UBER 0.00%↑ earnings presentation from 2/8/23. It illustrates that UBER riders and drivers are now at a new all-time high. I don’t use UBER/LYFT often but when I do I find them to be convenient and affordable. It encourages me to see the growing utilization.

Podcasts

Buffett- “They say in the stock market, ‘Buy into a business that’s doing so well an idiot could run it, because sooner or later, one will.'”

After less than 3 years, Bob Chapek was removed as the DIS 0.00%↑ Disney CEO and Robert Iger has returned. The Disney castle is under attack from multiple directions (cough Netflix NFLX 0.00%↑ ). Right now, Disney looks more like a haunted mansion to me than a magical kingdom.

Before I make my case to you I want to provide the cold hard facts.

Recent Disney CEO history-

1984 to 2005 (21 years) Michael Eisner

2005 to 2020 (15 years) Robert Iger

2/20 to 11/22 (~2.5 years) Bob Chapek

11/22 to Present Robert Iger, 72 years old (Part 2)

Okay, so it is a list of CEO’s, who cares. I want to call your attention that Robert Iger had 15 years to identify and train a worthy and successful successor. Bob Chapek was selected.

Bob Chapek had worked at Disney for ~23 years before he became CEO and Chapek came to the top job from the Parks and Resorts division. Chapek’s 33 month tenure as CEO was like trying to put sox on a cat🧦+😾 . It was bad, very BAD! Variety1 published a detailed summary of Chapek’s missteps, and below are a few stumbles that I selected-

Chapek had little experience in dealing with A-list talent and high-pressure political situations.

While COVID limitations were going on, he simultaneously released Marvel “Black Widow” in theaters AND Disney+... BUT, he failed to first strike a deal with the film’s star, Scarlett Johansson, whose compensation was tied to a series of box office bonuses.

He compounded the mistake by approving a public statement that Johansson was being “greedy and insensitive” to the challenges of the coronavirus pandemic.🤦🏻

It was staggering to many industry insiders that Chapek would so openly blast a movie star standing on her contractual rights. A rival studio chief told Variety at the time it was “the most embarrassing thing I’ve witnessed in my career.”

Chapek also resisted pressure to take a stand against a Florida law restricting classroom instruction on gender identity and sexual orientation, dubbed the “Don’t Say Gay” bill by its critics. Chapek chose to remain neutral even after Iger tweeted his opposition, and despite the company’s history as a champion of LGBTQ rights. **(Iger tweeted? I thought he was retired? That is kinda shady. Why doesn’t Iger stay out of the spotlight? More on that to come.)

Only a couple months after that, Chapek again shocked the industry by unceremoniously axing Peter Rice, the chairman of Disney General Entertainment Television, who is one of the most highly regarded executives in the industry. Rice had been seen as a possible contender for Chapek’s job, should it become open, and the move was seen by many as a preemptive strike against a formidable challenger.

Bob Chapek is removed in November 2022 and Robert Iger returns.

Return of Robert Iger-

There are a list of obvious reasons why Iger is good at the Disney CEO job. A couple that I want to call out are that he is an artful navigator of complex situations, he is an accomplished deal maker, and his memory of people, places, events and dates is masterful.

What I don’t like about Iger as CEO:

He was CEO for 15 years the first time, so he had multiple years to select, train and monitor a replacement CEO before his departure. Good leaders find ways to build businesses that outlast themselves. Even Steve Jobs found a successor in Tim Cook to run Apple. Iger failed at this critical requirement because he had to return as CEO.

Some number of CEO transitions are not going to succeed, I get it. When Iger returned he could have taken full responsibility for the problems with Chapek, apologized to Disney staff and investors and committed to repairing everything. Iger has not taken full responsibility.

That brings me to Iger’s ego. In the 1/2023 podcast interview <here> of Iger by a16z we can see that Iger has a few favorite words- “I, me, my”.

(Below are Iger quotes taken from the podcast.)

When I ran Disney.. When I hired.. When I read scripts..

He (Actor/Director) is intimidated because of me and my title.. But I wanted to put him at ease..

I had to do something because I was only going to be at Disney for 3.5 years before they got rid of me.. So I made a deal with Steve Jobs..

In June of 2009, I walked into Marvel’s office alone, to pitch the idea of Disney buying Marvel…

Perhaps Iger hoped the CEO succession would fail so that he could return and save the day. Iger is good at being the CEO of Disney, no in fact he is GREAT at it. BUT, by bringing Robert Iger back, he has all the negotiating leverage and Disney has a lot of unresolved problems. One of the most significant problems Disney has is who will be their future CEO after Robert Iger is done haunting the Disney mansion.

Videos

8 Minute video below, of mind blowing industrial machines. So cool. They mesmerize me😵💫🥰. Enjoy!

Books and Articles since my last edition

(I am usually reading 2 at a time, and if I get bored of a book I quit and move on.)

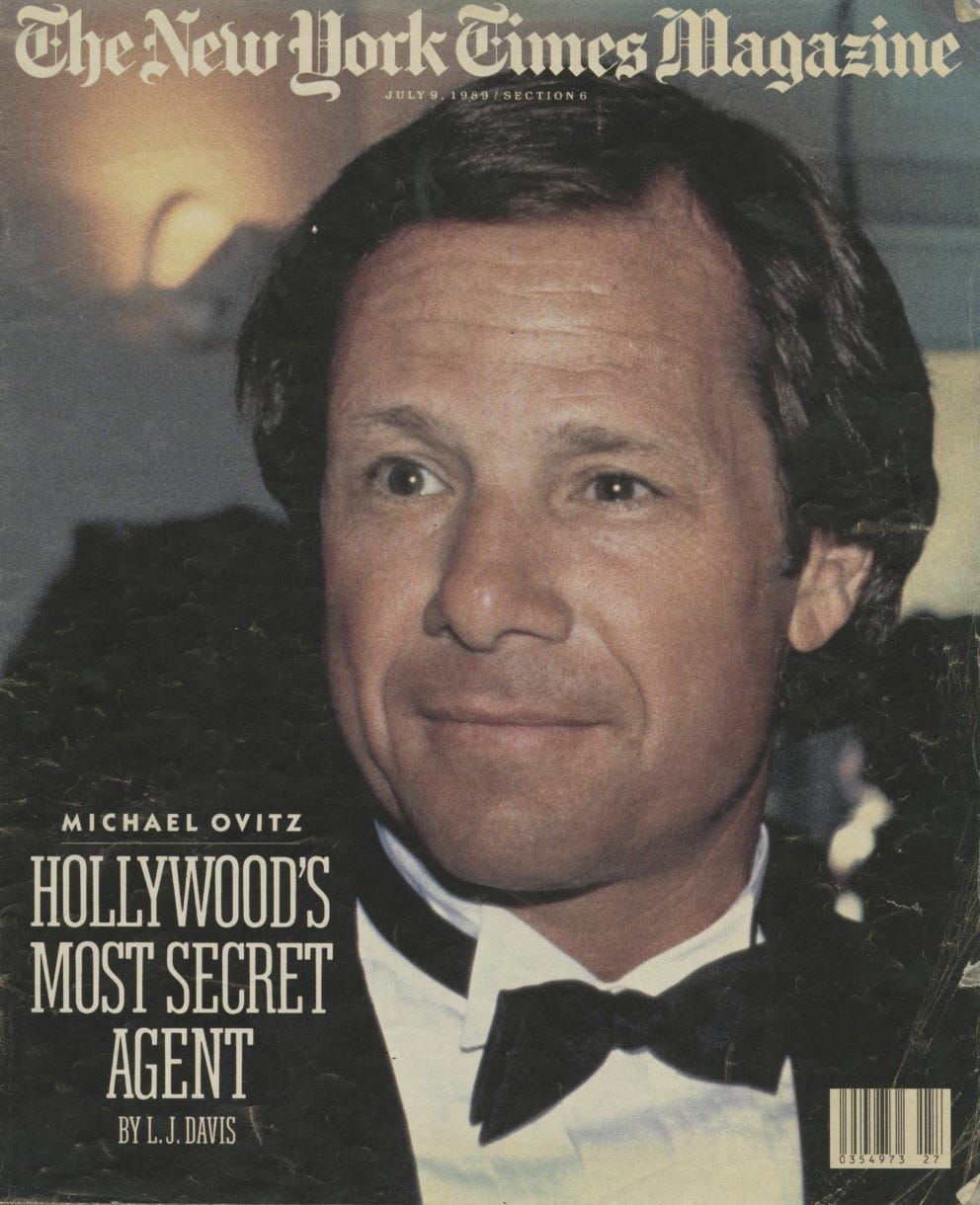

I would strongly recommend this book to anyone that wants a first person real life explanation (sometimes dishonorable) of how to maneuver a business into a fortified competitive position. But the book is also a cautionary tale. Michael Ovitz is a talent agent and some of his clients over the years included Steven Spielberg, Tom Cruise, Madonna, Dustin Hoffman, Kevin Costner, Bill Murray, Sylvester Stallone, and Barbra Streisand. Ovitz also was a founding partner in a talent agency, CAA. To say that Ovitz and CAA were connected to nearly everything in film and tv production, would not be an understatement. Actors, producers, directors, film studios, music, etc.

Ovitz views himself as a kid that was born in the middle class side of town and he hustled nonstop to improve his financial and social position. Although Ovitz never once mentions H. Helmer’s book 7 Powers: The Foundations of Business Strategy, Ovitz intuitively executes on ALL of the strategies during his career ascent. (See the graphic below.) And it is because of Ovitz’s ruthless use of the 7 powers that I found this book (Who is Michael Ovitz?) to be remarkable. At its peak CAA and Ovitz were so powerful the creative community had a visceral love/hate relationship with them. Ovitz’s competitive/controlling personality seemed to have earned him phenomenal success and simultaneously ruined most of his business/personal relationships. Be careful what you wish for because it comes at a price. Michael Ovitz honest writing about his personality flaws is admirable and I would strongly recommend the book.

David and Ben from the Acquired podcast recorded an outstanding👍🏽 interview of Ovitz about a year ago, 1hr 45min, link here.

Here is a link to many of the books I have read and my 1-5 star rating- Goodreads Books Read

Wild Card🃏

I’ve been a happy GEICO insurance customer for about 10 years, and fortunately have not had to make any claims. My auto insurance renewal was going to be a 30% increase. <I know, right!> I called GEICO to confirm it and to inquire about the cause of the increase… I still couldn’t believe it so a few days later I called back a second time📞📞. Both of the answers were identical. “There is nothing that I did, nothing that I changed, GEICO was just raising rates due to inflation.” So I switched to USAA Insurance and saved 30% on my auto 🚗 insurance.

GEICO was also going to increase my home insurance by 30%. So I switched to USAA Insurance and saved 30% on my home 🏡 insurance.

(This is not a case for USAA or against GEICO.)

Review your insurance renewal and compare it to a competitor. The success of personal finance is achieved one battle at a time⚔️, and the benefits can be substantial. Nobody cares about your money, as much as YOU 🫵🏽care about YOUR MONEY!💰

If you liked this post from Nick, why not share it and subscribe?

Disclaimer: All of my posts are for informational purposes only. I might own some of the companies discussed in these posts. This is NOT a recommendation to buy or sell securities discussed. Please do your own work before investing your money.

https://variety.com/2022/film/news/bob-chapesk-fired-disney-ceo-blunders-iger-1235438438/